| Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony. But that may only be true because “accommodation” doesn’t ever achieve what it aims to.

And so a great deal about Germany as well as Europe doesn’t make much sense. It is claimed Germany is fine, but that only valid in relative comparison to the rest of the Continent. In reality, Germany is not fine even in its vaunted industrial sector. No matter how it may look in comparison to its neighbors or even the rest of the world, the German engine of efficiency and determination remains atrocious when compared to some period other than this depression. |

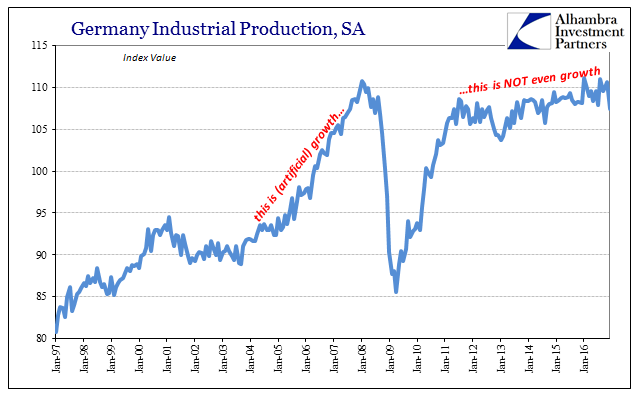

Germany Industrial Production, SA 1997-2016(see more posts on Germany Industrial Production, ) |

| German industrial production in December 2016 was only 1.4% more than industrial production in December 2015, and only 1.3% more than IP in December 2012. In fact, German industry has gained, according to this common statistic, only 9.6% since December 2007. There is no progress here or any recovery, not even the hint of one. If Germany is the engine of Europe, it is firing barely on a single cylinder. |

Germany Industrial Production, NSA 2007-2016(see more posts on Germany Industrial Production, ) |

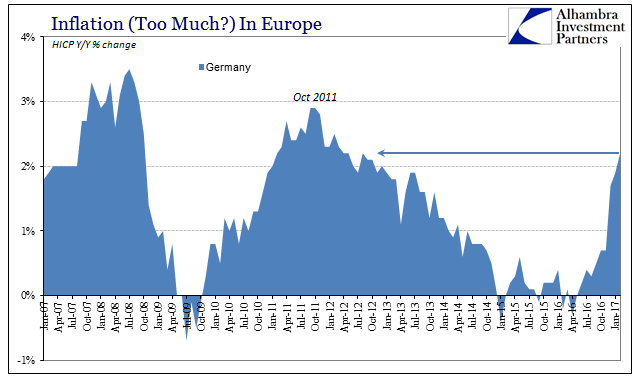

Yet, destatis reports this week that Germany’s inflation rate jumped to the highest since August 2012. The HICP rate was zero as late as May 2016, and just 0.7% in November. As a result, many are rushing to declare yet again recovery and monetary policy success – to the absurd point of worrying, like 2011, over this assumed acceleration getting totally out of hand. It is, after all, Germany:

|

Germany Consumer Price Inflation 2007-2017(see more posts on Germany Consumer Price Index, ) |

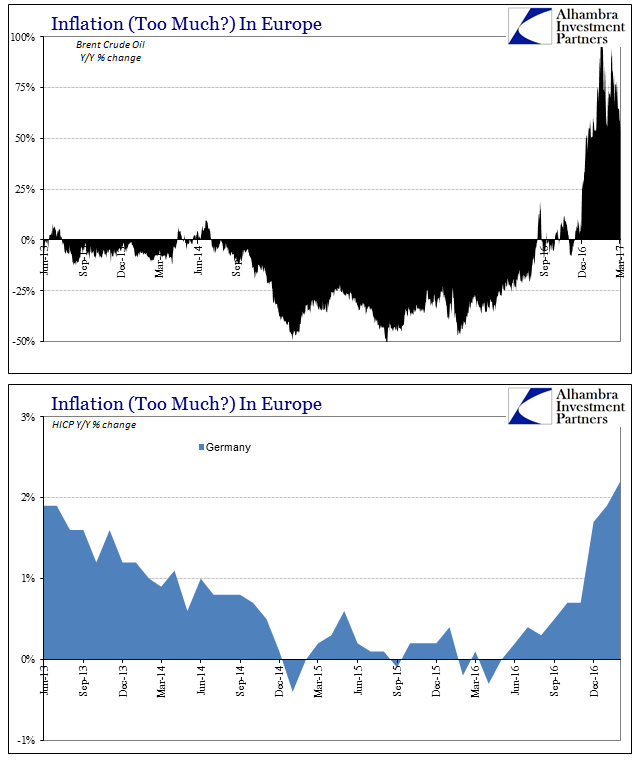

| If ECB policy was actually “ultra-loose”, would we not see German industry surging before inflation? That is how this is all supposed to work according to those who made it “ultra-loose.” Instead, all of Europe remains mired firmly in its slump with a burst of inflation that seems completely disconnected. As usual, the mystery is only in the media commentary about it, for the HICP issue for all of Europe is as the US CPI or PCE Deflator experience within the US. Oil. |

Eurozone and Germany Consumer Price Inflation 2013-2016(see more posts on Eurozone Consumer Price Index, Germany Consumer Price Index, ) |

| The market price of Brent Sea crude has rebounded just as the price of WTI has. Therefore, Europe’s inflation is “dollar” not ECB success. That includes a little extra amplification in those terms, to where Brent prices in euros have increased faster and farther than they would have when priced in dollars. The “rising dollar” as it has related to the euro this past year has served to intensify this burst of commodity base effects.

It may not seem much of a difference, as at the highest point on February 10 Brent in euros was up almost 94% versus Brent in dollars 82%, but it is a significant difference for Europe’s currency experience over the past year which has affected much more than just oil prices. The ECB for its part isn’t overly concerned because they realize without an actual economic rebound that reduces the massive inventory of crude oil stored all over the world (in places likely not yet discovered, too) oil prices are very likely to be stuck where they are (with more downside risks than upside). |

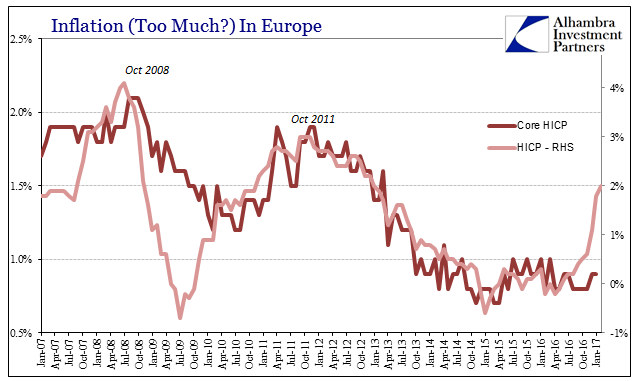

Eurozone Consumer Price Inflation 2013-2016(see more posts on Eurozone Consumer Price Index, ) |

| As the rate of change in oil prices has already begun to rollover, so, too, will HICP rates. That may have already started, as Germany’s inflation rate was 0.7% in November, jumping to 1.7% during December when oil prices began comparing to their lowest the year before, and then decelerating in each of the next two months, 1.9% and 2.2%, respectively. Unless something changes, the stay of European inflation at or above 2% will not be a sustained one. |

Eurozone Consumer and Core Consumer Price Inflation 2013-2016(see more posts on Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, ) |

It is yet another case of reflationitis, where the desire to see something other than depression causes distorted interpretations out of hope. As I wrote today with regard to Japan:

This is why markets are so captured under these various “reflation” ideas (the latest being the fourth). It is only human to recoil at these possibilities and believe them impossible so as to believe instead in the next big genius idea – even, as today, when there isn’t even one on the table. The mere hope for it is enough because to see Japan in our future just doesn’t seem at all plausible, true cognitive dissonance.

Europe has “achieved” 2% inflation at long last, but it has nothing to do with QE or a functioning economy. For that, the ECB can only hope that 2% doesn’t last very long. The last thing the people of Europe need is price pressures to go with an economy that hasn’t seen growth in a decade. The ECB might then have a whole lot more to worry about than German monetary policy criticism.

Tags: CPI,currencies,depression,dollar,ECB,economy,Euro,EuroDollar,Europe,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Federal Reserve/Monetary Policy,Germany,Germany Consumer Price Index,Germany Industrial Production,hicp,industrial production,inflation,Markets,Monetary Policy,newslettersent,oil prices,QE,stagflation,WTI