Tag Archive: U.K. Gross Domestic Product

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health. A stronger than expected number should be taken as positive for the EUR and a lower than expected number as negative to the EUR.

FX Daily, July 26: Quiet Fed Day without Yellen

By definition, the Federal Reserve Open Market Committee meeting is the highlight of the day. Without a press conference, and following last month's rate hike, there is practically no chance of a new policy initiative either on the balance sheet or the Fed funds target.

Read More »

Read More »

FX Daily, June 30: Greenback Stabilizes

The US dollar has been battered this week amid a shift in sentiment seen in how the market responded to comments mostly emanating from the ECB's annual conference. It is not really clear that Draghi or Carney gave new policy indications.

Read More »

Read More »

FX Daily, May 25: Euro Strength more than Dollar Weakness

The Dollar Index is heavy, just above the lows set earlier this week set near 96.80. However, this exaggerates the dollar's weakness because the weight of the euro and currencies that shadow it, like the Swiss franc and Swedish krona. As the North American session is about to start, the dollar is higher against the dollar-bloc currencies and the Japanese yen.

Read More »

Read More »

FX Daily, April 28: Markets Limp into Month End

Equity markets are stalling into the end of the month. MSCI Asia-Pacific Index is snapping a six-day advance, and the week's gain was sufficient to extend the advancing streak for the fourth consecutive month. The Dow Jones Stoxx 600 is trading off for the second consecutive session, after rallying for six consecutive sessions.

Read More »

Read More »

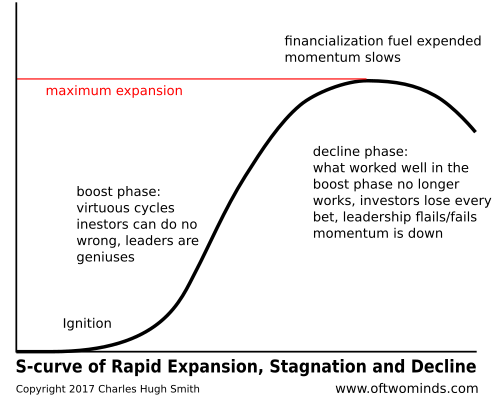

Who’s Playing The Long Game–and What’s Their Game Plan?

When we speak of The Long Game, we speak of national/alliance policies that continue on regardless of what political party or individual is in office. The Long Game is always about the basics of national survival: control of and access to resources, and jockeying to diminish the power and influence of potential adversaries while strengthening one's own power and influence.

Read More »

Read More »

FX Daily, March 31: Greenback Finishing Weak Quarter in Mixed Fashion

The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March.

Read More »

Read More »

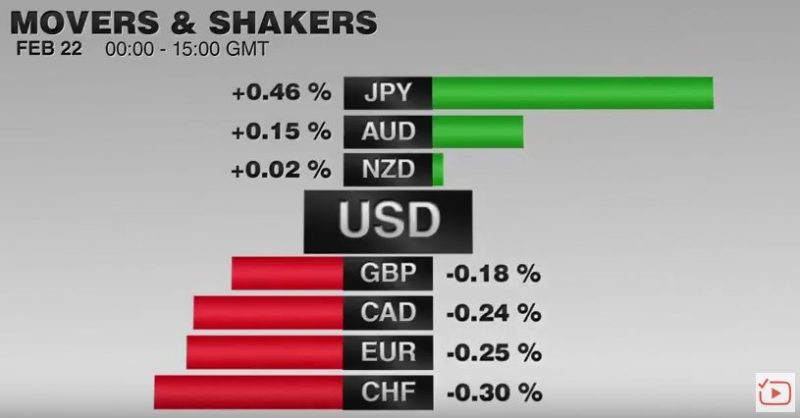

FX Daily, February 22: Euro Meltdown Continues

February has been cruel to the euro. Of the sixteen sessions this month, counting today, the euro has risen in four, and two of those were last week. Its new four-day slide pushed it below $1.05 for the first time in six weeks as European markets were opening. The $1.0560 area that was broken yesterday, and provided a cap today is 61.8% retracement objective of last month's rally.

Read More »

Read More »

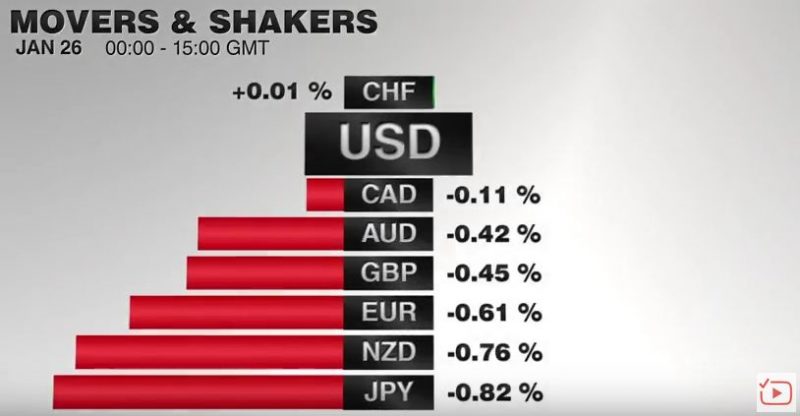

FX Daily, January 26: EUR/CHF collapses to 1.670

The US dollar is mostly firmer against the major currencies but is confined to narrow ranges, and well-worn ranges at that, but the focus has shifted to the strong advance in equities. Yesterday, the Dow Jones Industrials finally rose through the psychologically-important 20k level, and the S&P 500 gapped higher to new record levels.

Read More »

Read More »

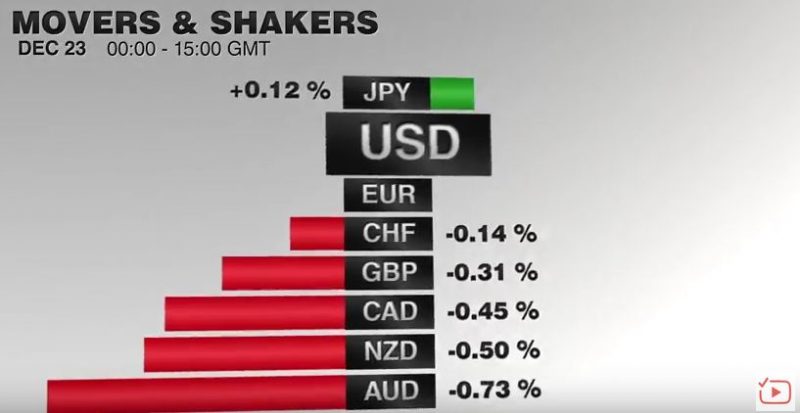

FX Daily, December 23: Markets Edge into Holiday Weekend

Asian shares trade heavily. The MSCI Asia-Pacific Index ex-Japan fell 0.4%. It is the fourth lower close this week and brings the loss to 1.75% for the week. It is fallen in seven of the past nine weeks. The Dow Jones Stoxx 600 is little changed on the session and is nursing a minor loss on the week and could snap a two-week advance.

Read More »

Read More »

FX Daily, November 25: Corrective Forces Emerge, but Underlying Trend is Evident

The US dollar's recent gains are being trimmed today, and it is down against all the major currencies. Many emerging market currencies, including the Turkish lira, Indian rupee, and Hungarian forint are firmer today.

Read More »

Read More »

FX Daily, October 27: Rising Yields Continue to be the Main Driver

The euro remains pinned near the seven-month low it recorded two days ago near $1.0850. It approached $1.0950 yesterday and has been confined to about a 15-tick range on either side of $1.0905 today. Against the yen, the dollar remains near the three-month high (~JPY104.85) also seen two days ago. New dollar buying emerged yesterday near JPY104.

Read More »

Read More »

FX Daily, September 30: SNB Intervenes to Polish Q3 Results

True to its recent habit, the US dollar is finishing the week on a firm note. On the month, though, the greenback has fallen against most of the majors, but sterling, the Canadian dollar, and the Swedish krona. Global equities are trading heavily, and investors' angst is lending support to bond markets.

Read More »

Read More »

FX Daily, August 26: And now for Yellen…

Yellen's presentation at Jackson Hole today is the highlight of the week. It also marks the end of the summer for many North American and European investors. It may be a bit of a rolling start for US participants, until after Labor Day. However, with US employment data next Friday, many will return in spirit if not in body.

Read More »

Read More »

FX Daily, July 27: Yen Falls on Fiscal Stimulus, while Sterling and Aussie Can’t Sustain Upticks

Swiss Franc: The Euro kept on climbing, after yesterday's rapid rise. The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

Read More »

Read More »

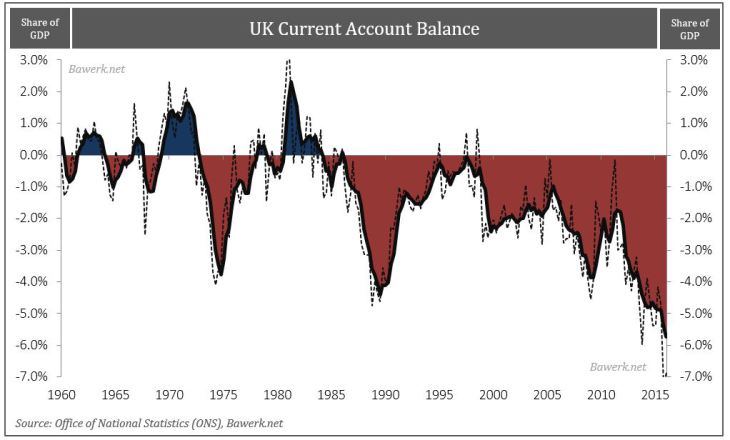

Brexit or not, the pound will crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience.

Read More »

Read More »

FX Daily April 27: Two Issues Loom Large Today: Soft Australia CPI and FOMC

The foreign exchange market is largely quiet as the market awaits fresh trading incentives and the FOMC statement later in the North American session. The main exception to the consolidative tone is the Australian dollar, which is posting its largest loss (~1.7%) in a couple of months. The short-term market was caught the wrong-footed when …

Read More »

Read More »

Fundamentals, FX, Gold and CHF: Week October 21 to 25

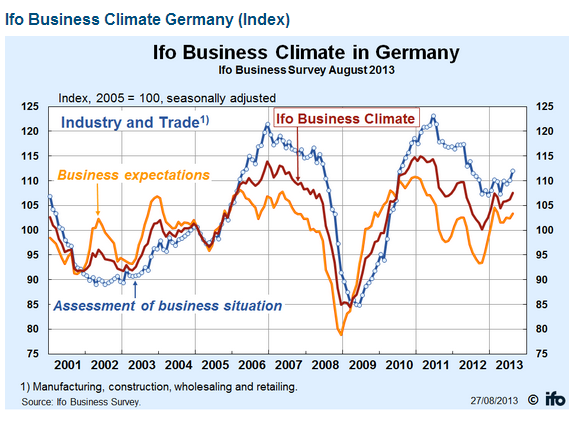

Major Fundamental Events The week contained a lot of important fundamental events, in particular Non-Farm Payrolls and preliminary “flash” PMI readings. Highest importance for FX rates Non-Farm Payrolls (NFPs) weakened to 148K, private NFPs to 126K, both against 180K expected. Especially the private NFPs were disappointing. The decrease in the unemployment rate from 7.3% …

Read More »

Read More »