Tag Archive: S&P 500 Index

Dollar & Stocks Jump; Bonds & Bullion Dump In Lowest Volatility September Ever

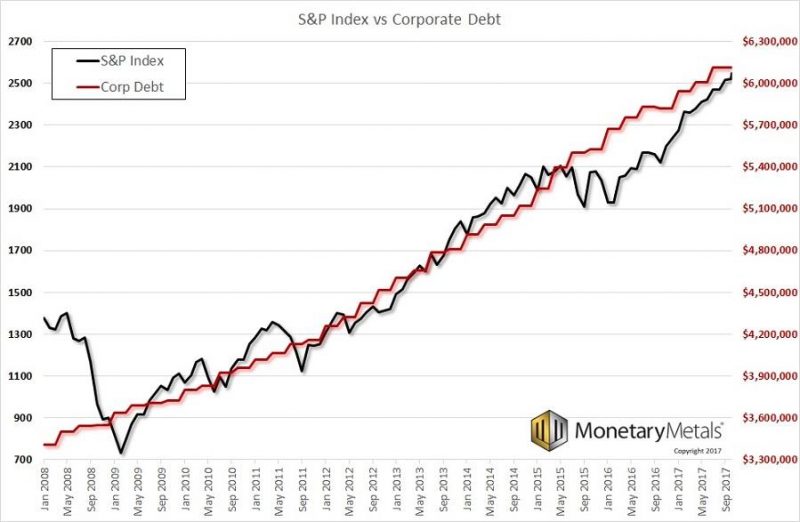

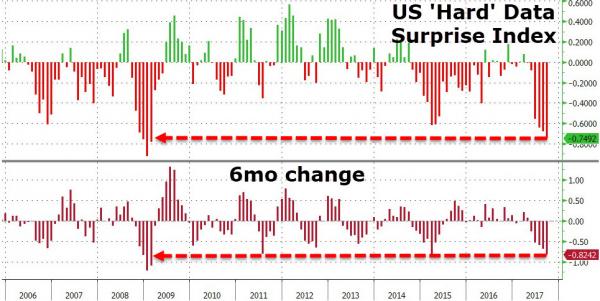

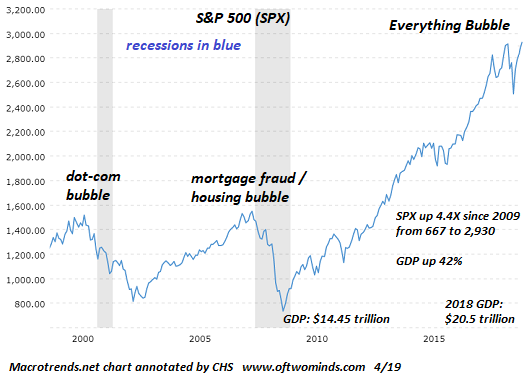

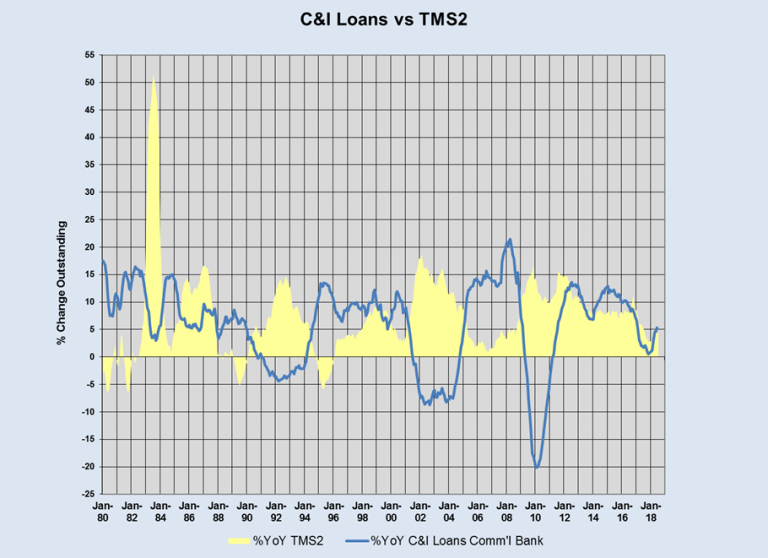

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown - the 4th-longest streak since 1928... So everything is awesome...BUT...US 'hard' economic data has not been this weak (and seen the biggest drop) since Feb 2009...Q3 Was a Roller-Coaster...Q3 was the 8th straight quarterly gain in a row for The Dow - the longest streak since Q3 1997.

Read More »

Read More »

21st Century Shoe-Shine Boys

Anecdotal Flags are Waved. “If a shoeshine boy can predict where this market is going to go, then it’s no place for a man with a lot of money to lose.”

– Joseph Kennedy

It is actually a true story as far as we know – Joseph Kennedy, by all accounts an extremely shrewd businessman and investor (despite the fact that he had graduated in economics*), really did get his shoes shined on Wall Street one fine morning, and the shoe-shine boy, one Pat...

Read More »

Read More »

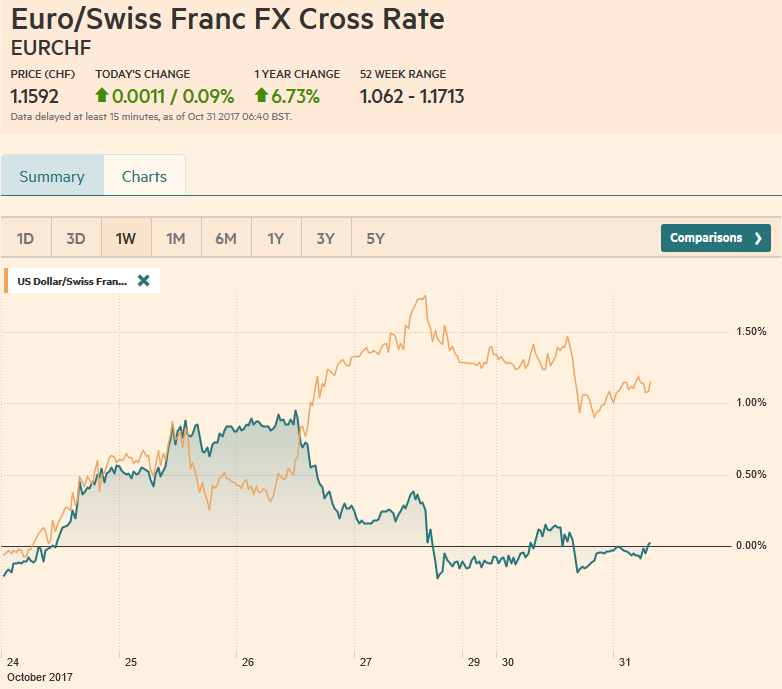

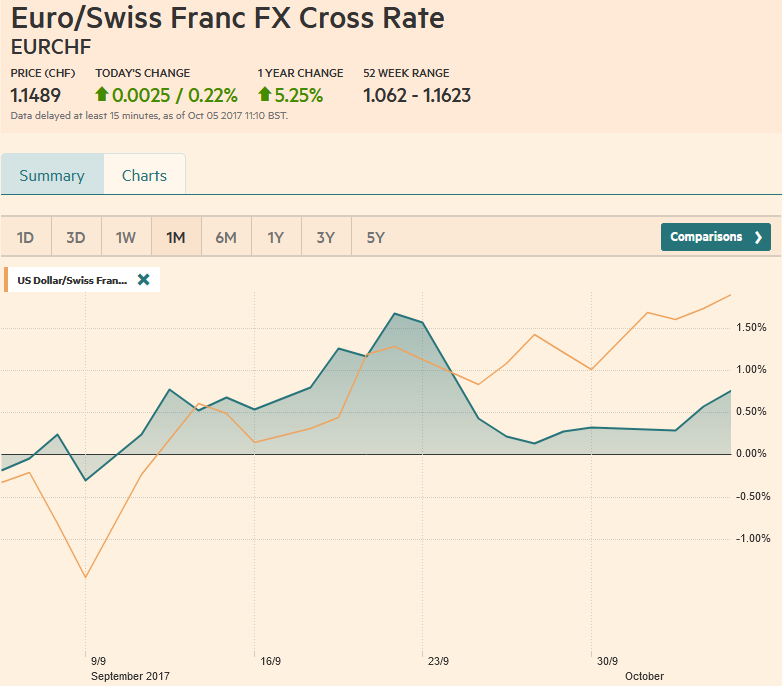

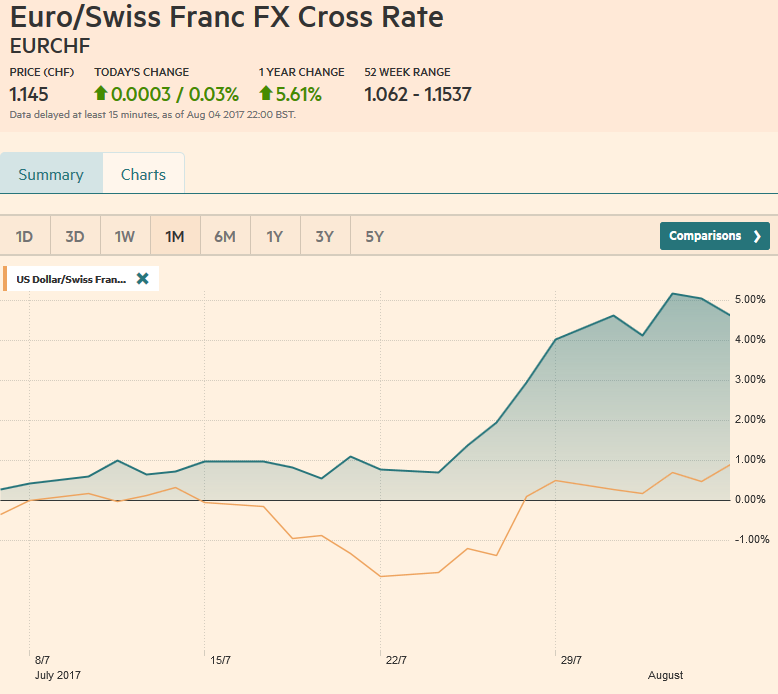

FX Weekly Review, September 04 – 09: Draghi Dovish? EUR and USD falling against CHF

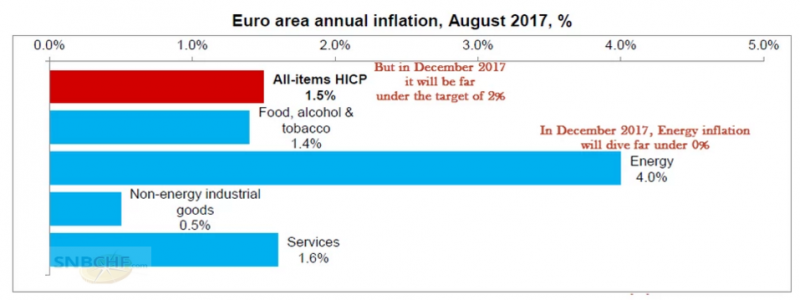

The euro rose close to CHF 1.15 with the ECB meeting this week. Finally traders realized that the ECB committed not to hike rates for a very long time. The ECB will review and take a first decision on the bond purchasing program this autumn. However, this program will come to an end only when the inflation target of 2% becomes in reach.

Read More »

Read More »

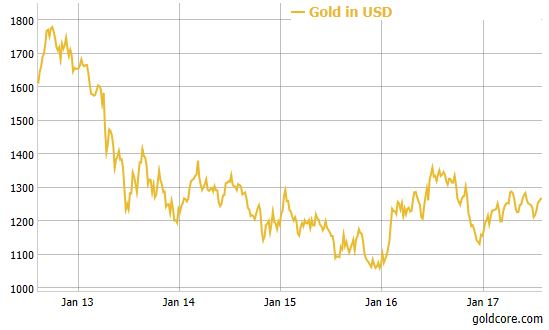

4 Reasons Why “Gold Has Entered A New Bull Market” – Schroders

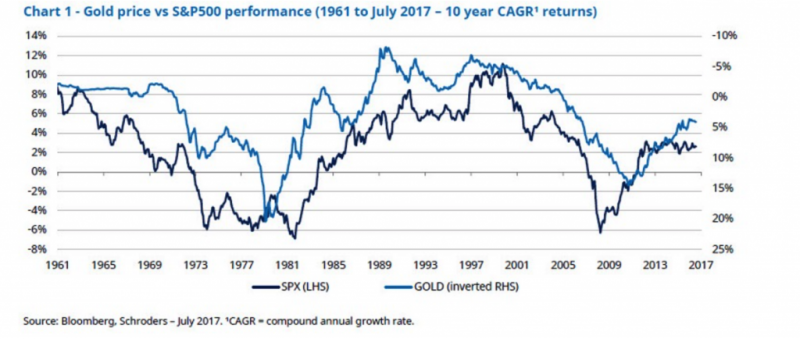

4 reasons why “gold has entered a new bull market” – Schroders. Market complacency is key to gold bull market say Schroders. Investors are currently pricing in the most benign risk environment in history as seen in the VIX. History shows gold has the potential to perform very well in periods of stock market weakness (see chart). You should buy insurance when insurers don’t believe that the “risk event” will happen. Very high Chinese gold demand,...

Read More »

Read More »

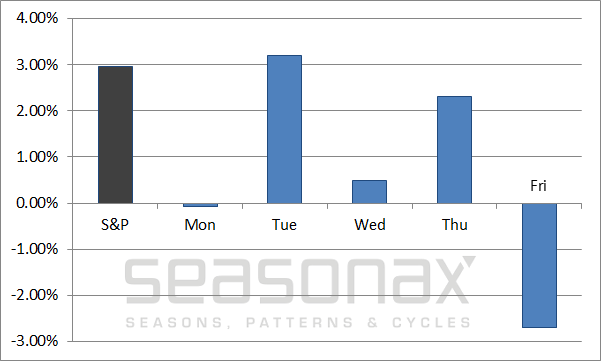

S&P 500 Index: A Single Day Beats the Entire Week!

Many market participants believe simple phenomena in the stock market are purely random events and cannot recur consistently. Indeed, there is probably no stock market “rule” that will remain valid forever. However, there continue to be certain statistical phenomena in the stock market – even quite simple ones – that have shown a tendency to persist for very long time periods.

Read More »

Read More »

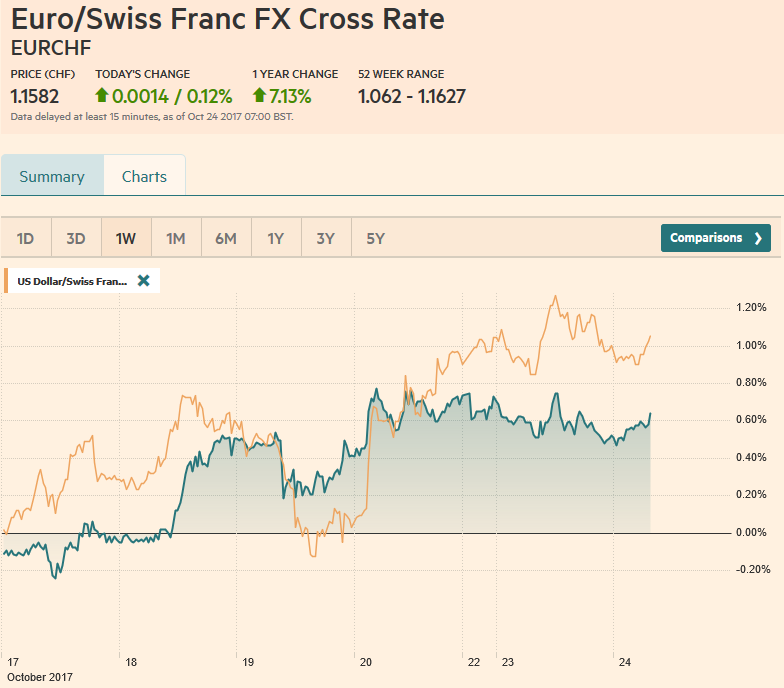

FX Weekly Review, August 28 – September 02: The end of big euro rise?

For us, the sudden euro rise from 1.08 to 1.14 is an illusion, the euro will fall sooner or later again. Macron will not help the French economy and low core inflation will prevent that the ECB ends her bond buying program.

Read More »

Read More »

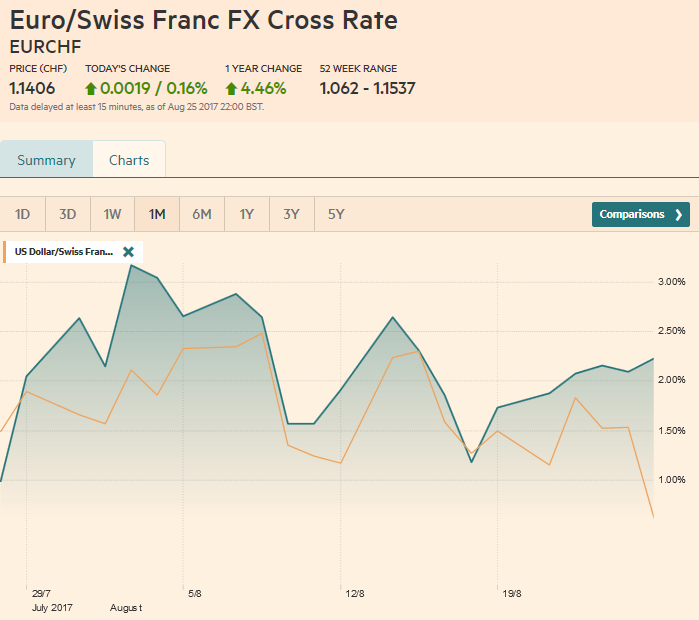

FX Weekly Review, August 21 – August 26: Dollar Loses its Gains Against CHF

The broad technical condition of the dollar deteriorated materially before the weekend. The dollar had some gains versus the franc during the last month, but it lost all during the last days.The EURCHF continues with a 2.5% win for the last month.

Read More »

Read More »

The Truth About Bundesbank Repatriation of Gold From U.S.

Bundesbank has completed a transfer of gold worth €24B from France and U.S. Germany has completed domestic gold storage plan 3 years ahead of schedule. In the €7.7 million plan, 54,000 gold bars were shipped and audited.

Read More »

Read More »

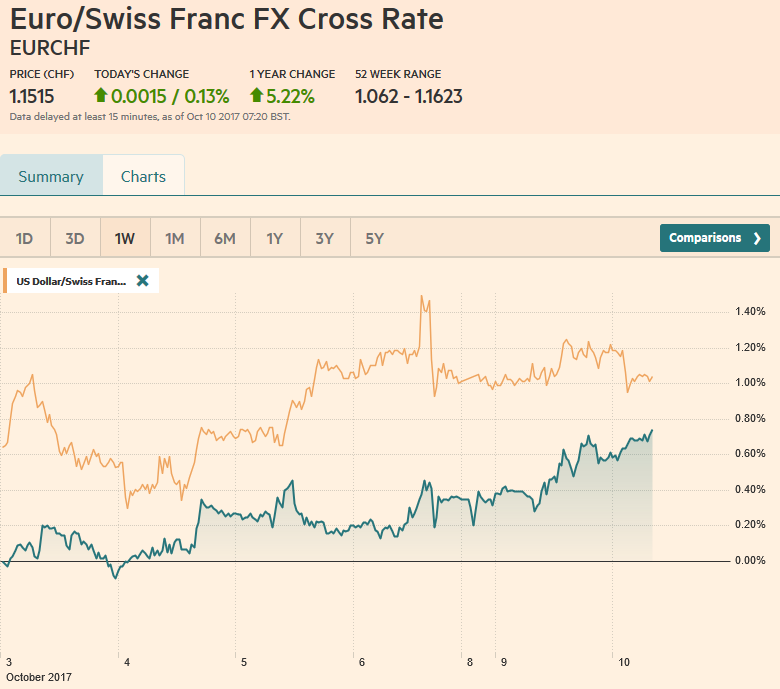

FX Weekly Review, August 14 – August 19: CHF Recovers after Dovish Draghi Comments

The euro has lost some momentum, Draghi does not want to talk about an early end of his bond buying programming. Confirmed by economic data, 1.2% core inflation compared to a long-term inflation target of 2%. Consequently the Swiss appreciated during the week.

Read More »

Read More »

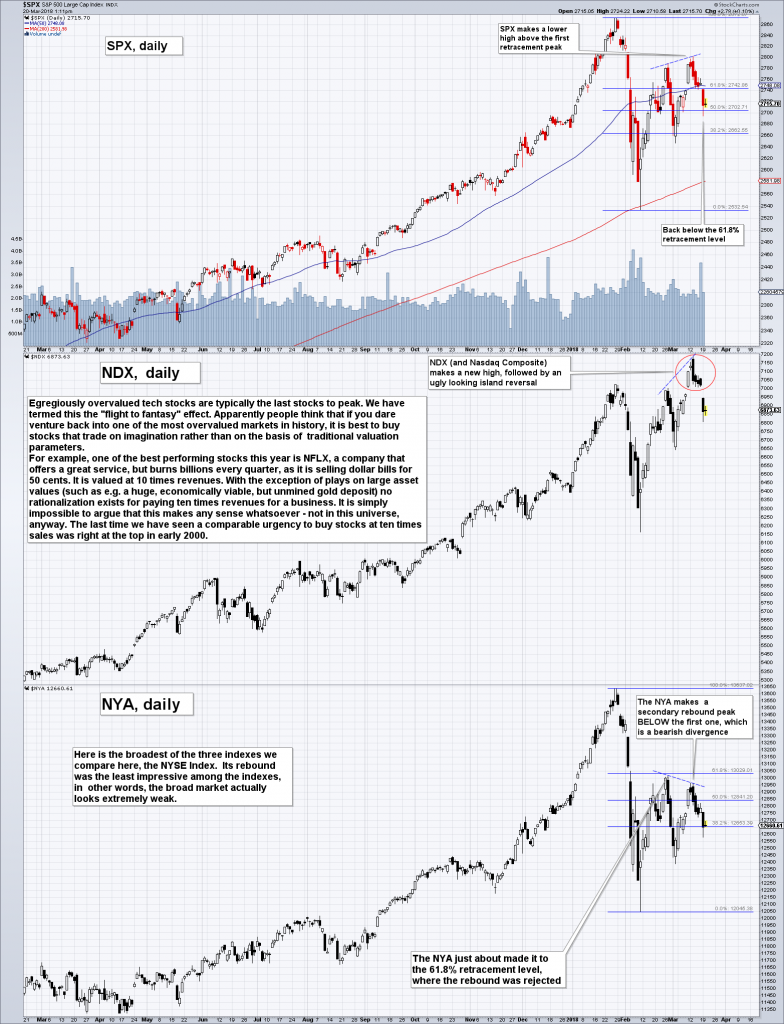

Prepare for Another Market Face Pounding

“Better than Goldilocks” “Markets make opinions,” goes the old Wall Street adage. Indeed, this sounds like a nifty thing to say. But what does it really mean? Perhaps this means that after a long period of rising stocks prices otherwise intelligent people conceive of clever explanations for why the good times will carry on. Moreover, if the market goes up for long enough, the opinions become so engrained they seek to explain why stock prices...

Read More »

Read More »

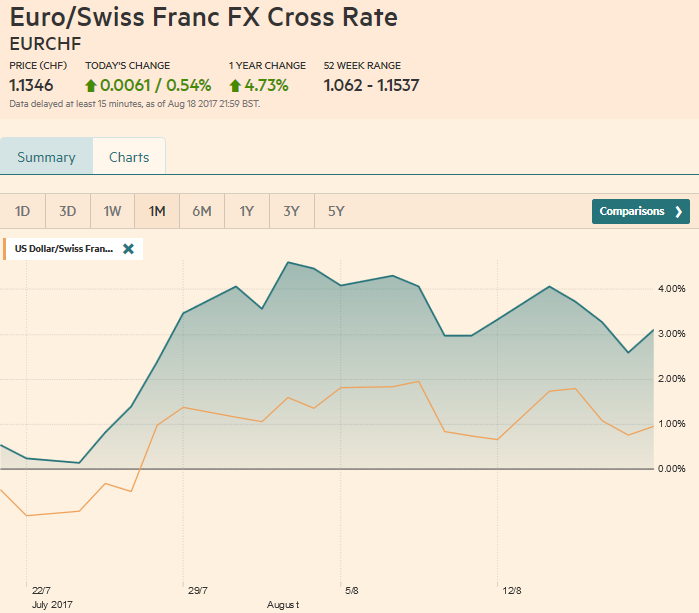

FX Weekly Review, July 31 – August 05: Second Week of Strong CHF Losses

The Swiss Franc entered the second week of stronger losses. While the euro gained 4% last week, the dollar appreciated against the Swiss Franc 2% during this week.

Read More »

Read More »

Gold Consolidates On 2.5percent Gain In July After Dollar Has 5th Monthly Decline

Gold consolidates on 2.5% gain in July as the dollar has fifth monthly decline. Trump administration and vicious “civil war” politics casting shadow over America and impacting dollar. All eyes on non farm payrolls today for further signs of weakness in U.S. economy. Gold recovers from 1.7% decline in June as dollar falls. Gold outperforms stocks and benchmark S&P 500 YTD.

Read More »

Read More »