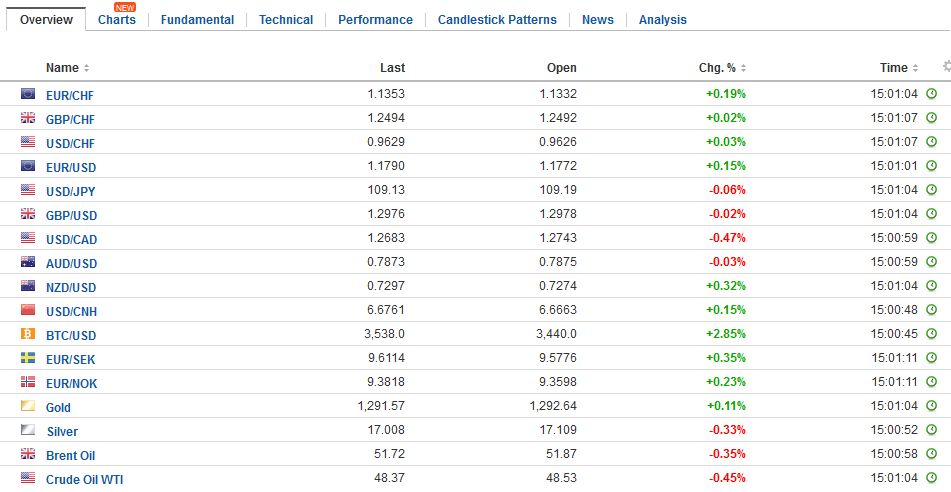

Swiss FrancThe euro is up by 0.19% to 1.1348 CHF |

EUR/CHF and USD/CHF, August 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe downward pressure on US yields, with the 10-year slipping to 2.18%, nearly a two-month low, coupled drop in equities helped underpin the Japanese yen. The dollar traded below JPY109 for the first time since the middle of June. The greenback could not get back above JPY109.30. There is a large ($1.6 bln) option struck at JPY109 that expires in NY today. The euro is sidelined. It has largely been confined today to a quarter cent range above $1.1750. It finished last week near $1.1780. Its four-week advance is at risk. There are chunky euro options that expire before the weekend. At $1.17 there are 1.2 bln euro options that will be cut today, and nearly 1.7 bln euros struck at $1.1755-$1.1765. |

FX Daily Rates, August 11 |

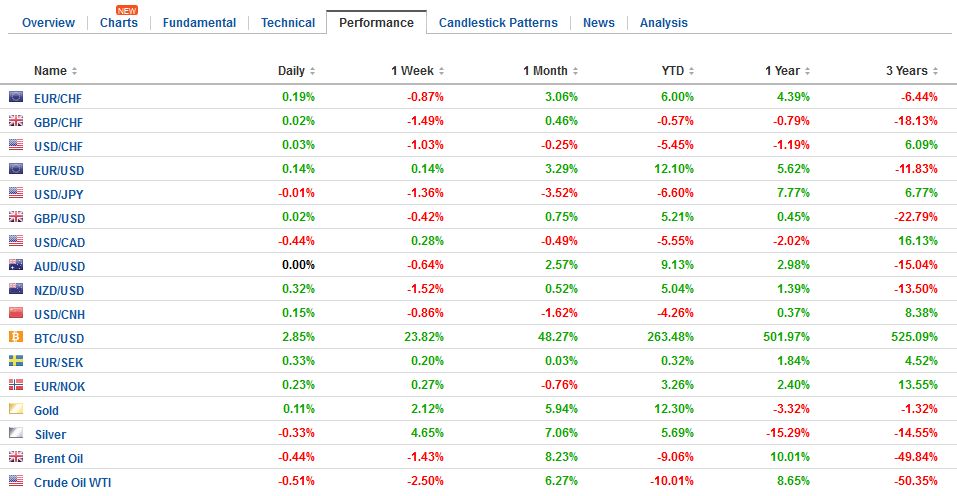

| There has been no apparent attempt by either North Korea or the United States to ease the rhetorical flourishes that have made global investors nervous. Risk assets were liquidated, and the funding currencies, particularly the Japanese yen and Swiss franc were bought back. The yen gained nearly 1.6% this week, ahead of the US session, while the Swiss franc gained 1.3%. Gold is edging higher today, for the fourth consecutive session, and 2.4% for the week to reach levels not seen in two months.

South Korean equities fell 1.7% today to bring the loss for the week to 3.2%. Tokyo markets were closed today for a public holiday, and the MSCI Asia Pacific excluding Japan fell 1.5% and 2.4% for the week. MSCI emerging market equity index also lost 2.4% this week to snap a four-week advance. The Korean won eased less than 0.2% today, which brought the weekly loss to 1.6%. It eclipsed the Philippine peso as the weakest in Asia but a couple of hundredths of a percent. After the yen, the Chinese yuan was the strongest in the region, gaining almost 1%. |

FX Performance, August 11 |

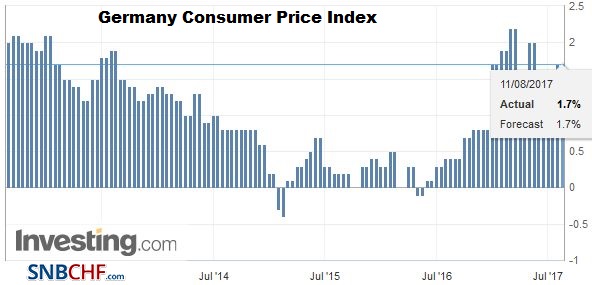

Germany |

Germany Consumer Price Index (CPI) YoY, July 2017(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

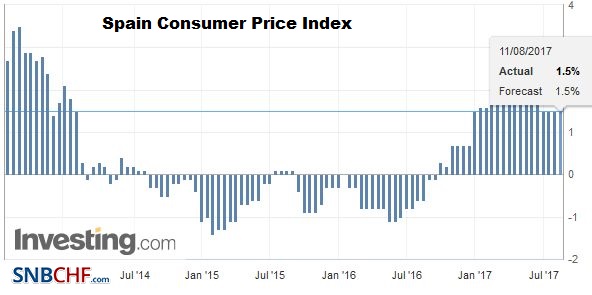

Spain |

Spain Consumer Price Index (CPI) YoY, July 2017(see more posts on Spain Consumer Price Index, ) Source: investing.com - Click to enlarge |

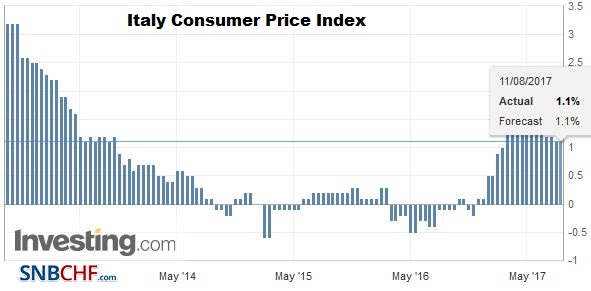

Italy |

Italy Consumer Price Index (CPI) YoY, July 2017(see more posts on Italy Consumer Price Index, ) Source: investing.com - Click to enlarge |

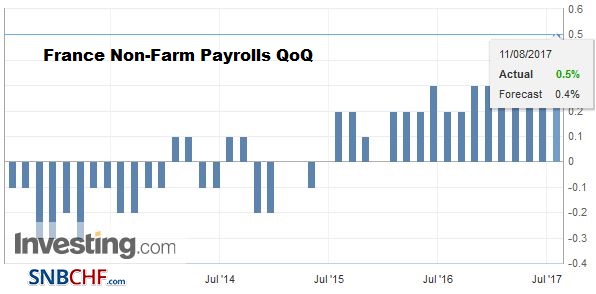

France |

France Non-Farm Payrolls QoQ, Q2 2017(see more posts on France Non-Farm Payrolls, ) Source: investing.com - Click to enlarge |

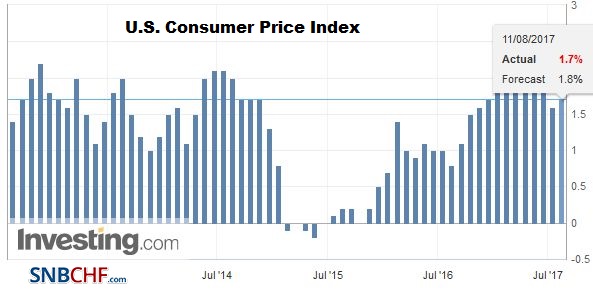

Unites States

|

U.S. Consumer Price Index (CPI) YoY, July 2017(see more posts on U.S. Consumer Price Index, ) Source: investing.com - Click to enlarge |

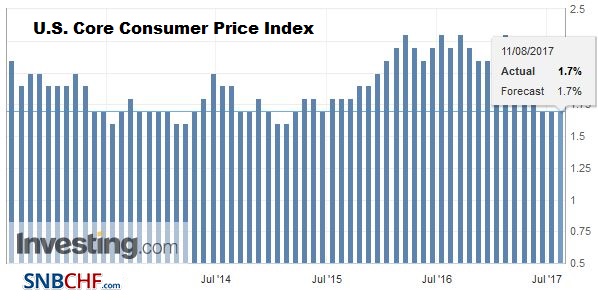

| Most expect the core rate to remain unchanged at 1.7% for the third consecutive month. If there is a surprise, we suspect it is to the upside of the core rate, perhaps encouraged by the uptick in the medical services component of the PPI (released yesterday) that feeds into the CPI. |

U.S. Core Consumer Price Index (CPI) YoY, July 2017(see more posts on U.S. Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

NY Fed Dudley’s comments yesterday did not address specifics about monetary policy. However, his broad-stroke characterization of the economy leaves little doubt that the Fed’s leadership is on track to announce next month the start of its gradual balance sheet operations. The resilience of the US economy was recognized, and despite the weakness in prices in H1, Dudley, like other Fed officials, continue to expect inflation to rise toward its medium-term target. The FOMC minutes from last month’s meeting will be reported next week. We expect the concern about the lack of price pressures was shared and that there is no urgency to hike in September. Instead, by beginning the balance sheet operations, the FOMC buys time to monitor prices going forward. We continue to think the odds of a December move are more than 50/50 for which the market is pricing in about a 1 in 3 chance.

The dollar-bloc currencies have fallen out of favor. It is not just about unwinding of risk due to the geopolitical concerns. In New Zealand, the central bank’s rhetoric protesting the currency’s strength was turned up a notch. In Australia, the central bank governor also made it clear that there was no rush to tighten monetary policy. His message was one of patience. The Canadian dollar fell every day last week and in three of this week’s five sessions. It is nearly flat in today’s activity. This is the second consecutive weekly decline, which followed a seven-week rally in eight weeks.

The September light sweet crude oil futures contracted posted a large outside down day yesterday, by trading on both sides of the previous day’s range and closing below that low. The market again rejects the $50 a barrel level. Many are skeptical about OPEC’s discipline and today’s IEA report illustrates why. The IEA estimates that the 22 countries bound by the agreement produced 470k barrels a day in July above the quotas. Global output is nearly 500k barrels a day above last July. Meanwhile, Brent prices have moved into backwardation, which means that front month contracts sell for more than the deferred months. October is the front-month Brent oil contract. The price of Oct Brent is above the price of contracts out until May 2018. It is the first time the price of the front month contract is above the first deferred contract in nearly 16 months. If it is sustained, it will be seen as a sign that the oil market is re-balancing.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CHF,$EUR,$JPY,$TLT,EUR/CHF,France Non-Farm Payrolls,Germany Consumer Price Index,Italy Consumer Price Index,newslettersent,Spain Consumer Price Index,U.S. Consumer Price Index,U.S. Core Consumer Price Index,USD/CHF