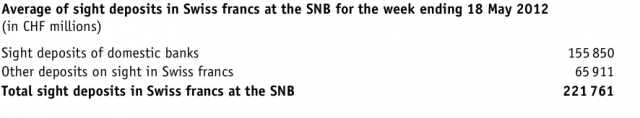

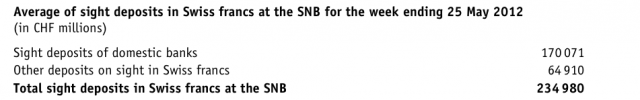

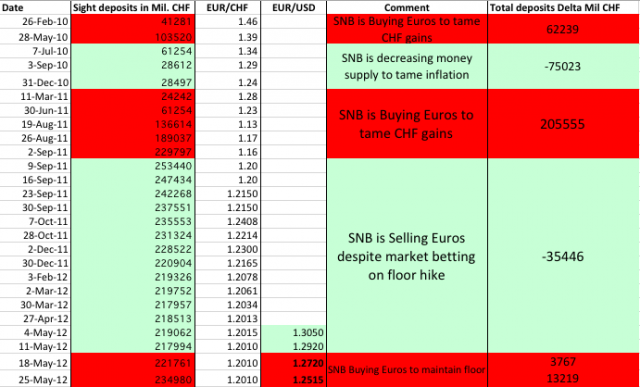

The game for the Swiss National Bank seems to have changed completely. Again the central bank had increase money supply, as measured by deposits at the SNB by local banks and other sight deposits, this time even by 13219 mil. francs (source). This money printing implies that the SNB had to buy in Euros in similar quantities in order maintain the floor.

Already last week the central bank had to shift its strategy from selling Euros to buying Euros. The SNB managed to reduce money supply by 35446 mil. (i.e. sell mostly euros) between Sep 9, 2011 and May 11, 2012. In the last two week it had to increase money supply by nearly 17000 mil. CHF, loosing nearly 50% of all “gains” in the previous money supply reduction.

We have speculated that the SNB will double or triple the Forex reserves before it gives in and the floor will break.

At the current speed of 13 bln per week, this will result in 676 bln. CHF per year, i.e. they will have tripled money supply and currency reserves in one year. This sum exceeds slightly the Swiss GDP, implying that a break of the floor from 1.20 to 1.10 (about 10%) on the basis of 50% Euros in the SNB reserves would result in a loss of around 5% of GDP at the central bank. Moreover, in the week ending in May 25th, nothing really extraordinary happened, what would happen in case of a Greek euro exit?

Is the Swiss debt soon rising more quickly than Italy’s one ?

If this SNB loss is realized, it would imply an increase of Swiss total debt (here the Swiss debt clock) by around 5% in one year. This is barely better than the 5.4% yield Italy has to pay on its debt services and is only weighted by the fact that Switzerland has currently negative yields on bills and a small primary surplus between 3 and 6 bln francs per year, abstracting from the small interest part).

As opposed to Italy, Switzerland cannot devalue the debt via inflation, since Swiss inflation is about zero and Italian inflation at 2.5%. On the contrary a break of the floor would even revalue the debt via deflation,

Swiss laws prohibit the state from taking too much debt, formulated in the famous Swiss debt break. The only institution that can do, whatever it wants, is the Swiss National Bank.

Should the floor continue to hold, it is possible that even bonds with higher maturities (up to 5 years) for the Swiss confederation (10 years yield currently at 0.64%) will have negative yields.

The SNB seems to be really anxious about this sudden rise in demand for the franc, they have even announced capital controls for the case of a euro break-up.

Are you the author? Previous post See more for Next post

Tags: Capital Controls,Deflation,Deposits,floor,franc,money printing,Reserves,Safe-haven,SNB sight deposits,Swiss National Bank,Switzerland,Switzerland Money Supply