Summary:

Shifting intermarket relationships pose challenge for investors.

The market is convinced the Fed will not raise rates.

Greater uncertainty surrounds the BOJ; there seems less willingness to shock and awe.

In our age of disparity, it may be easy to accept that all time is not equal. Touch a hot surface; time seems to move slowly. Time doing an enjoyable activity goes by lickety-split.

Another inequality of time are inflection points. These are non-linear jumps, breaks in time series or investors’ reaction function–how they respond to news. Is bad fundamental news good for stocks and bonds? Is a stand pat Fed bad for the dollar? Is easing by the BOJ positive or negative for the yen?

It is similar but different from Stephen Gould’s “punctuated equilibrium.” Recall that the traditional understanding of evolution is slow, incremental changes, which over time can lead to startling and profound changes. Gould’s innovation was to recognize that, at least sometimes, there are long periods of stasis (equilibrium) disrupted by a sudden change (punctuated) in over a short time.

The capital markets may be at such an inflection point. The relationship between fundamental news and investors’ response may be changing. The backing up of interest rates, despite unspectacular real sector data, no particular impulse on measured inflation, and a retreat in commodity prices, including oil, warns that something may be different now.

Many argue that monetary policy is reaching its political and/or ideological limit, even if theoretically interest rates can go deeper into negative territory that the ECB or BOJ have gone (see the SNB, for example). Similarly, more assets could be bought, but the trade-off between risk and reward appears to be shifting in a more adverse direction. At the same time, the perceived toxicity of fiscal policy has diminished.

Hollande argued the security pact trumps the stability pact and secured the EC’s blessing for once again overshooting the 3% deficit target. Canada’s new government campaigned on modest fiscal stimulus. In Japan, Abe is new fiscal support, even if there the “real water” is somewhat less than the bolder headlines.

The UK’s new Prime Minister appears to have jettisoned the prior Tory government’s fiscal rules, though the extent of this may not be known until the Autumn Statement in November. Italy’s Renzi want to explore the fiscal flexibility that EC Commissioners and Draghi claim to exist. Perhaps re-building from the tragic earthquakes may be such an opening.

Germany’s Schaeuble has suggested scope for small tax cut (that could still leave the government with a budget surplus), after next year’s election. In the US, both Clinton and Trump appear committed to fiscal stimulus.

Nevertheless, investors’ focus will be on two central bank meetings in the week ahead: the Bank of Japan and the Federal Reserve. The former is shrouded by a greater degree of uncertainty. It has repeated surprised investors. In contrast, investors appear as confident as they can be that despite some signals to the contrary, the Federal Reserve will take the next step on the path that it says it is committed of gradual normalization of its policy rate.

While investors will keenly watch what the BOJ does, they will scrutinize what the Fed says. If the Fed does not raise rates, then the dot plots will have to be downgraded to reflect the possibility of only one hike. At the end of last year, the median expectation by Fed officials was that four hikes in 2016 would be appropriate. The Federal Reserve rejects the criticism that it has over-promised and under-delivered. Fed officials and Yellen, in particular, have been careful to stress that the dot-plots are not commitments or promises.

However, if the Fed wanted to address the skeptics and keep the market prepared for a hike at the December meeting (there is precedent for a hike in September of an election year, but not November), there are a few things it can do.

First, it can reintroduce a formal risk assessment that was dropped earlier this year.

Second, it can indicate that the burden of evidence has shifted from needing to show continued improvement to as long as there is no deterioration, the Fed is prepared to raise rates.

Third, it can express greater confidence that the economy has weathered the bulk of an inventory cycle that has restrained growth for the past three-quarters. It can also be more confident that between rents, medical services, wages, and the diminishing impact of past dollar appreciation and the decline in oil prices, price pressures can be expected to increase gradually. It can cite the steepening of the yield curve and the increase in the break-evens as evidence that market-based measures of inflation expectations have also been lifted.

Unlike Governor Brainard’s recent comments, the FOMC statement may recognize diminished global risks. The UK referendum has come and gone with minimal disruption. The potential disruption from China (from the yuan and equity market) appear to have also lessened, and the world’s second largest economy appears to be stabilizing. Both the eurozone and the Japanese economy also are growing near trend.

One dissent to a stand-pat policy at the Fed would not be surprising (e.g. George); but a second one, would be part of a “hawkish hold.” At the same time, we argue that the impact of a 25 bp rate hike in the Fed funds target is being exaggerated by policymakers and investors alike. Expected returns for medium and long-term investors do not change very much on a quarter-point hike, especially, as the real rate (adjusted for inflation) remains below zero.

A 25-50 bp Fed funds target does not equate with prudence and caution, and is accommodative, while a 50-75 bp target is imprudent, reckless and is tantamount to introducing a tight monetary policy. Monetary policy would remain accommodative by nearly every conceivable metric, but simply a little less so.

The Fed’s critics complain of its communication style, even though Yellen strikes us as among the most plain-spoken Fed Chairs in modern times. Recall, Greenspan’s admonishments that if one thought they understood what he said, they misunderstood. Bernanke may have been prone to having a professorial voice and (arguably) over-sensitive to minor nuances.

JapanThe BOJ has had an even greater communication challenge. It has also struggled to shape market expectations. Remember for many years, including under Kuroda’s predecessors, under deflationary conditions; the BOJ was reluctant to eschew its traditional approach to monetary policy, which was similar to the Bundesbank. The DNA of the institution was not traditionally activist. Although Abe has given Kuroda a majority of supporters on the board, the more traditional values are still deeply-rooted with bureaucrats and technocrats inside the central bank. The unprecedented aggressive monetary policy, the size of the BOJ’s balance sheet and the wide range of assets it holds, and negative interest rates on top of that has not generated strong price pressures or more robust economic activity. Disappointment with the BOJ’s recent reluctance to take additional action appears to have facilitated yen strength. It is difficult to see how the BOJ can get ahead of expectations, where comments (sourced and not) have suggested a range of options are being considered from deeper negative rates, applying the negative rate to a wider range of deposits, to steepening the yield curve and buying foreign bonds. The market’s reaction to the BOJ announcement may be more important than the action itself. Investors should be open to the possibility that with global yields rising, curves steepening, monetary policy perceived to be near its political (if not economic) limits, the reaction function may be different. If the BOJ will not or cannot ease further, investors may sell the yen and, in effect, inject an easing impulse for it. |

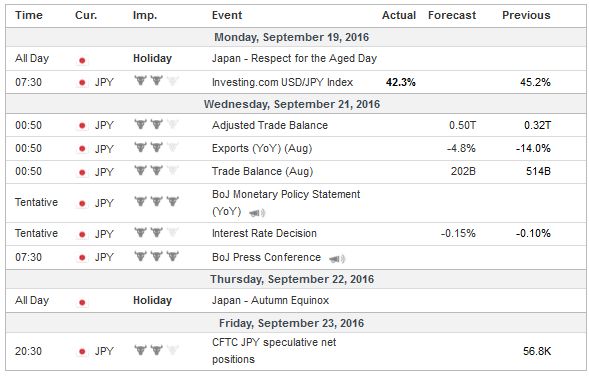

Economic Events: Japan |

United StatesMost recently, rising (US) yields appear to be more yen negative than the increase in equity market volatility has been yen positive. This is another anecdote warning that of a paradigm shift of sorts may be taking place. Lastly, we note that the polls for the US election have tightened considerably over the past fortnight. Among the most authoritative analysis of US, polls is found on Nate Silver’s fivethirtyeight.com website. A couple of weeks ago, Trump’s chances of being the next US President was about 15%. Now a survey of polls put his chances nearer 40%. In terms of states for tracking the Electoral College, there are three states that Trump has edged into a small lead: Florida (0.2%), Ohio (1.2%), and North Carolina (0.7%). Most paths to the White House for Trump requires that he carries these three states, but even if that happens, it might not be sufficient. Pennsylvania (Clinton ahead by 3.4%) and Michigan (Clinton ahead by 3.9%) appear necessary for a Trump victory. Where the candidate spend their time may be more important than what is said ahead of the first debate on September 26. Previously, it looked as if the Democrats would pick up five seats in the Senate to secure a majority. The odds have narrowed. The chances that the Democrats could win a majority in the House of Representatives was never particularly strong, and the probability has slipped. |

Economic Events: United States |

We think that rising interest rates, the drop in oil, and greater equity volatility have weighed on the Mexican peso (new record lows in the spot market) and the Canadian dollar. However, anecdotally some argue that it is not coincidental that as Trump as narrowed the gap, which his criticism of Mexico and NAFTA have added pressure on the peso and Loonie.

Switzerland |

Economic Events: Switzerland |

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,$CAD,Bank of Japan,Federal Reserve,Fiscal,MXN,newslettersent