Tag Archive: U.K. Consumer Price Index

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

Central Bank Chiefs and Currencies

Market opinion on the next Fed chief is very fluid. BOE Governor Carney sticks to view, but short-sterling curve flattens. New Bank of Italy Governor sought. A second term for Kuroda may be more likely after this weekend election.

Read More »

Read More »

Brexit UK Vulnerable As Gold Bar Exports Distort UK Trade Figures

Brexit UK vulnerable as gold bar exports distort UK trade figures. Britain’s gold exports worth more than any other physical export. Gold accounted for more than one in ten pounds of UK exports in July 2017. UK’s stock of wealth has collapsed from a surplus of £469bn to a net deficit of £22bn – ONS error. Brexiteers argue majority of trade is outside EU, this is due to large London gold exports. Single gold bar (London Good Delivery) is, at today’s...

Read More »

Read More »

FX Daily, September 12: Dollar Sports Heavier Tone as Yesterday’s Bounce Runs out of Steam

The sporadic updates continue while I am on a two-week business trip. Now in Barcelona, participating in TradeTech FX Europe. The euro advanced yesterday from NOK9.30 to NOK9.40. It is consolidating in a tight range today. The election results may have been a bit closer than expected, but the weight on the krone yesterday seemed to stem more from the unexpectedly soft inflation report.

Read More »

Read More »

FX Daily, August 15: Greenback Firms, Encouraged by Dudley and Ebbing of Tensions

NY Fed President Dudley appears to have stolen any potential thunder in the July FOMC minutes that will be released tomorrow. While we put more emphasis on today's US retail sales data and the August Fed surveys, many others argued that the minutes were the key report this week.

Read More »

Read More »

FX Daily, July 18: Dollar Dumped on Doubts on US Economic Agenda

News of the defection of two more Republican Senators doomed the Senate attempt to replace and repeal America's national health care. The failure to replace the system dubbed Obamacare, despite the Republican majority in both legislative chambers and the executive branch raises questions about the broader strategy of the Administration and raises serious questions about the rest of its legislative agenda.

Read More »

Read More »

FX Daily, June 13: Dollar Softens Ahead of Start of FOMC Meeting

The US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of the same magnitude. The year-over-year pace slowed but not as much as expected.

Read More »

Read More »

FX Daily, April 11: Dollar Pushed Lower in Subdued Activity

The US dollar has a slight downside bias today through the European morning. The market does not seem particularly focused on high frequency data, though sterling traded higher after an unchanged year-over-year reading of 2.3%, and the euro traded higher after a stronger Germany ZEW survey.

Read More »

Read More »

FX Daily, March 21: Euro Recovery Continues, Posts New Six Week High Other Currencies Mixed

Growing confidence that Le Pen will not be the next president of France following the televised debate for which two polls showed Macron doing best has lifted the euro and reduced the French interest rate premium over Germany. The euro pushed through $1.0800 after initially dipping below yesterday's lows.

Read More »

Read More »

FX Daily, January 17: Trump’s Comments Send the Dollar Reeling

The Pound has been subjected to a heavy amount of pressure as we progress further into 2017, with GBP/CHF rates being one of the heaviest losers. The pairing is now trading at a similar level to GBP/USD levels below the 1.22 mark. Their is an enjoyable symmetry between the two from an analysts point of view. Both are well regarded as safe-haven currencies, and in this time of increased uncertainty, both have almost the exact same value in the...

Read More »

Read More »

FX Daily, December 13: Narrowly Mixed Dollar Conceals Resilience

The US dollar is little changed against most of the major currencies. The dollar finished yesterday's North American session on a soft note, but follow through selling has been limited. After rallying to near 10-month high above JPY116 yesterday, the greenback finished on session lows near JPY115.00. Initial potential seemed to extend toward JPY114.30, but dollar buyers reemerged near JPY114.75, and it rose back the middle of the two-day range...

Read More »

Read More »

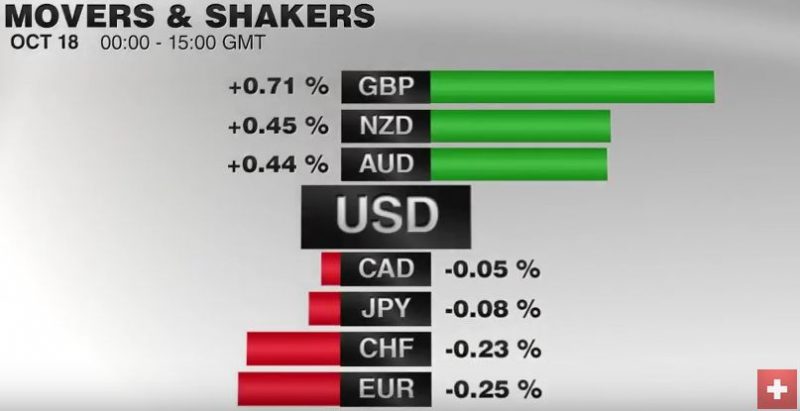

FX Daily, October 18: Dollar Slips Broadly but not Deeply

According to Bank of England deputy governor Ben Broadbent the drop in the value of Sterling has helped to stop the UK economy from falling further since the shock of the Brexit vote. He went on to say ‘in the shape of the referendum, we’ve had exactly one of those shocks’ and added that the Bank of England would not interfere with monetary policy to boost the Pound’s value.

Read More »

Read More »

Great Graphic: Consumer Inflation: US, UK, EMU

Price pressures appear to have bottomed for the US, UK, and to a lesser extent, EMU. Rise in prices cannot be reduced solely to the increase of oil. Core prices are also rising.

Read More »

Read More »

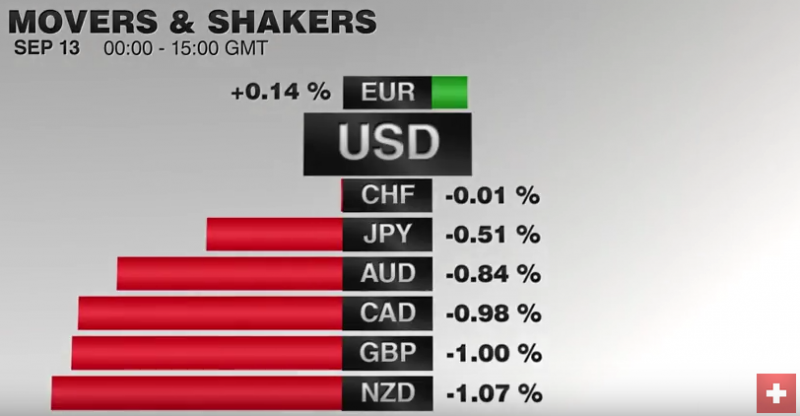

FX Daily, September 13: Much Noise, Weak Signal

The last ECB meeting and Dragh's hawkish comments is for us the main reason of the euro strength, this despite stronger Swiss GDP growth.

Read More »

Read More »

FX Daily, August 16: Dollar Slumps, but Driver may Not be so Obvious

The US dollar is being sold across the board today. The US Dollar Index is off 0.65% late in the European morning, which, if sustained, would make it the largest drop in two weeks. The proximate cause being cited by participants and the media is weak US data that is prompting a Fed re-think.

Read More »

Read More »

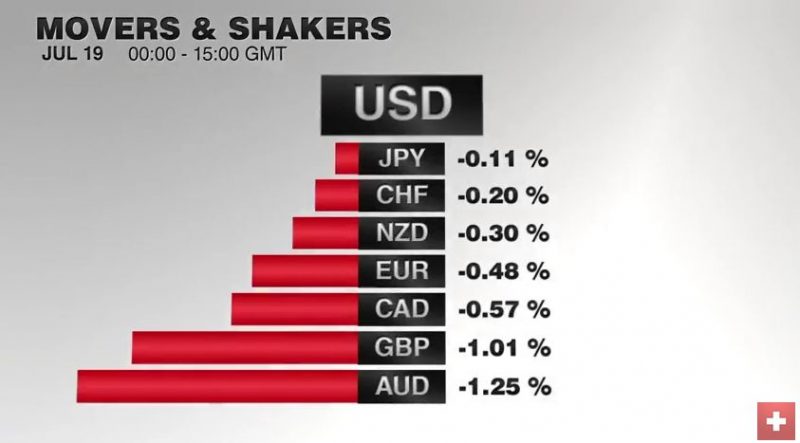

FX Daily, July 19: Dollar-Bloc Tumbles, but Euro and Yen Little Changed

The US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today.

Read More »

Read More »

New Month, Same Drivers

On the very first trading day of the year, the Nikkei, DAX, and S&P 500 gapped lower, setting the tone to a particularly challenging month for investors.The last week and a half has been better, and this will likely carry over into the start of the new month. Before January could slip into the history … Continue reading »

Read More »

Read More »