Tag Archive: Swiss real estate

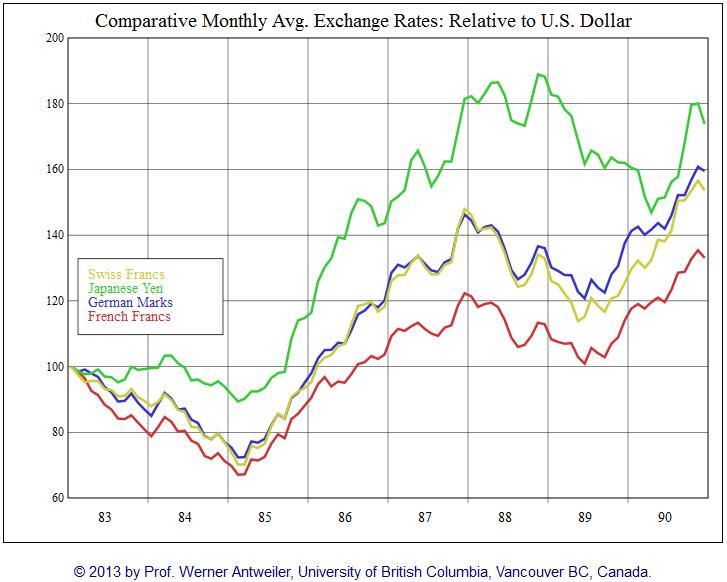

Swiss Franc History 1986-1996: Swiss real estate Boom and Bust

A critical Swiss franc history: This chapter describes the most controversial episode in the Swiss monetary history: How the Swiss National Bank helped to wreck the Swiss real estate market in the 1990s.

Read More »

Read More »

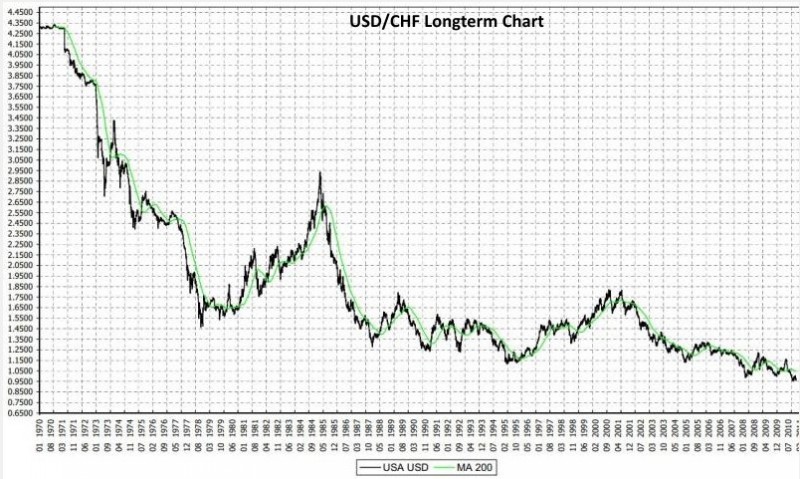

Swiss Franc History: The long-term view and the comparison with gold

We establish a long-term view and history of the Swiss franc. We compare the franc with gold.

Read More »

Read More »

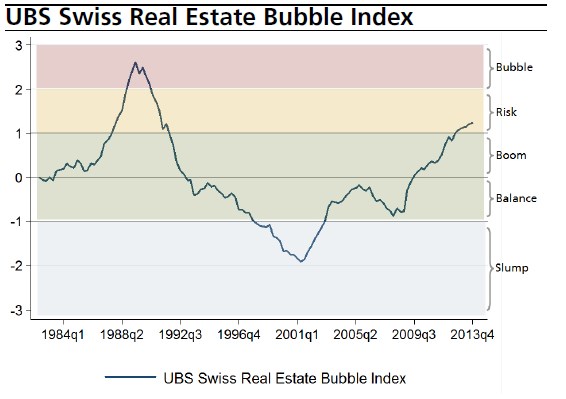

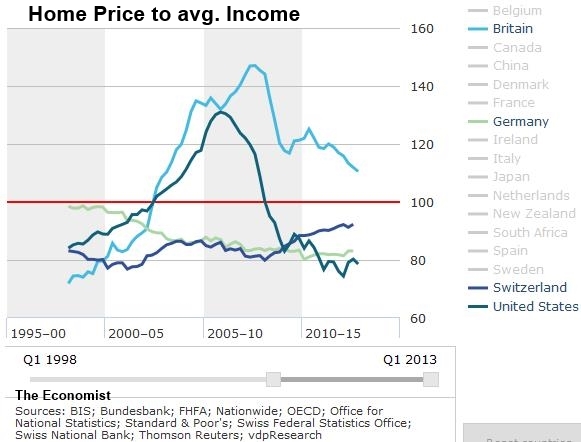

Update 2014: Swiss home price to income ratio small in historic and global comparison

Based on four different data sources, we prove that Swiss the home price to income ratio is small in global comparison and in a historic perspective. Combined with another decade of near zero interest rates, reason enough to think that the Swiss real estate boom should continue for another decade.

Read More »

Read More »

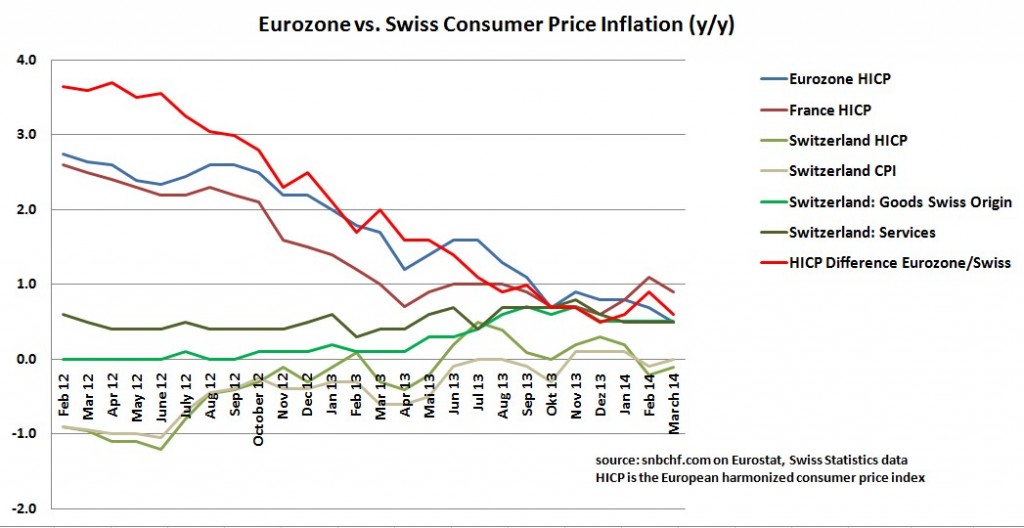

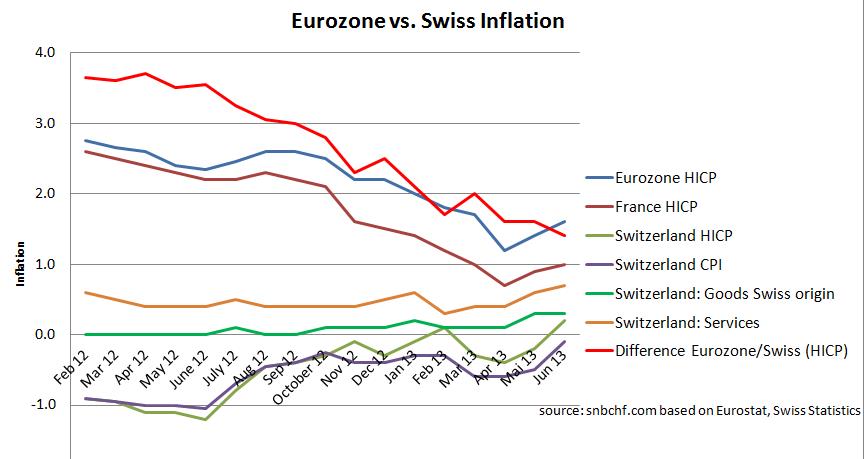

Swiss Yearly Inflation Rate Overtakes First Eurozone Countries

According to Swiss Statistics the yearly inflation rate is at 0.0%, and the monthly rate is +0.4%. The Spanish CPI is already under zero at -0.2%, and the Italian one is at +0.3%, not to speak about severe Cyprus or Greek deflation . Still in February 2012, the difference between the Swiss and Euro …

Read More »

Read More »

The IMF Assessment for Switzerland 2014 and our critique

In the 2014 assessment for Switzerland by the International Monetary Fund, several sentences sparked in our eyes; we will contrast them with our recent critique.

Read More »

Read More »

SNB’s Jordan Responds to the Critique from the Peterson Institute: What They Forgot to Ask Him …

SNB's Jordan Responds to the Critique from the Peterson Institute: What They Forgot to Ask...

Read More »

Read More »

No SNB Intervention: Massive Swiss M0 Increase due to Post Finance Transformation into a Bank

SNB did not intervene. Deposits of Swiss Post Finance had been reclassified from other sight liabilities to deposits of domestic banks.

Read More »

Read More »

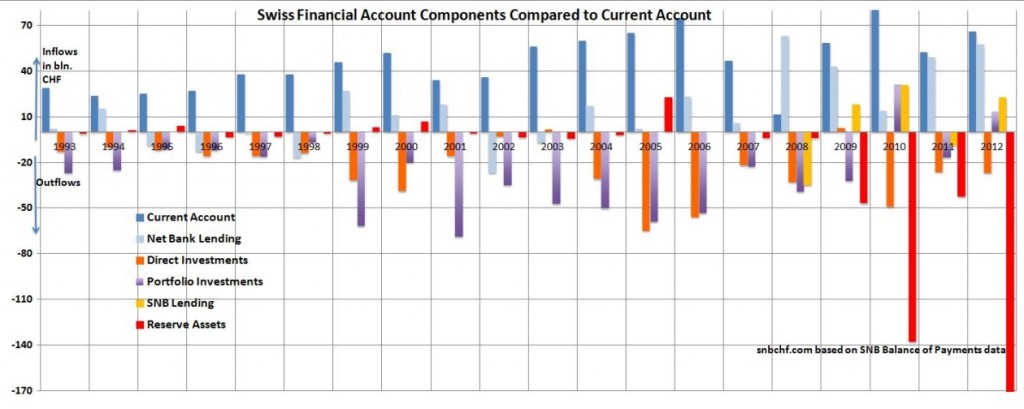

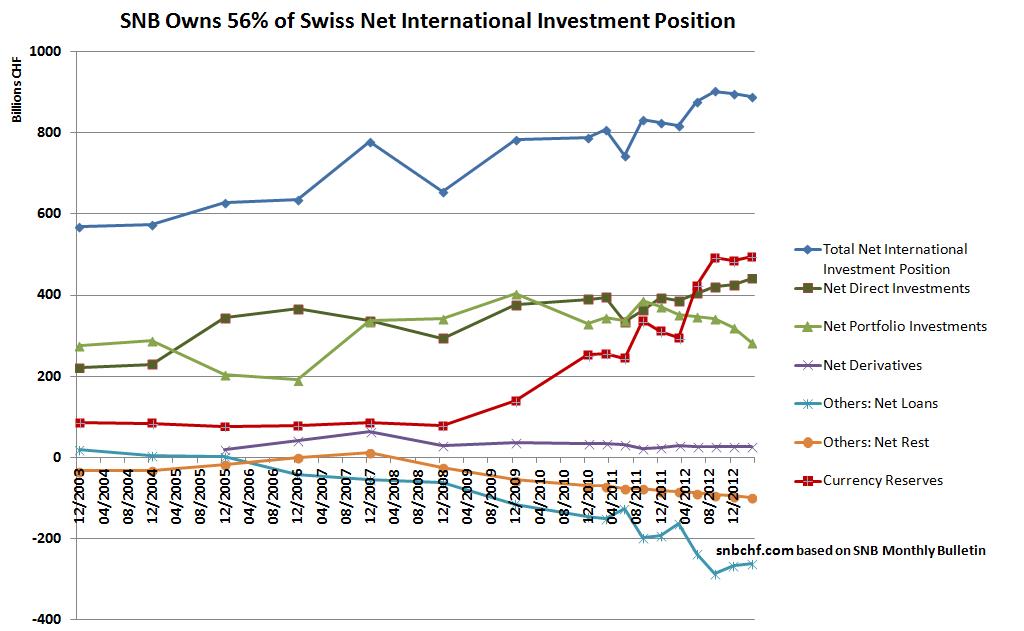

A Nationalization of Swiss Foreign Assets? SNB Owns 56% of Swiss Net International Investment Position

The SNB currently owns 56% of the Swiss net international investment position (“NIIP”). In the year 2007 this number was only 12%. Is the central bank implicitly nationalizing the Swiss international companies?

Read More »

Read More »

Our Detailed Estimate of SNB Q2 Results: 17 Billion Francs Loss, The Reality 18 Billion

UPDATE: July 30th, 2013: Our estimate for the quarterly loss missed the reality by 1 billion francs. The quarter results: 18.3 billion francs loss. The loss for H1 was 7.3 billion CHF. July 1st 2013: We estimate that the Swiss National Bank (SNB) obtained a loss of 17.3 billion francs in the second quarter 2013. … Continue reading »

Read More »

Read More »

The End of Swiss Deflation

The yearly change of the Swiss consumer price index has risen from -0.5% to -0.1%, the end of deflation is near. Swiss inflation measured with the European standard HICP has even improved to +0.2% y/y. Details

Read More »

Read More »

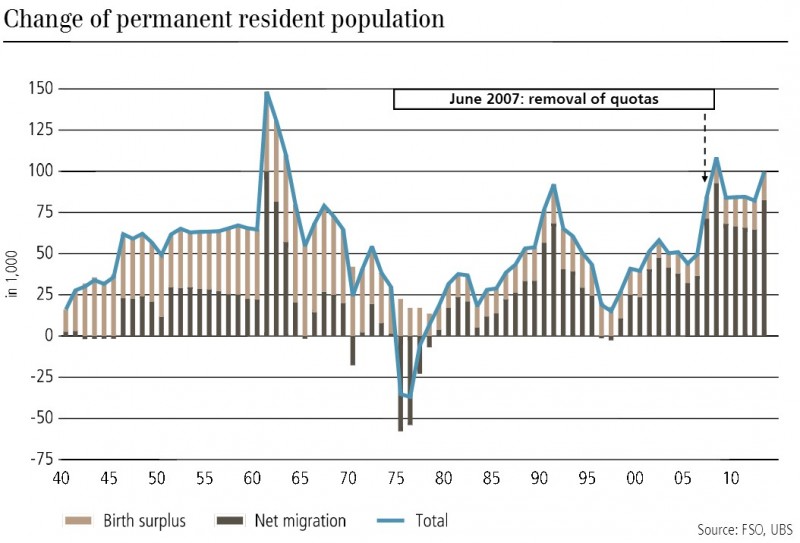

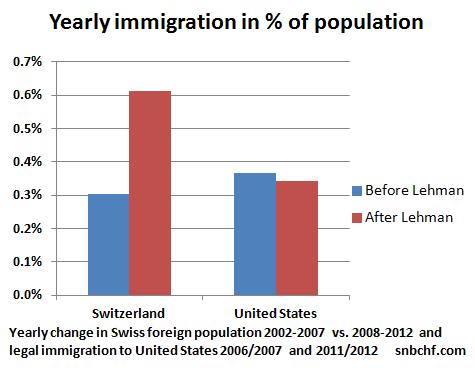

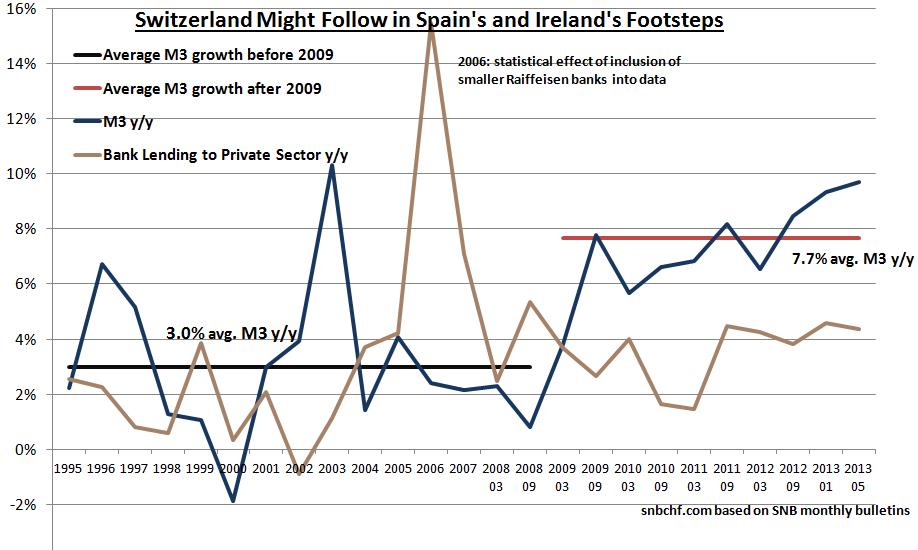

Excessive Money Supply: Switzerland Could Follow in Spain’s and Ireland’s Footsteps

In the Euro zone bank lending is contracting, M3 is rising very slowly. As opposed to that, Swiss bank lending is currently rising by 4.4% per year, M3 is increasing by 10% per year.

Read More »

Read More »

Swiss home price to income ratio small in historic and global comparison

Based on four different data source, we find out that Swiss home price to income ratio is small in global comparison. Therefore we wonder why the SNB must contain home price rises, but the Fed must artificially increase them.

Read More »

Read More »

Danthine’s Latest Statements Imply that SNB Might Remove Cap in 2014

SNB Vice Chairman Jean-Pierre Danthine is undoubtedly the most hawkish member of the governing board, an opposite personality to the rather interventionist and Keynesian hedge fund manager Philip Hildebrand. Danthine has perfectly understood that times for the SNB might get hard again in 2014. Jean-Pierre Danthine has made some comments recently: – Swiss franc stays …

Read More »

Read More »

SNB to Follow the Bank of Japan? Part1

Questions to George Dorgan Is there any chance that the SNB or other central banks could follow the BOJ and just depreciate the currency? George Dorgan: What did the BoJ do? Monetary easing and talk down the yen in a mercantilist style. A central bank is able to talk down a currency only if there … Continue reading »

Read More »

Read More »