Swiss Franc |

EUR/CHF - Euro Swiss Franc, December 05(see more posts on EUR/CHF, ) |

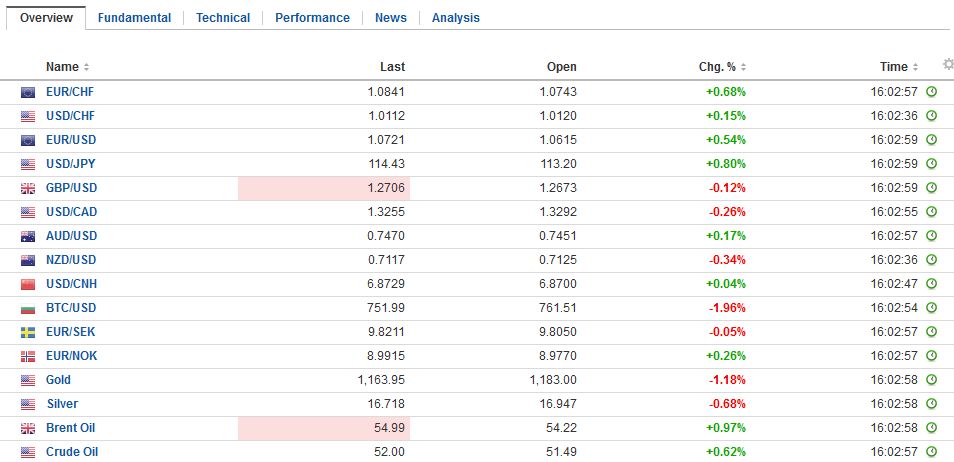

FX RatesAfter softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the markets’ attention. Austria turned back the populist right Freedom Party’s bid for the presidency. The Freedom Party does not appear to have carried any districts. In Italy, as the polls had consistently shown, the referendum to reduce the size and power of the Senate was easily rejected. Prime Minister Renzi has indicated plans to submit his resignation. Finance Minister Padoan, who canceled his plan to attend the EU finance ministers’ meeting that begins today, is seen as a potential caretaker. |

FX Performance, December 05 2016 Movers and Shakers . Source: Dukascopy - Click to enlarge |

| Reforms for the lower chamber are pending judicial review. Parliament elections are slated for 2018. It may comes sooner, but it is not imminent. Polls suggest that if an election were held today under the new electoral rules, the 5-Star Movement would win in the second round. At the same time, polls suggest that there is not much appetite (about one in seven) in Italy to leave the EMU. That said, we are hesitant to see the rejection of the referendum as part of an anti-establishment revolt. For sure, there was an element of that, but it does not do justice to the widespread opposition included Monti, for example, and members of Renzi’s party. |

FX Daily Rates, December 05 (GMT 16:02) |

| The euro initially was marked down in early Asia to almost $1.05. It recorded a new 20-month low. By early European turnover, the Europe had returned to unchanged levels near $1.0665 before consolidating. Italy’s 10-year yield is jumping nearly 10 bp. From a week ago the yield is still off seven basis points. The two-year yield is flat, while German, French, and Spain’s two-year yields are a basis point higher.

The fact that neither the US employment data nor the Italian referendum was able to sustain the euro’s losses warn of the risk of upside pressure on the euro. A move above the pre-weekend high, and especially a close above it (~$1.0690) would be favorable from a technical point of view. On the other hand, the dollar is already carving out an outside up day against the Japanese yen. It initially fell a little beyond JPY112.90 and rebounded to JPY114.45 in the European morning. Last weeks high was near JPY114.85. Sterling lost a cent in Asia to almost $1.2625 before finding the bids that drove it to nearly $1.2745 before consolidating in Europe. The dollar-bloc currencies are heavier but are technically poised to recover in North American activity. |

FX Performance, December 05 |

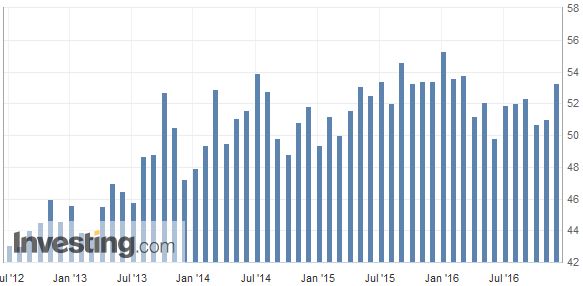

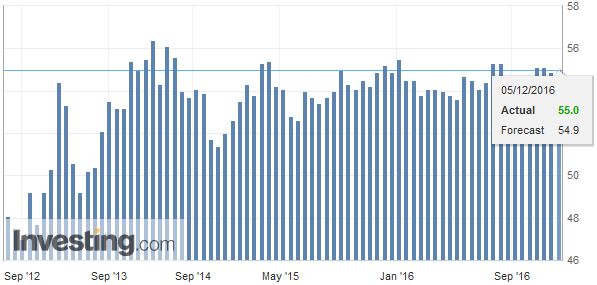

ItalyItaly’s stock market is above 0.3% higher, a laggard within Europe today. Italian bank shares are off 1.25% after gaining almost 5.2% last week. Recall that Monte Paschi is in the middle of a five bln euro capital raising exercise. The Dow Jones Stoxx 600 is about 1% higher in late-morning dealings. Financials are matching the market’s performance. Italy is also the beneficiary of favorable economic news. Last week, the manufacturing PMI rose to 52.2 from 50.9. This is the best reading since June. Today the news was repeated with the services PMI. It rose to 53.3 from 51.0. The Bloomberg median guesstimate was 51.6. The composite rose to 53.4 from 51.1. It is the best since February. |

Italy Services PMI, November 2016(see more posts on Italy Services PMI, ) . Source: Investing.com - Click to enlarge |

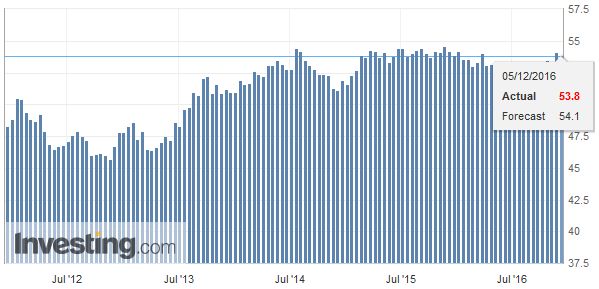

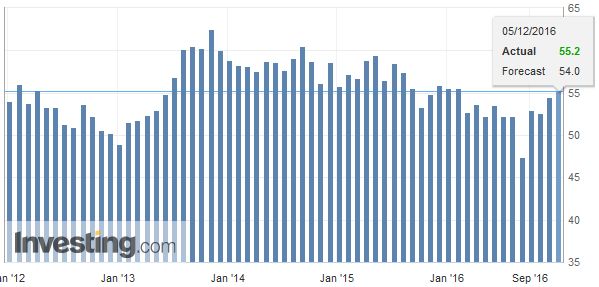

EurozoneThe eurozone aggregate services PMI slipped to 53.8 from the 54.1 flash, but it is still an impressive improvement from 52.8 in October. The November report is the strongest of the year. The composite also did not quite match the flash reading, but at 53.9 it too is the best of the year. The reason for the softening from the flash is due to France. Lastly, we note Spain’s report showed improvement over October and both the services (55.1) and composite (55.2) were better than expected. |

Eurozone Services PMI, November 2016(see more posts on Eurozone Services PMI, ) . Source: Investing.com - Click to enlarge |

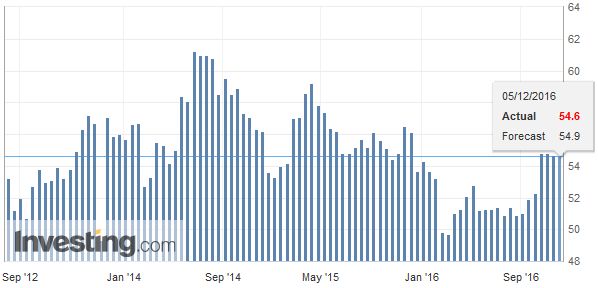

| The German flash report was tweaked slightly higher in the final reading, but France was cut. The service PMI was cut to 51.6 from 52.6. |

Germany Services PMI, November 2016(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

| This revised away most of the improvement from the 51.4 reading in October. The composite was slashed to 51.4 from the 52.3 flash estimate. It was 51.6 in October and is the lowest since July. |

Germany Composite PMI, November 2016(see more posts on Germany Composite PMI, ) . Source: Investing.com - Click to enlarge |

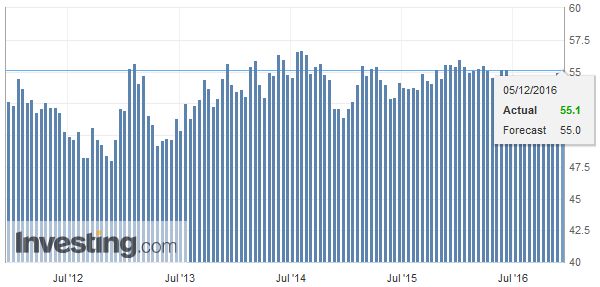

United KingdomThe UK’s economic news was also favorable. The services PMI rose to 55.2 from 54.5. The median guesstimate was a small decline. The composite rose to 55.2, as well, from a revised 54.7 (from 54.8). It is the highest since January. Separately, the UK reported a strong rise in auto sales (+2.9%). We also note that the Supreme Court begins hearing the government’s appeal of the Constitutional Court ruling that Parliament authority is needed to trigger Article 50. Meanwhile, the government’s position remains unclear as Foreign Secretary Johnson declined to endorse others’ proposal that the UK could pay for access to a single market. |

U.K. Services PMI, November 2016(see more posts on U.K. Services PMI, ) . Source: Investing.com - Click to enlarge |

United StatesAfter the November employment at the end of last week, the US calendar turns fairly light. Today features the ISM service PMI and the Fed’s new Labor Market Conditions Index. |

U.S. ISM Non-Manufacturing PMI, November 2016(see more posts on U.S. ISM Non-Manufacturing PMI, ) . Source: Investing.com - Click to enlarge |

| There are a few Fed speakers as well. Dudley and Evans speak in the North American morning, while Bullard is set to discuss the US economy after European markets close the day. |

U.S. Services PMI, November 2016(see more posts on U.S. Services PMI, ) . Source: Investing.com - Click to enlarge |

New Zealand

In other developments, the Prime Minister of New Zealand John Key unexpected resigned. He backed Finance Minister English as his successor. The New Zealand dollar is the weakest of the major currencies, off about 0.85% against the US dollar. Initial support is seen near $0.7050-$0.7060, with a break signaling a retest on the $0.6970 area. The opening of the Hong Kong-Shenzhen link was lost in the down move in equities. The Shanghai Composite fell 1.2%, while Shenzhen slipped 0.8%. The MSCI Asian-Pacific Index was off 0.8%. It is the second consecutive session loss and the fourth in the past five.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,$JPY,Austria,EUR/CHF,Eurozone Services PMI,Germany Composite PMI,Germany Services PMI,Italy,Italy Services PMI,newslettersent,U.K. Services PMI,U.S. ISM Non-Manufacturing PMI,U.S. Services PMI