On the Swiss FrancRecently I enumerated the different drivers for the continuing strength of the franc. Most commentators mentioned Brexit fears, but I insisted on the low rate and yield environment in the United States after the last Non-Farm Payroll report and the FOMC. Today’s jump in sterling after changed Brexit bets confirmed my view. This anticipation of an Anti-Brexit vote was not followed by a franc decline against USD. This also implies that a Brexit will not entrench a huge strengthening of the franc. |

Avg Probability of BREXIT Implied from Betting Odds |

continued by Marc Chandler

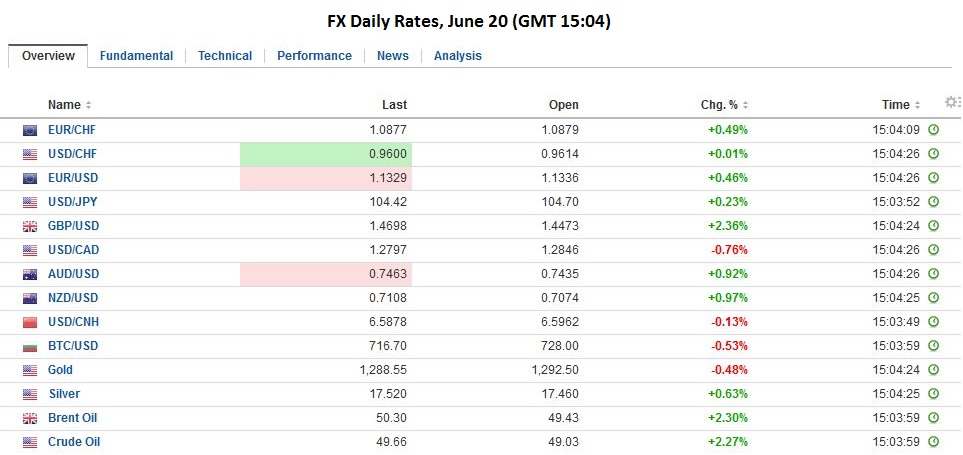

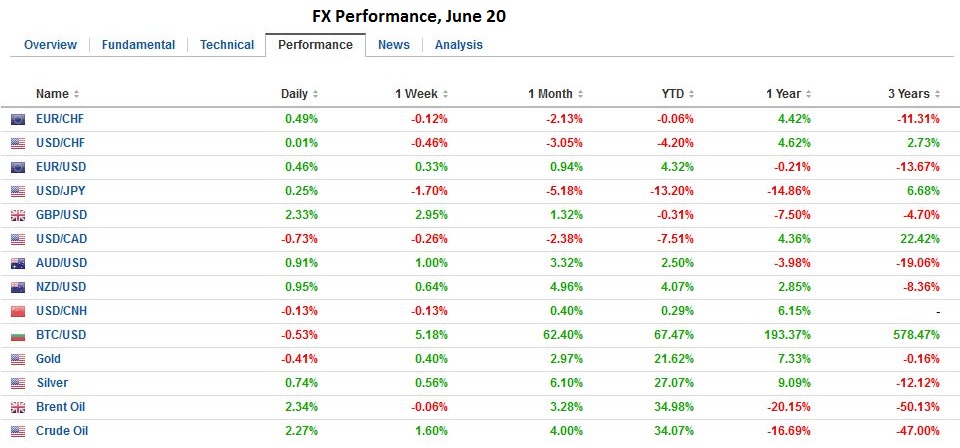

FX RatesSince the murder of UK MP Cox last week, the mood in the markets shifted. Today is the continuation what was seen in the last two sessions last week. The difference is that participants seem more confident, as the polls and betting odds seem to support our initial recognition of the tragedy’s potential to impact psychology. As we noted in our review of speculative positioning in the futures market, there was interest in buying sterling prior to last week’s reversal. In the week ending June 14, the gross long sterling position jumped 25.4k contracts to 61.7k. That is new buying, which is different than short-covering. There were some short-covering, 4.3k contracts (to 98.4k), but it amounts to 1/6 of the new buying. |

|

| Sterling is the strongest currency today, gaining 2% against the US dollar and 1.4% against the euro. The FTSE is posting a sharp advance of almost 2.5% but is lagging other main European bourses and the more than 3% gain in the Dow Jones Stoxx 600. It is interesting to note the sectors doing best in the UK: financials (+3.6%) and information technology (3%). Consumer staples (1.4% and materials (1.6%) are the laggards in late-morning turnover. |

UK gilts are bearing the brunt of the unwind of safe haven flows. The 10-year yield is up seven bp to 1.21%, and the 2-year yield is up five bp to 43 bp. This is only a couple basis points more than US Treasury yields have risen today. Peripheral benchmark 10-year bond yields are off 8-11 bp. During period anxiety, intra-EMU spreads widen over Germany, as anxiety eases, the spreads narrow. The introduction of sovereign bond buying has not altered that general pattern.

Asian equities popped higher at the open, with both the MSCI Asia-Pacific Index and the Nikkei gapping higher. The Nikkei closed 2.3% higher, its biggest gain in almost two months. The MSCI Asia-Pacific Index gained 1.8% and was making new highs late in the session. Chinese shares advanced, but fractionally (Shanghai Composite +0.1%), and underperformed India (0.8%) despite news that the central bank governor who is respected by many investors, is stepping down when his terms end in early September.

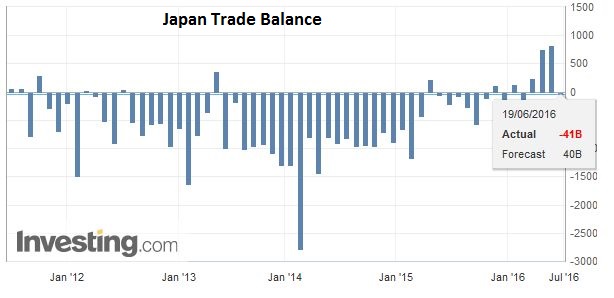

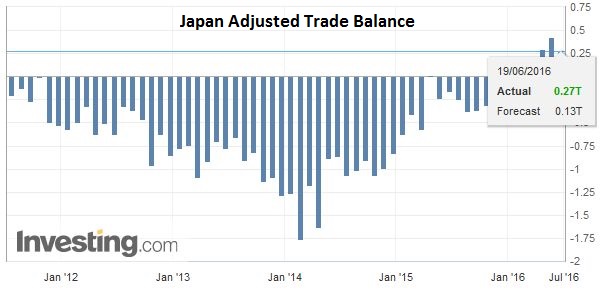

JapanIn an otherwise light economic calendar, Japan’s May trade figures stand out. Much of the headlines focused on the unexpected deficit of JPY40.7 bln. The median of the Bloomberg survey was for a JPY70 bln surplus. However, there are two mitigating factors. First, the impact from the earthquake is expected to be short-lived. The impact of the earthquake disruption may have been seen in the 11.3% fall in exports year-over-year, compared with April’s 10.1% decline. |

|

| Second, there is a seasonal issue. Since 1993, the has only been one year (2009) that the May trade balance was better than the April balance. When the seasonal patterns are adjusted for, May’s trade resulted in a JPY270 bln surplus (down from a revised JPY397 bln surplus in April).

Rising equities markets and rising core bond yields are weighing on the yen. It is the only major currency that is not rising against the dollar today. It is off about a third of one percent. The dollar remains well within the range established last Thursday: ~JPY103.55-JPY106.05. |

There has been a little market reaction to the results of Italy’s local elections that resulted in the anti-EU Five-Star Movement candidates become mayors in Rome and Turin. Italian shares are lagging behind today’s equity advance, though in fairness it had outperformed in recent days. Italy’s two and 10-year bonds are either keeping pace with Spain of beating it.

Spain goes to the polls this weekend in a “do-over” election after the election last December failed to produce a workable coalition. The recent polls suggest Rajoy’s PP will not secure a majority, and that Podemos may have been the biggest winner over the past six months, and overtaking the Socialists as the second largest party.

The euro was bid to $1.1380 in the Asian morning before easing in the European morning back toward $1.1330. Intraday support is seen near $1.1300. The euro has rallied from $1.1130 on June 16 to today’s high. A 38.2% retracement of this move is found near $1.1285.

The US dollar is being sold through the CAD1.2820 area that provided support in recent days. The next immediate target is near CAD1.2760. The Australian and New Zealand dollars are up about 1%. today. The Australian dollar looks poised to re-challenge the $0.7500 area that capped the advance (with a key reversal on June 9). A break of cap may signal another near-term one percent advance.

Graphs by the snbchf team and investing.com

Tags: FX Daily,Japan Trade Balance,newslettersent