Tag Archive: Switzerland Consumer Price Index

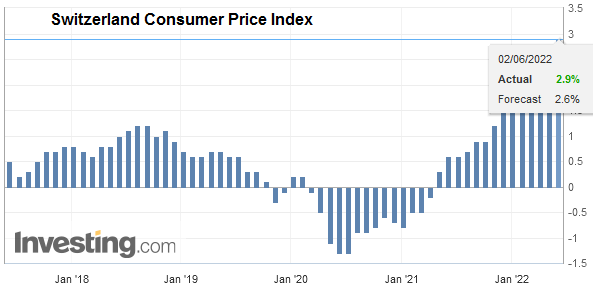

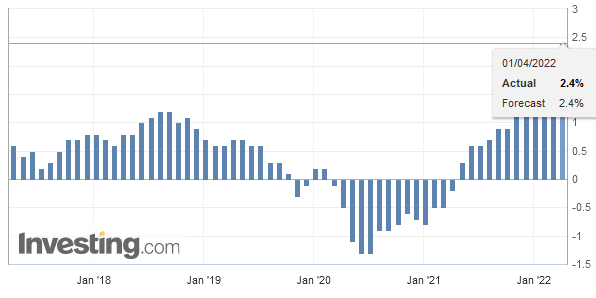

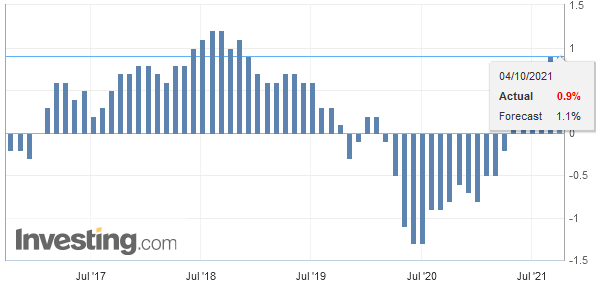

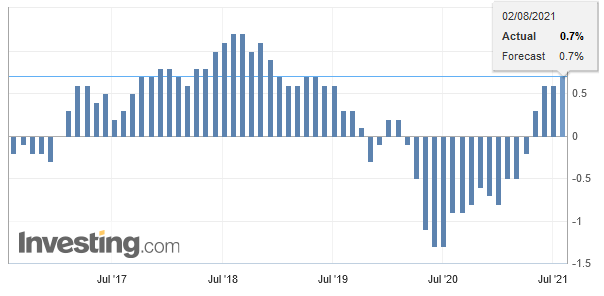

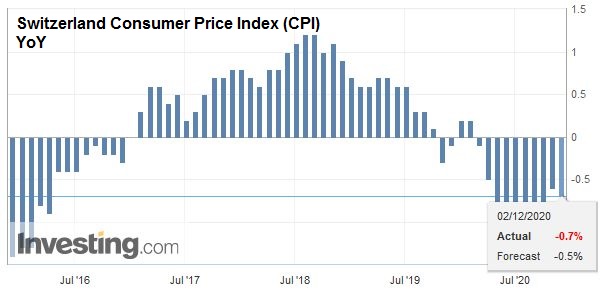

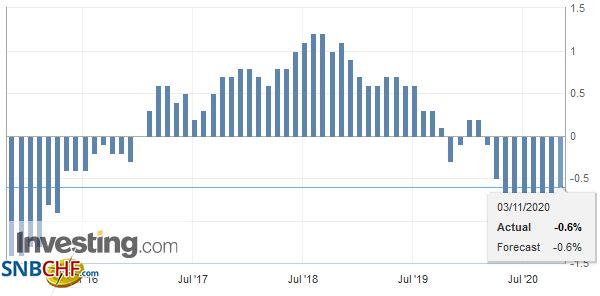

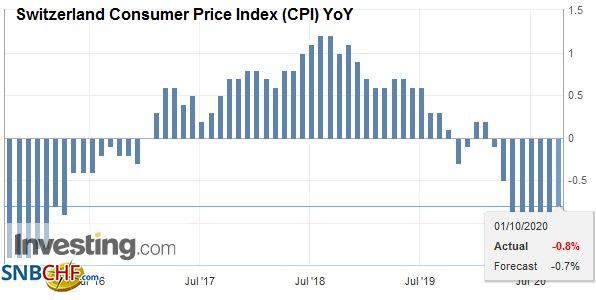

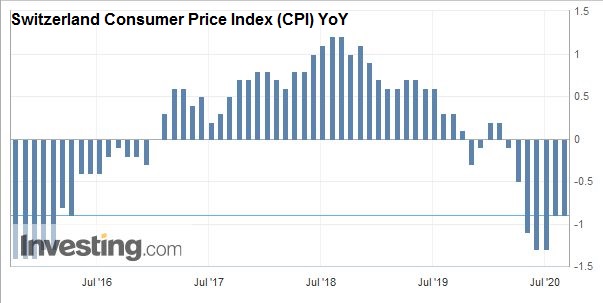

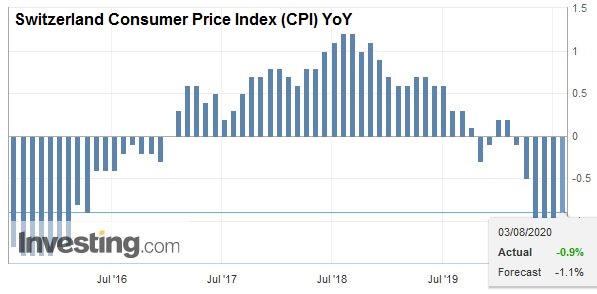

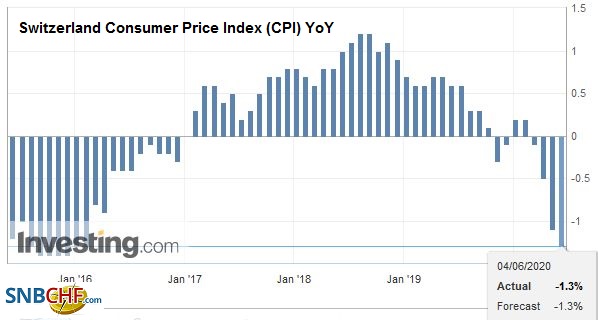

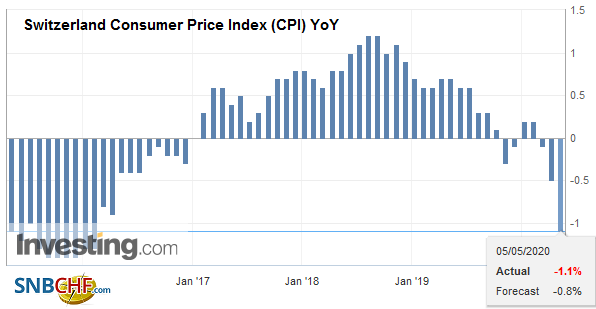

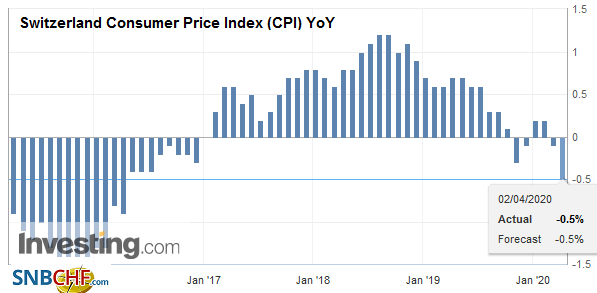

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

FX Daily, January 09: Sterling Pounded by May’s Hard Brexit

Sterling has stolen the US dollar's spotlight. The issue facing market participants was if the rise in hourly earnings reported as part of the pre-weekend release of US December jobs data was sufficient to end the dollar's downside correction. Instead, May's comments over the weekend indicating not just a desire but strategic thrust to abandon the single market in exchange for regaining control over immigration and not being subject to the...

Read More »

Read More »

Switzerland Consumer Price Index in December 2016: 0.0 percent against 2016, -0.1 percent against last month

Energy prices in Switzerland turned around from a minus 2.4% in November to a +6.8% in December. Oil prices had seen its trough exactly one year ago.

Especially in Germany and Spain, this translated into inflation rates, that are close to the ECB target rate of 2%.

Read More »

Read More »

FX Daily, January 05: Dollar Slide but Resilience Demonstrated while Yuan Squeezed Higher

There are two main developments. First, the high degree of uncertainty expressed in the FOMC minutes and the repeated references to the strong dollar spurred a wave of dollar selling. The dollar retreated in Asia, but European participants saw the pullback as a new buying opportunity.

Read More »

Read More »

FX Daily, December 14: Markets Quietly Edge into FOMC Meeting

The Pound is entering mid-December in the same fashion it begun the month after having a very strong November as well. After being buoyed by Donald Trump’s victory and the High Courts ruling that parliamentary approval is needed before invoking Article 50, the Pound has been boosted further after economic data has also impressed, with yesterday being a good example of this.

Read More »

Read More »

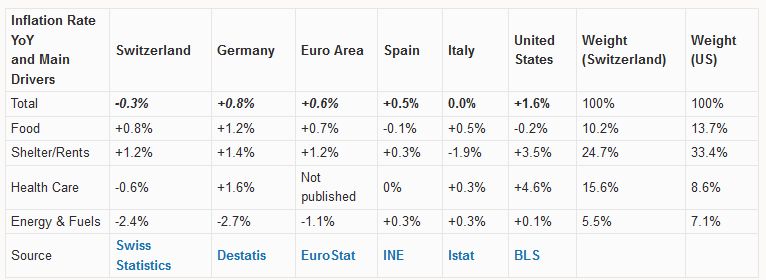

Switzerland Consumer Price Index in November 2016: -0.3 percent against 2015, -0.2 percent against last month

Swiss consumer price inflation remain the lowest in comparison with different countries in the euro zone and the United States. Consumer prices in the U.S. are driven by rising health care costs and asset price inflation in shelter. In Europe, we see the opposite phenomenon: Rents in Italy or Spain are steady or falling. In Germany and Switzerland rent control prevents that asset price inflation moves into consumer prices. In Switzerland, more and...

Read More »

Read More »

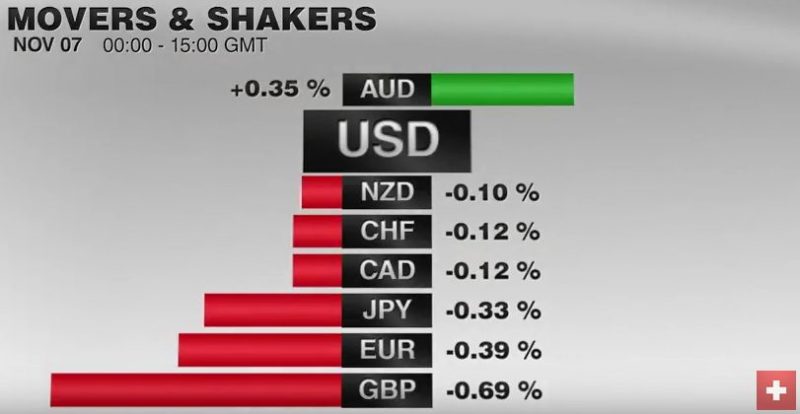

FX Daily, November 07: Dollar Stabilizing After Bounce

The DAX also gapped lower before the weekend and gapped higher today. It is stalling just ahead of the earlier gap from last week (10460-10508). It is up about 1.6% in late-morning turnover. The strongest sector is the financials, up 2.5%, with the banks up 3.4%. Deutsche Bank is snapping a five-session drop. It fell 9.1% last week. It has recouped more than half of that today.

Read More »

Read More »

Switzerland Consumer Price Index in October 2016: -0.2 percent against 2015, +0.1 percent against last month

Swiss consumer price inflation remain the lowest in comparison with different countries in the euro zone and the United States. Consumer prices in the U.S. are driven by rising health care costs and asset price inflation in shelter.

Read More »

Read More »

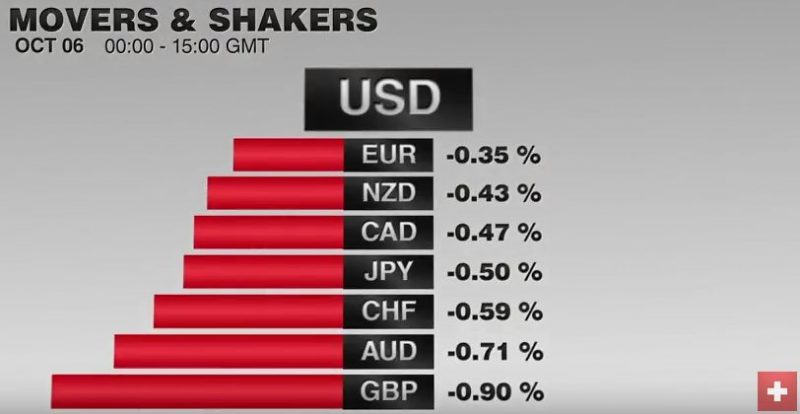

FX Daily, October 06: The Dollar is Firm in Quiet Market

The US dollar is advancing against the major and most emerging market currencies. Activity is subdued and ranges are narrow. We share four observations about the price action. First, the euro has been unable to sustain upticks even after Germany reported a jump in industrial orders three-times more than the median estimate (1.0% vs. 0.3%).

Read More »

Read More »

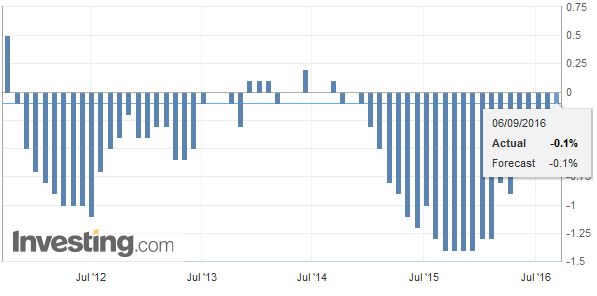

Swiss Consumer Price Index in August 2016: -0.1 percent against 2016, -0.1 percent against last month

We often look at parts of the CPI. For example food inflation is relevant in emerging markets or poorer people in developed nations. Food inflation in Switzerland has risen by 1.3% YoY compared to 0.2% in the U.S., and 1.4% in the eurozone and 1.1% in neighbour Germany. Rents are up +0.2% YoY. Existing Swiss rents are bound to interest rates; therefore they cannot follow the Swiss real estate boom yet.

Read More »

Read More »

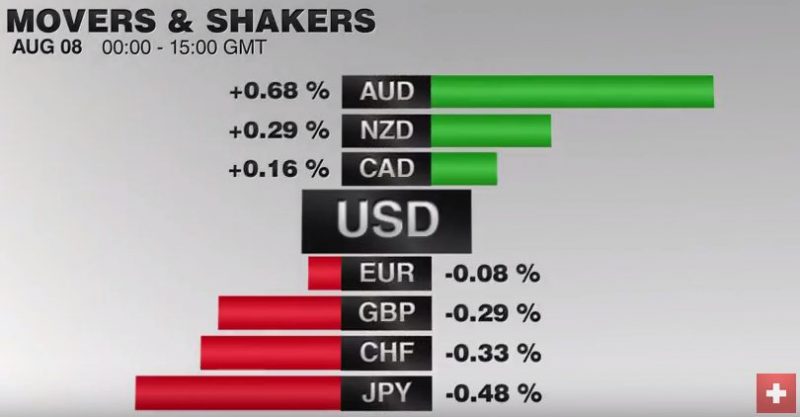

FX Daily, August 08: Stocks Up, Bonds Down, Dollar and Yen are Heavy

Investors favor risk assets today. Global stocks are moving higher in the wake of the pre-weekend US rally that saw the S&P 500 close at record levels. Bond yields are mostly firmer, again with US move in response to the robust employment report setting the tone in Asia.

Read More »

Read More »

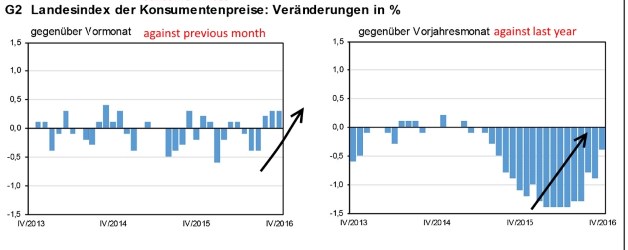

Swiss Consumer Price Index in July 2016: -0.2 percent against 2015, -0.4 percent against last month

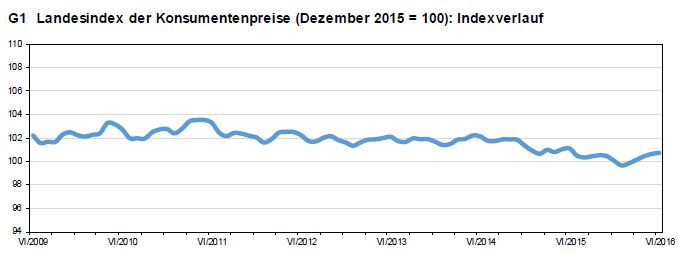

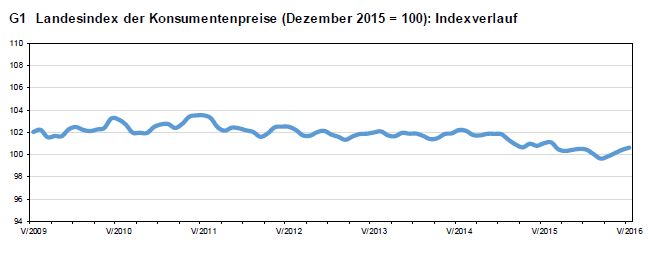

The Swiss Consumer Price Index (CPI) fell by 0.4% in July 2016 compared with the previous month, reaching 100.3 points (December 2015=100). Inflation was -0.2% in comparison with the same month in the previous year. These are the findings of the Federal Statistical Office (FSO).

Read More »

Read More »

Swiss Consumer Price Index in June 2016: -0.4 percent against 2015, +0.1 percent against last month

The Swiss Consumer Price Index (CPI) increased by 0.1% in June 2016 compared with the previous month, reaching 100.7 points (December 2015=100). Inflation was -0.4% in comparison with the same month in the previous year. These are the findings of the Federal Statistical Office (FSO).

Read More »

Read More »

Swiss Consumer Price Index in May 2016: -0.4 percent against 2015, +0.1 percent against last month

For the third time in a row, prices in Switzerland increased against the previous month. Inflation was -0.4% against last year. Still in 2015 yearly inflation was mostly around -1.5% y/y. Now yearly HCPI inflation is -0.5%. Will this rising price tendency continue?

Read More »

Read More »

Swiss Consumer Price Index in April 2016: -0.4 percent against 2015, +0.3 percent against last month

For the second time in a row prices in Switzerland increased by 0.3% against the previous month. Inflation was -0.4% against last year. Still in 2015 inflation was mostly around -1.5%. Will this rising price tendency continue? It will be a problem for the SNB.

Read More »

Read More »

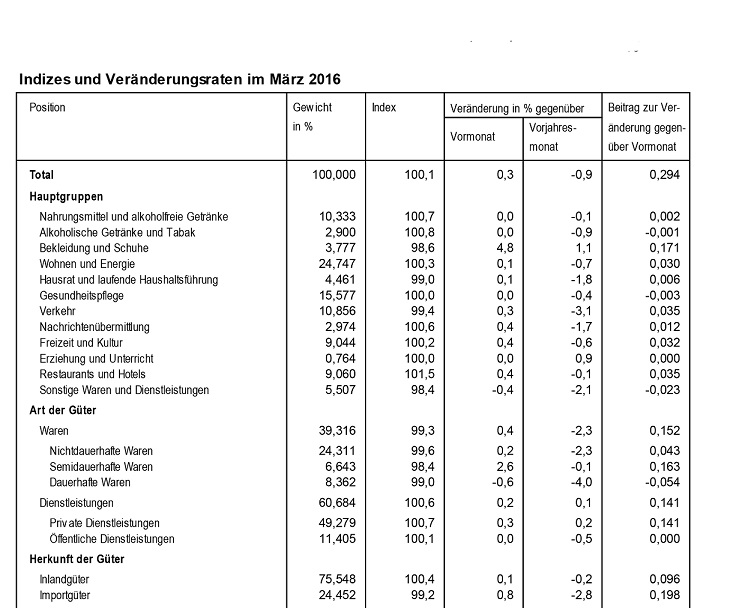

Swiss Consumer Price Index in March 2016: -0.9 percent against 2015, +0.3 percent against last month

08.04.2016 09:15 - FSO, Prices (0353-1603-50) Swiss Consumer Price Index in March 2016 Neuchâtel, 08.04.2016 (FSO) – The Swiss Consumer Price Index increased by 0.3% in March 2016 compared with the previous month, reaching 100.1 points (December 201...

Read More »

Read More »

SNB Monetary Policy Assessment and Critique

We examine the SNB monetary assessment statement of March 17 and the Swiss economy. We explain why negative rates may be a "toothless measure" if a central bank wants to weaken a currency. They have rather an inexpected consequence, they slow down GDP growth, in particular for banks and pension funds.

Read More »

Read More »

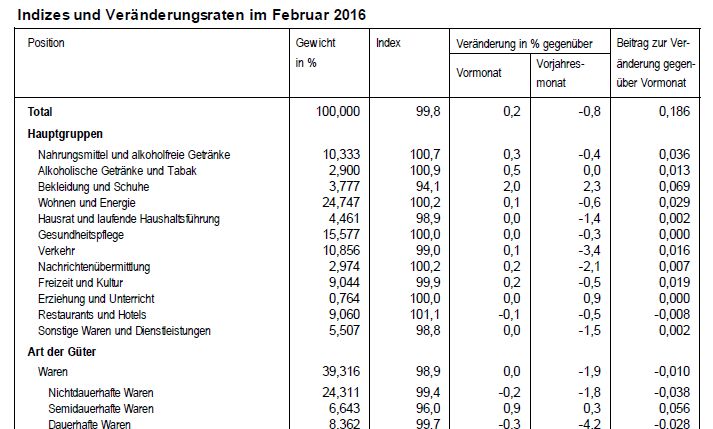

Swiss Consumer Price Index in February 2016: -0.8 percent against 2015, +0.2 percent against last month

08.03.2016 09:15 - FSO, Prices (0353-1602-40) Swiss Consumer Price Index in February 2016 Neuchâtel, 08.03.2016 (FSO) – The Swiss Consumer Price Index (CPI) increased by 0.2% in February 2016 compared with the previous month, reaching 99.8 points

Read More »

Read More »

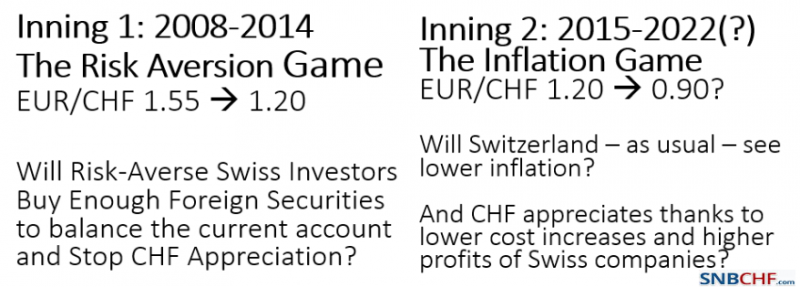

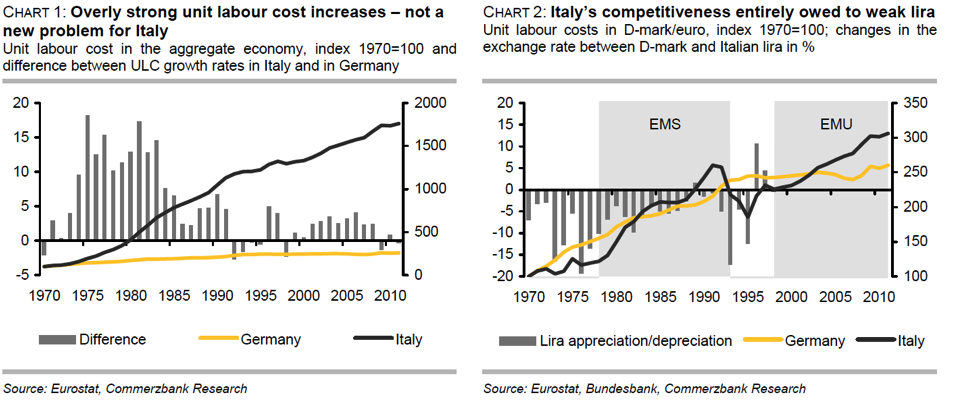

The two phases of CHF appreciation… and what is in between

We show the two phases or "two innings" of Swiss franc appreciation: The risk aversion phase and the high inflation phase.

With the weakening of emerging markets and the strengthening of the United States in 2013/2014, the Swiss National Bank (SNB) had won the first battle in the war against financial market, the "risk aversion game", the first inning in two-part match. Risk aversion is lower because the United States recovered with weaker oil...

Read More »

Read More »

(6) FX Theory: Carry Trade and Reverse Carry Trade

This page discusses two closely related concepts: the carry trade and the reverse carry trade.

Read More »

Read More »