Japan and Switzerland among the highest in Year to Date CPI for developed economies: a quite surprising result for current deflation fears

(This post appeared on Zerohedge)

At a time of speculations about global deflation, we show an interesting and very different aspect. Our CPI and wage data comparison among different developed countries, shows that Switzerland and Japan will see both inflation, whereas other countries like Australia will see disinflation.

Again some economists (my former colleague Mansoor Mohi-uddin of UBS in the Financial Times, Soberlook or even the IMF) uttered the idea that Switzerland and Japan see deflationary risks and that their central banks need to do something against it, via Quantitative Easing (the IMF) or even by an articial exchange rate peg. These economists are often able to compare only the Year on Year headline figures, which contain exchange rate effects: For example, a rising Swiss franc in 2011 and a resulting YoY deflation in imported products.

Year on Year CPI vs. Year to Date CPI

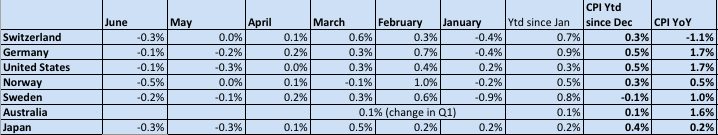

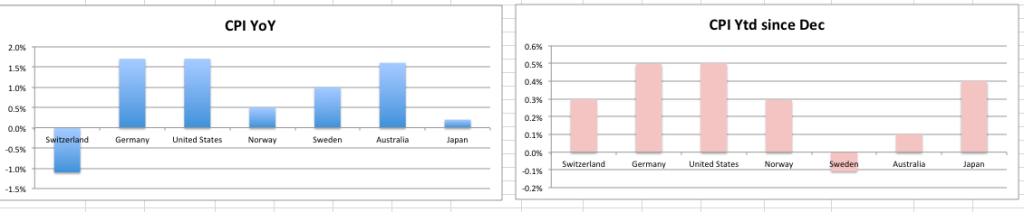

The Month on Month data show that there is no big difference between Switzerland, Japan and other developed economies:

(Sources: Swiss Statistics, German destatis, US BLS, Norway Statistics, Sweden Statistics, Australia BoS, Japan Statistics, history of Japanese CPI data, year to date computed by compounding of MoM values, June US and Japan estimated)

Neither Switzerland nor Japan are in deflation. Swiss YoY CPI is still in deflation, because the effects of the strong franc in 2011 are still to be washed out. Japan shows already YoY inflation.

Japan has the highest Year to Date Inflation (since end December) partially thanks to the higher USD/JPY exchange rate. If we measured the Year to Date CPI since End January, Switzerland would be close to the leaders. Most surprisingly Australia is on the bottom of the list (Q2 inflation data still missing) and some short-sighted investors piled into the Australian Dollar as supposed safe-haven.

Persistent wage inflation and nearly full employment

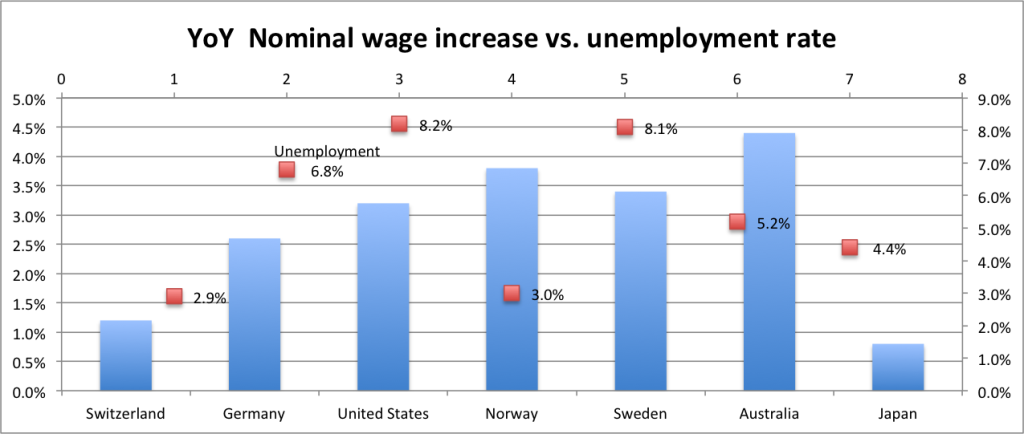

Many (here the protagonist) are claiming that the whole world is going into deflation, for us things look very different: The historically most important inflation driver, the nominal wages, are still on the rise:

(Sources: Swiss Statistics, German destatis, US BLS, Norway Statistics, Sweden Statistics, Australia BoS, Japan Statistics/only contractual change, most data from Q1/2012)

Australian and Norwegian wages will probably calm down with falling inflation expectations and less demand for commodities. US salary rises are hindered by the strong unemployment, German wage increase might slow with the euro crisis. This means that Japan and Switzerland will further cope up with other countries in the CPI provided that their currency does not appreciate.

Nearly full employment in all the cited developed economies except the US shows that the deflationary environment of the recent months is only temporary. Deflation is rather an effect of the recent strong fall in commodity prices. No wonder that the Fed is still reluctant to ease conditions; they saw the opposite temporary commodity price movements last year.

We do neither expect a global inflation nor a deflation scenario but a balance sheet recession in many countries but still an increase of wages and therefore a very slow global growth in both developed and developing countries and continuing disinflation (see chart of Ashraf Laidi to the right). CPIs will look soon similar for all developed countries, with the consequence that the currencies of the most secure and effective countries (measured in terms of trade balance and current accounts) will appreciate. These are for us e.g. Japan, Switzerland, Singapore and partially Sweden and Norway. The overvalued currencies with weaker trade balances like the Kiwi and Aussie must depreciate, because the central banks will slowly cut interest rates.

Only by a stronger appreciation of the yen and cheaper import prices, Japan might go into deflation. As opposed to the Bank of Japan, that currently does not intervene in the currency market, the Swiss National Bank (SNB) is still artificially depressing its currency, despite a record low of 2.9% in the unemployment rate, a strong trade balance and a Swiss Q1 GDP growth 0.7% versus 0.0% in the euro zone.

Are you the author? Previous post See more for Next post

Tags: 1970s,Bank of Japan,current account,Deflation,Euro crisis,floor,franc,IMF,imported inflation,inflation,Japan,Japanese yen,Ministry of Finance,MoF,peg,Safe-haven,Swiss National Bank,Switzerland,UBS,wage inflation,Zerohedge