Swiss Franc |

EUR/CHF - Euro Swiss Franc(see more posts on EUR/CHF, ) |

FX RatesThe latest US political news before roiled thin pre-weekend markets, but cooler heads and more of them are prevailing today. Trump’s fortune in the polls had bottomed prior to the re-opening of the investigation into Clinton’s emails and the national polls have narrowed. However, Clinton’s lead in the electoral college projections remains substantial. Nate Silver’s fivethirtyeight.com blog puts the odds of a Clinton just below 79%, down from 86.3% a week ago and 88% two weeks ago. Predictwise, another respected site, gives Clinton 88% chance of winning, down from 90% last week and two weeks ago. |

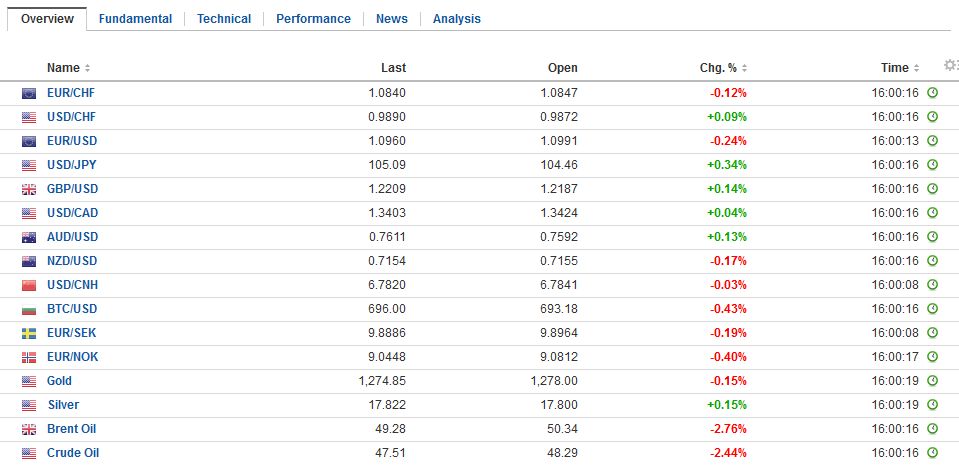

FX Performance, October 31 2016 Movers and Shakers . Source: Dukascopy - Click to enlarge |

| The US dollar is better bid against most of the major currencies. The notable exception is the Canadian dollar, which underperformed before the weekend, and the Australian dollar. The RBA meets tomorrow, and there is little chance of a rate cut. The Aussie is in the middle of its two-cent range seen $0.7500-$0.7700.

The euro was turned back from the $1.10 area. The $1.0940 is the initial retracement of the bounce that began before the latest US political developments, and then $1.1920. The 20-day moving average is near $1.1015. The euro has not closed above this moving average this month. |

FX Daily Rates, October 31 (GMT 16:00) |

| Indications that further developments are needed if expectations of the outcome of the US presidential election will change is helping the Mexican peso recoup its pre-weekend slide. The pullback can extend toward MXN18.80 after peaking near MXN10.10 ahead of the weekend. News of OPEC’s failure to agreed on specific cuts over the weekend was tipped last Friday. Oil prices are only slightly lower today.

News that prosecutors have dropped the fraud charges against South Africa’s finance minister is fueling a sharp recovery of the rand. It is up 2% near midday in Europe. On October 12, the dollar reached a high near ZAR14.50. It reached ZAR13.585 today. Trendline support drawn off the August and September lows comes in near ZAR13.50. |

FX Performance, October 31 |

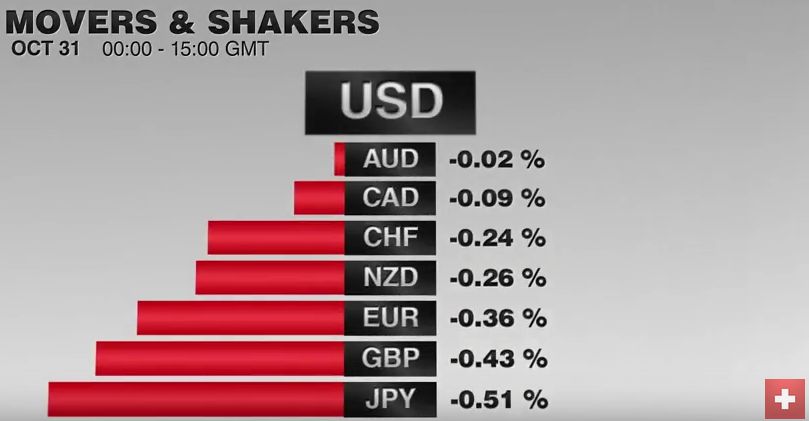

GermanyGermany reported poor retail sales. The Bloomberg survey median had a 0.2% increase after a 0.4% decline in August. Instead, September retail sales fell 1.4% (Aug revised to -0.3%). It is the largest slide in two years. German retail sales are up 0.4% from a year ago. |

Germany Retail Sales YoY, October 2016(see more posts on Germany Retail Sales, ) . Source: Investing.com - Click to enlarge |

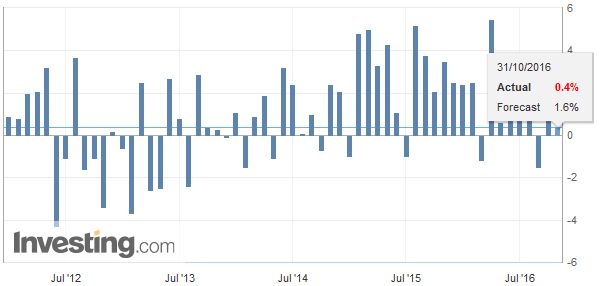

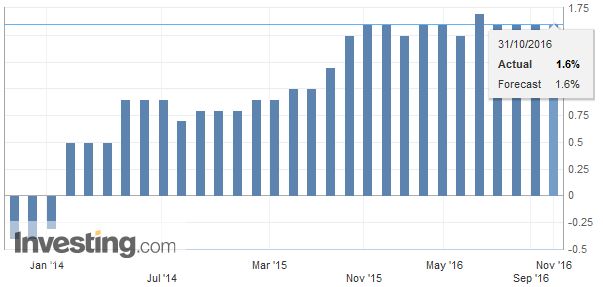

EurozoneSeparately, eurozone October CPI and Q3 GDP were in line with expectations. Headline CPI rose 0.5% after a 0.4% pace in September. |

Eurozone Consumer Price Index (CPI) YoY, October (Flash Estimate)(see more posts on Eurozone Consumer Price Index, ) . Source: Investing.com - Click to enlarge |

| The core rate was unchanged at 0.8%, suggesting the improvement came from energy. |

Core CPI Eurozone (Flash Estimate)(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

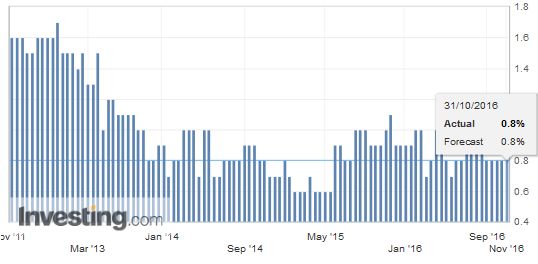

| The euro area is expanded by 0.3% in Q3 and a 1.6% year-over-year rate. Both were in line with preliminary estimates, which matched Q2’s performance |

Gross Domestic Product (GDP) YoY, Q3(see more posts on Eurozone Gross Domestic Product, ) . Source: Investing.com - Click to enlarge |

United Kingdom

Several UK papers fanned speculation over the weekend that Carney could resign as early as this week. Some reports even suggested his replacement could be a Tory MP who favored Brexit. We were skeptical. The Financial Times lead story today is more aligned with our thinking. It reads “Carney stands ready to serve a full 8-year term at Bank of England.” When initially joining the BOE, Carney accepted a half-term that would end in 2018. However, he had the option to extend it into a full-term, which extends to 2021. That is what at stake here.

The idea that Carney is considering resigning is likely far from the mark. It is true that he has been subject to fierce criticism for his warnings of the economic consequences of Brexit. Not only hasn’t Brexit taken place but early and aggressive measures by the Bank of England may have helped cushion the initial shock. In any event, if Carney is worried about threats to the central bank’s independence his abdication would set a dangerous precedent of the encroachment.

JapanThe dollar reached JPY105.50 before the weekend and finished near JPY104.75. It fell a half yen in early-Asia and rebounded to JPY105 early in the European morning. The dollar’s broader recovery and poor Japanese data took a toll. The BOJ two-day meeting has begun, but no fresh action is expected, even if it pushes out again when it will hit its inflation target. Industrial output was expected to have risen 0.9% and instead it was flat in September. This means the year-over-year rate slides to 0.9% from 4.5% in August. Retail sales were also flat, though a small gain was expected after the large 1.1% decline in August. Despite the month-to-month movement, Japanese retail sales are low and stable. The 3- and 6-month averages stand at 0.1%. |

Japan Construction Orders YoY(see more posts on Japan Construction Orders, ) . Source: Investing.com - Click to enlarge |

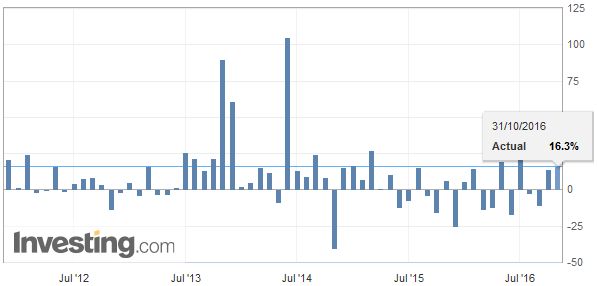

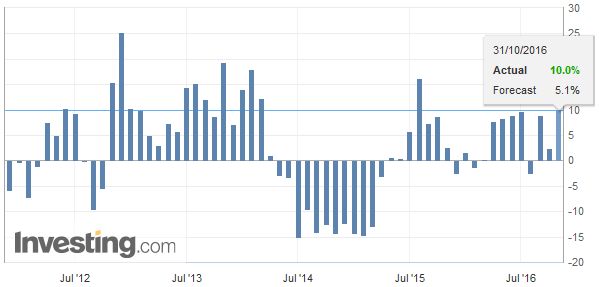

| One bright spot in Japan is housing/construction. Housing starts surged 10% year-over-year in September, almost double the expected gain, and four-fold faster than the 2.5% pace reported in August. Construction orders, more broadly, are up 16.3% in the year through September.

Japanese stocks were narrowly mixed, with the Topix eking out a small gain, while the Nikkei was a touch lower. News that Japan’s largest shipping companies will merge was a key talking point. The MSCI Asia-Pacific Index snapped a 3-day losing streak by rising about 0.25% today. |

Japan Housing Starts YoY, October 2016 . Source: Investing.com - Click to enlarge |

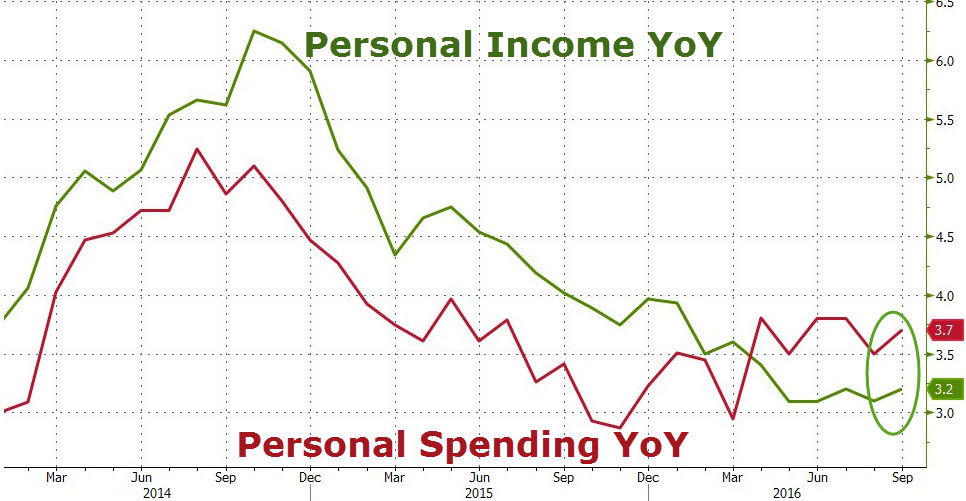

United StatesThe US reports personal income and consumption data, but this has already been incorporated into the Q3 GDP estimate released at the end of last week. |

U.S. Personal Income, Spending YoY(see more posts on U.S. Consumer Spending, U.S. Disposable Personal Income, ) Source: Zerohedge.com - Click to enlarge |

| The core PCE deflator may attract some attention, but only if it is different from the 1.7% pace seen in August. |

U.S. Core PCE Price Index YoY, October 2016(see more posts on U.S. Core PCE Price Index (PCE Deflator), ) Source: Investing.com - Click to enlarge |

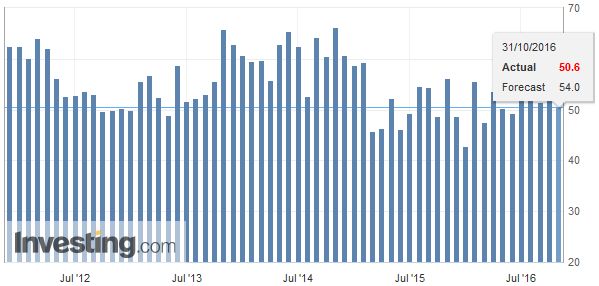

| The Chicago PMI and Dallas Fed manufacturing survey are also on tap. With the FOMC meeting this week and the jobs data, today’s reports underwhelm. |

U.S. Chicago PMI, October 2016(see more posts on U.S. Chicago PMI, ) . Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,Australia,Bank of England,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Eurozone Gross Domestic Product,Germany Retail Sales,Japan Construction Orders,newslettersent,U.S. Chicago PMI,U.S. Consumer Spending,U.S. Core PCE Price Index (PCE Deflator),U.S. Disposable Personal Income