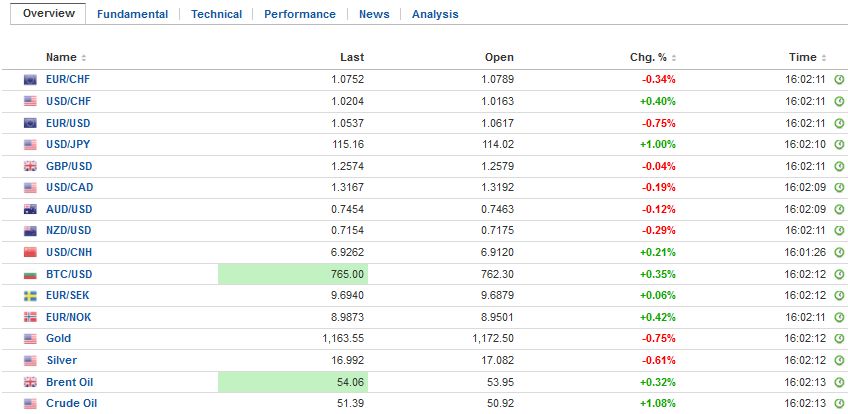

Swiss Franc |

EUR/CHF - Euro Swiss Franc, December 09(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge |

FX RatesThe euro has stabilized after extending yesterday’s ECB-driven losses. The euro’s drop yesterday was the largest since the UK referendum to leave the EU. Ahead of the weekend, there may be some room for additional corrective upticks, but they will likely be limited, with the $1.0650 area offering initial resistance. In the larger picture, this week’s range, roughly $1.05 to $1.0850 likely will confine the price action for the remainder of the month, though of course, thin holiday markets (after FOMC next week) could make for erratic price action. The German two-year yield is a few basis points from the record low seen in late November. The US premium is at the high for the week and less than two basis points below the extreme in 16 years. Next week, the FOMC meets, and while a rate hike has been discounted, growth and inflation forecasts may be lifted. The recent Wall Street Journal survey of economists found the majority expected three hikes next year. |

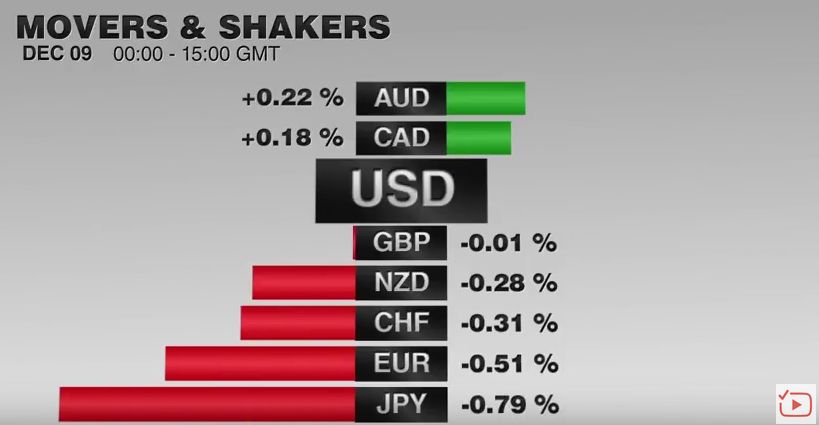

FX Performance, December 09 2016 Movers and Shakers Source: Dukascopy.com - Click to enlarge |

| Investors continued to digest the ECB’s announcements yesterday. Following the Federal Reserve, tapering is meant to imply a slowing of purchases toward an ending of them. What the ECB announced yesterday was most definitely not that. In fact, the asset purchases seem to be quite open-ended. Consider that the staff forecast of 1.7% for 2019 inflation was rejected by Draghi is insufficient to discharge the ECB’s duty. Draghi repeatedly and vociferously denied the ECB was tapering.

The reduction of the monthly purchases could reflect at least two forces. First, it could have been a small price to get some of the creditors, like Germany, to go along. This is desirable even if not necessary. It does not give up much. In fact, the ECB will buy 540 bln euro of bonds instead of the 480 bln the market had expected (9*60>6*80). By the end of next year, the ECB’s balance sheet will be about 40% of GDP. Second, by reducing the amount, the ECB could help alleviate some shortage pressure. |

FX Daily Rates, December 09 |

| Long rates rose in Europe yesterday and are higher today. Some are arguing that buying 20 bln less a month is a material force. At the same time, the rules were adjusted that allowed the ECB to buy bonds with yields lower than the deposit rate. That means that the short-end of the curves may find a better bid. Today, two-year peripheral yields are lower while rates in the core are slightly firmer.

The rising yields and equity markets weigh on the yen. The dollar is at its best level since the start of the week. Resistance is seen near JPY115.00. Today could be the first session the dollar has spent entirely above JPY114 since February. The major currencies are quiet, though the Canadian dollar is interesting. It is edging through yesterday’s highs. In fact, the US dollar fallen against the Canadian dollar in six of the past seven sessions. The recovery in oil prices and cross rate gains may have driven it. Three is scope for additional US dollar slippage, but we suspect it is limited, initially to CAD1.3160. A trend line connecting the May, August and Sept low comes in near CAD1.31. The currency-sensitive two-year interest rate differential is moving back in the US direction. |

FX Performance, December 09 |

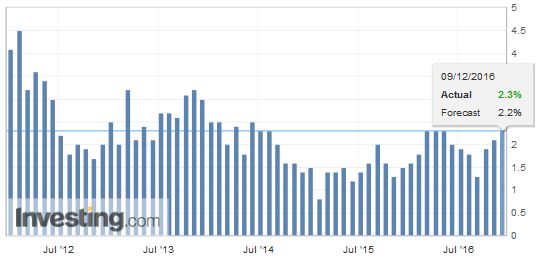

ChinaFour economic reports fill the news stream today. First China’s inflation rose. Headline CPI rose to 2.3% from 2.1%. Producer prices jumped more. They are up 3.3% from a year ago to stand at a five-year high. In October it was at 1.2%. Remember that until September producer prices had been falling since March 2012 on a year-over-year basis. |

China Consumer Price Index (CPI) YoY, November 2016(see more posts on China Consumer Price Index, ) Source: Investing.com - Click to enlarge |

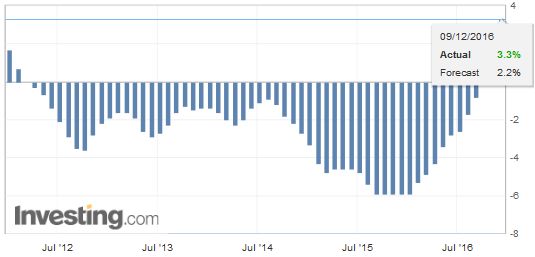

| Producer prices jumped more. They are up 3.3% from a year ago to stand at a five-year high. In October it was at 1.2%. Remember that until September producer prices had been falling since March 2012 on a year-over-year basis. |

China Producer Price Index (PPI) YoY, November 2016(see more posts on China Producer Price Index, ) Source: Investing.com - Click to enlarge |

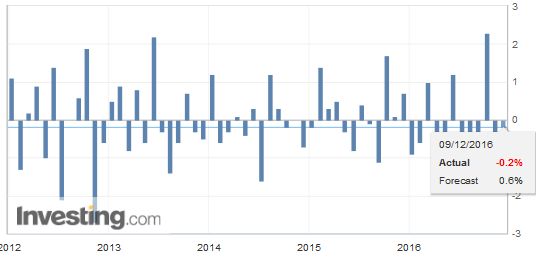

FranceSecond, France, like Germany earlier this week, reported disappointing industrial output figures for October. Output had been expected to rise around 0.5%, but instead fell 0.2%, and adding insult to injury, the September series was revised lower (-1.4% from -1.1%). Manufacturing was also a big disappointment fall 0.6% instead of rising by as much. The September figure was also revised down. The aggregate figure will be released next week. There is downside risk to the median guesstimate of 0.2%. |

France Industrial Production, October 2016(see more posts on France Industrial Production, ) Source: Investing.com - Click to enlarge |

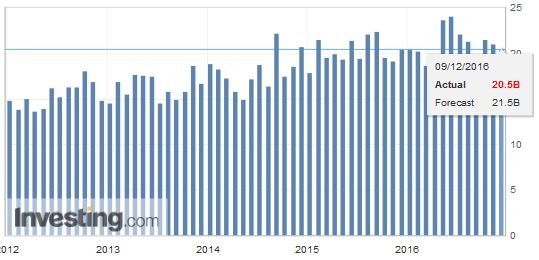

GermanyThird, Germany reported a smaller than expected trade surplus of 19.3 bln in October. |

Germany Trade Balance, October 2016(see more posts on Germany Trade Balance, ) Source: Investing.com - Click to enlarge |

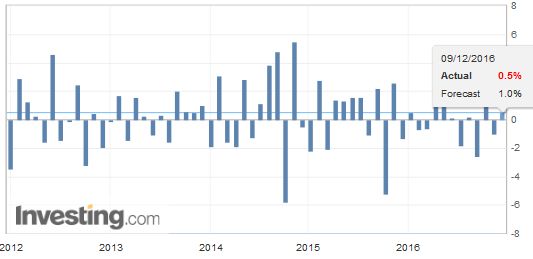

| Exports rose 0.5%, which represents a smaller recovery from the 1.0% revised decline in September (from -0.7%). Exports have risen 3% over the first 10 months of the year. |

Germany Exports MoM, October 2016(see more posts on Germany Exports, ) Source: Investing.com - Click to enlarge |

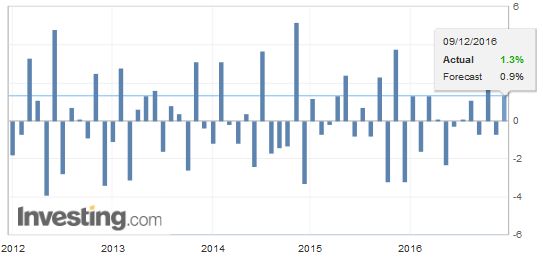

| Imports rose 1.3%, a little more than expected. The current account surplus was also a little smaller than expected. |

Germany Imports MoM, October 2016(see more posts on German Imports, ) Source: Investing.com - Click to enlarge |

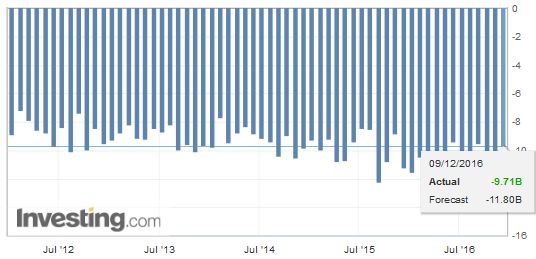

United KingdomFourth, the UK reported smaller trade and current account balances in October. The September figures were revised to show larger shortfalls, so the October improvement is more dramatic. The overall trade deficit narrowed to GBP1.97 bln, which is the smallest in five months. It is a third of the size of the September deficit that was revised to GBP5.81 bln (revised from GBP5.22 bln). |

U.K. Trade Balance, October 2016(see more posts on U.K. Trade Balance, ) Source: Investing.com - Click to enlarge |

United States

In other market developments, following the new record equity levels in the US, Asia rallied. The MSCI Asia-Pacific Index rose almost 0.2%, for the fourth consecutive gain. It is up 2.3% on the week. The Nikkei rose 3.1% this week and has gained in all but two weeks since the start of Q4. The Dow Jones Stoxx 600 is rising for the fifth session. It is up nearly 4% this week. Today’s gain are sufficient to fill the gap created in early January. However, some profit-taking is being seen in Italy, Spain, and Germany. Italian bank shares are off nearly 3% to snap a three-day advance. An announcement is expected either over the weekend or early next week about who will lead the next Italian government. Don’t be surprised if it is Renzi.

The North American session will not be bolstered by much data. The wholesale inventories may impact GDP forecasts, while the University of Michigan survey has little but headline risk.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$EUR,$JPY,China Consumer Price Index,China Producer Price Index,EUR/CHF,France Industrial Production,German Imports,Germany Exports,Germany Trade Balance,newslettersent,SPY,U.K. Trade Balance