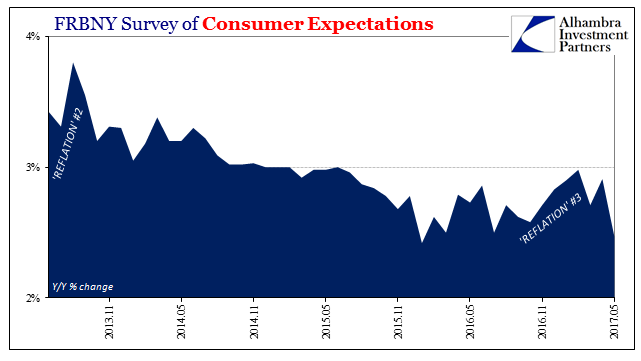

| The Federal Reserve Bank of New York has for the past almost four years conducted its own assessment of consumer expectations. Though there are several other well-known consumer surveys, FRBNY adding another could be helpful for corroborating them. Unfortunately for the Fed, it has.

The latest update for May 2017 suggests a considerable decline in forward inflation expectations, particularly those asked of consumers for three years ahead. At a median level of just 2.47%, that is barely more than the series low of 2.45% registered in January last year. So much for “reflation.” |

FRBNY Survey Of Consumer Expectations, November 2013 - May 2017 |

| Though the data does not go back all that far, it does capture now two “reflation” episodes. The first in 2013 was as the UST yield curve, eurodollar futures, or practically anything else. Consumers were as markets enamored with the idea of full recovery as well as it being close at hand. For this series, the mediam 3-year expectation was nearly 4% at its peak. That infatuation was only brief, as despite constant mainstream rhetoric and predictions for better days, inflation expectations as well as markets continued only in the wrong direction over the next few years of the “rising dollar.”

It has left officials exasperated, even as the acceleration of inflation this year was predictably brief.

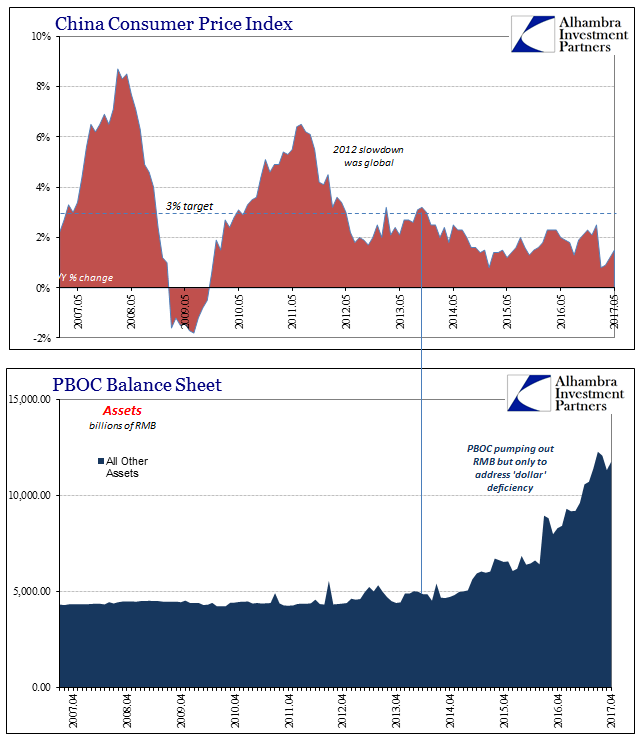

It isn’t just US inflation that has, for authorities anyway, disappointed. Last Friday, Chinese government sources reported that country’s CPI at 1.5% year-over-year also for May 2017. That is half the rate specified by government decree, an explicit target set by political officials for the PBOC to hit via monetary policy means. Though 1.5% is slightly above 0.8% estimated for February, it is still more like early 2016 than global or domestic “reflation.” |

China Consumer Price Index And PBOC Balance Sheet, April 2007 - May 2017(see more posts on China Consumer Price Index, ) |

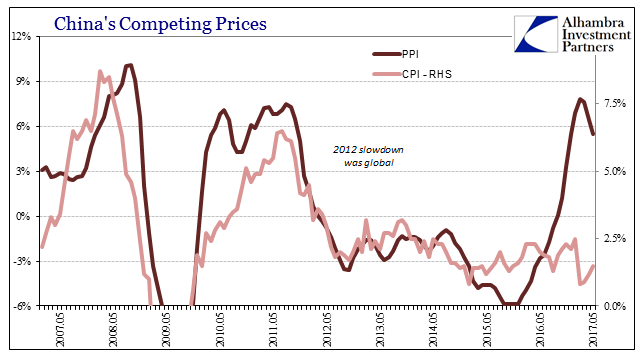

| Chinese producer prices, those more closely associated with commodities, also decelerated in May. From an oil/copper driven peak of 7.8% in February, China’s PPI has pulled back to a 5.5% increase as of this latest month. The disparity between the CPI and PPI only further highlights the lack of any momentum apart from commodity price base effects. |

China's Competing Prices, May 2007 - May 2017 |

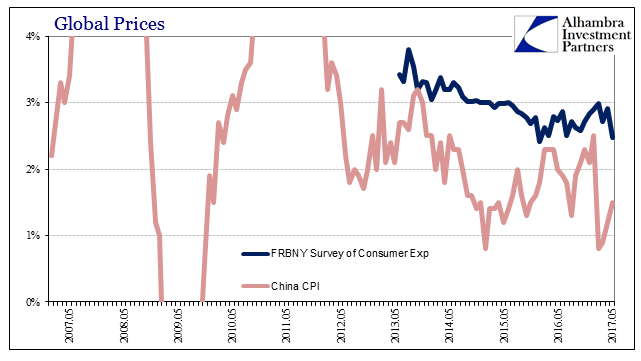

| There is instead more of FRBNY’s survey for consumer expectations in China’s CPI than its PPI. The overall trend in both those data series is similar for the same global economic reasons. No matter what either central bank has attempted in the past, consumer prices in both places are not much if at all affected (consumers in the US don’t appear all that much convinced by the US CPI’s small oil effects). In China, at least, the monetary deficiency is visible right on the PBOC’s balance sheet, where for the Federal Reserve it is left more of a private matter these days with the Fed no longer considering any role on that account. |

China Global Prices, May 2007 - May 2017 |

| It wasn’t supposed to be this way. By every historical standard, after a downturn there is an upturn. Yet again, however, the global economy experiences the former without much if any of the latter. The economy this year is better to be sure, but that just doesn’t mean what many people, including policymakers, thought it would. |

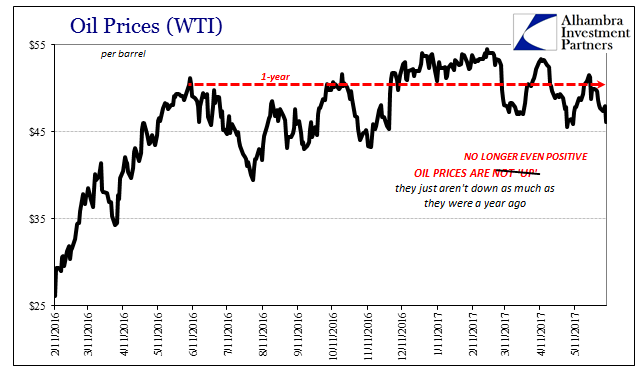

WTI Oil Prices, February 2016 - June 2017(see more posts on oil prices, ) |

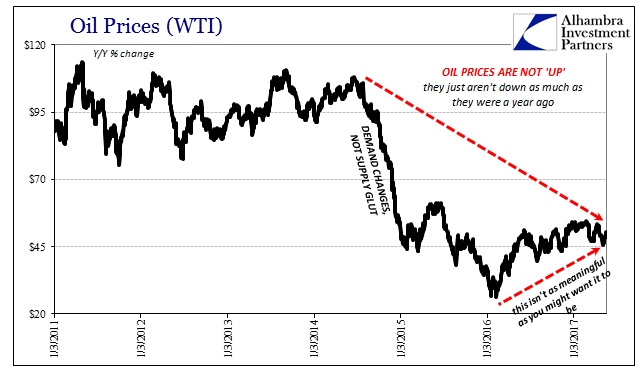

| Whether people in China or in the United States, there isn’t much real economic belief in “reflation” especially as it relates to any immediate economic evidence for it. Even at its more recent “height”, it was left more of a dim hope than actual expectation; a fragment of oil-driven optimism that was in truth not all that much. Global oil has been more of a dominant monetary condition than any central bank. |

Oil Prices WTI, January 2011 - June 2017(see more posts on oil prices, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: China,China Consumer Price Index,CPI,currencies,economy,Federal Reserve,Federal Reserve/Monetary Policy,inflation expectations,Markets,newslettersent,OIL,oil prices,PBOC,PPI,WTI