Tag Archive: Eurozone M3 Money Supply

FX Daily, February 27: The Rot Continues but Somewhat Less Dollar Friendly

A new phase of the Covid-19 is at hand. Yesterday was the first time that the number of new cases in the world surpassed the number of new cases China acknowledged. This confirms what we have known, namely that the battle for containing it in China has been lost.

Read More »

Read More »

FX Daily, July 25: Narrow Ranges Prevail

The US dollar is trapped in narrow trading ranges. That itself is news. At the end of last week ago, the US President seemed to have opened another front in his campaign to re-orient US relationships by appearing to talk the dollar down. Contrary to fears, and media headlines of a currency war, the dollar is fairly stable.

Read More »

Read More »

FX Daily, March 27: Global Equities Follow US Lead, Dollar Steadies

We argued that the talk of trade war was exaggerated. The confrontation, strong demands and a climb down is the Art of the Deal, and is part of the way the Trump Administration negotiates. We see striking parallels between the policymakers and tactics with the Reagan Administration's attempt to pry open Japanese markets.

Read More »

Read More »

FX Daily, November 28: Greenback Ticks Up in Cautious Activity

The US dollar is consolidating its recent losses with a small upside bias. What promises to be an eventful week has begun with the Bank of England stress test and the publication of the Fed's Powell prepared remarks for his confirmation hearing to succeed Yellen as Chair. Unlike last year, this year's BOE stress test saw all seven banks pass.

Read More »

Read More »

FX Daily, October 26: Draghi’s Day

It is all about the ECB meeting today. The market was hoping for more details last month, but Draghi pointed to today. The broad issue is well known. While growth has been strong, price pressures are still not, according to the ECB, on a durable path toward its "close but lower than 2%" target. The ECB judges that substantial additional stimulus is needed.

Read More »

Read More »

FX Daily, July 27: Dollar Remains on the Defensive

The US dollar is narrowly mixed after selling off following the FOMC statement. Sometimes the narrative explains the price action, and sometimes the price action explains the narrative. This seems to be the case of the latter. The dollar and interest rates fell, and so the Fed was dovish.

Read More »

Read More »

What Happened Monday

No impact from the latest North Korean missile test. Polls suggest Tories still ahead for the June 8 election. Prospects of an Italian election this year weighed on Italian stocks and bonds.

Read More »

Read More »

FX Daily, February 27: Asia Stumbles, Europe Recovers, Waiting for Trump

The late recovery in US equities before the weekend did little good for Asian markets. Nearly all the Asian equity markets moved lower, led by the 1.0% decline in Japan's Topix. It was the third successive loss for the Topix, which is the long losing streak of the year so far. The MSCI Asia Pacific Index lost 0.6%, further pushing it off the 17-month high seen last week.

Read More »

Read More »

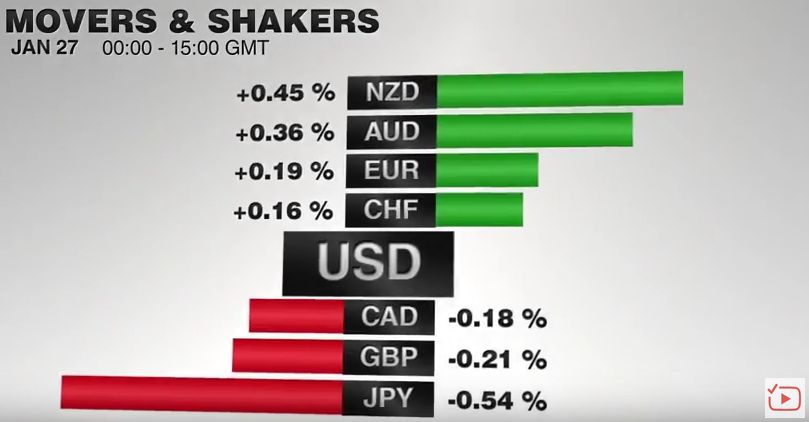

FX Daily, January 27: Week Ending on Mixed Note as Year of Rooster Begins

The Lunar New Year celebration thinned participation in Asia, where several centers are closed. Although the MSCI Asia Pacific Index slipped slightly, it rose 1.5% on the week, the fourth weekly gain in the past five weeks. The Nikkei advanced 0.35%, the third rise in a row. The 1.75% gain for the week snaps a two-week decline.

Read More »

Read More »

FX Daily, December 29: Dollar, Equities and Yields Fall

In thin holiday markets, a correction to the trends seen in Q4 has materialized. The US dollar is heavy. Japanese and European equities are lower. Bonds are firmer.

Read More »

Read More »

FX Daily, November 28: Corrective Forces Seen in Asia, Subside in Europe

As soon as markets opened in Asia, the greenback was sold, and corrective forces that had been nipping below the surface took hold. The euro, which had finished last week below $1.0590, rallied nearly a cent. Before the weekend, the greenback had pushed to almost JPY114, an eight-month high, before closed near JPY113.20. It was sold to almost JPY111.35 in early Asia. Sterling extended last week's gains and briefly poked through $1.2530, to reach...

Read More »

Read More »

FX Daily, October 27: Rising Yields Continue to be the Main Driver

The euro remains pinned near the seven-month low it recorded two days ago near $1.0850. It approached $1.0950 yesterday and has been confined to about a 15-tick range on either side of $1.0905 today. Against the yen, the dollar remains near the three-month high (~JPY104.85) also seen two days ago. New dollar buying emerged yesterday near JPY104.

Read More »

Read More »

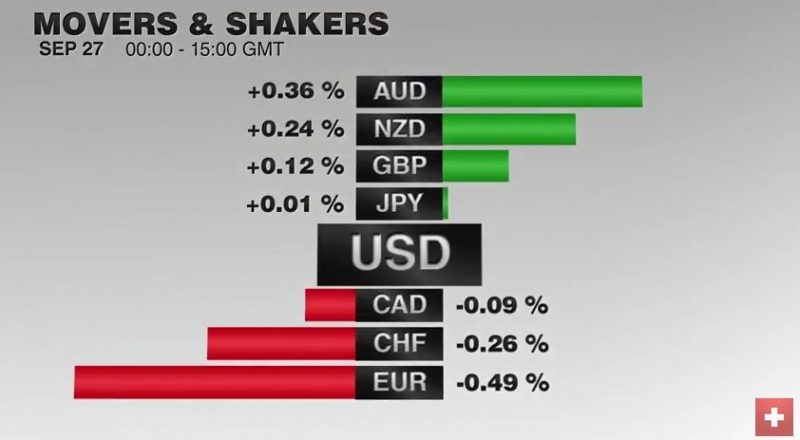

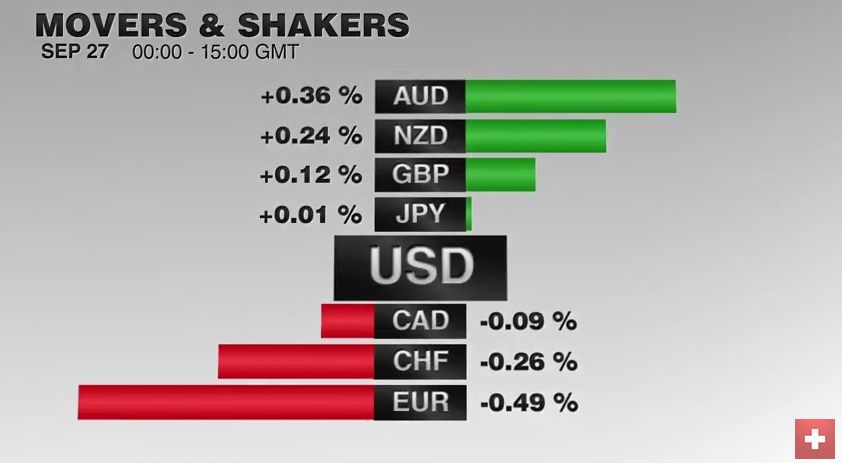

FX Daily, September 27: US Debate Lifts Peso, but Leaves the Dollar Non-Plussed

Since the monetary assessment meeting, the EUR/CHF is trending downwards. Sight deposits indicate that the SNB is intervening 0.9 bn per week. We emphasized that the preferred intervention corridor is between 1.08 and 1.0850. The first US Presidential debate may not sway many voters but has lifted the Mexican peso. The peso, which has fallen by about 1.3% over the past two sessions, has stormed by 1.5% today as the seemingly biggest winner of the...

Read More »

Read More »

FX Daily, August 26: And now for Yellen…

Yellen's presentation at Jackson Hole today is the highlight of the week. It also marks the end of the summer for many North American and European investors. It may be a bit of a rolling start for US participants, until after Labor Day. However, with US employment data next Friday, many will return in spirit if not in body.

Read More »

Read More »

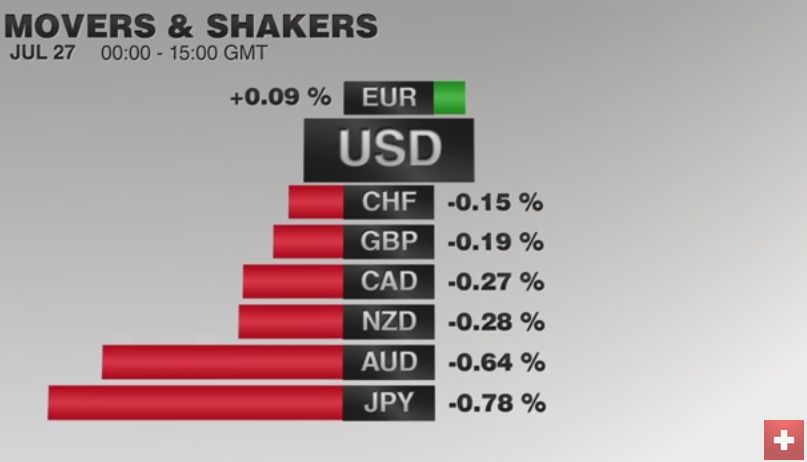

FX Daily, July 27: Yen Falls on Fiscal Stimulus, while Sterling and Aussie Can’t Sustain Upticks

Swiss Franc: The Euro kept on climbing, after yesterday's rapid rise. The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

Read More »

Read More »