Tag Archive: U.S. Dollar Index

FX Weekly Review, September 04 – 09: Draghi Dovish? EUR and USD falling against CHF

The euro rose close to CHF 1.15 with the ECB meeting this week. Finally traders realized that the ECB committed not to hike rates for a very long time. The ECB will review and take a first decision on the bond purchasing program this autumn. However, this program will come to an end only when the inflation target of 2% becomes in reach.

Read More »

Read More »

FX Weekly Review, August 28 – September 02: The end of big euro rise?

For us, the sudden euro rise from 1.08 to 1.14 is an illusion, the euro will fall sooner or later again. Macron will not help the French economy and low core inflation will prevent that the ECB ends her bond buying program.

Read More »

Read More »

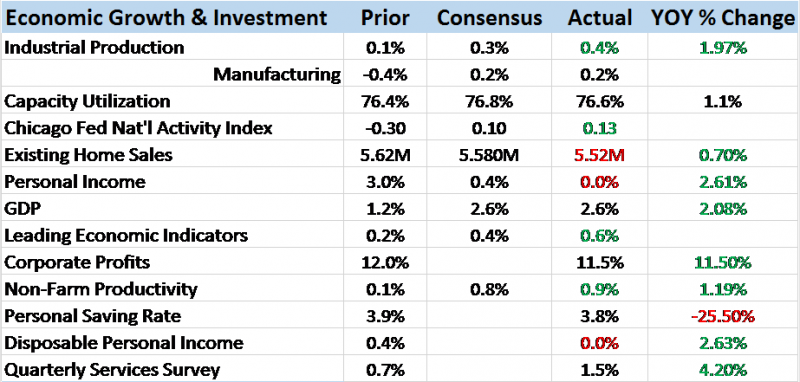

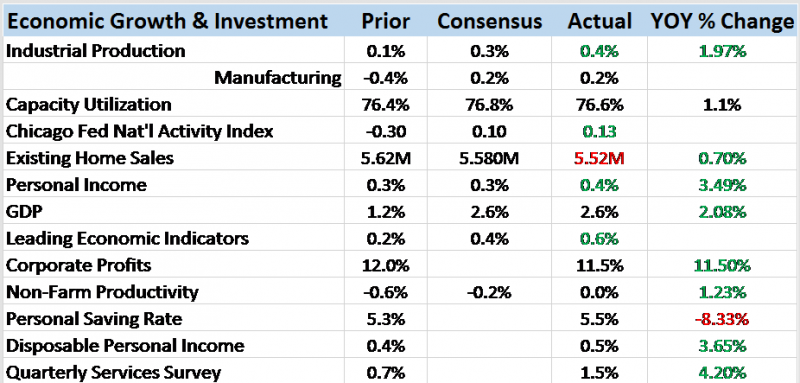

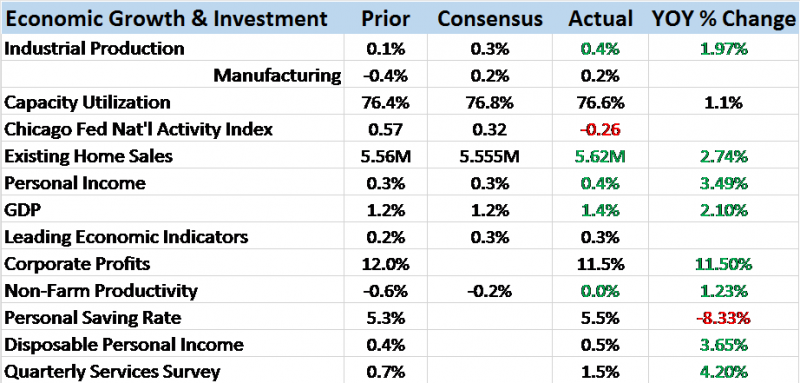

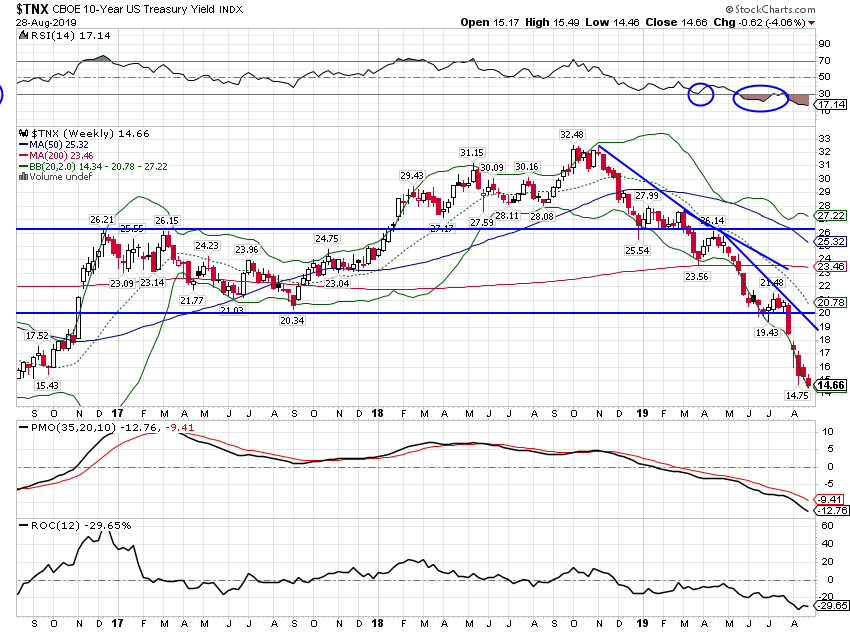

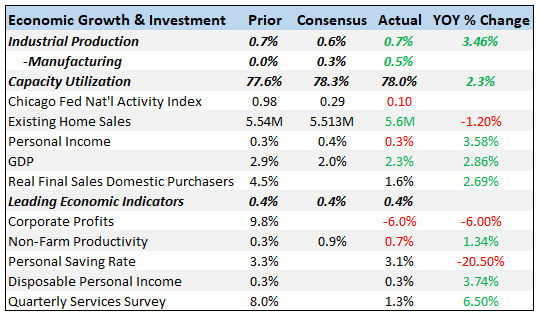

Bi-Weekly Economic Review: Don’t Underestimate Gridlock

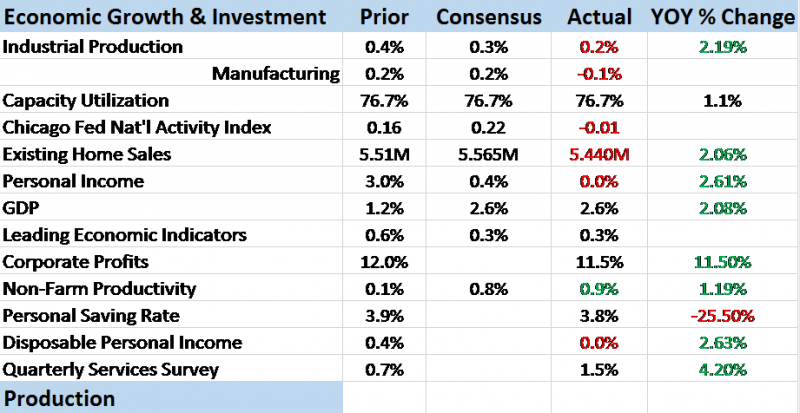

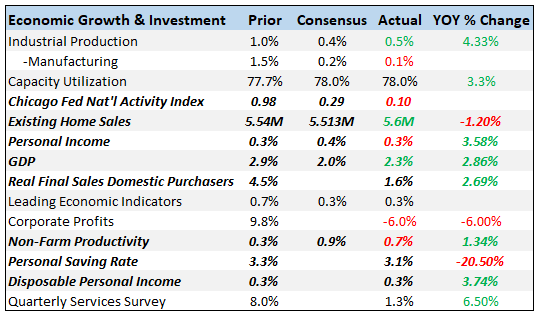

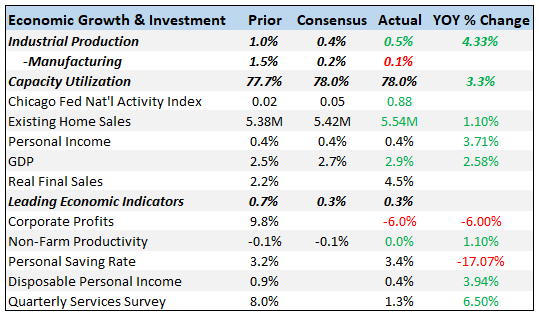

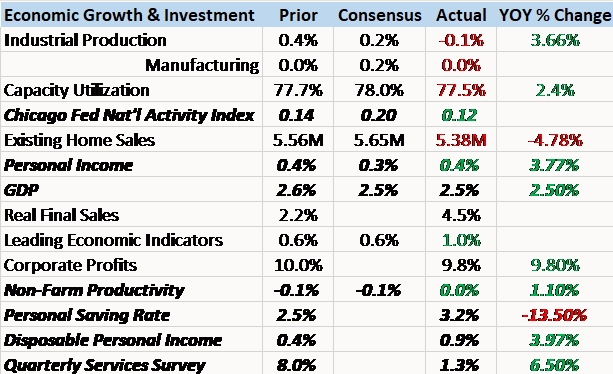

The economic reports released since the last update were slightly more upbeat than the previous period. The economic surprises have largely been on the positive side but there were some major disappointments as well. The economy has been doing this for several years now, one part of the economy waxing while another wanes and the overall trajectory not much changed. Indeed, the broad Chicago Fed National Activity index probably says it all, coming...

Read More »

Read More »

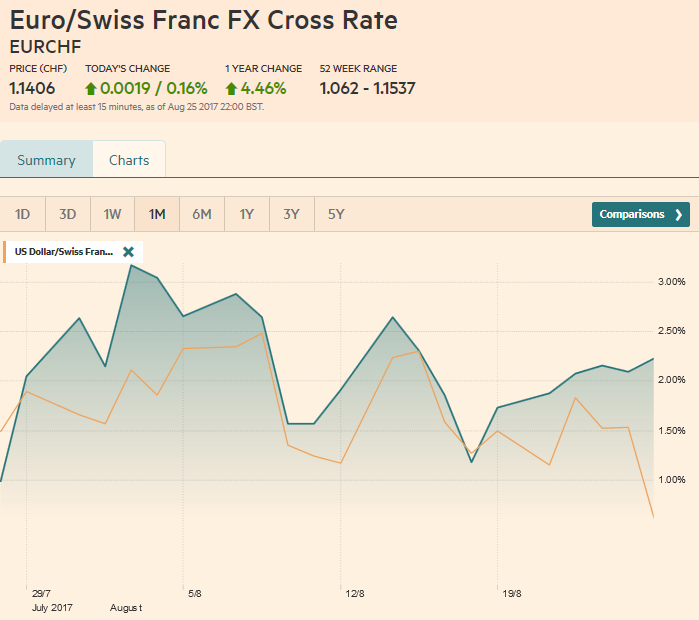

FX Weekly Review, August 21 – August 26: Dollar Loses its Gains Against CHF

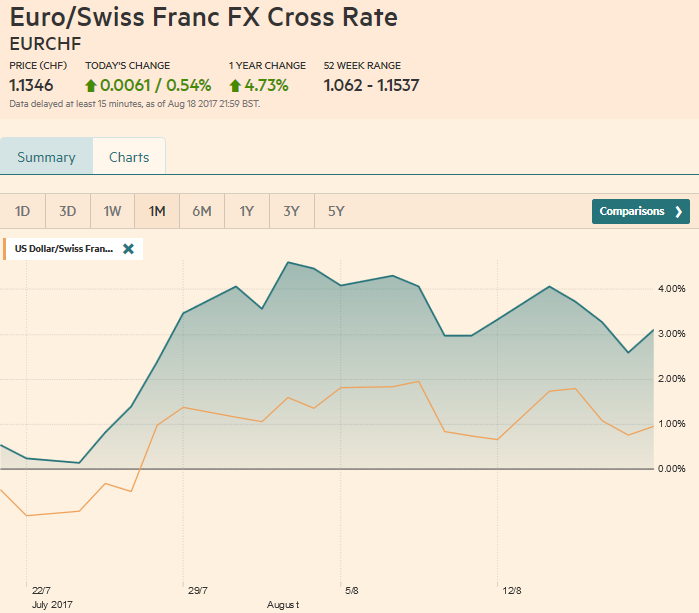

The broad technical condition of the dollar deteriorated materially before the weekend. The dollar had some gains versus the franc during the last month, but it lost all during the last days.The EURCHF continues with a 2.5% win for the last month.

Read More »

Read More »

Questions

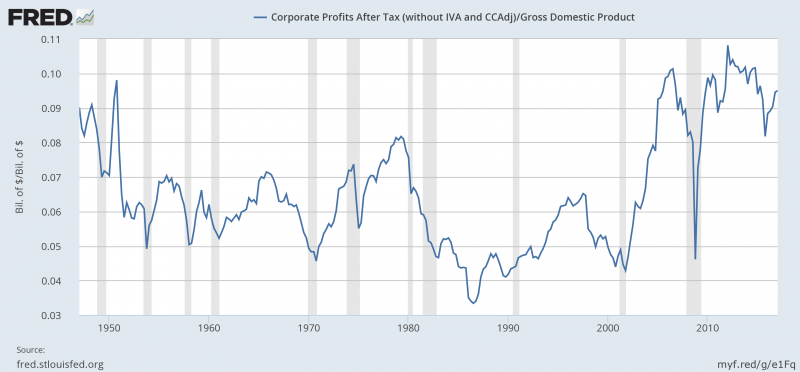

Why are profit margins persistently high? With decent earnings this quarter, corporate profits as a % of GDP will approach (maybe exceed) 10% again. That is abnormally high compared to the period 1960 to 2000. Margins actually started to rise in the mid-80s but really accelerated after 2000 and outside of the 2008 crisis have remained high. Why?

Read More »

Read More »

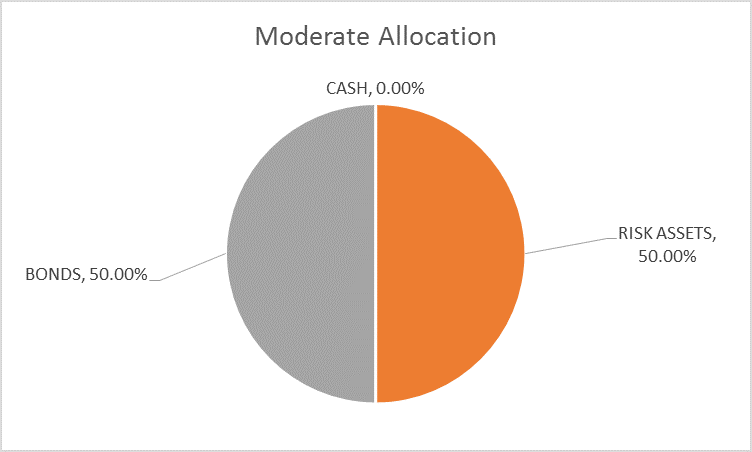

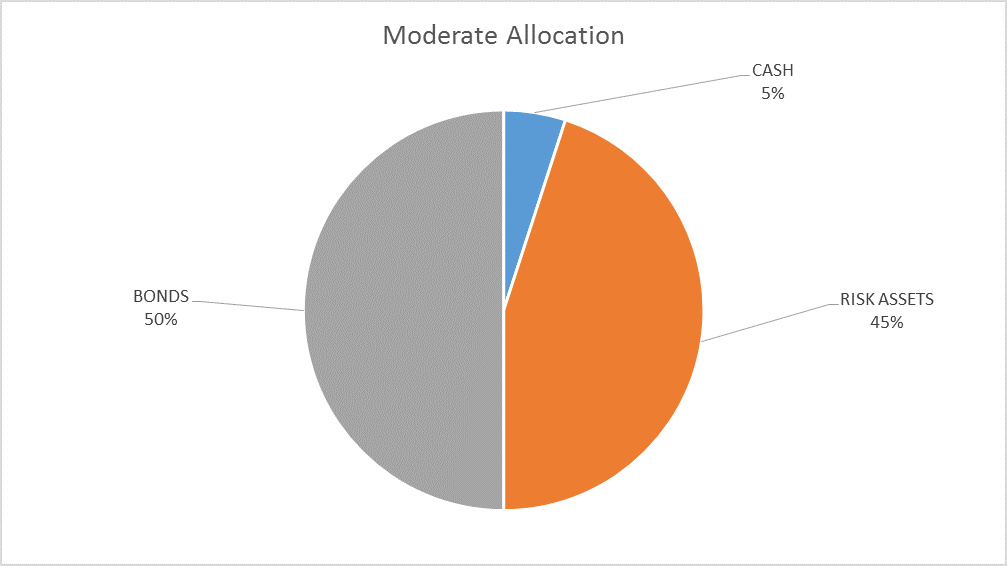

Global Asset Allocation Update: No Upside To Credit

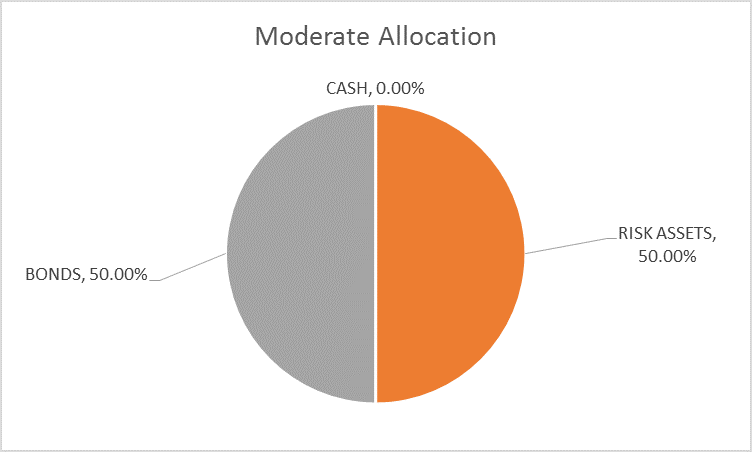

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand.

Read More »

Read More »

FX Weekly Review, August 14 – August 19: CHF Recovers after Dovish Draghi Comments

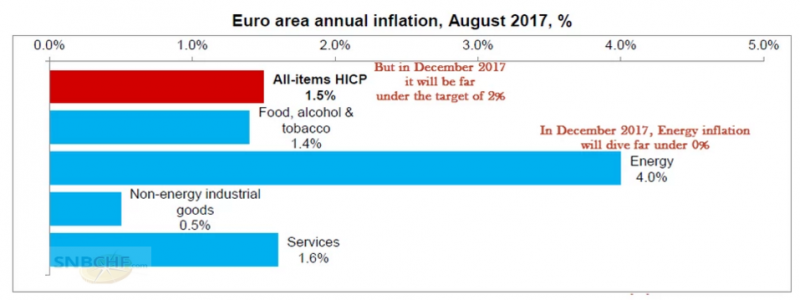

The euro has lost some momentum, Draghi does not want to talk about an early end of his bond buying programming. Confirmed by economic data, 1.2% core inflation compared to a long-term inflation target of 2%. Consequently the Swiss appreciated during the week.

Read More »

Read More »

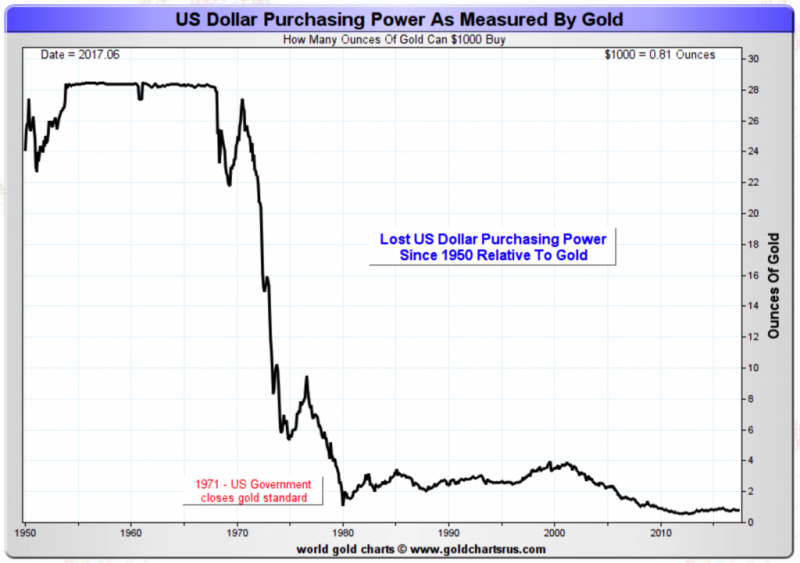

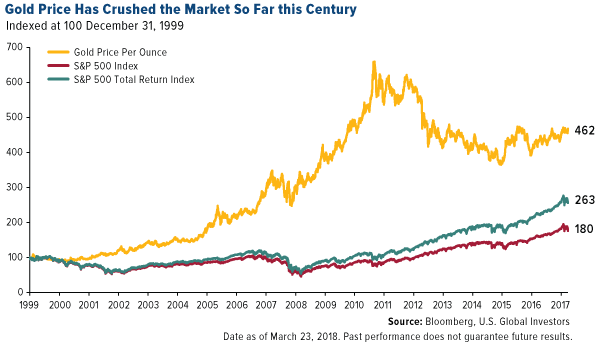

Gold Hedges USD Devaluation, Rise in Oil, Food and Cost of Living Since 1971 – Must See Charts

Gold hedges massive ongoing devaluation of U.S. Dollar. 46th anniversary of ‘Tricky Dicky’ ending Gold Standard (see video). Savings destroyed by currency creation and now negative interest rates. Long-term inflation figures show gold a hedge against rising cost of fuel, food and cost of living. $20 food and beverages basket of 1971 cost $120.17 in 2017.

Read More »

Read More »

Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it.

Read More »

Read More »

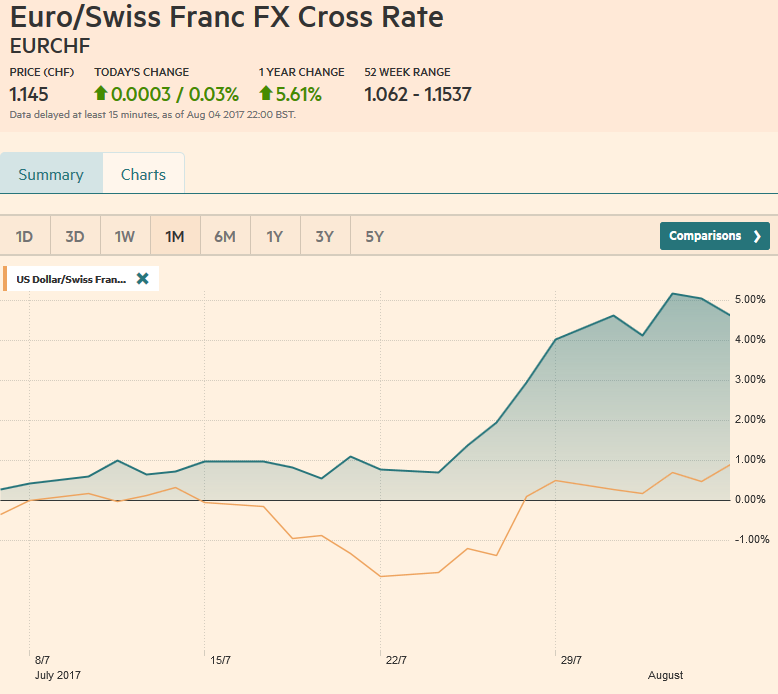

FX Weekly Review, July 31 – August 05: Second Week of Strong CHF Losses

The Swiss Franc entered the second week of stronger losses. While the euro gained 4% last week, the dollar appreciated against the Swiss Franc 2% during this week.

Read More »

Read More »

Bi-Weekly Economic Review: Extending The Cycle

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear.

Read More »

Read More »

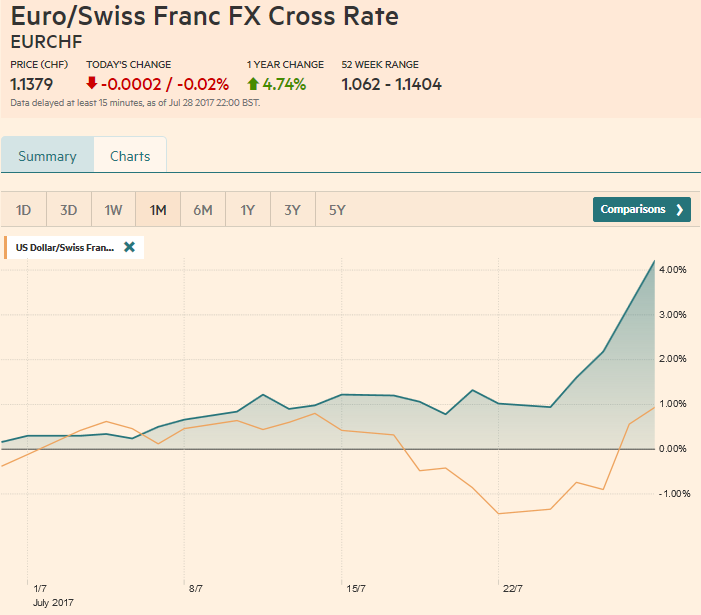

FX Weekly Review, July 24 – July 29: Swiss Franc getting crushed

The Swiss franc was the only major foreign currency that fell against the dollar last week. The 2.6% decline was the largest in two years.

Read More »

Read More »

Dollar View: Discipline or Stubbornness

Fundamental driver, divergence is still intact. The dollar's losses have barely met the minimum retracements of a bull market. Sentiment may be exaggerating the positive developments in Europe and the negative developments in the US.

Read More »

Read More »

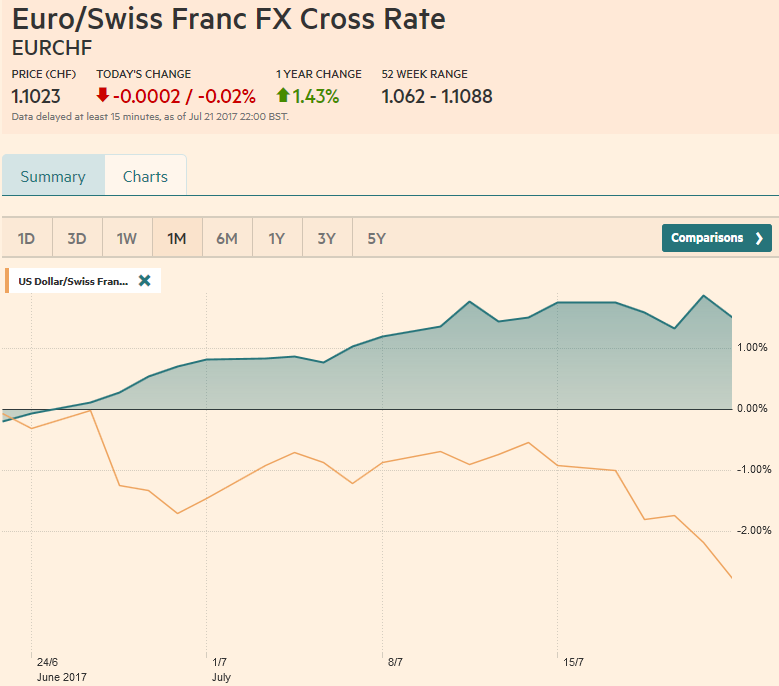

FX Weekly Review, July 17 – July 22: Euro and CHF move upwards against Dollar

Both Swiss Franc and Euro were moving upwards against the dollar. So CHF gained 3% versus the dollar in the last month. CHF losses against the euro are smaller, around 1.3%.

Read More »

Read More »

Global Asset Allocation Update: Not Yet

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month. Growth and inflation expectations rose somewhat since last month’s update. The change is minor though and within the range of what we’ve seen in recent months.

Read More »

Read More »

Bi-Weekly Economic Review: Attention Shoppers

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels.

Read More »

Read More »

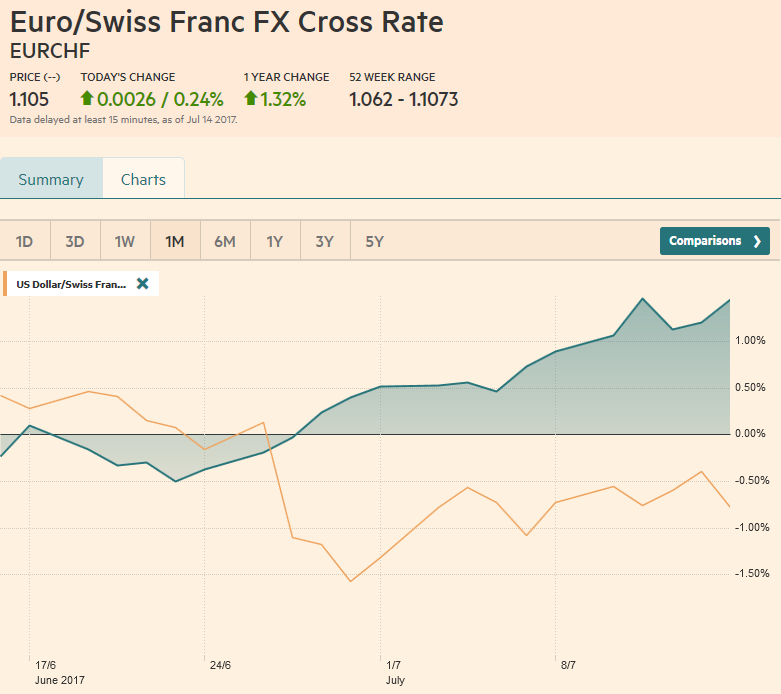

FX Weekly Review, July 10 – July 15: CHF Winning against USD, but losing vs. Euro

The Euro remained the strongest among EUR, CHF and USD during the last month.

The Swiss lost against EUR 1.5%, while it gained versus the dollar 0.75%.

Read More »

Read More »

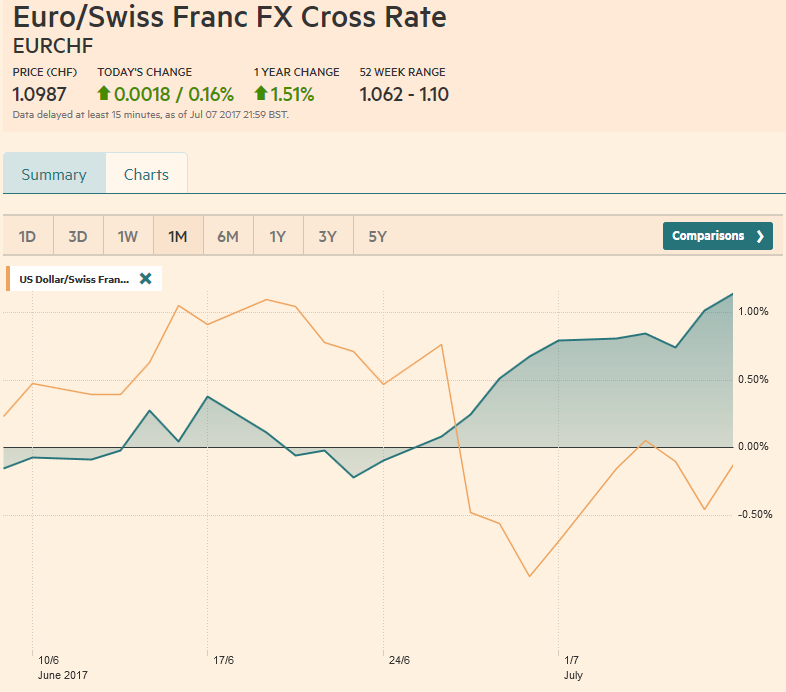

FX Weekly Review, July 03 – July 08: Second Euro appreciation phase

The ECB appears to be preparing investors for a further adjustment of its risk assessment and a reduction of its asset purchases as they are extended into next year.

This assessment has marked a new phase of an appreciating EUR/CHF rate. It followed the previous phase, the one with and after the French elections.

Read More »

Read More »