Tag Archive: Other Periphery

Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

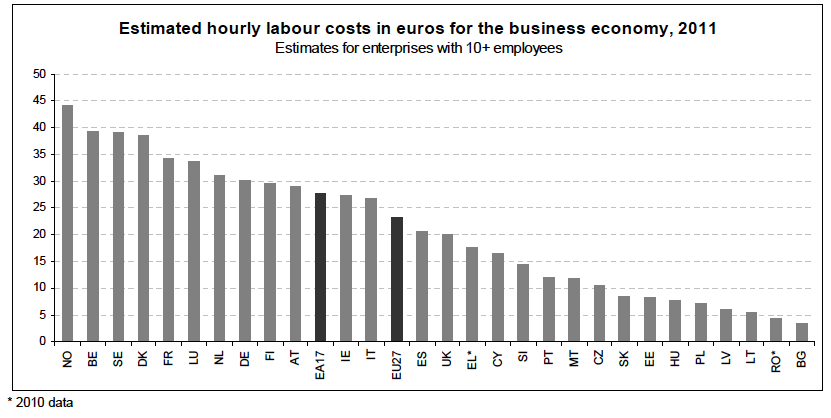

Italy has three options: 1. exit the euro zone and devalue the currency; 2. remain in the euro zone and devalue salaries. 3. go for Japan-like decades-long slow growth with stagnating wages, but also with falling inflation and (positive news!) falling bond yields.

Read More »

Read More »

Ways to the Northern Euro

Two ways for building the Northern euro, exit of Southern members or slow creation of Northern euro with currency interventions of central banks.

Read More »

Read More »

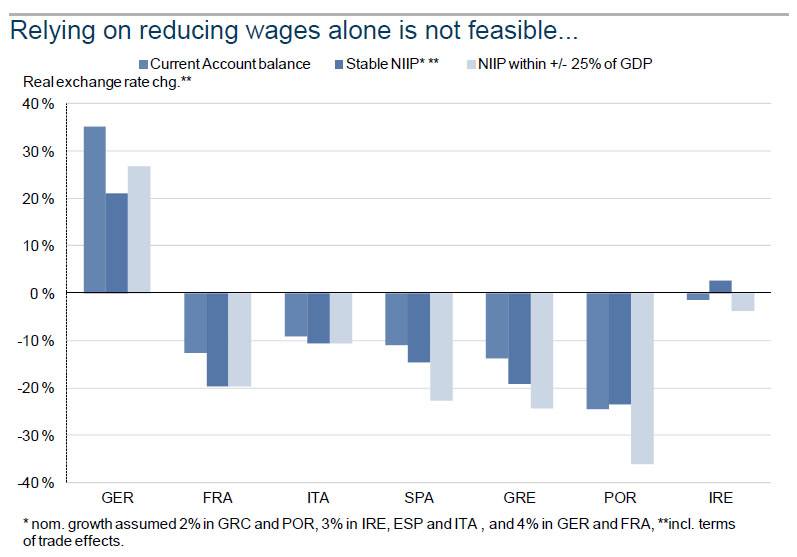

Goldman Sachs: Reducing Wages in Periphery Is Not Enough

The must-read Goldman analysis on Zerohedge: it is not enough to reduce wages in Greece or Spain. These countries will see lost decade(s). Completely in-line with our analysis that

Read More »

Read More »

Who Says No to Austerity and Global Imbalances, Must Say Yes to the Northern Euro

Eventually the euro will be abolished, a Northern Euro introduced: politicians and their economic advisors might just be waiting for a calm moment, especially with upcoming German inflation.

Read More »

Read More »

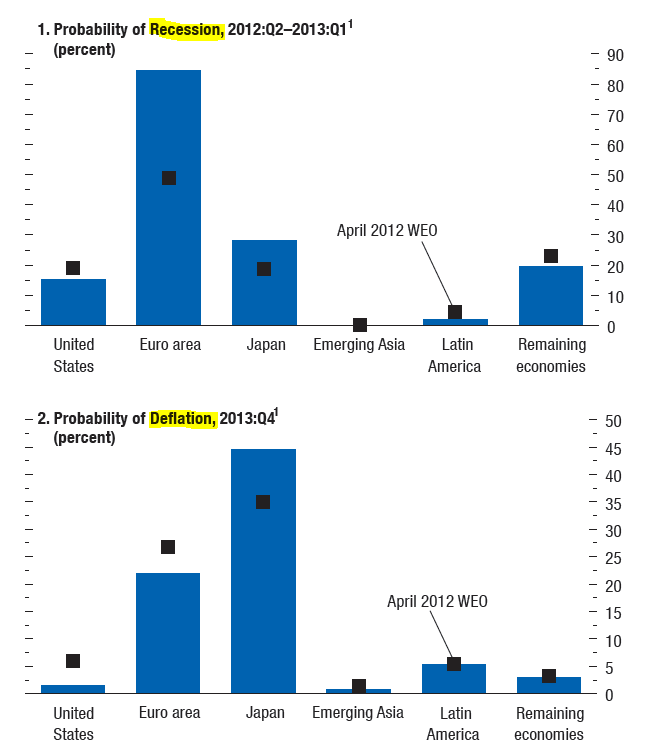

IMF World Economic Outlook

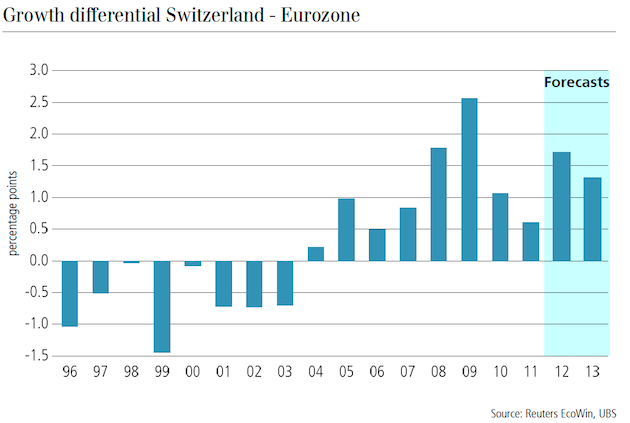

Alexander Gloy is founder and president of Lighthouse Investment Management The IMF’s (International Monetary Fund) “World Economic Outlook”, a slim 250-page piece, came out. Some excerpts: Substantial reductions in estimated output (GDP) growth for 2013 for all major countries: Unemployment in the Euro-Area (“EA”) is now expected to rise above the level …

Read More »

Read More »

The next SNB rumor: Wall Street Journal and our response

A bit breathlessly…. The next SNB rumor story comes from the so-well established Wall Street Journal, its columnist Nick Hastings. WSJ: The Swiss National Bank was bold before. And the central bank would be well advised to be just as bold again. When the SNB announced just over a year ago that it was setting a …

Read More »

Read More »

Otmar Issing’s new book on the euro crisis

We well remember when the über-bailouter of the Financial Times Wolfgang Münchau claimed that except some old economy professors like Otmar Issing nobody in Germany would like to abolish the euro. According to Münchau the euro can be saved only via a fiscal and a banking union. The response to Münchau’s post could be … Continue reading...

Read More »

Read More »

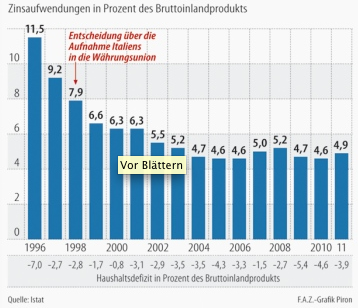

Guest Post: Six Reasons Why Italy May Exit the Euro Before Spain; Ultimate Occupy Movement

Six Reasons Why Italy May Exit Before Spain

1) Rise of the Five Star Movement

2) 44% of Italians view the euro negatively, only 30% favorably. That is biggest negative spread in the eurozone. In Spain more view the euro positively than negative, albeit by a small 4 percentage point spread.

Read More »

Read More »

Wolfgang Münchau, FT: Merkel was the winner of the Euro summit

Wolfgang Münchau endorsed many of our arguments Wolfgang Münchau, Financial Times, has endorsed many of our arguments of our Friday's opinion about the Euro summit where we stated that there was nothing really new. Münchau even claims that "The real victor in Brussels was Merkel."

Read More »

Read More »

Merkel: ‘No Eurobonds as Long as I Live’, Hollande: ‘Eurobonds will take up to 10 years’

German chancellor Angela Merkel today confirmed the content of our article that Eurobonds are pure utopia. She vows "No Eurobonds as Long as I Live".

Read More »

Read More »

Italy: About the Hypocrisy of Politicians and the Blindness of the English-Speaking Financial Papers

Just a little wrap-up of two tweets read in 5 minutes, to which I finally added a bit more out of my recent Tweets. One Tweet: The British finance minister Osborne has emphasized that the euro zone needs to protect its peripheral economies. “The whole of Europe needs to become more competitive and productive. That …

Read More »

Read More »