Tag Archive: yuan

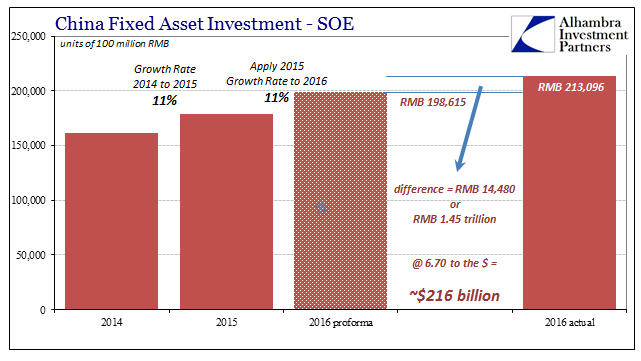

A Clear Anchor

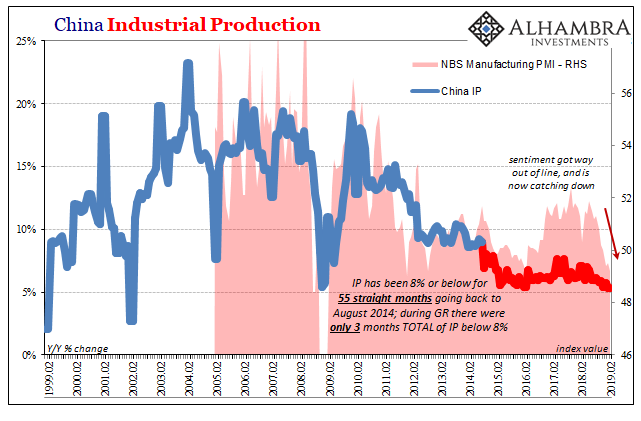

All the way back in January I calculated the total size of China’s 2016 fiscal “stimulus.” Starting in January 2016, authorities conducted what was an enormous spending program. As it had twice before, the government directed increased “investment” from State-owned Enterprises (SOE). By my back-of-the-envelope numbers, the scale of this fiscal side program was about RMB 1.45 trillion, or nearly 2% of GDP

Read More »

Read More »

FX Daily, September 07: ECB Focus for Sure, but not Only Game in Town

The US dollar is trading broadly lower. The ECB meeting looms large. Many, like ourselves, expected that when Draghi said in July that the asset purchases would be revisited in the fall, it to meant after the summer recess, not a legalistic definition of when fall begins. Still, there have been some reports, citing unnamed sources close to the ECB, that have played down such expectations, and warn a decision on next year’s intentions may not be...

Read More »

Read More »

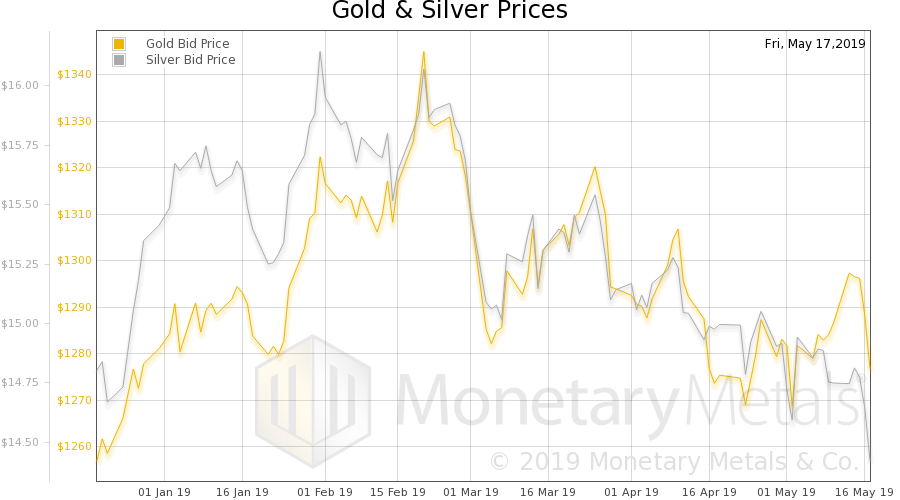

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Latest developments show risks in crypto currencies. Confusion as bitcoin may split tomorrow. SEC stepped into express concern over ICOs. ICOs have so far raised $1.2 billion in 2017. ICOs preying on lack of understanding from investors. Physical gold not vulnerable to technological risk. Beauty and safety in simplicity of gold and silver.

Read More »

Read More »

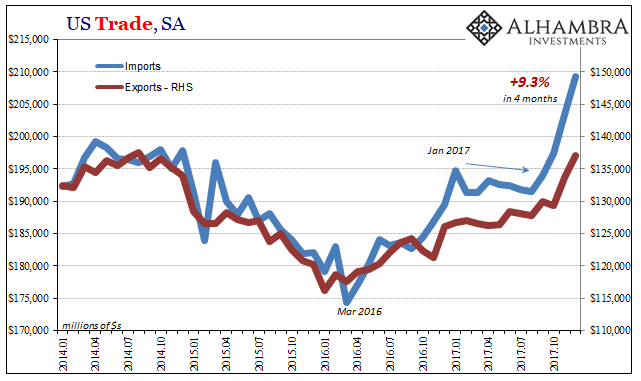

FX Daily, August 08: Trade Featured as Dollar Drifts Lower

The US dollar has a slightly lower bias today, but the against most of the major currencies, it is consolidating within the range set at the end of last week. The main exceptions are sterling and the Canadian dollar. They had extended their pre-weekend losses yesterday, and are trading within yesterday's range today.

Read More »

Read More »

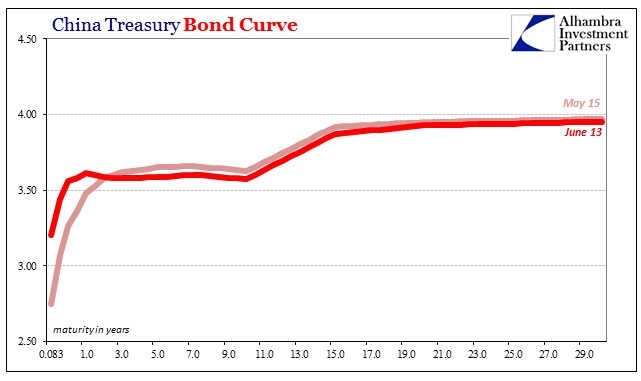

The ‘Dollar’ Devil Shows Itself Again In China

Some economic and financial conditions leave a yield curve as a more complex affair.Then there are others that are incredibly simple.The UST yield curve is the former, while right now the Chinese Treasury curve is the latter.

Read More »

Read More »

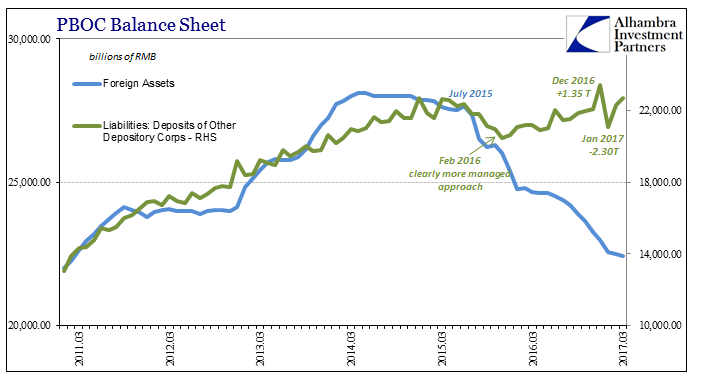

PBoC: Mechanical Tightening PBoC is China Central Bank

The mainstream narrative as it relates to Chinese money is “tightening.” Having survived the economic downturn last year, we are to believe that the PBOC is once again on bubble duty. They raised their reverse repo rates, considered to be their policy benchmarks, three times up to mid-March.

Read More »

Read More »

To The Asian ‘Dollar’, And Then What?

The Bretton Woods system was intentionally set up to funnel monetary convertibility through official channels. The primary characteristic of any true gold standard is that any person who wishes can change paper claims into hard money. It was as much true in any one country as between those bound by the same legal framework (property).

Read More »

Read More »

FX Daily, April 14: Holiday Markets Remain on Edge

The holiday-induced calm in the capital markets conceals a high degree of anxiety. The investment climate has been challenged by heightened geopolitical risk and unusual complaints about the US dollar's strength from the sitting US President. While sending an "armada" toward the Korean peninsula, the US ordered a missile strike against Syria in retaliation for the use of chemical weapons and dropped the largest bomb in the world on Afghanistan.

Read More »

Read More »

FX Daily, April 13: Greenback Stabilizes After Trump Induced Slide

The US dollar slid after US President Trump complained about its strength. The sell-off extended into early Asian activity, before stabilizing. It is mixed in late morning European turnover, which is already lightening up due to the extended Easter holiday.

Read More »

Read More »

FX Daily, March 31: Greenback Finishing Weak Quarter in Mixed Fashion

The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March.

Read More »

Read More »

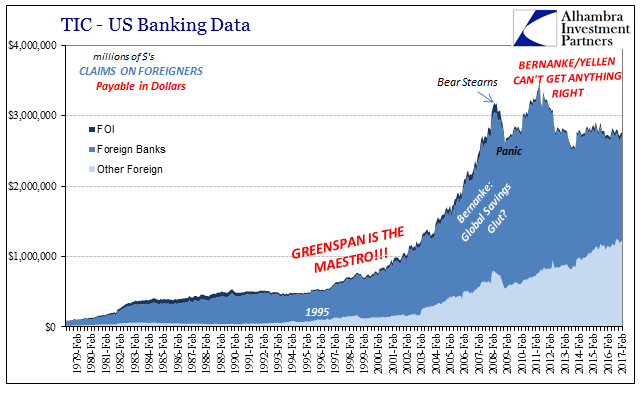

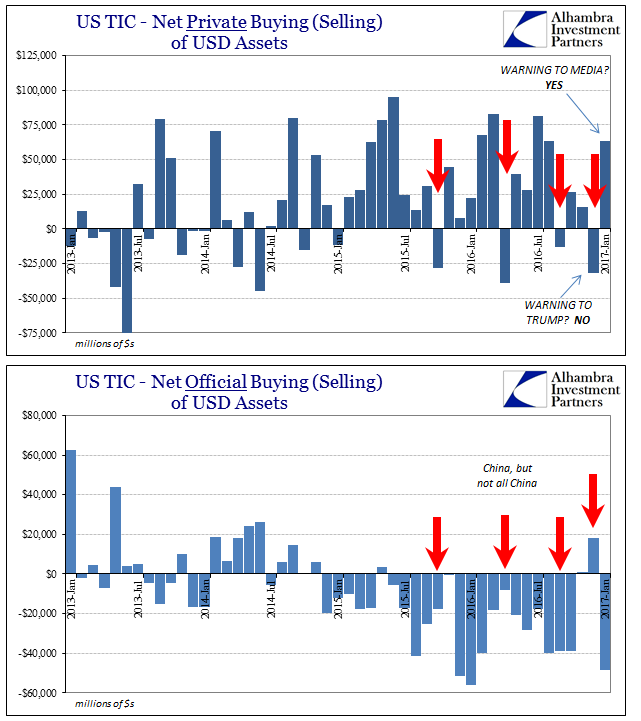

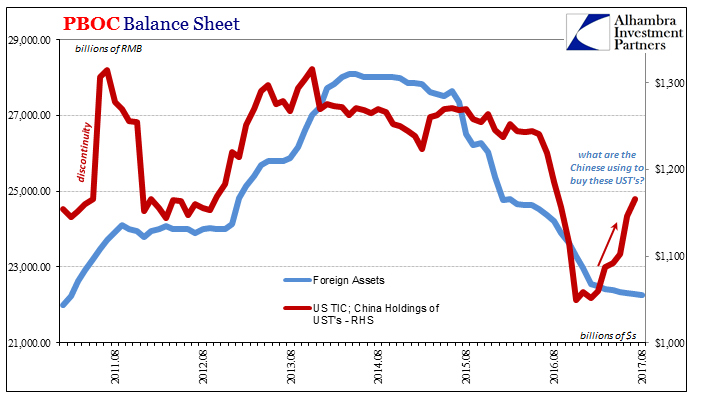

TIC Analysis of Selling

When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke reserved for disreputable leaders of...

Read More »

Read More »

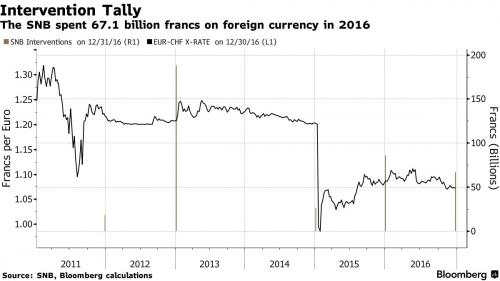

SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China.

Read More »

Read More »

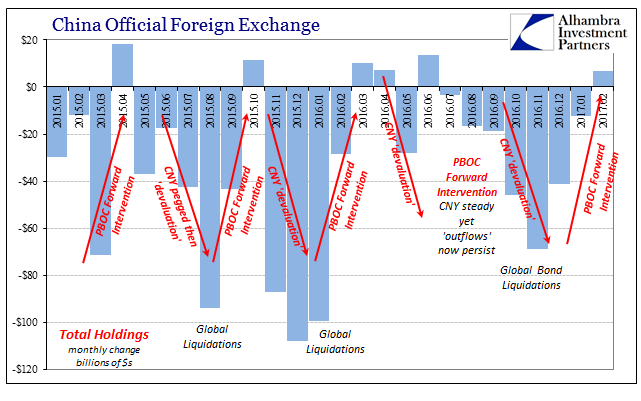

Non-Randomly Surveying RMB

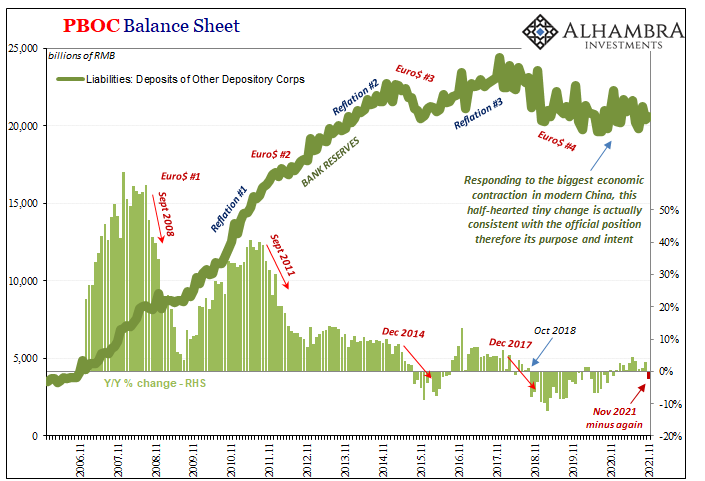

China’s central bank, unlike other central banks, is constantly active almost never resting. Because it is always in motion, the PBOC can seem to be “adding” liquidity at the very same time it might be “draining” it. Its specific actions should never be interpreted as standalone procedures related solely to some unknown policy stance. That is particularly true given that we know what their stance is and has been – neutral.

Read More »

Read More »

Status of US Pivot To Asia

Pivot still taking place, but without TPP, more militaristic. President Trump seems a little less confrontational toward China. China is unlikely to be cited as a currency manipulator in next month's Treasury report.

Read More »

Read More »

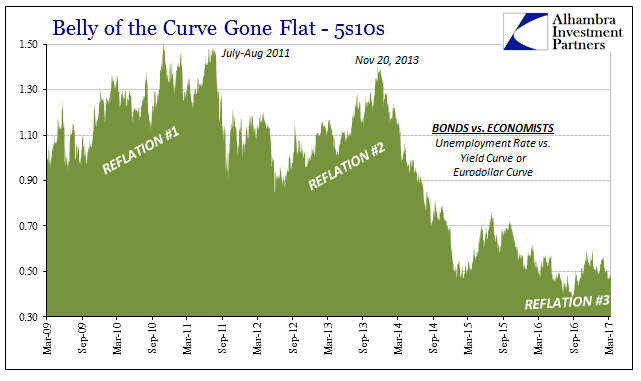

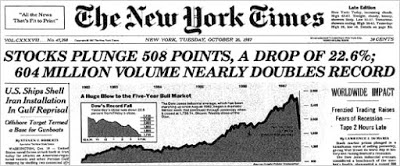

Pressure, Sure, But From Where?

It may just be that in life you have to get used to disappointment. Though not for lack of trying, I have spent a great deal of time over the years intending to piece together exactly what happened on days like October 15, 2014. The official explanation is an obvious whitewash, one so haphazard that I doubt it will ever be referred to again outside of ridicule.

Read More »

Read More »

China’s NPC Ends with New Initiatives

China will make its mainland bond market more accessible. As China's portfolio of patents grows it will likely become more protective of others' intellectual property rights. PRC President Xi will likely visit US President Trump early next month.

Read More »

Read More »

Trump Administration Modifying Stance on Way to G20

Confrontation with China has been dialed down. Criticism of the Fed has been walked back. There is less talk about the dollar. Employment data has been embraced.

Read More »

Read More »

China And Reserves, A Straightforward Process Unnecessarily Made Into A Riddle

The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece.

Read More »

Read More »

FX Daily, March 07: Greenback Continues to Recover from the Late Pre-Weekend Slide

The US dollar has continued to recover from the slide on what still largely appears to have been a buy the rumor sell the fact response to Yellen's speech just before last weekend. Yellen was the last of around 11 Fed officials that spoke last week, and nearly all but Bullard signaled readiness to hike rates at next month's meeting.

Read More »

Read More »