Tag Archive: Swiss National Bank

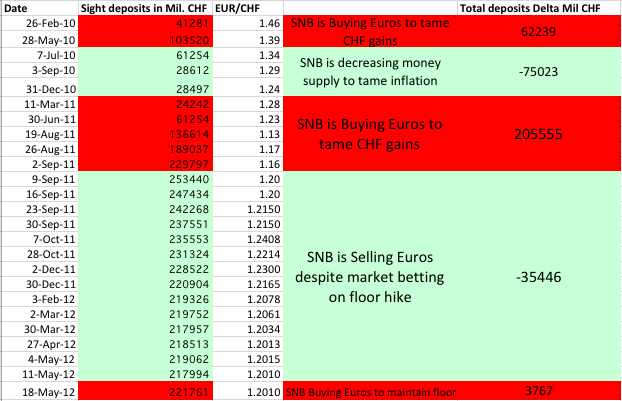

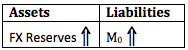

Huge rise in Currency Reserves: The SNB has restarted the printing press

The game for the Swiss National Bank seems to have changed completely. Again the central bank had increase money supply, as measured by deposits at the SNB by local banks and other sight deposits, this time even by 13219 mil. francs (source). This money printing implies that the SNB had to buy in Euros in …

Read More »

Read More »

SNB’s Jordan admits that EUR/CHF floor will not be raised

For the first time the chairman of the Swiss National Bank Jordan has admitted that the EUR/CHF floor of 1.20 will not be raised. In an interview with the Swiss Sonntagszeitung, here also cited by Bloomberg, he said:

Read More »

Read More »

Rumors about tax on Swiss deposits for foreigners and further SNB measures: SNB begging for pips

Exactly when the US had a relatively good Markit Flash PMI, rumors are sent out that deposits in CHF for foreigners should be taxed. To send out this rumor together with good US data seems to be intentional. According to Banque CIC the SNB has declined to comment. We remember the last SNB meeting when similar rumors circulated.

Read More »

Read More »

Why the floor will never be lifted to 1.25 ?

Or why the biggest opponents of the SNB are not Weltwoche and the SVP (Swiss People’s Party) but the Federal Reserve

Read More »

Read More »

Will the SNB double or triple the forex reserves before they give in ?

Some economists have claimed that the Swiss National Bank (SNB) will be always able to maintain the floor. As opposed to George Soros’ defeat of the Bank of England, the SNB is able to print money ad infinitum, whereas the BoE had limited currency reserves to support sterling. The question, however, is where this “infinitum” …

Read More »

Read More »

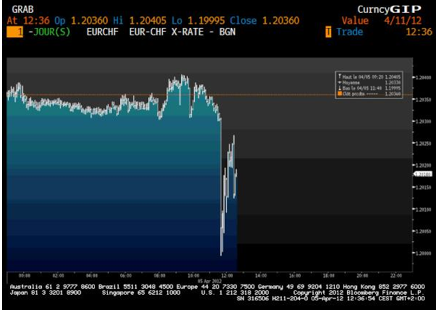

Why the SNB fixed the peg at 1.2010 and not at 1.2000 ?

As we have showed in a preceding post, the SNB seems to have decided the peg the franc to the euro at 1.20. Therefore the SNB traders were actively selling euros and buying francs even close to the floor limit of 1.20. But then in the beginning of April some Asian traders managed to push the … Continue reading...

Read More »

Read More »

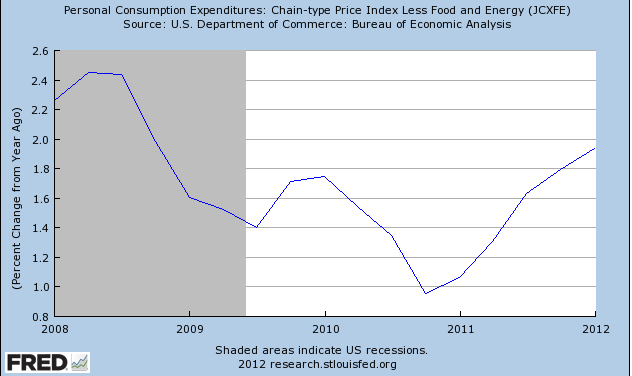

The vicious cycle of the US economy or why the US dollar must ultimately fall again

Just some simple words about the vicious cycle of the US economy and the consequences on the US dollar: A stronger USD will not rescue the US economy, quite the contrary. US companies will not hire in the US, but outsource or hire overseas. If they hire in the US, due to the high number …

Read More »

Read More »

Is the play time over for the SNB ? SNB Buys Euros Again, but the EUR/CHF does not move a pip

As also noticed by Credit Suisse, the Swiss National Bank had to buy euros and sell Swiss francs in the week of May 11th to May 18th. Their recent easy strategy to sell euros and buy Swiss Francs and to diversify from euros into other currencies may not continue.

Read More »

Read More »

The Northern Euro introduction: A retrospective from the year 2030

A retrospective from the year 2030 on two decades of failed european integration policy and 10 years of successful disintegration policy The following essay shows that currency regimes come and go over the time. Nothing is stable with the time, especially the use of a currency. What has never happened in history is the use …

Read More »

Read More »

Former SNB chief economist: Capital controls are just empty words

A former SNB chief economist says that capital controls are impossible, just empty words. In case of a Euro break-up the Swissie must rise together with USD, GBP and JPY An article, surprisingly from the usually left-wing Tagesanzeiger, more or less closely translated with some additional remarks.

Read More »

Read More »

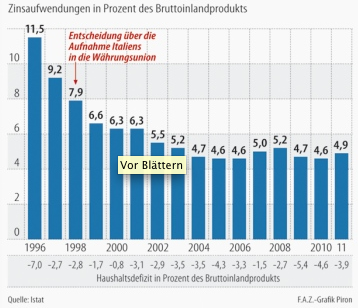

Italy: About the Hypocrisy of Politicians and the Blindness of the English-Speaking Financial Papers

Just a little wrap-up of two tweets read in 5 minutes, to which I finally added a bit more out of my recent Tweets. One Tweet: The British finance minister Osborne has emphasized that the euro zone needs to protect its peripheral economies. “The whole of Europe needs to become more competitive and productive. That …

Read More »

Read More »

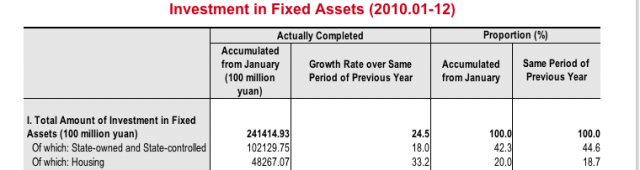

The Chinese Government, a bubble creator or when finally does China consume ?

The years 2009 to 2011 have seen four institutions that created bubbles in commodity, stock and real estate markets. 2008 and 2009 saw the massive Keynesian interventions by the US state and the Chinese government. In 2009 the first Quantitative Easing measures enabled a first flood of hot money into Emerging Markets. Summer 2010 witnessed …

Read More »

Read More »

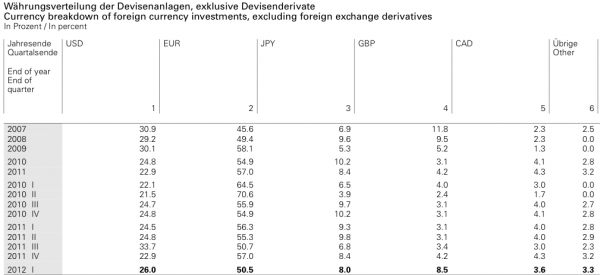

Is the SNB pegging away from the Euro to the SDR currency basket using their FX reserves ?

We reckon that the central bank has introduced an automatic peg mechanism which obliges them to buy euros at exactly 1.2010 and sell euros above this level (reasons and details here). If they sold more euros than they bought, they are happy to have offloaded some items of their overloaded balance sheet. If they bought more euros than they sold, however, there are some "superfluous" euros. Instead putting these euros on their balance sheet, they...

Read More »

Read More »

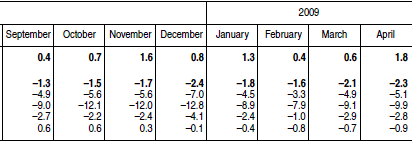

Forget Non-Farm Payrolls, Take US Personal Disposable Income as Lead Economic Indicator

The unreliable Non-Farm Payrolls has far too much importance Interesting to see that markets needed two relatively bad NFPs to really believe that their main indicators, the “Non-Farm Payroll” reports were strongly biased in January and February by a positive weather effect. HFT algorithms that highly influence stock market prices, are not able to take …

Read More »

Read More »

SNB buys Swiss Francs and sells Euro: Welcome to the EUR/CHF peg

Why the big Q1 loss of the SNB was actually a big win for the central bank Anybody watching the EUR/CHF exchange rate this year was wondering why the volatility the pair saw last year had completely left. The pair slowly fell from 1.2156 over 1.2040 at the end of Q1 to 1.2014 today. FX … Continue reading...

Read More »

Read More »

EUR/CHF, A History, The Game Changes: April 2012

EUR/GBP: If You Want To Know Why Its Falling, Have A Look At The SNB Thanks Goose for the reminder that the SNB released figures on its FX reserves holdings and these showed a marked increase in GBP holdings. This has been a constant theme over the last few weeks/months, the SNB buys EUR/CHF in the marketplace … Continue reading »

Read More »

Read More »

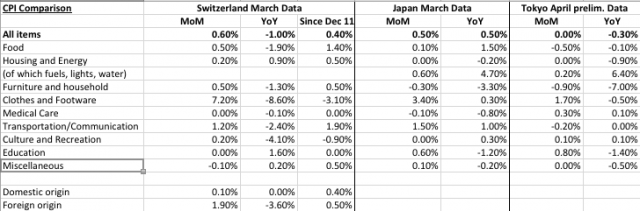

Why is the Swiss safe-haven so completely different from the Yen ?

4 future scenarios for the Swiss franc and the Japanese yen For many people it is astonishing that the Swiss franc continuously rises against the euro, especially when markets are up. Is the CHF no safe-haven any more ? This year the Japanese yen has strongly fallen against the major currencies. Together with the upturn …

Read More »

Read More »

EUR/CHF, A History, Market Betting on Floor: March 2012

Nomura Touts EUR/CHF Longs Strategists there advise going long around the current levels, they say the floor will not break. They target 1.24. I have to agree. To me, it’s a question of buying low or buying a bit lower. By Adam Button || March 30, 2012 at 14:50 GMT EUR/CHF Touches One-Month Low Bounced off … Continue reading »

Read More »

Read More »

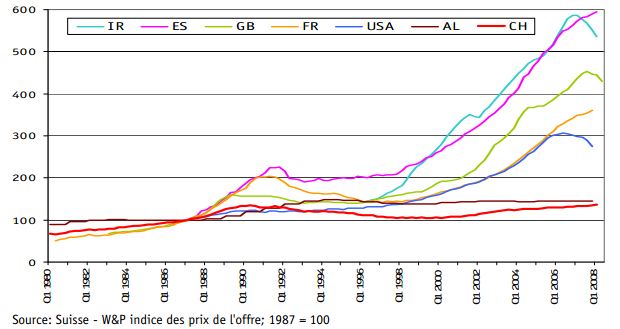

Why the Euro Crisis may last another 15 years

Abstract In the following article we will explain which types of crisis occur in the euro area and will argue that this crisis will last at least another fifteen years. (1) Competitiveness crisis: Before the euro introduction peripheral countries regularly saw their currency depreciate against the German Mark and helped them to increase their competitiveness. …

Read More »

Read More »