Tag Archive: The Stock Market

The Great Stock Market Swindle

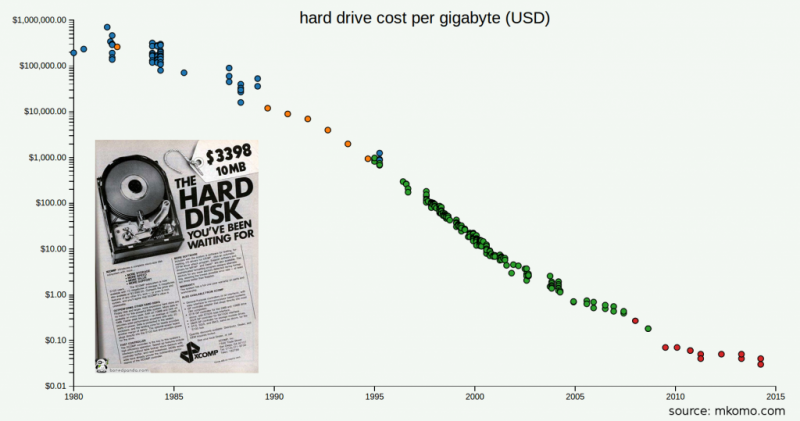

Finding and filling gaps in the market is one avenue for entrepreneurial success. Obviously, the first to tap into an unmet consumer demand can unlock massive profits. But unless there’s some comparative advantage, competition will quickly commoditize the market and profit margins will decline to just above breakeven.

Read More »

Read More »

Visions of Tomorrow from the Permanently High Plateau

Mad as a Hatter. Somewhere, someone first said “bull markets don’t die of old age.” We suppose this throwaway phrase was first uttered in a time and place much like today. That is, in the midst of a protracted bull market where stock prices had detached from the assets and earnings of companies their shares represent claim to.

Read More »

Read More »

A Fully Automated Stock Market Blow-Off?

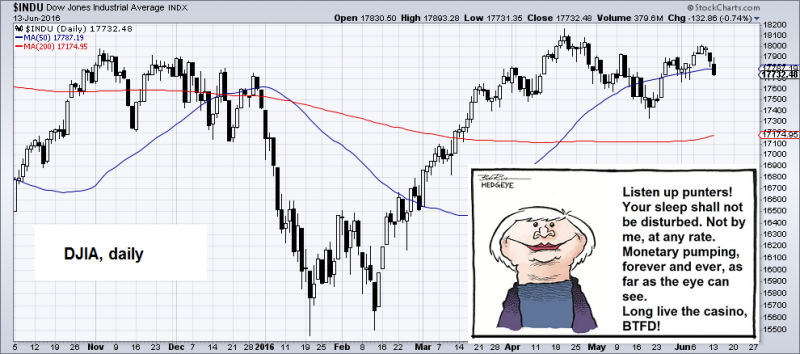

About one month ago we read that risk parity and volatility targeting funds had record exposure to US equities. It seems unlikely that this has changed – what is likely though is that the exposure of CTAs has in the meantime increased as well, as the recent breakout in the SPX and the Dow Jones Industrial Average to new highs should be delivering the required technical signals.

Read More »

Read More »

Bank of Japan: Destination Mars

Asset Price Levitation One of the more preposterous deeds of modern central banking involves creating digital monetary credits from nothing and then using the faux money to purchase stocks. If you’re unfamiliar with this erudite form of monetary policy this may sound rather fantastical.

Read More »

Read More »

Gold Silver Update for Purists

It’s that dreaded day after Independence Day. The weather is gorgeous and I don’t really feel like trading either. The thought of just phoning it in had occurred to me, but as the new month just rolled over I thought I may as well take another peek at our monthly charts.

Read More »

Read More »

Why the Fed Will Talk Down the Dollar

And right now, in the wake of Brexit, tighter monetary policy is clearly not an option. Plus, a stronger dollar (by virtue of the “peg”) strengthens the Chinese Yuan and the Saudi Riyal… something neither country will tolerate.

Read More »

Read More »

The VIX Breaks Out – Market Risk Continues to Surge

The Sharp Move in the VIX Accelerates In Monday’s trading session, the upward move in the volatility index VIX (which measures the implied volatility of SPX options) continued unabated, vastly out of proportion with the move in the underlying stock...

Read More »

Read More »

Stocks Set Another Valuation Record

Believe It Or Not… There Actually Is Some Downside Risk BALTIMORE – Not much action in the stock market last week. A few little steps ahead to over the 18,000 line for the Dow. Then a few little steps back. Currently the index sits at 17,732. Th...

Read More »

Read More »

Twitter’s Other Growing Problem – A Surging Share Count

It seems like almost everybody has an opinion about Twitter. As for the company it seems that their “window of opportunity” to massively succeed has essentially closed as user growth and revenue have both slowed, quite dramatically, over the past 18 months. Oddly, the strategy at Twitter seems to be not to thrive, but just to survive.

Read More »

Read More »

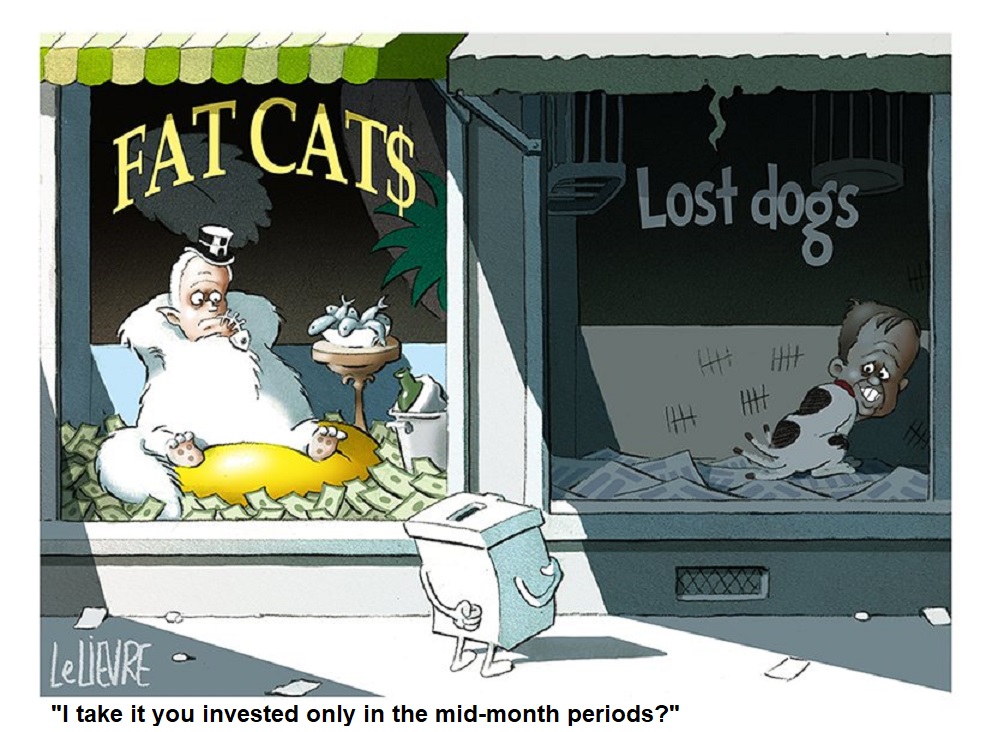

Pareto’s Wily Foxes

Smart Money Fleeing Stocks DUBLIN – The Dow dropped 180 points on Tuesday – or about 1%. And another clever billionaire says he is looking elsewhere for profits. Reuters: “Activist investor Carl Icahn on Monday said there was a chance the stock m...

Read More »

Read More »

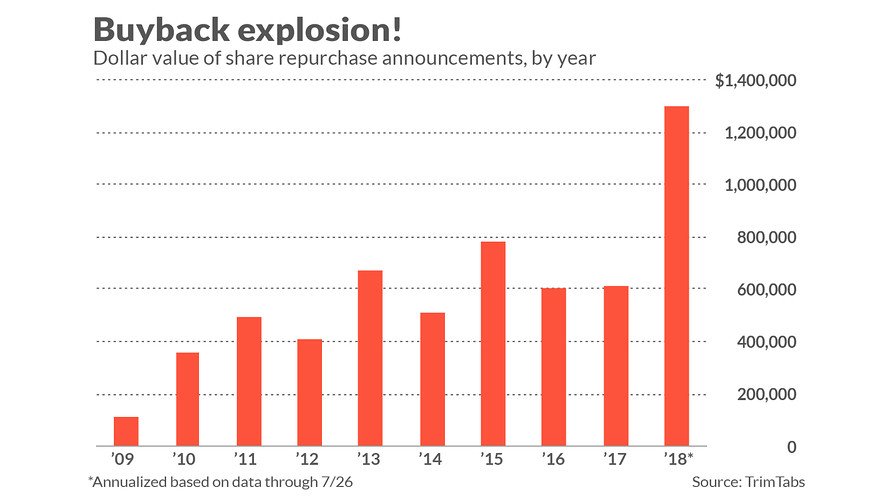

Share buybacks and dividends with borrowed money: Cure Worse than the Disease

The Fed’s monetary policies have made funding share buybacks and dividend payments with borrowed money an attractive management tactic. In the face of stalling business prospects, these short-term gimmicks can make business operations appear healthy.

Read More »

Read More »

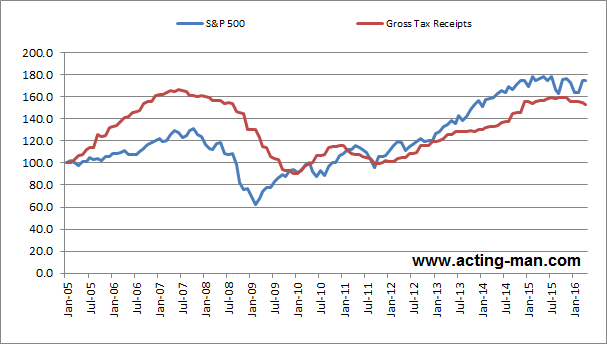

Corporate Tax Receipts Reflect Economic Slowdown

We compare Tax Receipts against the Stock Market. It becomes obvious that tax receipts have slowed down recently. And so should the performance of the stock market.

Read More »

Read More »

The “Canary in the Coal Mine” for Chinese Stocks

The Largest Online Marketplace in the World This company is twice the size of Enron at its peak ($100 billion). Pharmaceutical giant Valeant, which blew up in the last year, was only $90 billion at its peak. Before I get to what the stock is, let m...

Read More »

Read More »