Swiss Franc |

EUR/CHF - Euro Swiss Franc, January 18(see more posts on EUR/CHF, ) |

GBP/CHFYesterday morning Theresa May, the UK Prime Minister set out a clear and realistic plan for the UK’s Brexit, which is likely to begin at the end of March this year. Many had expected to see her give a ‘Hard Brexit’ leaning speech and the Pound had lost value in the lead up to her comments, but when she announced that the UK Parliament will be having a final vote on the Brexit deal the markets welcomed the news and the Pound rallied. It is now clear that the UK will not remain a member of the EU’s single market, as it would be impossible for the UK to abide by the EU’s rules whilst also going down the Brexit route voted for by the UK electorate. The GBP/CHF pair has gained roughly around 2 cents since the speech although over the past month the Pound has lost close to 4% against the Swiss Franc as Brexit jitters have really weighed on the Pound’s value. The Swiss Franc itself has also been benefiting from high demand as investors have been moving funds into safe haven currencies such as CHF and JPY, in anticipation of UK President-Elect Donald Trumps inauguration this Friday. |

GBP/CHF - British Pound Swiss Franc, January 18(see more posts on GBP/CHF, ) |

FX RatesThe US dollar has stabilized after yesterday’s bruising. From a fundamental perspective, little has changed. After hard exit signals from the UK government sent sterling down from $1.2430 on January 5 and 6, to below $1.20 at the start of the week, the pound rallied back to almost $1.2430 yesterday amid “sell the rumor buy the fact” activity. It was helped by comments about the US dollar from US President-elect Trump and an advisor at Davos. |

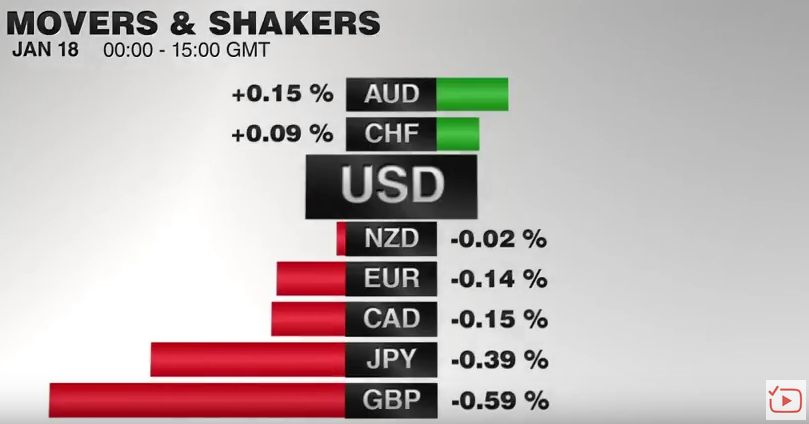

FX Performance, January 18, 2017 Movers & Shakers Source: Dukascopy.com - Click to enlarge |

| Of all the things that can and do move foreign exchange prices, the personal preference and wishes of officials are often not particularly salient except for risk. Ultimately, our bullish outlook on the dollar is driven by macroeconomic considerations, including the divergence of monetary policy. Comments by two Fed officials (President Williams and Governor Brainard) reiterated that fiscal stimulus could lift growth and the deficit and monetary policy would have to take that into account.

The seeming concession UK Prime Minister May made yesterday was that she recognize Parliament’s right to vote on the final agreement even though her government is fighting against needing Parliament’s approval to trigger Article 50 in the first place. What she has done is played the game of chicken with both the EU and her own Parliament. If the UK does not get what it wants, she threatened, it can leave the EU without and agreement. And if Parliament does not approve her agreement, in the end, the two-year countdown would leave little time to negotiate a new agreement and therefore would force the UK to leave without an agreement. In the vernacular, May seemed to declare yesterday that it is “My way or the highway.” |

FX Daily Rates, January 18 |

| Sterling is the weakest major currency today, though the US dollar is stronger against them all. It is off nearly 0.9% after rallying 3% yesterday. It had fallen 1.1% on Monday. While sterling has lost its upside momentum, a break of $1.2225-$1.2250 would likely be seen as a preliminary technical indication that a top is in place.

The US dollar is trying to snap seven-session decline against the Japanese yen. The dollar fell every session last week and the first two of this week. On January 6 the last time the dollar rose it finished the North American session near JPY117. Today it recorded a low a little below JPY112.60 before rebounding to JPY113.45. A move above JPY113.60 could spur a further advance toward JPY114.20. |

FX Performance, January 18 |

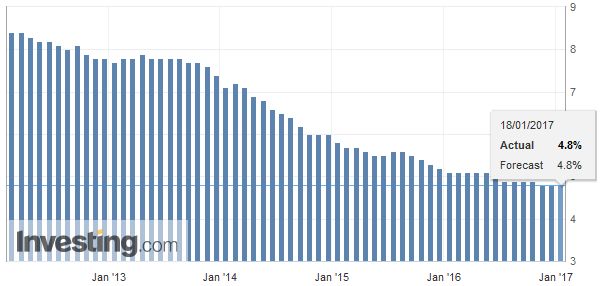

United KingdomSeparately, the UK employment report was a bit better than expected, but not much of a market mover today. |

U.K. Unemployment Rate, December 2016(see more posts on U.K. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

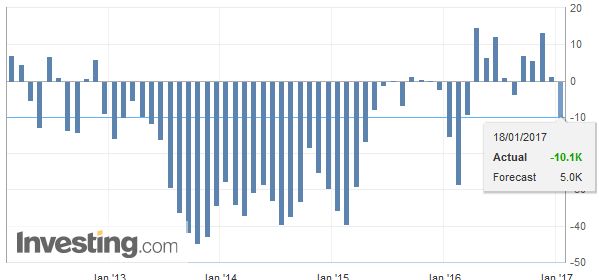

| Those claiming jobless benefits fell 10.1k in December. The median of the Bloomberg survey expected a 5k increase. |

U.K. Claimant Count Change, December 2016(see more posts on U.K. Claimant Count Change, ) Source: Investing.com - Click to enlarge |

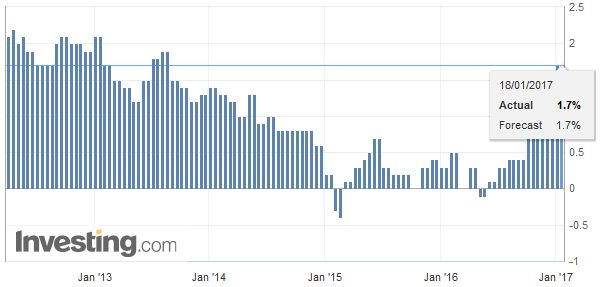

| Average weekly earnings, which are reported with an additional month lag, rose more than expected in November. The three-month year-over-year pace rose to 2.8% from a revised 2.6% (from 2.5%) the previous period. Excluding bonus payments, average weekly earnings rose 2.7% from 2.6%). |

U.K. Average Earnings ex Bonus, December 2016(see more posts on U.K. Average Earnings, ) Source: Investing.com - Click to enlarge |

EurozoneDraghi will likely note that the core CPI of 0.9% remains near the trough of 0.6% seen in early 2015. That implies the increase in the headline is mostly energy. In addition, yesterday’s bank lending survey for Q4 suggested that credit growth appeared to stall in Q4.

|

Eurozone Consumer Price Index (CPI) YoY, December 2016(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The euro’s rally yesterday met the 38.2% retracement of its losses since the US election a little below $1.0710. Support is now seen in the $1.0635-$1.0665 band. It may require a break of $1.06 to turn the technical indicators (MACD, Slow Stochastics) lower to boost confidence that a top is in place. |

Eurozone Core Consumer Price Index (CPI) YoY, December 2016(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

GermanyThe rise in German and eurozone December inflation was confirmed, and some expect the hawks at the ECB to push against the asset purchase program at tomorrow’s meeting. Having just secured the nine-month extension (of 60 bln euros rather than the current 80 bln euros) at the December meeting, it is too early to expect a change in either direction. |

Germany Consumer Price Index (CPI) YoY, December 2016(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

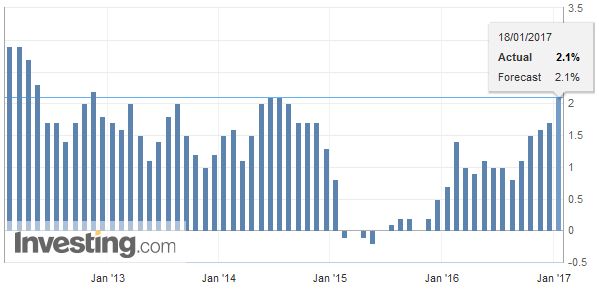

United StatesThe North American session features the Bank of Canada meeting, US CPI and industrial production, and a few Fed officials speeches, including Yellen late an hour before the equity market closes. The Bank of Canada is widely expected to leave on hold. We suspect Governor Poloz comments may be a little more upbeat, given the stronger employment report and the improved trade balance. Of course, risks remain, including US trade policy, where many companies have pursued a continental strategy for more than two decades. The US dollar approached CAD1.30 yesterday for the second time in four sessions, and it would mark a near-term bottom as CAD1.30 held in September and October as well. The Slow Stochastics have turned higher, though the MACDs are lagging. The CAD1.3200 area needs to be overcome to boost confidence that a low is in place. Today’s US data is expected to show that headline CPI moved above 2.0% for the first time since July 2014, while the core rate may be steady at 2.1%. |

U.S. Consumer Price Index (CPI) YoY, December 2016(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Industrial output has fallen in three of the past four months through November but is expected to snap back 0.6% in December. If true, it would be the largest gain since July 2015. Manufacturing itself has fared better. It fell “only” two of the past four months. The median forecast of a 0.4% gain would also be the best since July 2015.

It is unreasonable to expect Yellen to change her generally upbeat assessment of the US economy in today’s remarks. She speaks again later this week. The same for Dallas President Kaplan, a voting member, and perceived centrist. Minneapolis Fed President Kashkari is also voting member but is perceived to be more a dove. |

U.S. Core Consumer Price Index (CPI) YoY, December 2016(see more posts on U.S. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,FX Daily,gbp-chf,Germany Consumer Price Index,newslettersent,U.K. Average Earnings,U.K. Claimant Count Change,U.K. Unemployment Rate,U.S. Consumer Price Index,U.S. Core Consumer Price Index