Tag Archive: $TLT

FX Daily, February 14: Investors Remain Uneasy even as Equities Stabilize

There is an unease that continues to hang over the market. It is as if a shoe fell last week, and most investors seem to be waiting for the other shoe to drop. It is hard to imagine the kind of body blow that the equities took last week without some kind of follow through and knock-on effects. Moreover, the focus today on US CPI may prove for nought.

Read More »

Read More »

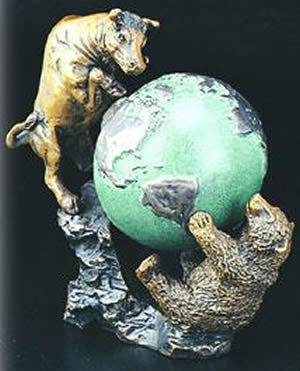

Great Graphic: Stocks and Bonds

The relationship between stocks and bonds does not appear to have changed much. It is difficult to eyeball correlations. Question the meaning of a chart that has two time series and two scales and.

Read More »

Read More »

FX Daily, February 12: Equity Markets Find Firmer Footing, Dollar Softens

The most important development today has been the stability in the equity markets after last week's meltdown. The recovery from new lows in the US before the weekend set the tone for today's moves. Tokyo markets were on holiday, and the MSCI Asia Pacific Index excluding Japan snapped a seven-day slide with a nearly 0.6% gain.

Read More »

Read More »

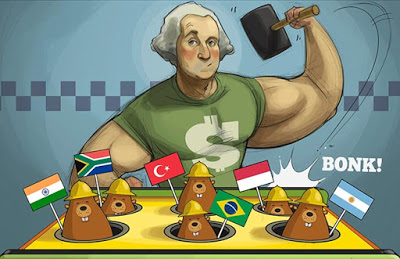

FX Daily, February 09: Equity Sell-Off Extends to Asia, but More Muted in Europe

The 100-point slide in the S&P 500 and the 1000-point drop in the Dow Jones Industrials yesterday spurred more bloodletting in Asia. The 1.8% drop in the MSCI Asia Pacific Index (for a 6.7% loss for the week) may conceal the magnitude of the regional losses. At one point the CSI 300 of the large Chinese mainland shares was off more than 6% before closing off 4.3% (and 10% for the week). The H-shares index was down 3.9% and 12% for the week.

Read More »

Read More »

FX Daily, February 08: Dollar Firms, While Equities Search for Stability

The swings in the equity markets are subsiding, bond yields are firm and the US dollar is extending its recovery. Although US equities closed lower, the MSCI Asia Pacific Index snapped a four-day drop by posting a 0.25% gain. However, the MSCI Emerging Markets Index is off nearly as much, though the range was modest. European markets are also lower, and the range for the Dow Jones Stoxx 600 is the smallest in more than a week.

Read More »

Read More »

FX Daily, February 05: Dollar Consolidates while Equity Rout may be Ebbing

Asian equity markets were weighed down by losses in the US markets ahead of the weekend. The MSCI Asia Pacific Index was off 1.4% after the 1.0% pre-weekend loss. The Nikkei gapped lower and shed 2.5% and has fallen in eight of the past nine sessions. The notable exception in Asia was the Shanghai Composite. The 0.75% was led by the financial sector amid talk that a report later this week will show a strong jump in yuan lending from banks, which...

Read More »

Read More »

FX Daily, January 29: A Brief Word

The US dollar is modestly firmer, but nothing to suggest a outright correction rather than consolidation. However, have a dramatic drop over the past month, much more than we think is justified by macroeconomic developments and interest rates, we think the dollar may have overshot.

Read More »

Read More »

FX Weekly Preview: ECB and BOJ Meetings Could be Key to Dollar Direction

The US dollar has been marked lower since the middle of last month. It flies in the face strong growth, rising inflation expectations, and greater conviction that the Fed will continue to raise interest rates this year. Moreover, an oft-cited knock on the dollar, the widening current account, may be offset this year by the impact from US corporations repatriating earnings that have been kept offshore.

Read More »

Read More »

FX Daily, January 19: Dollar Crushed as Government Shutdown Looms

The US dollar is broadly lower as the momentum feeds on itself. Asia is leading the way. The Japanese yen, Taiwanese dollar, Malaysian Ringgit, and South Korean won are all around 0.45% higher. Asian shares also managed to shrug off the weakness seen in the US yesterday. The MSCI Asia Pacific Index advanced 0.7%. It is the sixth consecutive weekly gain. The dollar's drop comes as US yields reach levels now seen in year. The 10-year yield is at its...

Read More »

Read More »

FX Daily, January 18: Currencies Consolidate After Chop Fest

The US dollar rallied in the North American afternoon yesterday and the timing coincided with the release of the Fed's Beige Book that saw several districts report wage and price pressures. The US 10-year yield moved toward toward 2.60%, and helped by speculation that as US companies repatriate earnings kept abroad that they may have to liquidate the investments, some of which are thought to be in Treasuries.

Read More »

Read More »

China and US Treasuries

The US Treasury market was consolidating yesterday's 7.5 basis point jump in 10-year yields when Bloomberg's headline hit. The claim was that Chinese officials are "wary of Treasuries". Yields rose quickly to test 2.60% and the dollar moved lower. It is difficult to determine the significance of the claim as the Bloomberg story does not quote anyone.

Read More »

Read More »

FX Daily, January 16: Dollar Given a Reprieve

After extending its recent slide yesterday, which the US markets were on holiday, the dollar is firmer against all the major currencies and most of the emerging market currencies. There does not seem to be macroeconomic developments behind the dollar's stabilization, and the gains are quite minor, suggesting a pause in the downtrend rather than a reversal at this juncture.

Read More »

Read More »

FX Daily, January 12: Euro Jumps Higher

There is one main story today and it is the euro's surge. The euro began the week consolidating it recent gains a heavier bias, but the record of last month's ECB meeting surprised the market with its seeming willingness to change the forward guidance early this year in a more hawkish direction. This spurred a 0.7% gain in the euro back above $1.20. The euro stayed bid in Asia, but took another leg up (~0.75%) in response to reports that a...

Read More »

Read More »

Is the BOJ Tapering?

The G3 central banks are in flux. The Federal Reserve is gradually raising rates and allowing the balance sheet to shrink by not fully reinvesting the maturing proceeds. The ECB will purchase half as many bonds in the first nine months of 2018 as it did in the last nine months of 2017.

Read More »

Read More »

FX Daily, January 11: Capital Markets Calmer, Greenback Consolidates

As market participants were just getting their sea legs back after the start of the year, it was hit by a one-two punch of ideas that BOJ policy was turning less accommodative and that Chinese officials were wary of adding to their Treasury holdings. Then late yesterday, a news wire reported that Canada suspected the US was going to withdraw from NAFTA.

Read More »

Read More »

FX Daily, January 09: Dollar Correction Extended

The US dollar's upside correction that began before the weekend has been extended in Asia and Europe today. The main exception is the Japanese yen. The yen's modest gains have been registered despite the firmness in US rates and continued advance in equities; both factors associated with a weaker Japanese currency.

Read More »

Read More »

FX Daily, January 08: Dollar Posts Modest Upticks to Start the New Week

The US dollar is enjoying modest but broad-based gains after trading firmly at the end of last week despite the slightly disappointing jobs report. The dollar's upticks are understood to be corrective in nature. The Canadian dollar appears to be protected by the increased prospects of a rate hike next week after its stellar employment report.

Read More »

Read More »

FX Daily, January 05: Dollar Given Reprieve Ahead of Employment Report

As the US dollar finished last year, so too did it begin the New Year, and after extending its losses, the bears have paused. Technical factors had been stretched, but it appears to have been old-fashioned macroeconomic considerations to have helped the dollar to move off the mat. Quickly summarized, these considerations are a larger than expected Australian trade deficit, slippage in Japan's service sector PMI, a larger than expected drop in the...

Read More »

Read More »

FX Daily, January 04: Greenback Continues to Consolidate Recent Losses

The US dollar is sporting a softer profile across the board, though remaining largely in the ranges seen over the past couple of sessions. At the same time, the news stream suggests that the global synchronized growth cycle strengthened late last year and is bound to carry over into the New Year.

Read More »

Read More »

The Past is Not Passed: 2017 Spills into 2018

The New Year may have begun in fact, but in practice, full participation may return only after the release of US employment data on January 5. The macroeconomic and policy tables have been set, though interpolating from the Overnight Index Swaps market, there is 45% chance the Bank of Canada hikes rates at its policy meeting near the middle of the month.

Read More »

Read More »