| If there is still no current or present indication of rising economic fortunes, and there isn’t, then the “reflation” idea turns instead to what might be different this time as compared to the others. In 2013 and 2014, it was QE3 and particularly the intended effects (open ended and faster paced, a bigger commitment by the Fed to purportedly do whatever it took) upon expectations that supposedly set it apart from the failures of QE’s 1 and 2. This time it is more fiscal than monetary, a potential difference that isn’t lost on “reflation” believers. |

Oil WTI, May 2016 - February 2017 |

| There is every reason to suspect that a broad array of “stimulus” will be unleashed at some point, one that will include tax cuts corporate as well as personal income (rumored). The repeal of Obamacare is thought to be helpful in releasing the hiring impulse particularly for small businesses, and even Dodd-Frank’s impending removal could in theory restart bank leverage. |

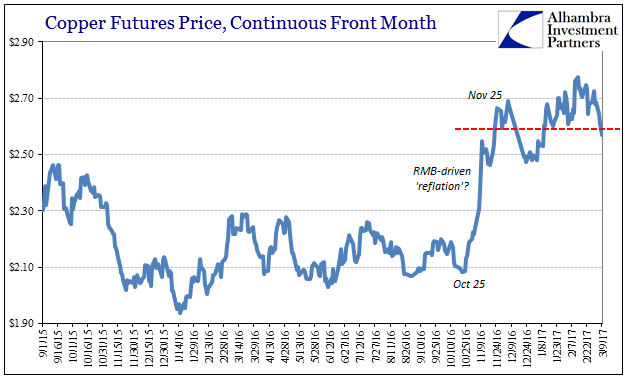

Oil Copper, 2015 - 2017 |

Even if you believe that all those things together or separately will achieve the sought after “difference”, it is becoming clearer that they will be possibilities to watch in 2018 rather than 2017. The tax cut package which was promised in detail weeks ago is nowhere near ready for public evaluation (apparently). The repeal of Obamacare has been far from ideal so far, where even in friendly circles it is being described in terms once used for the passage of Obamacare itself. As to the last, Dodd-Frank, it may be the case that it doesn’t happen at all.

|

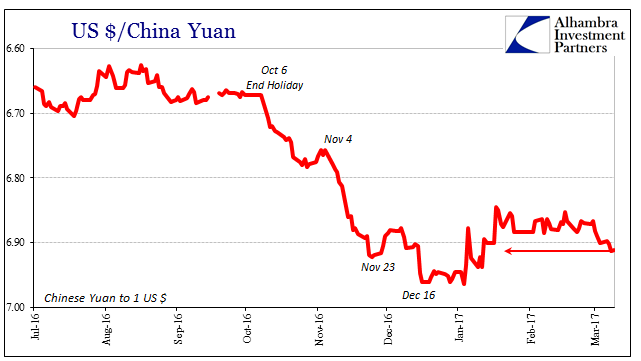

US Dollar / China Yuan, July 2016 - March 2017 |

| All of these setbacks, and they are legitimate setbacks to a “reflation” regime predicated on little more than hope ,would be considerable pressure for any positive “reflation” trade. The action in oil prices the past week or so, for one, might be consistent with growing doubts about timing if not President’s Trump’s ability to ultimately get these done.

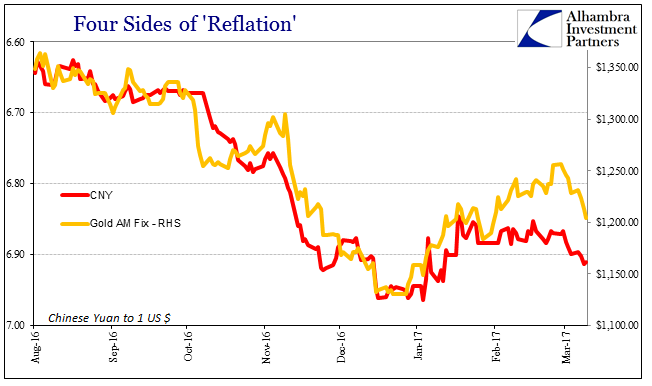

There starts the parade of correlations: That being said, however, this turnaround possibly against “reflation” reflected primarily in the sudden downside to WTI might be explained better in more familiar terms. Just as oil and copper have dropped out of their extremely tight ranges, so too have a number of other prices and trading – starting with CNY. |

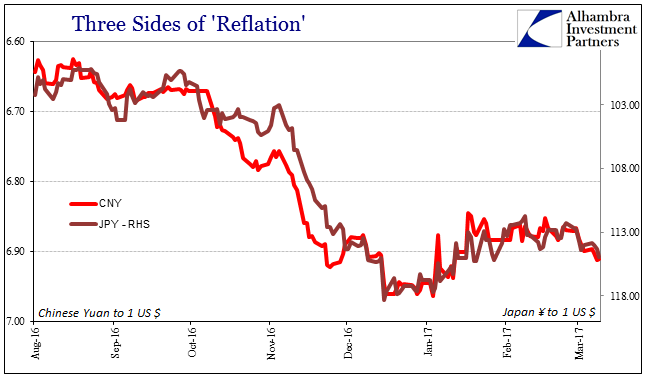

Oil CNY JPY, Aug 2016 - March 2017 |

| My favorite, for lack of a better word, is again JPY with CNY; once more they alternate to where the pain in one is the relief for the other. Right now, with CNY inching closer to its latest zero-hour, it is China taking the brunt (CNY down though the PBOC has expended great effort to keep it stable) where Japan is allowed the reprieve (JPY down in the direction BoJ wants it to go). This is the reverse, of course, from the middle of December through early February, where JPY was rising again (infuriating the BoJ) while CNY was, too (at the great effort of China’s central bank).

Again, even if you believe Trump is the game-changer (and I do not, expecting instead that these necessary improvements are only that, improvements), pushing the paradigm shift further into the future risks the intrusion of things that will not have changed by the time those policy alterations become viable. |

Oil CNY Gold, Aug 2016 - March 2017 |

Tags: $CNY,$JPY,China,commodities,Copper,currencies,depression,dollar,economy,EuroDollar,eurodollar futures,Federal Reserve/Monetary Policy,Gold,Japan,Markets,newslettersent,OIL,oil prices,Reflation,WTI