| We can add China to the list of locations where the near euphoria about inflation rates is rapidly falling apart. This is an important blow, as the Chinese economy has been counted on to lead the world out of this slump if through nothing other than its own sheer recklessness. “Stimulus” was all the rage one year ago, and for a time it seemed to be producing all the right effects. This was “reflation”, after all.

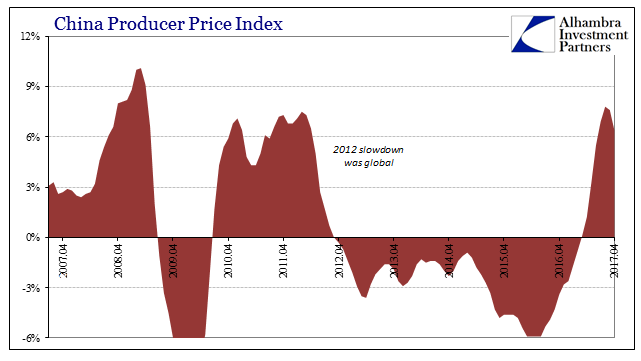

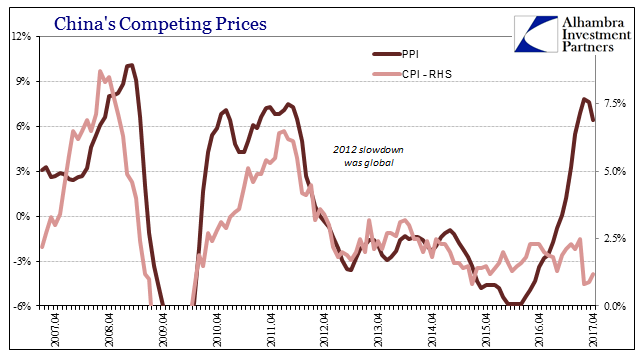

Producer prices in China had been still negative as late as last August. That country’s Producer Price Index (PPI) had contracted for 53 consecutive months before turning slightly positive in September 2016. Then, like in so many other places around the world, inflation seemed to appear in forceful fashion all at once. For China’s PPI, that meant a 7.8% annual increase for February 2017, the highest inflationary burst since the worst of the Global Financial Crisis.

|

China Producer Price Index, April 2007 - May 2017(see more posts on China Producer Price Index, ) |

| Over the past few months, however, the PPI has, also like other places around the world, started its second derivative descent. As the burst of commodity price increase due to base effects at the absolute trough last year pass, so does what might otherwise appear to be even recovery-style momentum. For April, Chinese official calculations disappointed with just a 6.4% annual PPI rate.

|

Germany Inflation, January 2007 - May 2017 |

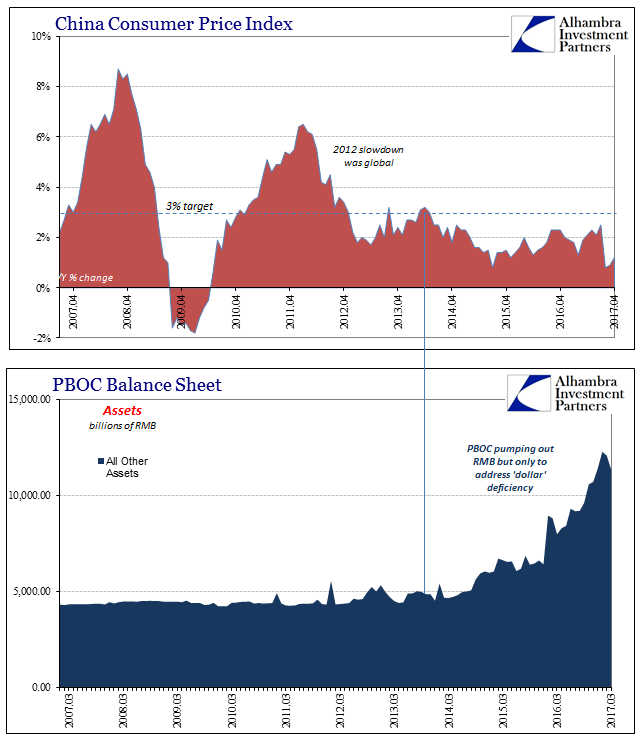

| More importantly, such inflation never even made it past the producer level. Chinese consumer prices barely budged despite the transitory onslaught of commodities. The CPI nudged almost imperceptibly upward in 2016, reaching at most 2.5% for January this year. That was a fair distance below the government’s 3% target, and was due to problems in their hog supply rather than economic momentum.

|

|

| The most recent CPI estimate for April 2017 was just 1.2%, following two months each less than 1%. Not for lack of effort, of course, as the Chinese central bank has been pumping out record amounts of RMB, just directed into the upper tiers of the banking system as a means to sort out chronic “dollar” difficulties.

|

China Cnsumer Price Index And PBOC Balance Sheet, March 2007 - March 2017 |

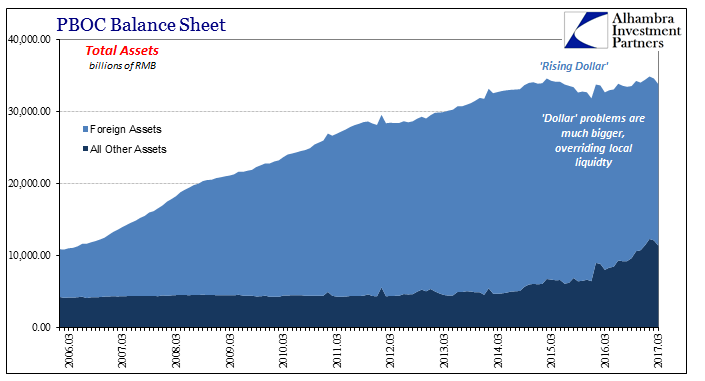

| Thus, for China at least, their inflation (meaning economic) problems are counted directly on the country’s central bank balance sheet. Commodity prices may rise on a global basis of false pretenses (commodity prices aren’t actually up in a meaningful sense), but in China that means even less, particularly as viewed from the CPI.

|

PBOC Balance Sheet, March 2006 - March 2017 |

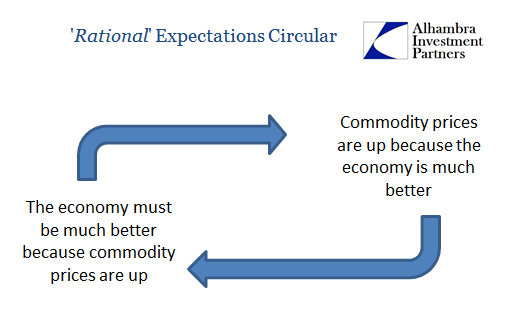

| They are all stuck on that side of the Pacific with the same circular logic that has prevailed on this side. As has been the case consistently since August 2007, no matter what any central bank does, outside of sentiment and rhetoric there isn’t any trace of it after long; as if swallowed whole by “some” unseen problem far bigger than any of the “best and brightest” central banks around the world can come up with.

All that changes are these intermittent periods where for a brief respite between “dollar” events “we” become convinced that things just have to be getting better. It is a logical fallacy, the human instinct for recency bias that there is just no way economic stagnation can just go on for as long as it has. The dichotomy like that between China’s PPI and CPI is observed in other places, such as in different measures of US consumer sentiment drawn from the same survey.

It results in repeated circumstances where every small positive, no matter how slight, is seized upon, amplified, and blown out of any proportion because continued depression just cannot happen. Every small signal of potential optimism is turned into the most convincing piece of happy evidence that has ever been conceived; only to be forgotten often in the space of just a few months, overturned by predictable reality brutally restored once more. Policymakers have contributed mightily to the confusion because they are often paralyzed by the same denial, left in a similar state of perplexity because the orthodox textbook contains no chapters on total (meaning prolonged) monetary policy failure. It is for them just as inconceivable as are the hazardous global economic settings created by it.

|

Full story here Are you the author? Previous post See more for Next post

Tags: Business Cycle,China,China Producer Price Index,commodity prices,Copper,CPI,currencies,depression,economy,Federal Reserve/Monetary Policy,inflation,Markets,Monetary Policy,newslettersent,oil prices,PBOC,PPI,recovery