A bit breathlessly….

The next SNB rumor story comes from the so-well established Wall Street Journal, its columnist Nick Hastings.

WSJ: The Swiss National Bank was bold before. And the central bank would be well advised to be just as bold again. When the SNB announced just over a year ago that it was setting a floor for the euro at 1.20 Swiss francs, many in the market did not expect it to hold. But, it did.Yes, the exercise has cost the SNB dear.

The central bank’s reserves have risen by 70% to a record CHF418 billion, much of it denominated in euros, a currency whose future is hardly assured. This is seen as imprudent management in some quarters.

George Dorgan:

WSJ: Nonetheless, the benefits of the SNB’s program of intervention to maintain the floor come-what-may have largely outweighed the negatives.

George Dorgan: Correct, the Swiss economy has stabilized, the measure was successful up to now. The FX reserves are financed with new liabilities to commercial banks, even if they cost nothing for a central bank as long as inflation is low. Similarly as states that accumulate debt over the 90% Reinhard Rogoff debt/GDP threshold, central banks may raise a country’s debt.

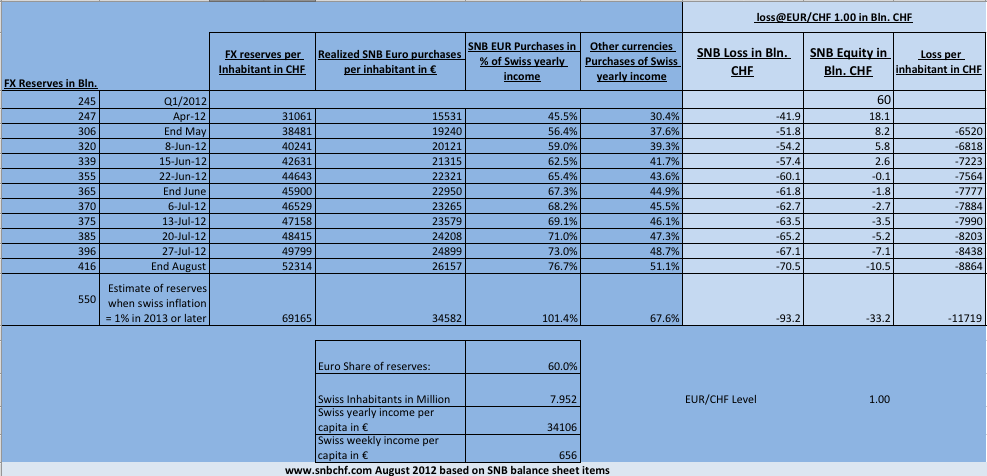

The long-time negatives, however, are potential 93 billion francs losses at EUR/CHF of 1.00, a mere 15% of Swiss GDP. Given that Switzerland has currently a 45% debt/GDP ratio, a loss would raise it to 60%, admittedly still clearly under the 90% threshold. But this one point that makes Switzerland and the franc so attractive, the low debt.

WSJ: By keeping the franc competitive, the SNB has ensured that Swiss exporters have helped to prevent the Swiss economy from facing an even fiercer contraction. Recent data showed that despite the SNB’s help the economy shrank by 0.1% in the second quarter.

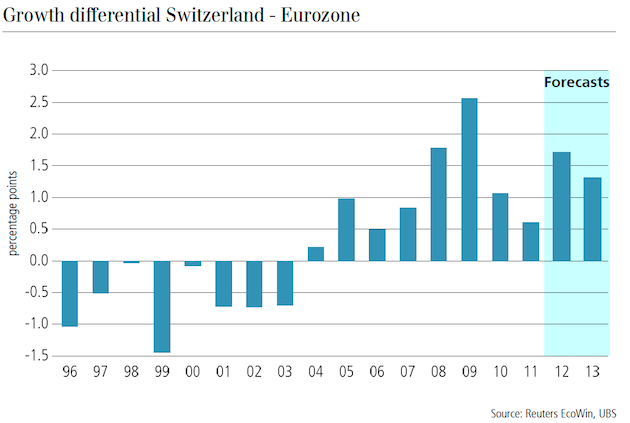

George Dorgan: Compared with the 2.6% depreciation of italian GDP or the 1.3% contraction of Spanish GDP, the Swiss economy improved by 0.5% YoY. It was stronger in recent years despite the strong franc. Does the Swiss economy have a problem ? Or is it rather the European or the world economy ?

WSJ: Given these economic pressures, it isn’t surprising that there’s speculation the SNB would like to lift the floor for the euro even higher when it meets on Thursday.

George Dorgan: Oh yes, Nick. Switzerland must remain on its Island of Happiness! GDP must rise every quarter, even if the whole world is going into recession ! Unemployment must fall to 0%, the low level of 2.9% is not sufficient. The SNB is in fact almighty, not like vice president Danthine recently said: “Monetary Policy is not almighty”.

And the recent decision by the European Central Bank to ease some of the market’s concerns about the euro-zone debt crisis is providing just that opportunity.

George Dorgan: Can you imagine what rich Germans think ? They will fear that there will be in the next years a new wealth tax to finance the 193 billion € German ESM participation ? A socialist German government in next years’ elections would probably do this.

After the ECB decided the lira-isation of monetary policy, i.e. low growth (enforced by conditionality and austerity) and high inflation (caused by monetary expansion), we expect further inflows into the Swissie in the next weeks. These inflows will come especially from rich German investors, who strongly doubt the ECB policy:

Handelsblatt’s deputy editor in chief, Florian von Kolf wrote, “Today is a black day for democracy…Merkel is silent…seemingly happy to have been partly relieved from her here Sisiphus task to save the euro”.

WSJ: With the euro now rebounding of its own accord, trading up at nearly CHF1.21, the SNB must be tempted to raise the floor to CHF1.22 or even CHF1.30.

But would this work?

Given the success of the floor at CHF1.20, it probably would.

George Dorgan: Is increasing currency reserves from 250 billion to 416 billion francs in one year a success ? Is obliging each Swiss to deliver 73% of this year’s income to the SNB and to convert all this money into euro, a success ? Not counted the 40% share in other currencies, e.g the slowly dying US dollar…

WSJ: The SNB has already convinced the market that its policy is credible. In fact, reserves data published by the bank last Friday indicate that speculation against the SNB may have started to diminish.The figures suggest that the SNB spent about CHF10 billion keeping the franc down in August, nearly one-sixth the level it spent in previous months.This could be key to encouraging the SNB to try and defend a higher floor for the euro.

George Dorgan: That is correct, FX reserves increased by 10 bln. CHF. We do not know what the SNB did with the missing 5 billion CHF, because they increased money supply by 15 billion francs or more in August. A loss or they started with repos again ? Swaps are usually included in the IMF FX reserves data.

But already this week the SNB had to print another 5 billion CHF.

As for credibility: In May Thomas Jordan declared that the floor will not be raised:

“We can not arbitrarily manipulate our currency. In an even worse crisis situation this would be disastrous and counterproductive. The minimum price must be legitimized. The current minimum rate is realistic and has helped the Swiss economy.”

WSJ: Steven Barrow, currency strategist at Standard Chartered Bank STAN.LN +0.21% in London, points out that if franc support is coming largely from safe-haven flows driven by individuals keen to get out of the euro, rather than by speculators, demand for the franc is going to be the same at CHF1.30 as at CHF1.20.

George Dorgan: That’s we are noticing here in Switzerland in Private Banking, too.

But can’t you imagine that many long-term investors from Europe or the Emerging Markets would be really happy to buy a house in Switzerland getting awarded another 10% bonus from the SNB ? Ever heard about a real-estate bubble in Switzerland ?

Maybe you have listened that Credit Suisse speaks of 1% Swiss inflation in 2013, this without a floor hike. 58% of Swiss imports come from Germany, but German wages currently rise by 3% YoY. A floor hike to 1.30 means another 8% more inflation for imported products plus paying the higher German wages. You easily end up at 2% or 3% total inflation. And the SNB assets will depreciate with inflation and costs of liabilities will rise with inflation.

Even without a floor hike, the central bank might finally lose control of monetary policy, as a finance professor in Geneva explained. Her main principle, price stability, will be in big danger.

And maybe you do not remember what investors did at the end of 2009, in May 2010 or March 2011 when Swiss inflation picked up a bit: They piled in masses into francs, in 2011 even in the hope that the SNB would hike rates.

All this seems to be strange now, given that Switzerland still sees YoY deflation, but more than one year after the floor introduction these deflation pressures will be washed out soon.

WSJ: Of course, the success of any SNB policy shift will depend very much on the euro. If fears about the euro-zone debt crisis return, and the euro comes under heavy selling pressure again, the central bank will once more have its work cut out defending the single currency.

But given that the SNB took the initial decision to create a floor a year ago when the outlook for the euro appeared much less certain than it does now, and given that the bank has built a reputation for successful intervention, it is in a much better position to raise and defend a new floor now if it wants to.

(This is an opinion column by Nicholas Hastings, who is a Senior Correspondent in London for Dow Jones Newswires and has written about foreign exchange for more than 20 years. He previously covered a variety of markets, including equities, fixed income, commodities and energy. He can be contacted on +44-20-7842-9493, by email at [email protected] or on Twitter @NickHastingsDJ)

George Dorgan: The outlook for the euro is that Germany will pay for it, but Merkel will prevent any consumption excesses in the periphery and enforce austerity via the fiscal compact. The peripheral consumers stopped spending already some months ago, the Germans stopped spending recently.

Both periphery and Germans will increase their savings rate via lower outlays, Germans in the fear of potential ESM costs, or as reaction Monti’s or Rajoy’s lower pensions and bigger austerity.

Moreover, can you imagine that Germans pay higher income tax this year, even if Germany can finance itself with little more than 0% ?

Yes, the Europeans and the euro will survive the crisis thanks to the positive current account balance and the Americans who spend a bit more again in the artificial thinking that the housing crisis is finished. But prices for US homes have just gone up because money was flooding out of Europe, Brazil and China and investors do not know where to put it.

What comes next ? A slow US recovery or the global recession and the big european mistake, like Jim Rogers speaks of ?

For us, one thing for sure, the reestablishment of competitiveness of Spain or Italy will not be successful. Italy as a whole will become the same for Germany as Southern Italy was and is for Northern Italy: a region to be financed by the tax-payer for many years or maybe forever. Spain will not be able to pay down its debt, even if Draghi pushed Spanish yields down to 3% (see the Natixis research). We expect Spain not to comply with the fiscal compact as foreseen.

And the Swiss will take part in the European transfer union sooner or later, this via the SNB losses or if the peg fails, via the potential Swiss adoption of the euro.

Are you the author? Previous post See more for Next post

Tags: Draghi,ECB,floor,intervention,Kenneth Rogoff,Other Periphery,peg,Spain,Swiss National Bank,Switzerland,Switzerland Money Supply

1 comments

Shervin

2012-09-12 at 16:18 (UTC 2) Link to this comment

Fantastic article. Like all currency peg experiments, this too will end in tears.