| The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece. Yet, each and every time the delta pushes positive there is the same analysis as if anyone was prevented from reviewing the history so as to very easily see the regularity by which all this happens.

From the WSJ:

That is almost always the interpretation, when reserves flash positive (and not even positive but also a lower negative) it must be due to the skill and precision of China’s much admired central bankers. From CNBC:

|

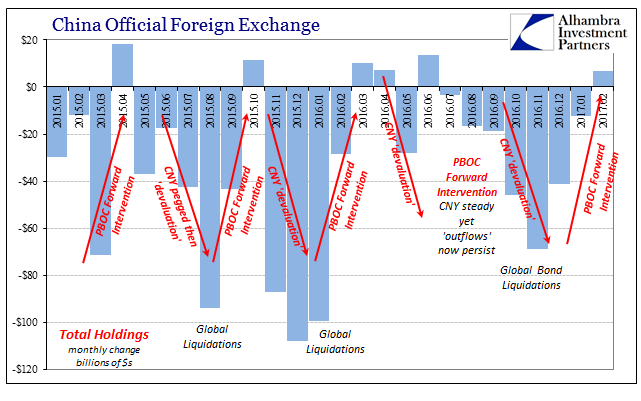

China Official Foreign Exchange 2015-2017 |

I wrote in early October 2015 when China’s assumed “outflows” merely dropped by half from the catastrophic level reached that August that mainstream commentary was setting itself up for this very repeated miscalculation.

I even quoted an article written in the Financial Times which stated directly, “the pressure has subsided.” It didn’t, of course, which after a year and a half begs someone to ask the mainstream why they keep running into the same issue of so much of the same bad analysis over and over. While the FT was in October 2015 claiming the “pressure has subsided” at least one mainstream outlet, Bloomberg, at roughly the same time described at least the means for why it wasn’t.

The problem with doing this is obvious, for if the “dollar” issue isn’t resolved at the maturity of those forwards you have to deliver “dollars” in addition to the contemporary private market demand for them. It’s like adding double demand to some point in the future, an effort you as a central bank undertake because you believe that this FX disruption is temporary. If it’s not, the result is clockwork repetition. |

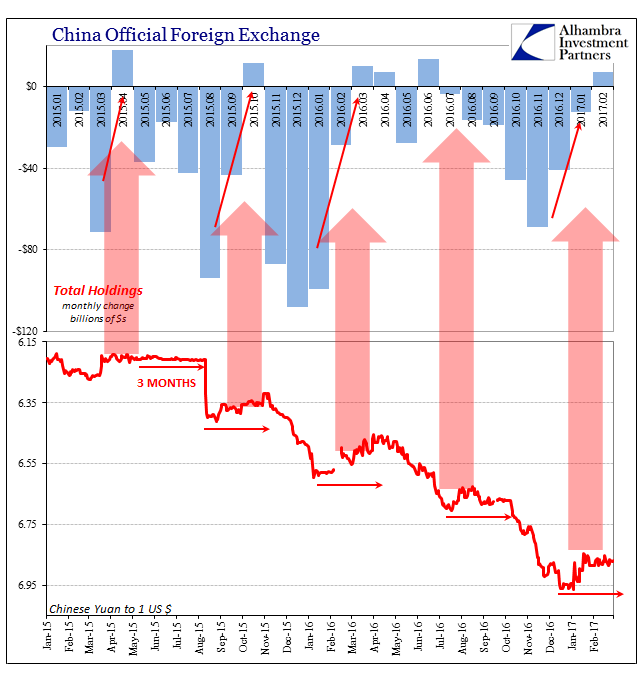

China Official Foreign Exchange, Total Holdings 2015-2017 |

This part is universal and unfortunately not strictly limited to the Chinese experience. I wrote in later October 2015 the stinking familiarity of it all:

China has more going for it than Brazil, a far better basis with which to absorb repeated and regular monetary blows. Though the difference is in the degree, it is not in the direction. |

Global Eurodollar Effects 2004-2016 |

But this is all an old story by now, practically ancient in the fast paced world of “reflation” and “this time is different.” That helps explain why we are subjected to this kind of analysis of China’s situation (from the same CNBC article):

If CNY starts falling again, and it has the past few days dipped below 6.90 again, it won’t be because of the FOMC voting to increase a money market rate corridor for a money market that nobody uses and a corridor that so often doesn’t apply to anything. It will be instead because of the inability of PBOC ad hoc measures to alleviate a “dollar” problem that just won’t go away, entering now a fourth year for the Chinese to try to handle. |

US / China Yuan 1998-2017 |

Tags: Ben Bernanke,Brazil,China,currencies,Derivatives,economy,EuroDollar,eurodollar standard,Federal Reserve/Monetary Policy,Forex reserves,FX,global dollar short,Janet Yellen,Liquidity,Markets,newslettersent,PBOC,real,renminbi,yuan