Swiss Franc |

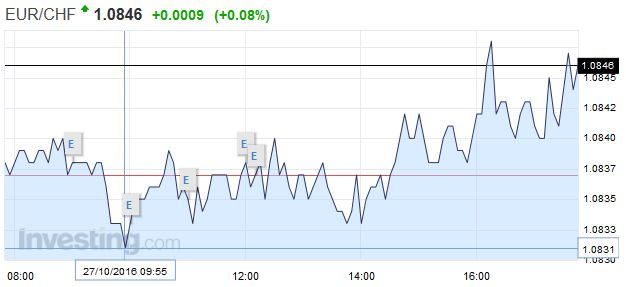

EUR/CHF - Euro Swiss Franc, October 27(see more posts on EUR/CHF, ) |

|

GBP/CHF rates have levelled out over the past couple of weeks following some heavy losses earlier this month. The Pound crashed following UK Prime Minister Theresa May’s comments regarding the triggering of Article 50 early next year. Whilst we knew this was coming the timeline was shrouded in uncertainty and the confirmation rocked the markets and sapped investor confidence, which in turn caused the Pound to lose value. We did see a mini recovery for Sterling earlier in the week, which was halted following Bank of England (BoE) governor Mark Carney’s speech earlier this week, which despite mentioning a prospective interest rate hike due to policy changes, remained fairly dovish. The BoE have come to logger heads with the government over the current economic conditions inside the UK and the best way to move forward, with Carney remaining fairly negative due to the Breixt decision and the subsequent consequences this would have on our economy. As such he stated he may not continue on his current position beyond the end of his current contract, once again adding to the uncertainty surrounding the UK at present. GBP/CHF rates continue to trade around 1.2150 and I do not see a sustainable recovery for Sterling in the short to medium-term, or whilst current market conditions remain as they do. If you have an upcoming GBP or CHF currency exchange to make and you are concerned by the increased market volatility of late, it may be wise to look at protecting the gains you’ve made, or limiting your losses with one of our forward contracts, rather than gamble on what has become an increasingly volatile and unpredictable market. |

GBP/CHF - British Pound Swiss Franc, October 27 |

FX RatesThe euro remains pinned near the seven-month low it recorded two days ago near $1.0850. It approached $1.0950 yesterday and has been confined to about a 15-tick range on either side of $1.0905 today. Against the yen, the dollar remains near the three-month high (~JPY104.85) also seen two days ago. New dollar buying emerged yesterday near JPY104. The driving force is the continued climb in interest rates. The US 10-year yield pushing through 1.80% and is at its highest level since early June. It has moved above its 200-day moving average (~1.72%) recently for the first time since the very start of the year. |

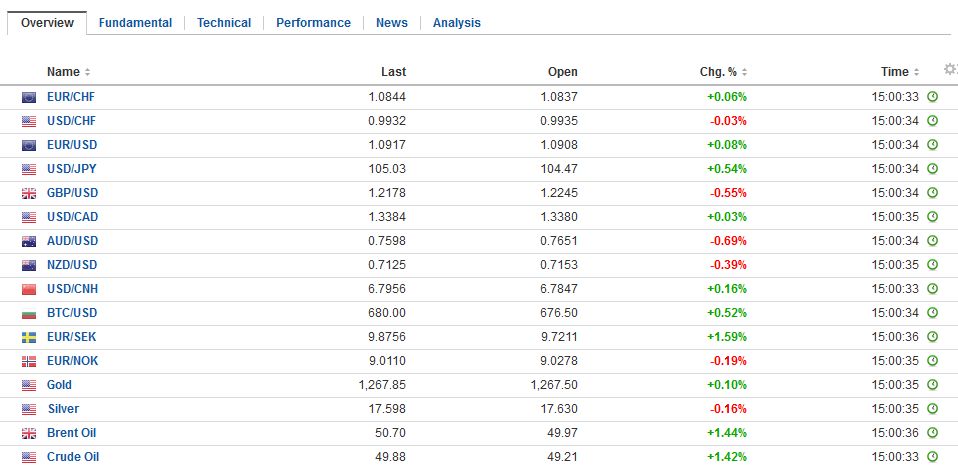

FX Performance, October 27 2016 Movers and Shakers . Source: Dukascopy - Click to enlarge |

| The dollar-bloc currencies are under pressure are poor price action in North America yesterday. The US dollar closed at new session highs against the Canadian dollar. The US dollar is near seven-month highs against the Loonie. The Australian dollar was again turned back from the $0.7700 area. It appears to be in one cent on either side of $0.7600. Initial support now just below there at $0.7580.

While the ECB is widely expected to announce its changes at the December meeting, the BOJ’s Kuroda all but said not to expect from action next week. Kuroda indicated that it might not need to buy JPY80 trillion a year to keep the 10-year bond yield near the zero target. Separately, local press reports continue to play up the likelihood that the BOJ pushes out again when its inflation target will be reached at FY2018. It seems rather than a date-specific guidance, the BOJ (and investors) would be better served by keeping it vague like the US “medium term” or the UK’s rolling two-year framework. The ECB talks about achieving its target as quickly as possible. The BOJ keeps finding itself in a position where to maintain its credibility it is stretching it needlessly. |

FX Daily Rates, October 27 (GMT 15:00) |

| The rise in yields is not just a US phenomenon. The 10-year German bund yield closed above its 200-day moving average (8 bp) yesterday, for the first time this year and the 10-year yield is up another handful of basis points. The 0.14% yield is the highest in four months. Today may be the first day since early-January that the yield on the UK’s 10-year gilt will close above its 200-day moving average (1.16%). The 10-year JGB yield has been flirting with its 200-day moving average (-6.5 bp) since early-September. Yields are broadly steady between minus 10 bp and zero.

The widespread criticism that the easy monetary policy and negative interest rates asphyxiate banks may be a bit exaggerated. At least four large banks reported earnings today (Deutsche Bank, Barclays, Nomura, and BBVA) and they all did better than expected. Deutsche Bank, for example, surprised by reporting a profit in Q3. One thing that they had in common was that trading profits had been an important contributor. The reports, however, were not sufficient to prevent heavier stock prices. |

FX Performance, October 27 |

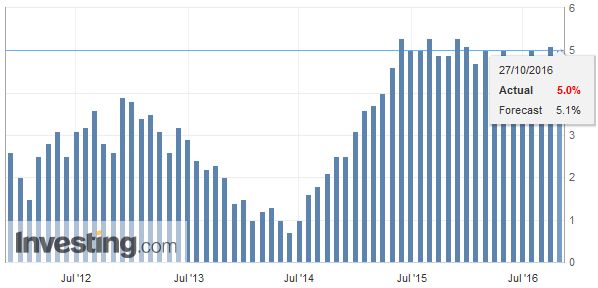

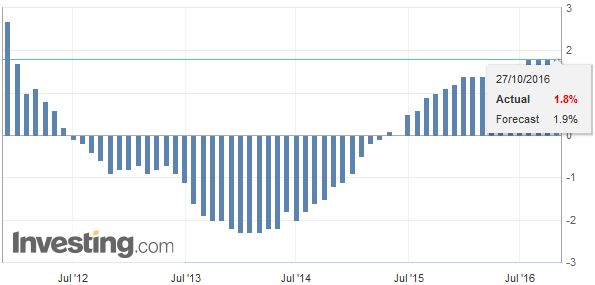

EurozoneDespite the backing up of rates, the market remains convinced that the ECB will extend its asset purchases. Most of the increased price pressures in the eurozone likely reflect the recovery in oil prices The flattish core rate below 1% reflects this. In addition, the recovery in lending seems to stall at a subdued pace. Lending to non-financial companies grew 1.9% year-over-year in September, unchanged from August. Similarly, lending to households remained stuck at 1.8%. M3 growth itself slowed to 5.0% from 5.1% |

Eurozone M3 Money Supply YoY, September 2016(see more posts on Eurozone M3 Money Supply, ) . Source: Investing.com - Click to enlarge |

| Sweden and Norway central banks held policy-making meetings, but both kept policy on hold. Sweden’s Riksbank kept expectations further easing next year very much alive. Norway’s Norges Bank left rates on hold for the fourth meeting and judged that the economy had evolved along its expectations. Norway’s krone is the strongest of the majors today, with a 0.5% rise against the dollar. The Swedish krona is the weakest of the majors today, and it has fallen about 0.5%. |

Eurozone Private Sector Loans YoY, September 2016(see more posts on Eurozone Private Sector Loans, ) . Source: Investing.com - Click to enlarge |

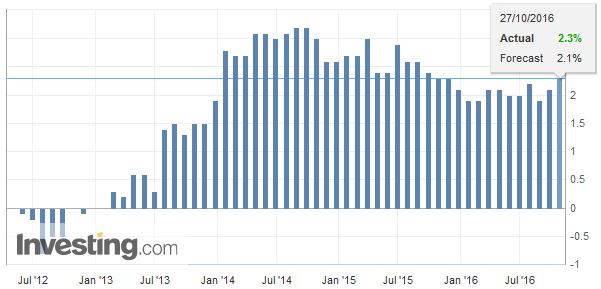

United KingdomThe UK reported stronger than expected Q3 GDP. The preliminary estimate is that the economy is expanded by 0.5%. Many had expected a 0.3%-0.4% pace after a 0.7% Q2 expansion. The strength of services seems to have more than offset the other drags. Sterling continues to trade in the consolidated range that has confined prices since the flash crash. The Dow Jones Stoxx 600 is off about 0.3% near midday in London, while the financials are off 0.2%. Deutsche Bank shares are off 0.5% at pixel time and have been alternating advances and declines since last Thursday. If the pattern holds, this will be the fifth week that the beleaguered bank shares have risen. Italian bank shares are slightly higher. They have been moving up only one exception since October 13. |

U.K. Gross Domestic Product (GDP) YoY, September 2016(see more posts on U.K. Gross Domestic Product, ) . Source: Investing.com - Click to enlarge |

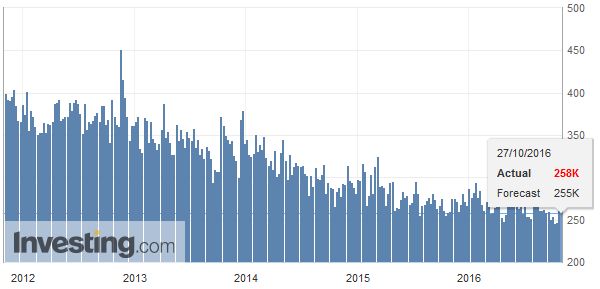

United StatesThe US reports September durable goods orders, but the focus is on tomorrow’s first look at Q3 GDP. Weekly initial jobless claims may get a passing look, but next week is the national report, and a modest slowing of jobs growth is anticipated. An increase in pending home sales, which would be only the second improvement since April, bodes well for later in Q4 and early Q1 17. Lastly, the KC Fed manufacturing activity index jumped to 6 in September from -4 in August. It was the second increase since February 2015. A pullback but a still positive reading is expected in October. |

U.S. Initial Jobless Claims, October 27 2016(see more posts on U.S. Initial Jobless Claims, ) . Source: Investing.com - Click to enlarge |

| For the 21st straight month, Core Durable Goods Orders contracted YoY – the longest in US history outside of a recession. Business spending proxy segment of the report, New Orders non-defense, ex-aircraft plunged 1.2% MoM (much worse than the -0.1% expectation) and down 3.6% YoY.

This remains the longest non-recessionary contraction in durable goods orders in US history… |

U.S. Core Durable Goods Order, October 2016(see more posts on U.S. Core Durable Goods Orders (ZH), ) Source: Zerohedge.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Bank of Japan,Deutsche Bank,ECB,EUR/CHF,Eurozone M3 Money Supply,Eurozone Private Sector Loans,FX Daily,newslettersent,U.K. Gross Domestic Product,U.S. Core Durable Goods Orders (ZH),U.S. Initial Jobless Claims