Tag Archive: FX

Computer Glitch–Brief Commentary

Thanks for your patience. See you tomorrow. Japan: USD reached nearly JPY159.15, highest since late April. US Treasury added Japan to fx watchlist after recent intervention. USD up past six consecutive sessions coming into today. Japanese rhetoric about fx escalates. National CPI headline and core ticked up primarily utilities (electricity and gas). Excluding food and energy, CPI slowed to 2.1% from 2.4%. This was largely in line with the Tokyo...

Read More »

Read More »

Holiday Overview: The State of Play

FX: The dollar

traded mostly higher last week. I suspect more near-term gains, but

I am less convinced than I was a week ago. Given the FOMC minutes

and more recent commentary from Fed officials, I suspect the market is

exaggerating the chances of two cuts this year. That had been my

leaning too, but I think the recent resilience of the labor market and

sticky inflation has shifted the views at the Fed. The...

Read More »

Read More »

September Monthly

Three forces are shaping the investment climate. The US-China trade conflict escalates at the start of September as both will raise tariffs on each other's goods and are threatening another round in mid-December (US 25% tariffs on $250 of Chinese imports will increase to 30% on October 1).

Read More »

Read More »

Fighting inflation with FX, a real traders market

The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by improving access for U.S. goods exported to Canada and Mexico and contained the list of negotiating objectives for talks that are expected to begin in one month.

Read More »

Read More »

China And Reserves, A Straightforward Process Unnecessarily Made Into A Riddle

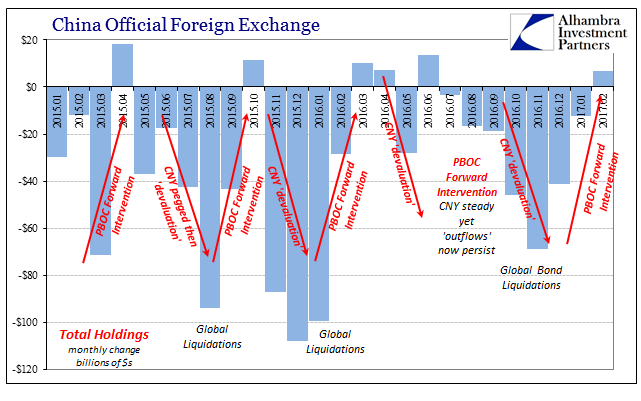

The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece.

Read More »

Read More »

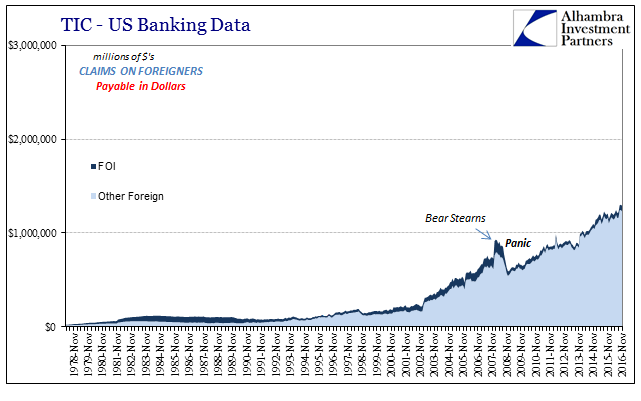

Do Record Eurodollar Balances Matter? Not Even Slightly

The BIS in its quarterly review published yesterday included a reference to the eurodollar market (thanks to M. Daya for pointing it out). The central bank to central banks, as the outfit is often called, is one of the few official institutions that have taken a more objective position with regard to the global money system. Of the very few who can identify eurodollars, or have even heard of them, the BIS while not fully on board is at least open...

Read More »

Read More »

Dollar’s Technical Tone Improves

It is not that the US dollar had a particularly good week. It was mixed. The best performers were sterling and the Canadian dollar. The pound led with a 1.6% gain, followed closely by the Canadian dollar.

The latest polls suggest that tho...

Read More »

Read More »

Death of an FX punter

terriegym: Ive came back to my computer and Alpari have closed all my trades, loosing over $1000 off of my current balance, anyone got any idea what may have happened!!! they arent answering the phone!!

Read More »

Read More »

The liquidity monster and FXCM

As we have already pointed out about Thursday’s unprecedented Swiss franc move following the SNB’s announcement about removing its 1.20 euro level floor and introducing a -0.75 per cent interest rate regime, the real story to pay attention to is what...

Read More »

Read More »

‘Negative’ has such unfairly negative connotations

Dear people, ATTENTION: HEAD OF FINANCIAL INSTITUTIONS/NETWORKMANAGEMENT/TREASURY AND/OR CASH MANAGEMENT FURTHER TO OUR SWIFT DATED 26 08 2011 PLEASE BE INFORMED THAT DUE TO THE CONTINUED PREVAILING MARKET SITUATION AFFECTING THE SWISS FRANC, WE HAVE...

Read More »

Read More »

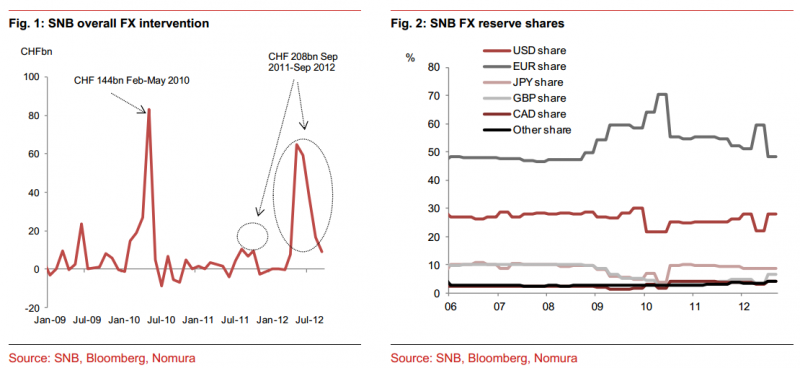

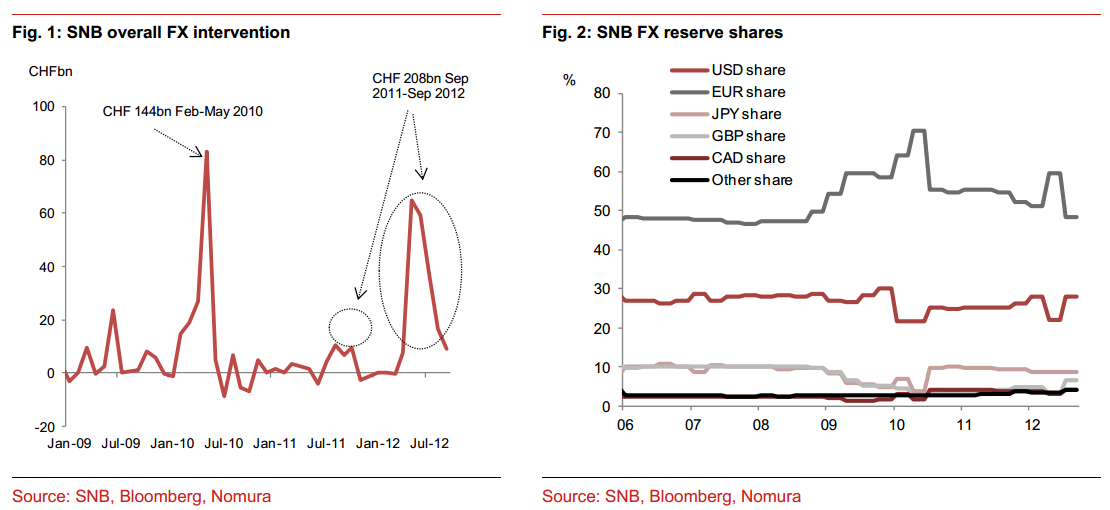

The Swiss National Bank straddle

It’s Swiss National Bank reserve figures Wednesday! That glorious day when we get to see how exactly the ingredients of the SNB’s cake have changed. Or to put it more literally, how have they been dealing with the masses of euro assets they are colle...

Read More »

Read More »