Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price. - Click to enlarge

The Dollar Increases in Value

The dollar moved up, though most people would say gold fell about $40, and silver 32 cents. In the mainstream view, the value of the dollar is 1/N (N is the quantity). So how could the dollar go up? Certainly, the quantity keeps on increasing.

Our view is different. If you borrow dollars to buy an asset, and the asset doesn’t generate enough yield to pay the interest, you have to sell or default.

It should go without saying that it is an unsustainable Ponzi scheme if everyone keeps borrowing more and more to simply bid up the price of any asset (including gold).

So here we are, and the dollar is getting more valuable again.

Fundamental Developments

Let’s take a look at the supply and demand fundamentals.

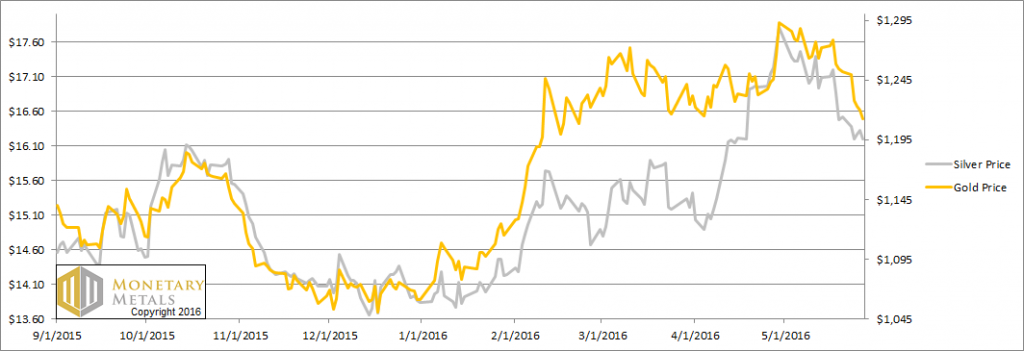

Gold and silver pricesFirst, here is the graph of the metals’ prices. |

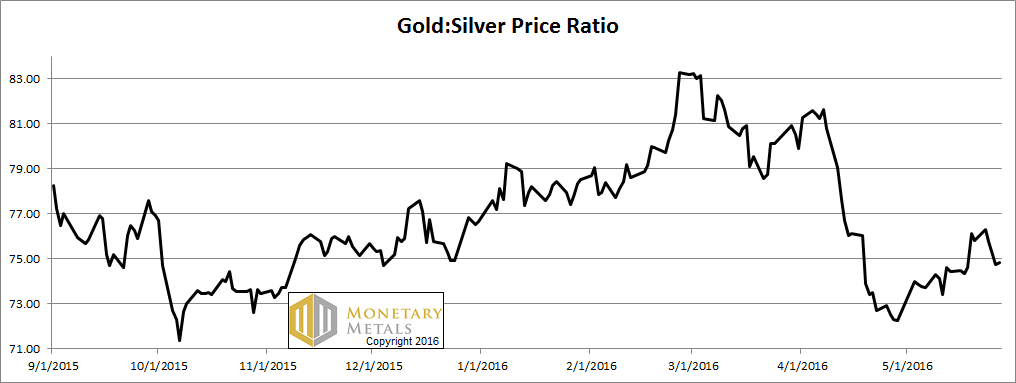

Gold-silver ratio.Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down a bit this week. |

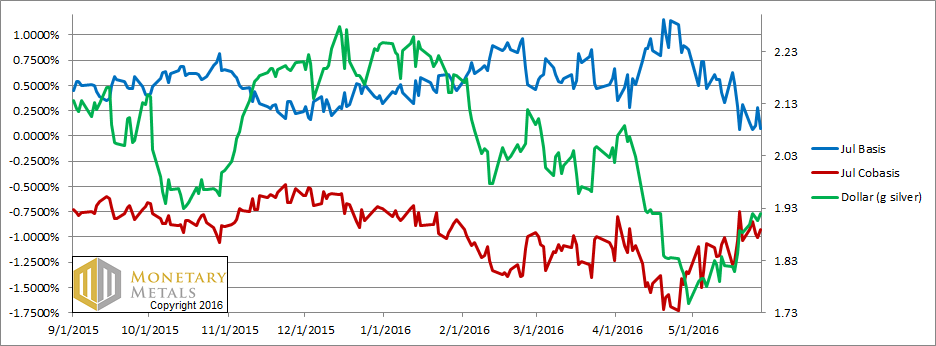

For each metal, we will look at a graph of the basis and co-basis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and co-basis in red.

Gold basis and co-basis and the dollar priceHere is the gold graph. The red line is back to a tight correlation with the green. That is, the price of the dollar is rising (i.e. the price of gold, measured in dollars is falling). Along with it, we finally see a noticeable rise in the scarcity of gold. Gold finally got a bit scarcer as its price fell another $40. |

Speculators were finally flushed out a bit, with stop orders getting hit in this brutal (to them) price action. Regular readers of Monetary Metals didn’t get caught, as we have been saying that the fundamental price of gold is below the market price.

Our calculated fundamental price of gold is just under $1,170. Sure, gold got scarcer with the price drop. But only in proportion.

Silver basis and co-basis and the dollar priceNow let’s turn to silver. |

The same pattern applies in silver. As is the case4 in gold, silver is scarcer at this lower price – proportionally.

The fundamental price is $13.90. This gives us a fundamental gold-silver ratio of about 84.

Charts by: Monetary Metals

Full story here Are you the author? Previous post See more for Next post

Tags: dollar price,gold basis,Gold co-basis,Gold prices,gold ratio,gold silver ratio,Gold-Cobasis,newslettersent,Precious Metals,silver basis,Silver co-basis,silver prices,silver ratio