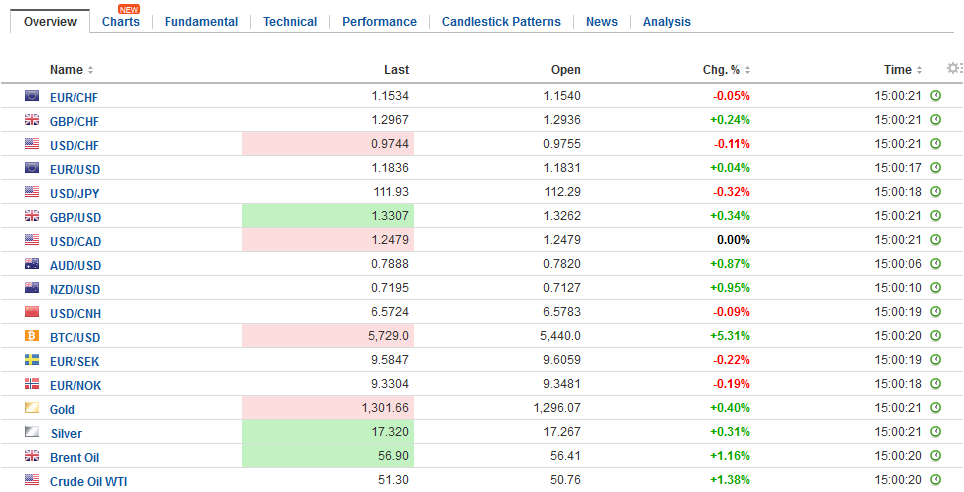

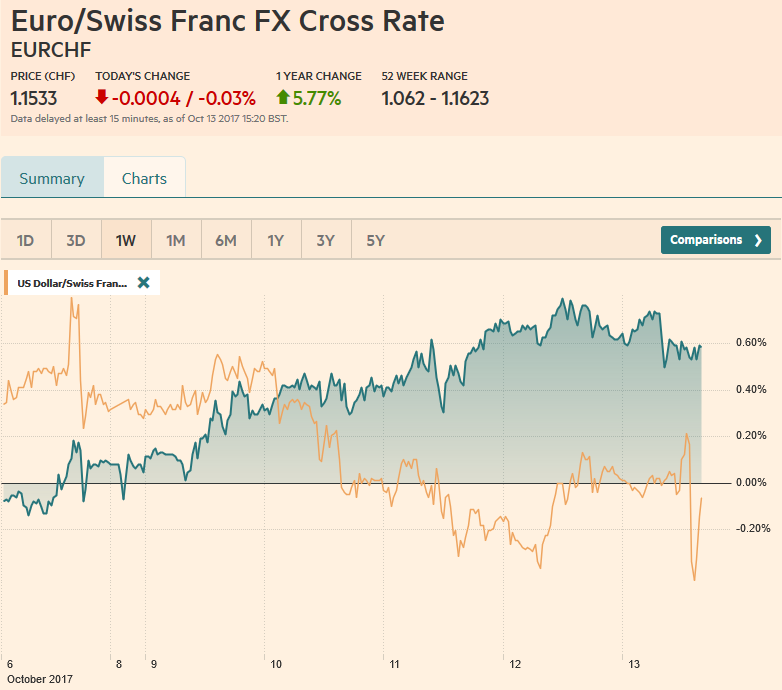

Swiss FrancThe Euro has fallen by 0.03% to 1.1533 CHF. |

EUR/CHF and USD/CHF, October 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe EU’s leading negotiator whipsawed sterling yesterday. The net effect was to ease fears that the UK would leave the EU without the agreement Initial concerns that the negotiations had stalled sent sterling to nearly $1.3120. The willingness to discuss a two-year transition period spurred sterling’s recovery. After trading on both sides of Wednesdays, it closed on its highs was a bullish technical signal and there has been follow-through buying today. It is approaching a 50% retracement of the decline since late September. It is found near $1.3345, which also corresponds to the 20-day moving average. Next week, the UK reports CPI, retail sale, and September labor report. The market is pricing around a 75% chance of a rate hike next month and next week’s data will impact the expectations. |

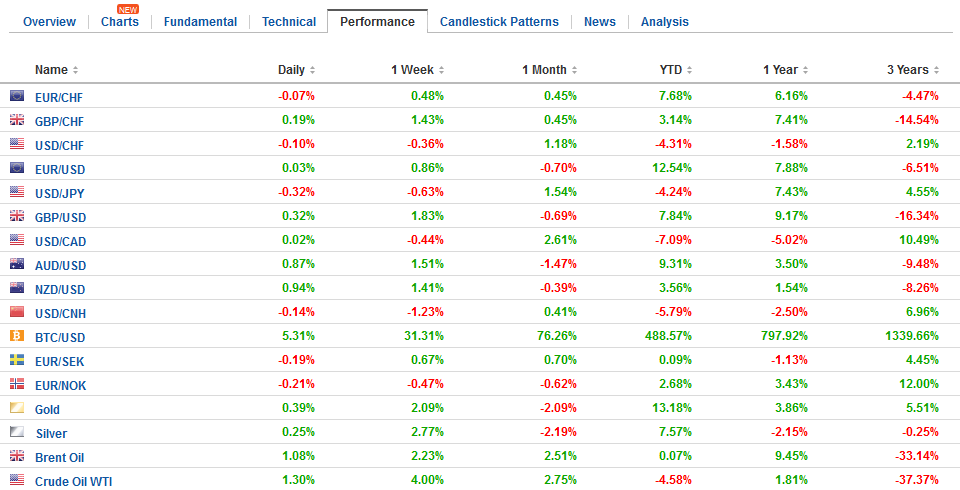

FX Daily Rates, October 13 |

| The December 2017 Fed funds futures is yield is unchanged from the end of last week at 1.265%. Our work suggests fair value, assuming a 25 bp hike in December is 1.295%. The December 2018 Fed funds contract’s implied yields are off 0.h5% for the week to 1.635%, which suggests that the market is just shy of discounting a single rate hike next year.

The dollar slipped to JPY111.85, which is the lowest level since September. However, greenback recovered in the European morning as US yields also rose. Initial resistance is seen around JPY112.40. The US 10-year yield is edging higher for the first time in three sessions. The yield peaked a week ago near 2.40%, which capped US benchmark yield over the past six months. The dollar-yen exchange rate is particularly sensitive to US 10-year yields. There is a $579 mln option struck at JPY112.50 that will expire today. There is also a 513 mln euro option struck at $1.18. Ahead of this weekend’s election in Austria, the equity market has advanced nearly 0.8% today. Coming into today’s session is was flat in the week. The Dow Jones Stoxx 600 is up about 0.5% on the week. The government’s benchmark 10-year bond kept pace with Germany this week. |

FX Performance, October 13 |

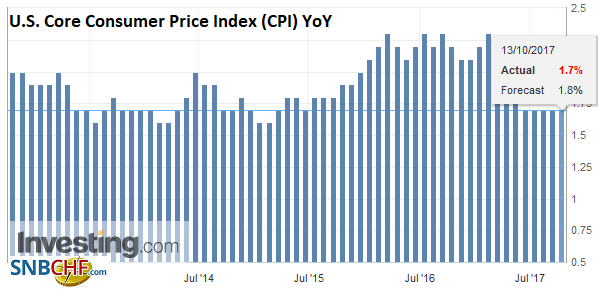

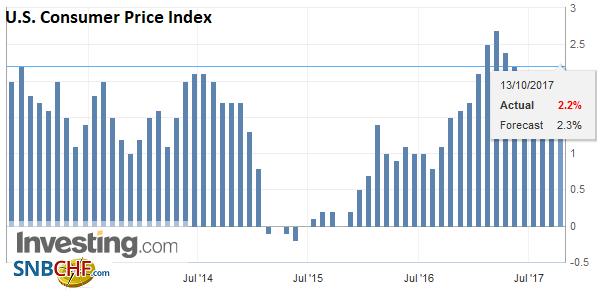

United StatesToday’s US data will likely determine if the dollar’s heavy tone this week is more corrective after a strong September or if this year’s downtrend is resuming. We suspect that both retail sales and CPI could surprise on the upside. Some of the strength we expect will reflect the headline reports, but the key to the markets’ reaction will be in the core rate. The median Bloomberg forecast is for a 0.2% rise in core CPI. That would match the August increase and be the best two month gain. The year-over-year rate is expected to move higher for the first time since January. |

U.S. Core Consumer Price Index (CPI) YoY, Sep 2017(see more posts on U.S. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The headline retail sales likely rose sharply. It will be bolstered by the strong auto sales and higher gasoline prices. Excluding these two items and building materials, retail sales may rise 0.4%, which would fully offset the 0.2% decline seen in August. As we saw with autos, the storms are creating a demand shock for some goods, some of whom are in sectors where inventory levels were tight before the storms. |

U.S. Consumer Price Index (CPI) YoY, Sep 2017(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

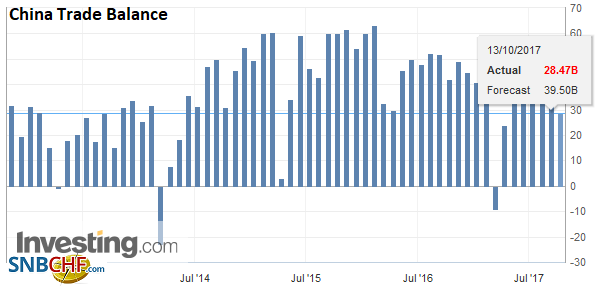

ChinaTurning to Asia, China reported its September trade figures. The overall trade balance fell sharply to $28.5 bln from almost $42 in August. Both export and imports rose.

|

China Trade Balance (USD), Sep 2017(see more posts on China Trade Balance, ) Source: Investing.com - Click to enlarge |

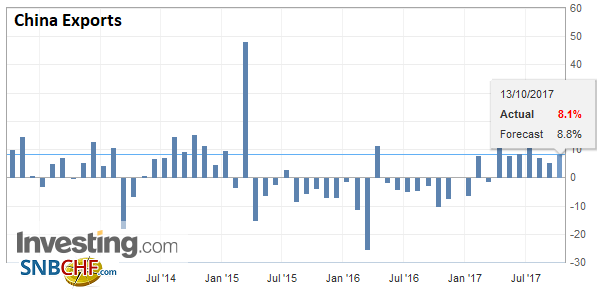

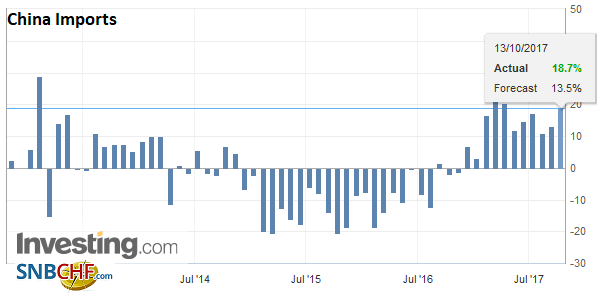

| Exports rose 8.1% year-over-year, which was less than expected, though an improvement from the 5.6% in the year through August. Imports rose 18.7%, accelerating from the 13.5% pace in August. In addition to the increase in trade, a couple of details stand out. |

China Exports YoY, Sep 2017(see more posts on China Exports, ) Source: Investing.com - Click to enlarge |

| China’s bilateral trade surplus with the US rose to a new record ($28.1 bln). China’s exports to North Korea fell ($. Arguably more important than the slower exports, China’s imports from North Korea fell nearly 38% from a year ago. |

China Imports YoY, Sep 2017(see more posts on China Imports, ) Source: Investing.com - Click to enlarge |

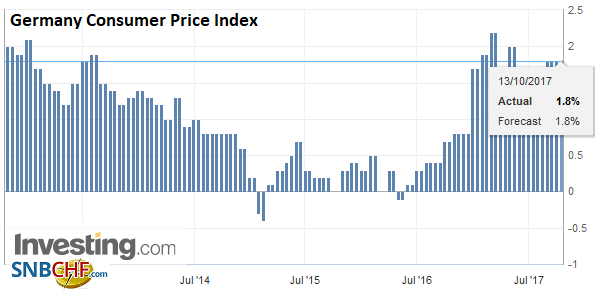

Germany |

Germany Consumer Price Index (CPI) YoY, Sep 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

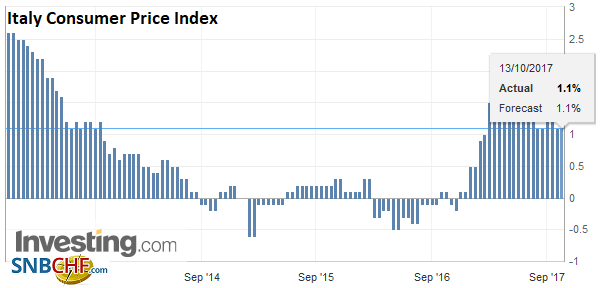

Italy |

Italy Consumer Price Index (CPI) YoY, Oct 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Japan’s Ministry of Finance confirmed that foreign investors returned to Japanese equities. Foreign investors had been selling Japanese equities since July but were net buyers in the last week of September (~JPY954 bln). MOF data showed foreign investors bought about JPY1.23 trillion of Japanese shares last week, which appears to be the most on four years.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,$TLT,China Exports,China Imports,China Trade Balance,EUR/CHF,Germany Consumer Price Index,Italy Consumer Price Index,newslettersent,U.S. Consumer Price Index,U.S. Core Consumer Price Index,USD/CHF