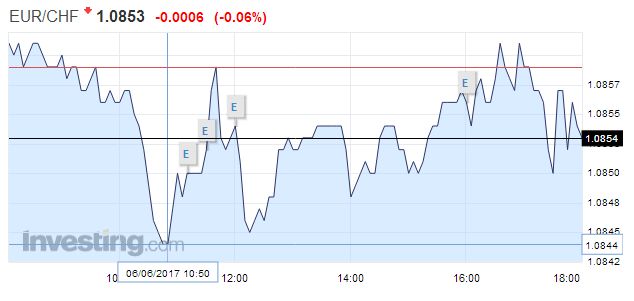

Swiss FrancThe euro is lower at 1.0853 (-0.06%). |

EUR/CHF - Euro Swiss Franc, June 06(see more posts on EUR/CHF, ) |

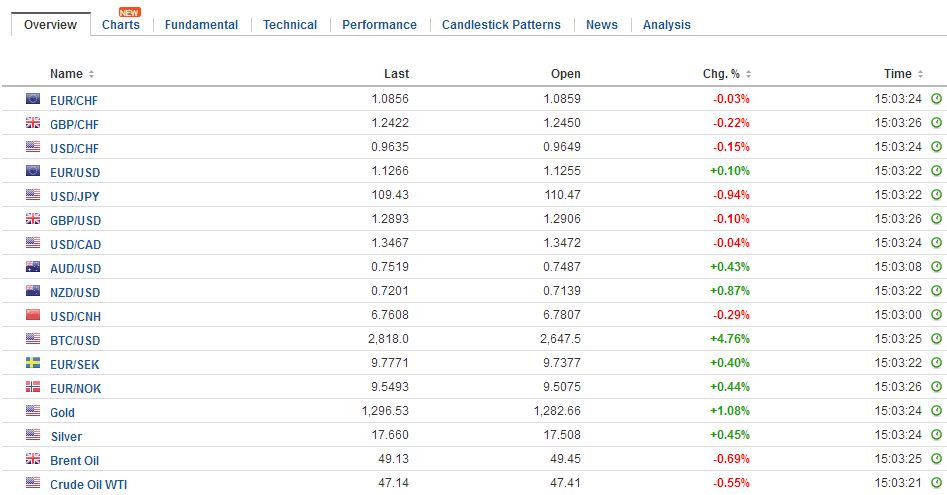

FX RatesThe week was supposed to be dominated by the UK election and the ECB meeting, but the yen is stealing the show in the first part of the week. The US dollar has been sold through JPY110 for the first time since late April. The euro has fallen from JPY125.30 before the weekend to JPY123.25 today. The yen’s strength weighed on Japanese share prices. The Nikkei lost almost 1%, its largest loss in 2.5 weeks. The retreat was led by health care (-2.2%) and telecom (-1.6%). On the other hand, the 30-year bond auction drew the highest bid-cover seven months Sterling is firm but does not appear to be going anywhere quickly. It did rise to its highest level in nearly two weeks at $1.2950. The options market continues to be investors anxiety is being expressed. The one-week put-call skew is the most extreme 3.89% discount for sterling calls over puts) since the referendum. It briefly pushed through the 4% mark. One-week implied volatility reached 14% yesterday and softer today nearer 13.20%. The Australian dollar initially fell around a quarter of a cent on the news but rebounded to approach yesterday’s higher just shy of $0.7500. After a strong two-day rally (that began from ~$0.7375), the Aussie is consolidating. A move above $0.7520 would likely signal the next leg up that could carry it toward $0.7600 initially. |

FX Daily Rates, June 06 |

| In response to Macron’s victory in the first round of the French presidential contest, the dollar gapped higher on April 24. It briefly entered the gap the next day, but was not able to close it and the dollar rallied over the next several weeks. However, the recent dollar deterioration, and today’s drop, that gap is in play today. It extended to JPY109.40 and a break warns of a test on the year’s low set in mid-April near JPY108.

Adding to the upward pressure on the yen, according to reports, was news that a stronger than expected increase in Japan’s cash wages. The 0.5% year-over-year increase in April. It is the highest of the year and matches the highs seen in Q4 16. |T|he erratic nature of the time series may be traced to bonus payments. They rose 5.6%. In Japan, the shift from part-time workers to full-time positions is being associated with upward pressure on cash wages, while in the US, that shift is thought to put downward pressure on average wages. The euro is trading inside yesterday’s range, which was inside the pre-weekend range. The euro has not traded below $1.12 since May 31. The upside is stymied by the $1.1300 level, which matches the high seen in the immediate response to the US election last November. There are some large euro options that roll off today. The $1.1200-$1.1220 area houses 1.4 bln euro option expires today. The $1.1250-$1.1275 see another 2.5 bln euros expires. Options struck at $1.12 expire tomorrow (2.8 bln euros) and on Thursday (1.6 bln euros). While cash wages rose, when adjusted for inflation, real cash earnings were flat in April from a year ago. This matches the best reading so far in 2017. Wage growth is understood as a necessary even if the insufficient prerequisite for stronger consumption. |

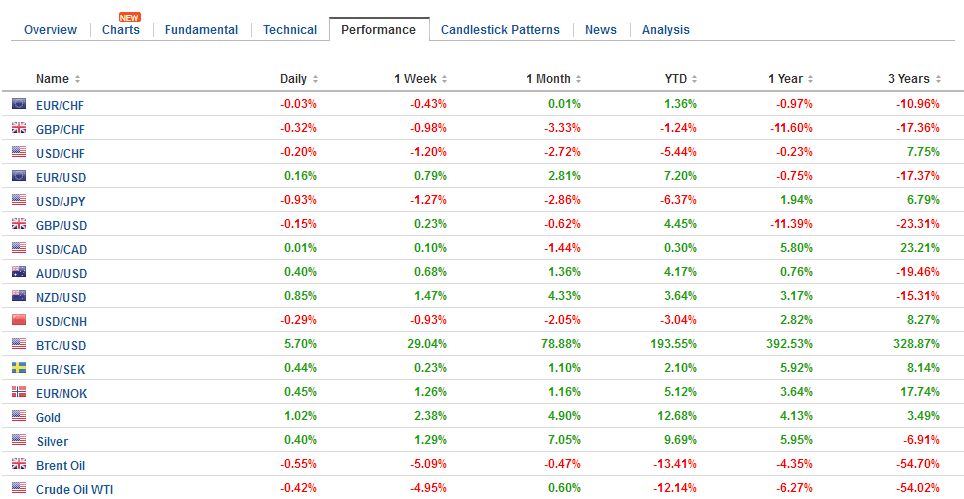

FX Performance, June 06 |

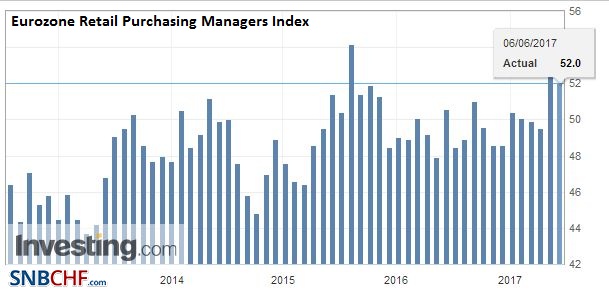

EurozoneThe news stream in Europe is light. The eurozone reported another rise in Sentix Investor Confidence survey. It is at a 10-year high. Despite the improving wealth effect from rising equities, and falling unemployment, European shoppers are still lethargic. Retail sales rose a stingy 0.1% in April, and the March series was revised to show a 0.2% rise rather than 0.3%. |

Eurozone Retail Sales YoY, April 2017(see more posts on Eurozone Retail Sales, ) Source: Investing.com - Click to enlarge |

Eurozone Retail Purchasing Managers Index (PMI), May 2017(see more posts on Eurozone Retail PMI, ) Source: Investing.com - Click to enlarge |

|

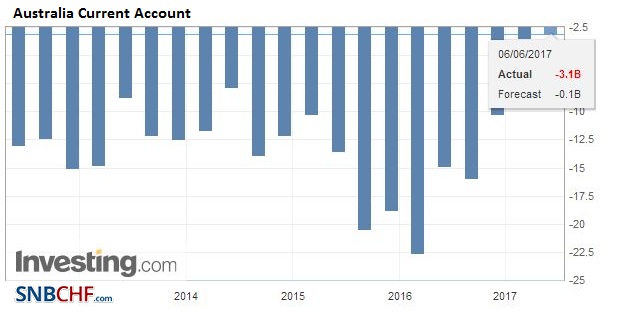

AustraliaAs widely anticipated, the Reserve Bank of Australia left rates on hold, as it has done now for 10 months. The RBA seemed to want to look the prospect of near-term softer growth. While the central bank was meeting, Australia reported a much larger than expected Q1 current account deficit (A$3.1 bln vs. median forecast for an A$0.5 bln shortfall). Net exports contracted to -0.7% of GDP from +0.2% in Q4 16. This risks a weaker than expected Q1 GDP that will be reported tomorrow. The median forecast was for a 0.3% expansion. |

Australia Current Account, Q1 2017 Source: Investing.com - Click to enlarge |

United States

The US reports JOLTS, the job opening index. It tends not to be a market mover. Last week’s jobs report was disappointing, but yesterday’s non-manufacturing ISM’s employment component shot up to 57.8 from 51.4 in April. It was the highest in nearly two years. The composite employment report was also strong. Canada reports its IVEY Purchasing Manager Index. It had rallied strongly in March and April, and we would not be surprised to see a small pullback. Meanwhile, the US dollar is trading heavily against the Canadian dollar for the third day, after moving higher in a four-day run until the jobs data on June 2.

In our work, we tend to emphasize the yen’s sensitive to the interest rate differential with the US. The US 10-year yield cannot find traction. It is off three basis points to 2.15%. It is a single basis point above the low seen in response to the tepid US employment data at the end of last week.

Old gaps are providing good mile markers, if not attractors. The US 10-year yield gapped higher last November 14, and that gap was a breakaway gap, and the yield did not look back. That gap is found between roughly 2.15% and 2.165%. It was closed following the jobs data. The 2.17% area corresponds with a 50% retracement of the rise in yields since the US election. The next retracement level is near 2.07%.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Retail PMI,Eurozone Retail Sales,FX Daily,newslettersent