(Sporadic updates continue as the first of two-week business trip winds down)

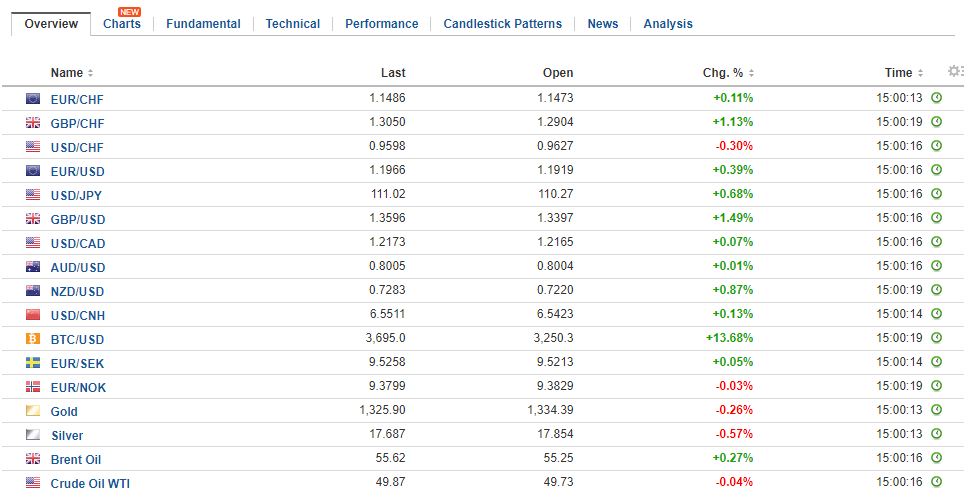

Swiss FrancThe Euro has risen by 0.03% to 1.1481 CHF. |

EUR/CHF and USD/CHF, September 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

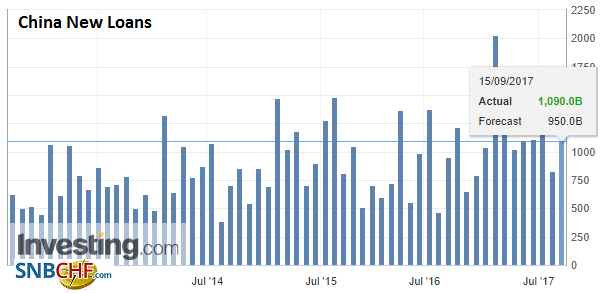

FX RatesNorth Korea missile launch failed to have much impact in the capital markets. The missile apparently flew the furthest yet, demonstrating its ability to hit Guam. However, there was not an immediate response from the US. South Korea said it had simultaneously conducted its own drill which included firing a missile into the Sea of Japan (East Sea). The yen initially popped higher. The greenback fell to around JPY109.55 after briefly pushing through JPY111.00 in North America yesterday. The dollar quickly bounced off the 20-day moving average, which also coincided with a 38.2% retracement of this week’s dollar gains (~JPY109.60). Good buying was seen and the dollar returned to the JPY110.80 by late in the Asia session. |

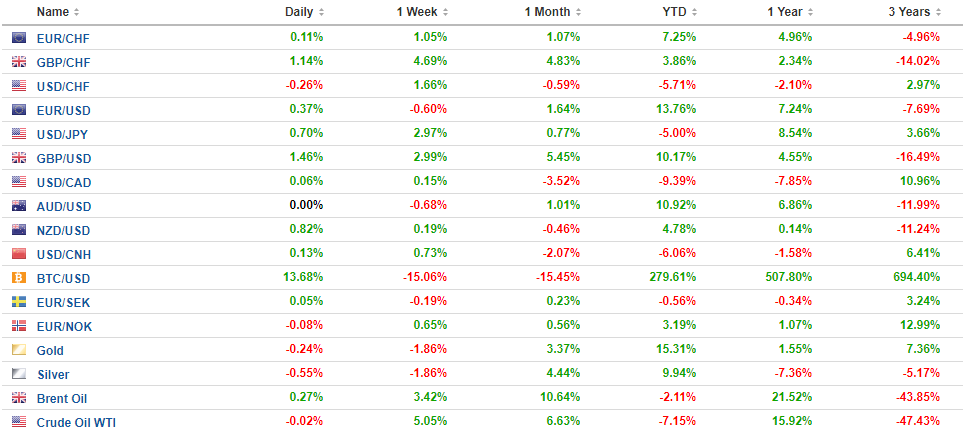

FX Daily Rates, September 15 |

| Korea shares rose 0.35%, its fourth advance in the past five sessions, to bring the weekly gain to 1.8%. The rise came despite continued foreign liquidation. Foreign investors sold $305 mln worth of Korean shares ahead of the weekend, which was nearly half of the week’s sales. The Kospi closed near its best levels in a month. The won, on the other hand, slipped around 0.4% over the past week. More broadly, the MSCI Asia Pacific Index rose about 0.6% on the week, its fifth weekly increase. This regional benchmark has had one losing week since early July.

There are some large currency options that expire today that could impact trading. There are 1.8 bln euros struck at $1.19 that will be cut today. There are 2.2 bln euros struck at $1.20, which seem less relevant now with the euro around $1.1930. There are $1.6 bln in options struck between JPY110.50 and JPY110.60 that expire today. There is a more modest GBP206 mln option struck at $1.34 that roll off today. |

FX Performance, September 15 |

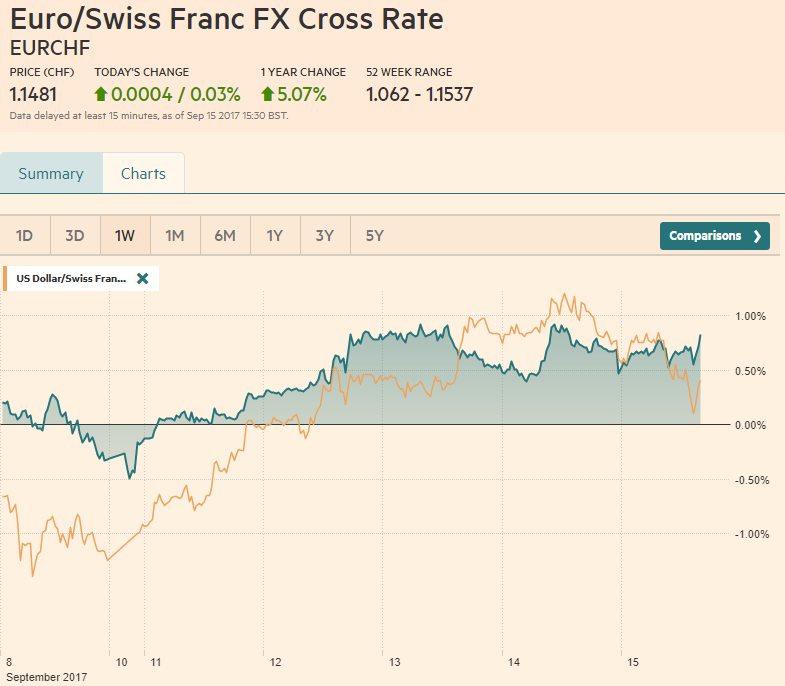

ChinaWhile media trumpets that the Chinese yuan had its biggest weekly fall of the year, it needs to be put in context. The yuan’s decline was about 0.7%. Remember under the old Bretton Woods system, one percent movement was consistent with a pegged regime. Moreover, the yuan had risen about 2.6% in the previous three weeks. It was not simply a case of a soft yuan, though the PBOC consistently set the fixing rate lower and removed some disincentives to short the yuan, but the dollar was also generally well bid. The Dollar Index, for example, rose as much as the yuan fell. Chinese data disappointed and the Chinese shares traded heavily after the data, giving back the gains scored earlier in the week. |

China New Loans, Aug 2017(see more posts on China New Loans, ) Source: Investing.com - Click to enlarge |

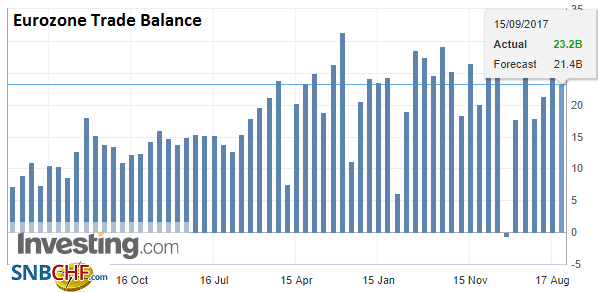

EurozoneSterling is the big winner of the week. The BOE’s hawkish forward guidance sent sterling sharply higher yesterday and it is building on those gains today, reaching $1.3450. It had finished last week near $1.32 and had finished last month near $1.2930. The implied yield on the December short-sterling futures contract rose 13 bp on the week through yesterday, while the yield on the 10-year Gilt rose 18 bp. While sterling gained around 1.7% against the dollar (@~$1.3425), the euro slide about 2.6% against it (@~GBP0.8880). The prospect that the BOE raises rates while the ECB announces an extension of its purchases, which given the sequencing that has been outlined means that the UK could be a year ahead of the ECB in raising rates, caught many participants wrong-footed. Given the importance the MPC placed on high frequency data, sterling is likely be particularly sensitive to the data flow in the coming weeks. Interpolating from the OIS, the market appears to be pricing in a greater chance that the BOE hikes this year (~64%) than the Fed (Bloomberg ~47%; our own calculation suggests that a little less than a 40% chance has been discounted). |

Eurozone Trade Balance, Jul 2017(see more posts on Eurozone Trade Balance, ) Source: Investing.com - Click to enlarge |

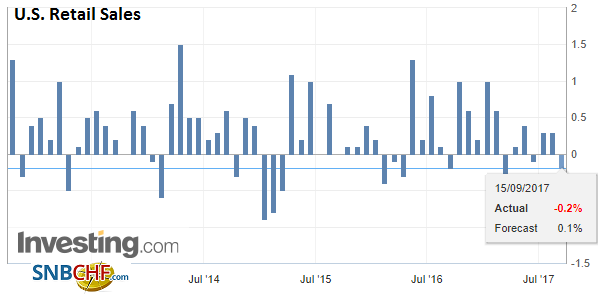

United StatesAhead of the weekend the US reports a slew of data. The most important are the August retail sales and industrial output figures. We suggest there is upside risk to the median forecast that US retail sales rose 0.1% August. That risk stems partly from prices, like gasoline, and partly from volume, as the Redbook weekly figures have been rising. The market has already seen that auto sales were softer. |

U.S. Retail Sales, Aug 2017(see more posts on U.S. Retail Sales, ) Source: Investing.com - Click to enlarge |

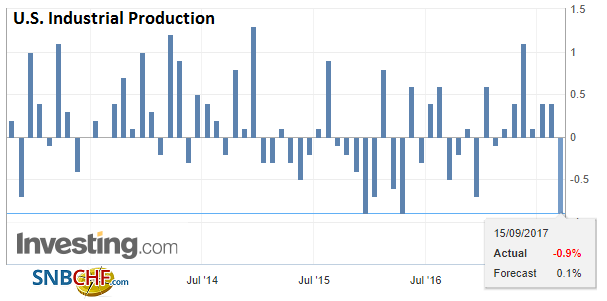

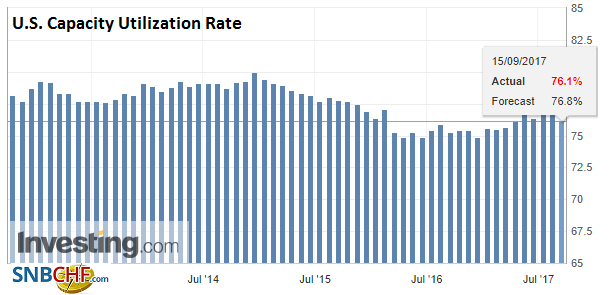

| Industrial output is also expected to have risen 0.1%. Here, although the bar is low, we are concerned about downside risks stemming from auto related output and some slippage from the energy sector. Manufacturing itself may have fared better. Recall manufacturing employment rose by 36k in August, the largest increase since August 2013, which itself was the largest since March 2012. Many economists are puzzled by the lack of more robust investment given the low interest rates. We are struck by the relatively low capacity utilization give the maturity of the expansion cycle. Capacity utilization rate was 76.7% in July and is expected to be unchanged in August. |

U.S. Industrial Production, Aug 2017(see more posts on U.S. Industrial Production, ) Source: Investing.com - Click to enlarge |

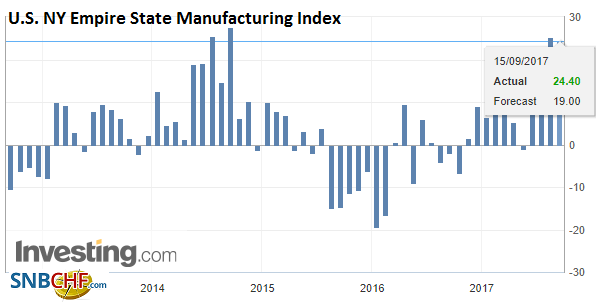

| The US also reports the Empire State manufacturing survey for September. It will be overshadowed by the retail sales report. |

U.S. NY Empire State Manufacturing Index, Sep 2017(see more posts on U.S. NY Empire State Manufacturing Index, ) Source: Investing.com - Click to enlarge |

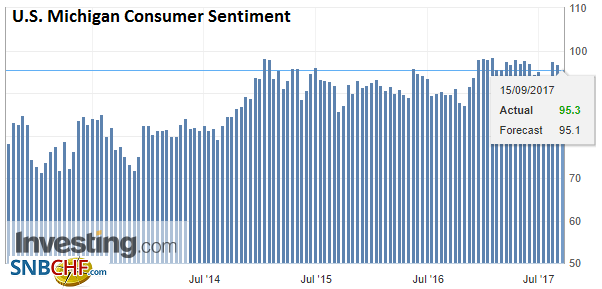

| Later, the University of Michigan’s consumer sentiment and inflation expectations survey will be released. The long-term inflation expectation stood at 2.5% in August. |

U.S. Michigan Consumer Sentiment, Sep 2017(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

| It is expected to be unchanged. It has not been above 2.6% since March 2016. It has not been below 2.4% this year. This seems like the definition of stability. |

U.S. Capacity Utilization Rate, Aug 2017(see more posts on U.S. Capacity Utilization, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$JPY,China New Loans,EUR/CHF,Eurozone Trade Balance,Korea,newslettersent,U.S. Capacity Utilization,U.S. Industrial Production,U.S. Michigan Consumer Sentiment,U.S. NY Empire State Manufacturing Index,U.S. Retail Sales,USD/CHF