Category Archive: 1) SNB and CHF

SNB Sight Deposits: increased by 3.4 billion francs compared to the previous week

The sight deposits at the SNB increased by 3.4 billion francs compared to the previous week.

Read More »

Read More »

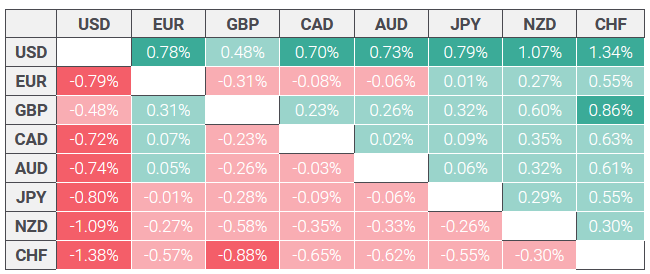

USD/CHF stays above 0.9100 nearing the highs since October

USD/CHF hovers below 0.9152, the highest since October reached on Monday. US Dollar strengthened as higher Retail Sales amplified expectations of the Fed prolonging higher policy rates. Swiss Franc faces challenges due to the likelihood of SNB implementing another rate cut in the June meeting.

Read More »

Read More »

Canadian Dollar remains vulnerable after strong US Retail Sales

Canadian Dollar gives away gains as USD bounces up following strong Retail Sales data. Investors’ concern that Middle East conflict might escalate provides additional support to the safe-haven US Dollar. Oil prices have depreciated nearly 3.5% from early April highs, adding negative pressure to CAD.

Read More »

Read More »

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

The Pound Sterling faces pressure as geopolitical tensions improve the appeal for safe-haven assets. UK’s employment and inflation data will influence speculation over BoE rate cuts.

Read More »

Read More »

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

For decades, the exchange rate has played a key role for the Swiss economy and for the Swiss National Bank's monetary policy.

Read More »

Read More »

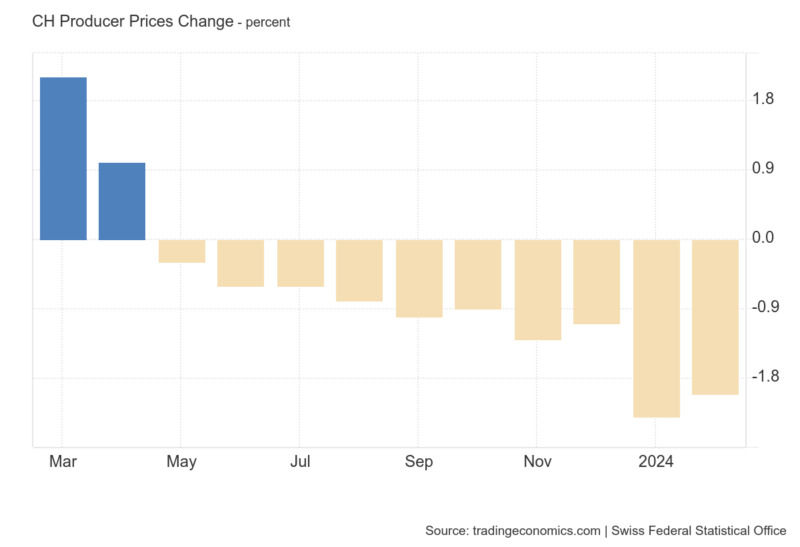

Swiss Franc at risk as inflation diverges from SNB forecasts

Swiss Franc is vulnerable as inflation data continues to undershoot official forecasts. The SNB expected inflation to average 1.9% in 2024 in its December forecast, but it currently sits at 1.2%.

Read More »

Read More »

EUR/CHF Price Analysis: Pullback possible amid mixed signals

EUR/CHF has rebounded from the 0.9254 December 2023 lows and rallied up to resistance from a key barrier in the form of the 50-week Simple Moving Average (SMA). The pair is probably still in a long-term downtrend despite recent strength.

Read More »

Read More »

The Swiss National Bank vs. the Federal Reserve: The Fed’s Capital Losses in Perspective

Switzerland’s central bank, the Swiss National Bank (SNB), lost $3.6 billion in 2023,

after a gigantic loss of $150 billion in 2022. But after booking these losses, and properly subtracting them from its capital, the SNB still had positive capital of over $70 billion.

Read More »

Read More »

US Dollar enters fourth day of consecutive losses ahead of Powell testimony

The US Dollar trades softer across the board on Wednesday. US Federal Reserve Chairman Jerome Powell is heading to Capitol Hill for his semi-annual testimony. The US Dollar Index snaps an important support, looking bleak ahead of the ECB decision and NFP data.

Read More »

Read More »

Swiss Franc extends losses on Swiss interest rate outlook

The Swiss Franc (CHF) edges lower against the US Dollar (USD) on Wednesday as traders continue to bet on a less-inflationary outlook for Switzerland, supporting a relatively low interest rate policy and dampening foreign capital inflows.

Read More »

Read More »

Vorwort des Buches « L’Humanité vampirisée ». Philippe Bourcier de Carbon (version Allemande)

Philippe Bourcier de CarbonIngenieur der Hochschule Polytechnique, DemographGründungsvorsitzender von AIRAMA, « Internationale Allianz für die Anerkennung der Beiträge des Nobelpreisträgers Maurice Allais »

Read More »

Read More »

USD/CHF Price Analysis: Trades back and forth around 0.8800

USD/CHF trades sideways near 0.8800 as the focus shifts to US economic data.

The Swiss economy is expected to have growth at a moderate pace of 0.1% in the last quarter of 2023.

Fed policymakers support holding interest rates unchanged in the range of 5.25%-5.50%.

Read More »

Read More »

EUR/CHF hits ten-week highs above 0.9550 as Franc continues to soften

EUR/CHF up over 3% from December’s lows.

ECB President Lagarde looks ahead to growth rebound.

Swiss Franc is broadly weaker across the majors market.

Read More »

Read More »

Sichtguthaben bei der SNB ziehen leicht an

Die Einlagen von Bund und Banken lagen am 23. Februar bei 480,5 Milliarden Franken nach 477,1 Milliarden in der Woche davor, wie die SNB am Montag mitteilte. Das ist ein Anstieg um 3,4 Milliarden Franken.

Read More »

Read More »

Parlamentskommission reicht in Credit-Suisse-Untersuchung Anzeige ein

Die Sonderkommission des Schweizer Parlaments zur Untersuchung des Credit-Suisse-Debakels geht gegen Indiskretionen vor.

Read More »

Read More »

Forex Today: Pound Sterling weakens on soft UK inflation, US Dollar consolidates gains

The US Dollar Index consolidates it's gains early Wednesday after rising 0.7% to a fresh three-month high near 105.00 on Tuesday. Eurostat will release fourth-quarter Gross Domestic Product (GDP) data in the European session and there won't be any high-tier data releases from the US later in the day.

Read More »

Read More »

Gold price consolidates post-US CPI losses, seems vulnerable near two-month low

Gold price (XAU/USD) extends its sideways consolidative price move and remains depressed below the $2,000 psychological mark, or a two-month low heading into the European session on Monday. The stronger-than-expected US consumer inflation report released on Tuesday fueled speculations that the Federal Reserve (Fed) will wait until the June policy meeting before cutting interest rates.

Read More »

Read More »

USD/CHF retraces its recent gains on risk appetite, inches lower to near 0.8730

USD/CHF attempts to recover its recent gains registered in the previous session. The USD/CHF pair edges lower to near 0.8730 during the European hours on Thursday. The improved risk appetite weakened the US Dollar (USD) against the Swiss Franc (CHF). Additionally, the subdued US bond yields are contributing downward pressure to undermining the Greenback.

Read More »

Read More »

USD/CHF heading for 0.8500 as Swiss Franc climbs into four-month high against Greenback

The USD/CHF slipped through the 0.8600 handle on Thursday as broader markets push over the US Dollar (USD), bolstering all other major currencies across the board and lifting the Swiss Franc into a new twenty-week high against the Greenback.

Read More »

Read More »

-638453232816314704-800x305.png)