Tag Archive: U.S. Initial Jobless Claims

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week.

FX Daily, January 11: Capital Markets Calmer, Greenback Consolidates

As market participants were just getting their sea legs back after the start of the year, it was hit by a one-two punch of ideas that BOJ policy was turning less accommodative and that Chinese officials were wary of adding to their Treasury holdings. Then late yesterday, a news wire reported that Canada suspected the US was going to withdraw from NAFTA.

Read More »

Read More »

FX Daily, January 04: Greenback Continues to Consolidate Recent Losses

The US dollar is sporting a softer profile across the board, though remaining largely in the ranges seen over the past couple of sessions. At the same time, the news stream suggests that the global synchronized growth cycle strengthened late last year and is bound to carry over into the New Year.

Read More »

Read More »

FX Daily, December 14: US Rates Bounce Back, but Dollar, Hardly

US interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment forecasts. Yet its interest rate trajectory and inflation forecasts were largely unchanged. Yellen, as her recent predecessors have done, played down the implications of the flattening of the yield curve.

Read More »

Read More »

FX Daily, December 07: Equities and Oil Stabilize

Global equities are stabilizing today after the recent downside pressure. The MSCI Asia Pacific Index snapped an eight-day slump with a 0.4% gain, led by a rebound in Tokyo and India. European markets are firm, with the Dow Jones Stoxx 600 up around 0.25% near midday in London. All sectors are higher but telecom and real estate are performing best, while energy and health care are laggards.

Read More »

Read More »

FX Daily, November 30: US Dollar Comes Back Bid, but Brexit Hopes Underpin Sterling

The US dollar is broadly firmer. The rise in US yields yesterday has seen the greenback extend its recovery against the yen. It briefly pushed through JPY112.40, after dipping below JPY111.00 at the start of the week, for the first time since mid-September. Since the end of last week, been capped at the 200-day moving average against the yen, found near JPY111.70, but yesterday it pushed past. There are nearly $1 bln of options struck between...

Read More »

Read More »

FX Daily, November 22: Global Equity Rally Resumes, while Dollar Slips

Global equities are on the march. US indices shrugged off their first back-to-back weekly decline in three months to set new record highs yesterday. The MSCI Asia-Pacific followed suit and recorded their highest close. The Dow Jones Stoxx 600 is struggling, as the CAC and DAX are nursing small losses.

Read More »

Read More »

FX Daily, November 16: Euro Extends Pullback

After rising to its best level since October 20, the euro reversed direction yesterday and has extended its pullback today. The unexpected tick up in US core CPI and better than expected retail sales may have helped spur the euro losses after three cent run-up over the past several sessions. There bearish candlestick (shooting star) leaves the late euro longs in weak hands.

Read More »

Read More »

FX Daily, November 02: Dollar Pulls Back in Asia

We suggested the market was at crossroads. It is still not clear if the dollar's breakout, supported by higher yields is real or simply the fraying of ranges. Asia has pushed the dollar broadly lower. While the greenback finished the North American session above JPY114.00 for the first time since July, the fact that the US 10-year yield could not push back above the 2.40% level, does not help confidence.

Read More »

Read More »

FX Daily, October 26: Draghi’s Day

It is all about the ECB meeting today. The market was hoping for more details last month, but Draghi pointed to today. The broad issue is well known. While growth has been strong, price pressures are still not, according to the ECB, on a durable path toward its "close but lower than 2%" target. The ECB judges that substantial additional stimulus is needed.

Read More »

Read More »

FX Daily, October 19: Kiwi Drop and Sterling Losses Punctuate Subdued FX Market

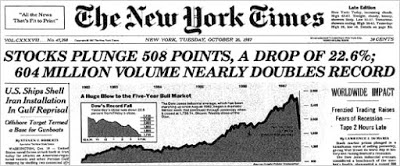

The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these factors has been addressed to some extent. Circuit breakers have been introduced, and have evolved. The financial capacity has grown immensely.

Read More »

Read More »

FX Daily, October 12: Discipline Argues Against Consensus Narrative

Following the release of the FOMC minutes from last month's meeting, the consensus narrative that has emerged says that it was dovish because there is a growing worry the reason inflation fell is not simply due to transitory factors. This explains, according to the narrative the dollar's losses and the stock market rally.

Read More »

Read More »

FX Daily, October 05: Sterling and Aussie Weakness Featured in the Otherwise Becalmed FX Market

The US dollar is mostly little changed as the broad consolidation that has emerged this week continues. The two powerful forces that have emerged--expectation of a Fed hike at the end of the year and European political challenges--appear to have reached a tentative equilibrium.

Read More »

Read More »

FX Daily, September 21: Market Digests Fed, Greenback Consolidates, Antipodeans Tumble

The market has mostly interpreted the Fed's action in line with our thinking. Despite the lowering of the long-run Fed funds rate, the shifting one of the three hikes from 2019 into 2020, and recognizing that the weaker price impulses are somewhat mysterious, the Fed clearly signaled its bias toward hiking rates one more time this year and three next year.

Read More »

Read More »

FX Daily, September 14: New Trump Tactics Help Greenback and Rates

In the face of much cynicism and pessimism about the outlook for the Trump Administration's agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative branch itself, as in limiting the...

Read More »

Read More »

FX Daily, September 07: ECB Focus for Sure, but not Only Game in Town

The US dollar is trading broadly lower. The ECB meeting looms large. Many, like ourselves, expected that when Draghi said in July that the asset purchases would be revisited in the fall, it to meant after the summer recess, not a legalistic definition of when fall begins. Still, there have been some reports, citing unnamed sources close to the ECB, that have played down such expectations, and warn a decision on next year’s intentions may not be...

Read More »

Read More »

FX Daily, August 31: US Core PCE Deflator may Challenge the Greenback’s Firmer Tone

The US dollar recovery was marginally extendedin Asia, and while it remains firm, it is lost some of its momentum. The Fed's target inflation measure, the core PCE deflator, may decline from 1.5% to 1.4%, according to the median forecast in the Bloomberg survey. That would be the lowest read since the end of 2015 and likely spur more speculation against another Fed hike before the end of the year.

Read More »

Read More »

FX Daily, August 24: Greenback Firmer in Becalmed Markets

The US dollar is enjoying a firmer tone in quiet. Sterling is stabilizing after grinding down to its lowest level since late June. The Mexican peso, which had dropped in thin trading in Asia and Europe yesterday following Trump's threat to exit NAFTA and force Congress to fund the Wall or face a government shutdown recovered fully and is now slightly higher on the week.

Read More »

Read More »

FX Daily, August 17: Euro Softens on Crosses, Treasuries Stabilize

The US dollar had steadied after softening in the North American afternoon yesterday when the dissolution of President Trump's business councils as a series of executives stepped down. The FOMC minutes added more fuel to the move.

Read More »

Read More »

FX Daily, August 10: Tensions Remain Elevated, Dollar Firms

It is difficult to walk back the saber-rattling rhetoric. US Secretary of State Tillerson tried to defuse the situation, which had appeared to ease nerves in North America yesterday. However, references to the modernization of US nuclear forces, a multi-year project begun last year, spurred a fresh threat by North Korea to fire four intermediate range missiles near Guam in week's time.

Read More »

Read More »

FX Daily, July 27: Dollar Remains on the Defensive

The US dollar is narrowly mixed after selling off following the FOMC statement. Sometimes the narrative explains the price action, and sometimes the price action explains the narrative. This seems to be the case of the latter. The dollar and interest rates fell, and so the Fed was dovish.

Read More »

Read More »