Swiss FrancThe ECB prolonged its bond purchases, which came unexpected for markets. Consequently the EUR/CHF lost nearly half of its big gains that it registered in the beginning of the week. The ECB expects lower inflation for longer, which makes the life for the SNB harder for longer. |

EUR/CHF - Euro Swiss Franc, December 08(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge |

|

GBP/CHF rates have fallen slightly this week with the pair now trading around 1.2750, having started the week above 1.29 on the exchange. Sterling has come under pressure again due to the Supreme Court ruling regarding the triggering of Article 50. The Supreme Court is likely to back up the High Court’s ruling, which means the referendum result will have to be ratified by Parliament. Despite this, MP’s last night voted in favour of the Governments timeline to start our exit from the EU in March. Our Brexit will go ahead as planned in my opinion and when it does it is likely to through the markets into more chaos, as the UK starts to try and find its feet away from the EU and all the potential pitfalls that come with it. This is likely to benefit the CHF moving forward and therefore it may be wise to lock in any GBP/CHF transfers ahead of this point. We also need to consider the prospective interest rate hike by the US FED, which could cause investors to move money away from the more riskier currencies and into safe havens such as the USD & CHF, again a move which would strengthen the CHF position. Looking at the key economic data for the rest of the week and all eyes will now switch to tomorrow’s Swiss Unemployment rate and UK Trade Balance figures. With Unemployment in Switzerland expected to remain unchanged at 3.3%, expect additional market movement on GBP/CHF rates if the figure comes outside of this remit. If you have an upcoming GBP or CHF currency exchange to make and you are concerned by the increased market volatility of late, it may be wise to look at protecting the gains you’ve made, or limiting your losses with one of our forward contracts, rather than gamble on what has become an increasingly volatile and unpredictable market. |

GBP/CHF - British Pound Swiss Franc, December 08(see more posts on GBP/CHF, ) Source: Investing.com - Click to enlarge |

FX RatesThe US dollar is trading lower against all the major currencies as the corrective forces continue to hold sway. The euro rose to nearly four-week highs in the European morning, briefly pushing through $1.08. With today’s gains, the euro has recouped 38.2% of the losses since the US election. Although we have suggested potential in this correction toward $1.0850, the next important retracement objective is a little above $1.09. |

FX Performance, December 08 2016 Movers and Shakers Source: Dukascopy.com - Click to enlarge |

| The euro’s recovery ahead of the ECB meeting, however, seems to leave it vulnerable to a buy the rumor, sell the fact type of activity. Perhaps the rumor is that Draghi has no important surprises to unveil. Nearly everyone is looking for an extension of the asset purchases, some operational adjustment to allow it to reduce the risks of scarcity, and some measures to make it securities lending program more user-friendly. Also fitting in a pullback in the euro could be the first increase in the US premium over Germany on two-year money for the first time in five sessions today. Initial support for the euro may be pegged in the $1.0740-$1.0760 area, with a break sending the single currency back toward $1.07. |

FX Daily Rates, December 08 |

| Since the end of July 2015, the yuan has fallen 9.7% against the US dollar. This may help Chinese exports, especially as China continues to evolve away from simple assembly work and toward more value added. However, as many other countries have found the linkage between currency valuation and exports is far from simple or straightforward. There is little substitute for stronger demand. |

FX Performance, December 08 |

JapanThere are three other developments that are on the radar screen of international investors today. First, Japan revised Q3 GDP unexpectedly lower to 0.3% rather than 0.5%, which reduces the annualized rate to 1.3% from 2.2%. Business spending and inventories drove the revisions, while the upticks in consumption were insufficient to do more than blunt some of the impacts. The GDP deflator was revised to minus 0.2% from minus 0.1%, leaving Japan as one of the few countries still experiencing deflation. At the same time, Japan adopted the best practices in terms of GDP calculation (which other countries such as the US and many European countries have already done). Among other things, it means that research and development expenditures are counted as capital formation rather than an intermediate input. This means that at the end of last year, the Japanese economy was about 6.5% larger (JPY532.2 trillion instead of JPY500.6 trillion). The dollar held above its week’s low against the yen (~JPY112.90). A move now back above JPY113.60-JPY113.80 would likely help stabilize the dollar’s tone. |

Japan Gross Domestic Product (GDP) YoY, Q3 2016(see more posts on Japan Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

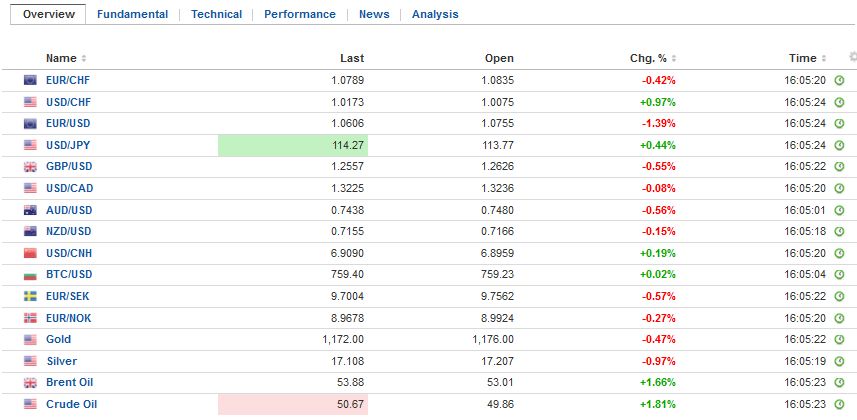

ChinaSecond, China reported its November trade figures. The surplus was smaller than expected at $44.6 bln (compared with $49.06 bln in October). |

China Trade Balance (USD), November 2016(see more posts on China Trade Balance, ) Source: Investing.com - Click to enlarge |

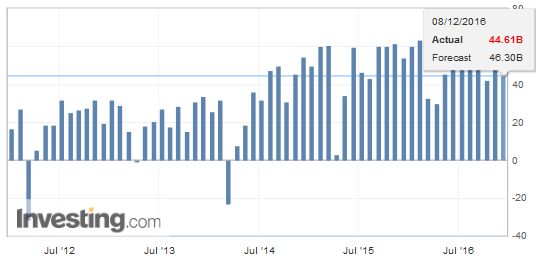

| Both exports and imports rose. Exports rose for the first time in seven months on a year-over-year basis, even if just barely (0.1% in dollar terms). |

China Exports YoY, November 2016(see more posts on China Exports, ) Source: Investing.com - Click to enlarge |

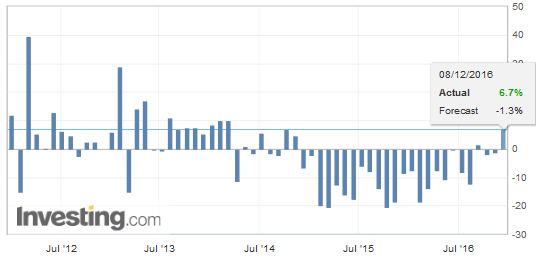

| Imports rose 6.7%, the most in two years. Imports of copper, iron ore and coal rose. The impact on either the dollar-bloc currencies, like the Australian dollar or metal producers like the South African rand, has been muted. |

China Imports YoY, November 2016(see more posts on China Imports, ) Source: Investing.com - Click to enlarge |

Eurozone

Third, Italy’s political situation is far from clear. A new government will be formed, and it still looks possible that Renzi, the head of the largest party, is a likely candidate. The state of the election law is problematic. The Constitutional Court will not review the electoral reforms for the lower chamber until January 24. There is no electoral law for the upper house. And there is no returning to the previous law, which was ruled unconstitutional.

Many are still talking about the referendum results as being anti-establishment and seem to think the Five Star Movement will be swept into power and call for an immediate referendum on EMU membership. Leave aside the fact that polls consistently show that the vast majority of Italians want to the euro instead of a new lira; the Constitutional Court has ruled out referendums on international treaties.

Late yesterday, Moody’s cut the outlook on Italy’s credit rating to negative from stable. It is the Baa2 credit, according to Moody’s, which is two notches into investment grade. S&P has it lower at BBB- and Fitch has it a step higher at BBB+. A one step cut by Moody’s would have little consequence.

DBRS is the one to watch. It gives Italy an A rating. It is under review, which after postponing for the referendum, will make a decision by early February. It previously was most concerned about growth but recognizes the recent developments are credit negative. The DBRS rating is important because the most optimistic rating agency is the one the ECB pays the most attention to in setting the haircut on collateral. If DBRS cuts Italy’s rating, the haircut will be larger.

The Financial Times lead story is that Italy has requested more time for Monte Paschi to complete its capital raising exercise, arguing that the referendum complicated matters. Meanwhile, Italian banks shares are gaining for the third session. It is up nearly 2% after yesterday’s almost 4.5% advance and Tuesday’s nearly 9% charge. Italy’s 10-year sovereign bond is underperforming with a six bp rise in yields. However, on two-year money, Italy is outperforming the core and other periphery countries today.

Unites StatesThe US reports weekly initial jobless claims and Canada reports housing starts, permits, house prices and capacity utilization rates. These are not market moving reported, and the focus will be on the ECB. |

U.S. Initial Jobless Claims, November 2016(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: $CNY,$EUR,$JPY,China Exports,China Imports,China Trade Balance,ECB,EUR/CHF,gbp-chf,Italy,Japan Gross Domestic Product,newslettersent,U.S. Initial Jobless Claims