We think that the Swiss National Bank invested far more in Italian and Spanish bonds than analysts like Standard and Poor’s expected and was able to front-run ECB decisions. This new style of hedge funds, formerly called “central banks”, can refinance at zero percent and is able to show a lot better performance than the common market players.

Update on October 31 after the SNB results

Our assumption is probably wrong. The SNB increased security positions (and possibly peripheral bond positions) in July and August, but the increase comes more from equity positions (that increased from 10% to 12%).

Theoretically they could have sold peripheral bond positions again before the end September after prices strongly increased. The full details about change in securities holdings at end of September will be published only with the monthly bulletin.

Recent ECB Decisions and Peripheral Bond Purchases by Hedge Funds

“Third point, regarding whether it’s unlimited or limited – we don’t know! Basically, the Introductory Statement – and I am really grateful to the Governing Council for this – endorses the remarks that I made in London about the size of these measures, which need to be adequate to reach their objectives.”

This was followed by the technical realization of the Outright Monetary Transactions (OMT) in the ECB meeting on September 6.

Many hedge funds, however, only started buying Spanish bonds at the beginning of October. Once again hedge funds had a very bad market timing. On July 24, Spanish 5yr. bonds yielded 7.59% and Italian ones 5.62%.

(click to expand)

Standard and Poor’s Critique with the SNB

At the end of September, Standard and Poor’s (S&Ps) published a very superficial analysis that claimed the SNB mainly bought bonds of core European countries like Germany, Austria, the Netherlands or France and pushed down their yields, but it did not help the periphery to finance themselves.

The SNB immediately rejected the analysis and said that S&P completely ignored the “sizable increase of SNB deposits with other central banks”.

In our paper “Is Standard and Poor’s a Rating Agency or a Rumor Agency?” we showed the major flaws of the “rumor agency”:

As discussed, the first major mistake was to put government bond purchases and cash at other central banks into the same pot.

Taking deposits at other central banks out of the reserve figure we got a new total of near €40bn while Credit Suisse estimated €30–35bn.

Either way, we are talking far less than the S&P’s €60bn-€80bn but not insignificant at all.

(source FT Alphaville)

S&P made several other mistakes in their analysis:

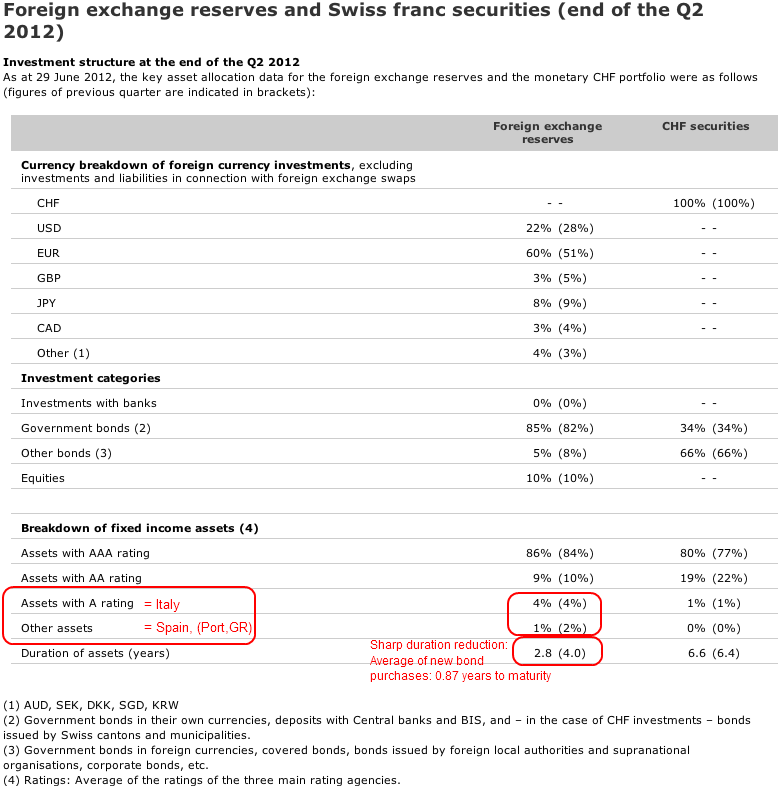

1. They completely ignored the durations of the SNB purchases. The duration of the newly purchased bonds by the SNB was around 0.87 years, which fell from 4.0 years in Q1 to 2.8 in Q2 (see below). But the rating agency used 10 year French bonds in order to prove that the Swiss pushed down yields, but most probably the SNB did not buy these bonds at all.

2. S&P ignored the price change of existing SNB holdings as of the end of December 2011. We estimate that the SNB had gains of 5 billion CHF just because of bond price changes.

3. The yield of the French 1-year BTAN changed from 0.24% at the end of 2011 to 0.02% at the end of July. Therefore a big price influence by the SNB can be excluded.

4. Yields of these core European short-term bonds remained stable during the big SNB interventions between the middle of May and end of June. This indicates that the SNB has helped to back-stop a fall in prices of core European notes like the French ones. In this point S&P is right, but this is nothing new, just an old rumor warmed up by S&P.

5. The unchanged “A rating” share of 4% between Q1 and Q2 shows that the central bank bought Italian government bonds with a value of at least 2 billion francs. Apart of Italy there are only the small Slovenia and Slovakia that have an A rating. The central bank reduced the share of “Other assets” in the second quarter.

6. If the SNB deposits euro cash at the ECB, then this money can be used for ECB refinancing operations and benefits the periphery. Moreover, these SNB funds to the ECB are sterilized.

The following graph sums up the real SNB data and not the data from Standard and Poor’s rumor.

(click to expand)

SNB cash positions vs. securities positions and bond yields (snbchf.com, data SNB’s IMF data and monthly bulletins)

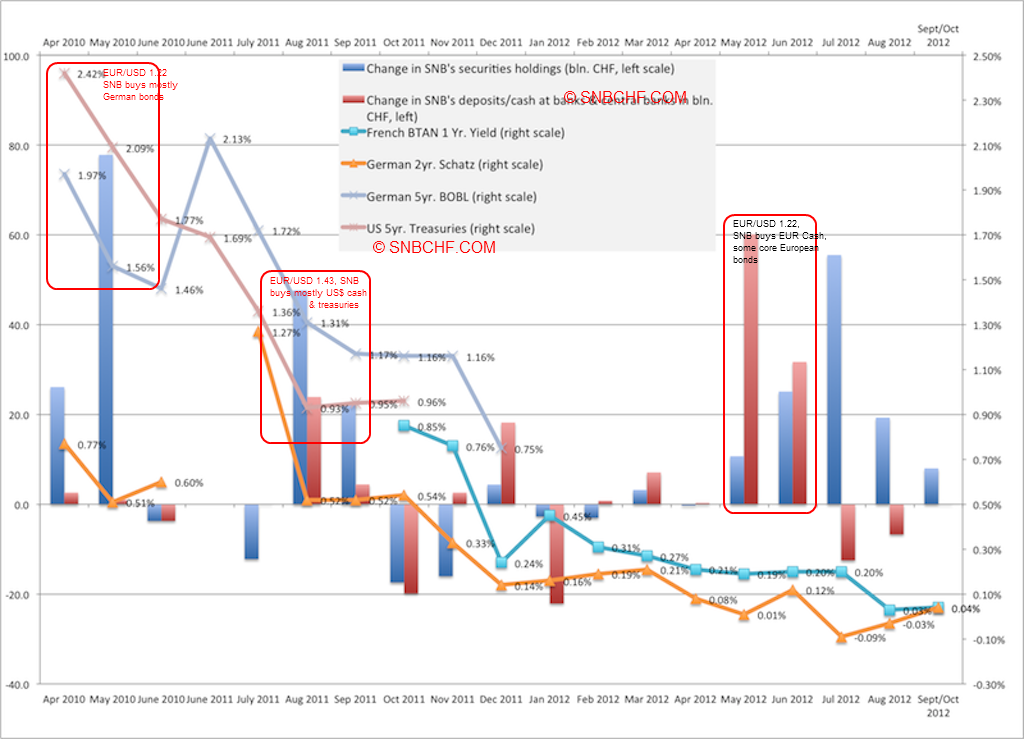

Movements in 2012

As we said above, SNB bought bonds with an average duration of 0.87 years. The graph shows that the SNB did not influence the yields of the short-term “core bonds” at all. French one-year BTAN’s (oats) stood at a yield of 0.24% at the end of December 2011 and at 0.20% at the end of July 2012. Especially in May and June 2012, the SNB bought euros at other central banks and some core European bonds, but prices and yields of French bonds remained the same.

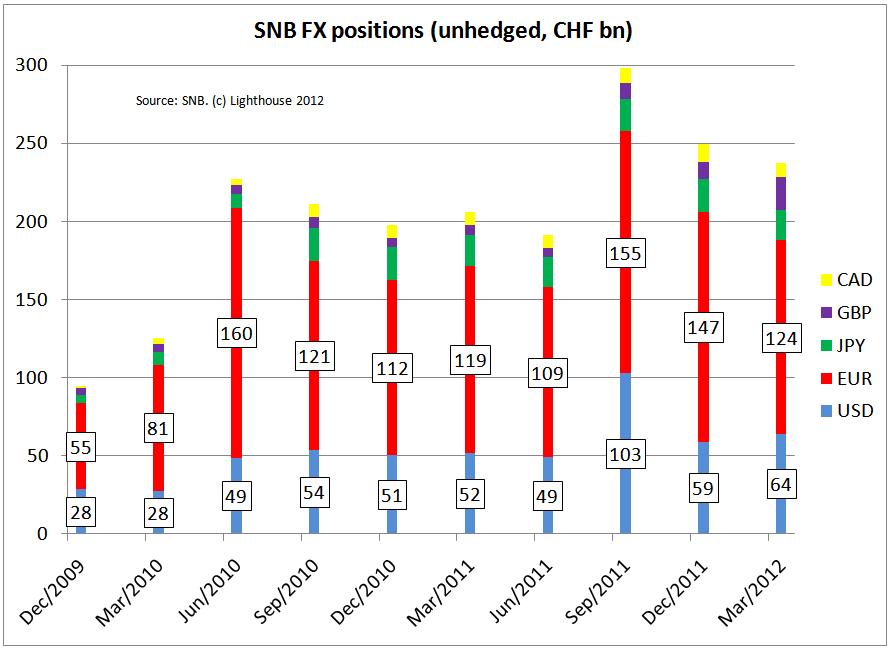

Between August and October 2012 the SNB reduced their bond purchases heavily, but French yields fell to 0.04%. Consequently French bond prices rose even if the Swiss did not help to push them upwards. A slightly different picture applies to the German 2 year Schatzanweisungen. Between December 2011 and July 2012, their yields fell from 0.24% to minus 0.09%, while bond prices increased a bit. But many commentators stated that the SNB diversified away from German bonds in the second quarter and bought French, Austrian and Dutch bonds instead.

May 2010

The picture was a bit different in May 2010, when the SNB tried to keep the EUR/CHF rate over 1.40 despite the first big Greek crisis. The market moved out of peripheral bonds, Spanish 10-year yields rose from 4 to 5 percent. The central bank bought 80 bln. francs in securities and lost the fight against the markets. The euro was weak at the time and traded at 1.22 US$. Therefore the central bank mostly purchased German bonds with a duration of five years and more. The graph below shows that SNB doubled the euro reserves in Q2/2010.

The graph above indicates that German bond yields fell only slightly more strongly than US treasury yields. Yet the main driver of the fall in German and US yields was the first Greek crisis and not the SNB.

(click to expand)

August/September 2011

In August 2011 the EUR/USD was trading around 1.43. At this price the US$ was interesting and the SNB was said to have “saved the dollar”. It bought more US$ than euros. It invested mostly in US treasuries, German bonds and in currency or deposits at other central banks.

The seignorage effect does not exist any more for the SNB, but inflation risks are high

The seignorage effect on which Dr Jordan was still insisting in August 2011, does not exist any more: Both SNB liabilities and SNB assets (core European bonds) yield zero percent. There is no margin left for seignorage.

With the Fed’s QE3 operation, interest rate and inflation risks especially for the most secure bonds, like European core bonds or US treasuries, are high. Prices of these instruments might fall and lead to losses in the SNB positions.

Interest rate risk is the vulnerability of a bond or fixed income asset class to movements in prevailing interest rates. Bonds with elevated interest rate risks tend to perform well when rates are falling, but they will underperform when interest rates are rising. (Keep in mind, bond prices and yields move in opposite directions). As a result, rate-sensitive securities tend to perform best when the economy is slowing, since slower growth is likely to lead to falling rates.

Inflation Risk: Because of their relative safety, bonds tend not to offer extraordinarily high returns. That makes them particularly vulnerable when inflation rises.

Imagine, for example, that you buy a Treasury bond that pays interest of 3.32%. That’s about as safe an investment as you can find. As long as you hold the bond until maturity and the U.S. government doesn’t collapse, nothing can go wrong….unless inflation climbs. If the rate of inflation rises to, say, 4 percent, your investment is not “keeping up with inflation.” In fact, you’d be “losing” money because the value of the cash you invested in the bond is declining. You’ll get your principal back when the bond matures, but it will be worth less. (source)

See also the warning “High potential losses associated with ‘safe’ bonds” from the Swiss private bank Vontobel to their clients and our speculation that German Bunds might finally fall in price.

What happened in July and August 2012?

Completely against what Vontobel recommended, the SNB increased their holdings in euro-denominated securities and reduced cash holdings at other central banks in July and August 2012. We wonder what the central bank purchased?

Quite surely they continued with big euro purchases given that the common currency was trading around 1.24 EUR/USD. We think that some “insider information” from the ECB and the Fed let them know that OMT and QE3 were imminent.

Therefore, we judge that the central bank increased the share of “A ratings” (mostly Italian bonds) from 4% to maybe 7% and other ratings (Spanish bonds) from 1% to 3%, buying these peripheral bonds at record-low prices.

Since Italy has an average rating under A now, these bonds should be reclassified. The “Other Assets” with a rating under “A” could easily contain 9%.

Before doing this the Swiss might have got insurance from the ECB that they will prevent Italy and Spain from going bust in the next five years and that these countries will remain in the euro zone.

The return of the seignorage effect

A 7.59% yield of Spanish 5-year bonds compounded for five years will give a nice 44% return. Even in the case of a 40% haircut these securities will have a higher return than a zero-percent yielding German bond. Similarly a 5.62% yield in Italian five-year bond compounded for these five years will lead to 31% return. Moreover, we think that the central bank increased the share of equities from 10% to levels around 12%, higher equity prices will help to reach this level.

And all this using cheap Swiss funds at zero percent: We see the return of the seignorage effect.

SNB results tomorrow, October 31st

The central bank will publish more detailed data about the holdings in July, August and the whole third quarter tomorrow morning, October 31st.

The first thing we will look at, is the distribution of reserves in different ratings and asset classes.

We reckon that they did just the opposite of what Standard Poor’s thought: they bought quite a big amount of peripheral bonds in July and August. Last but not least, the SNB was a lot better in timing than any hedge fund. Some have said that Switzerland is a big hedge fund with a small country attached. Indeed it is and a lot better performing one.

Are you the author? Previous post See more for Next post

Tags: Central Bank,Duration,ECB,European central bank,Government Bonds,IMF,Monthly Bulletin,Other Periphery,Rating,Swiss National Bank