Tag Archive: Capital Controls

Cyprus, the Final Compromise: The Winners and the Losers

UPDATE March 25 The final compromise: via Reuters TOP NEWS Detail of EU/IMF bailout agreement with Cyprus Sun, Mar 24 22:19 PM EDT BRUSSELS (Reuters) – Cyprus clinched a last-ditch deal with international lenders on Monday for a 10 billion euro ($13 billion) bailout that will shut down its second largest bank and inflict heavy …

Read More »

Read More »

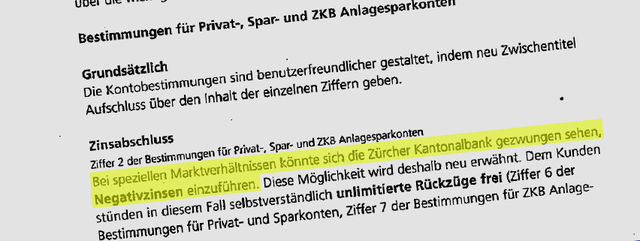

ZKB may introduce negative interest rates for ordinary savers

After UBS and CS introduced negative interest rates for big clearing accounts, ZKB changes general conditions for a potential introduction of negative rates even for ordinary savers. Time to get in contact with Geneva cash storing warehouses? More about the ZKB move on

Read More »

Read More »

Credit Suisse and UBS Will Charge Negative Interests Above a Threshold

Credit Suisse and UBS will charge negative interests for cash clearing clients above a threshold. Last year such was worth 150 bps, this year on 28 bps. See the official news at FT Alphaville

Read More »

Read More »

Gold, CHF, Brent Arbitrage Trading after Negative CS, UBS Interest Rates

Credit Suisse and UBS will charge negative interests for cash clearing clients above a threshold. Last year such news was worth 250 bps, on December 3 only 28 bips. One remembers August 26, 2011, when UBS only spoke of negative interests and consequently EUR/CHF rose from 1.1420 to 1.1688. At the time FX traders …

Read More »

Read More »

How former central bankers stepped up against the central banks

There are already three former European central bankers who criticize more or less openly the European Central Bank (ECB).

Read More »

Read More »

Steen Jakobsen, Chief Economist Saxo Bank is buying in our arguments

Steen Jakobsen sees 25% percent chance that the floor breaks and if it does it breaks to parity. Last week Thomas Jordan removed any hopes on a hike of the EUR/CHF and invited smart money and hedge funds to a no-risk, high return game on the Swiss franc, which these gratefully accepted. After Morgan Stanley …

Read More »

Read More »

A central bank running suicide ? SNB prints at pace never seen since EUR/CHF parity in August 2011

The most recent money supply data from the Swiss National Bank (SNB) has shown increases of huge amounts. As compared with its loss of 19 bln. francs in 2010 (3% percent of the Swiss GDP), the central bank printed tremendous 17.3 bln. in the week ending in June 1st and 13 bln. in the one …

Read More »

Read More »

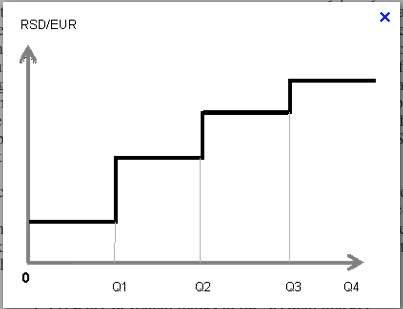

CNBC rumors: Different peg methods for the SNB

There are currently rumors going on on CNBC that the SNB is planning something this night. As we explained here, the SNB had to strongly restart the printing press and printed tremendous 13 bln francs in one week. Moreover, they probably sold some of their in Q4 2011 and Q1 2012 acquired GBP, JYP and …

Read More »

Read More »

Huge rise in Currency Reserves: The SNB has restarted the printing press

The game for the Swiss National Bank seems to have changed completely. Again the central bank had increase money supply, as measured by deposits at the SNB by local banks and other sight deposits, this time even by 13219 mil. francs (source). This money printing implies that the SNB had to buy in Euros in …

Read More »

Read More »

SNB’s Jordan admits that EUR/CHF floor will not be raised

For the first time the chairman of the Swiss National Bank Jordan has admitted that the EUR/CHF floor of 1.20 will not be raised. In an interview with the Swiss Sonntagszeitung, here also cited by Bloomberg, he said:

Read More »

Read More »

Rumors about tax on Swiss deposits for foreigners and further SNB measures: SNB begging for pips

Exactly when the US had a relatively good Markit Flash PMI, rumors are sent out that deposits in CHF for foreigners should be taxed. To send out this rumor together with good US data seems to be intentional. According to Banque CIC the SNB has declined to comment. We remember the last SNB meeting when similar rumors circulated.

Read More »

Read More »

Former SNB chief economist: Capital controls are just empty words

A former SNB chief economist says that capital controls are impossible, just empty words. In case of a Euro break-up the Swissie must rise together with USD, GBP and JPY An article, surprisingly from the usually left-wing Tagesanzeiger, more or less closely translated with some additional remarks.

Read More »

Read More »

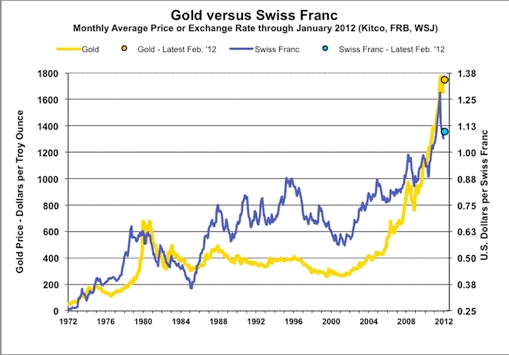

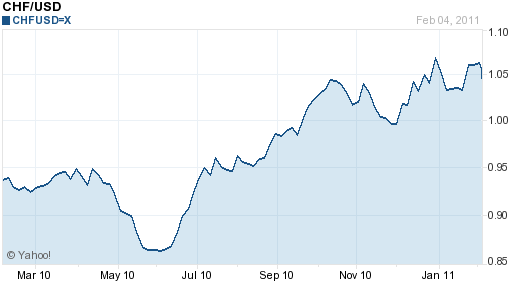

Has the Swiss Franc Reached its Limit? (February 2011)

Feb. 6th 2011 Extracts from the history of the Swiss franc (February 2011) The second half of 2010 witnessed a 20% rise in the Swiss Franc (against the US Dollar), which experienced an upswing more closely associated with equities than with currencies. It has managed to entrench itself well above parity with the Dollar, and …

Read More »

Read More »

Capital controls: The poison cupboard of the SNB

The SNB has already tried a lot to weaken the franc. A (google) translation of a list of capital controls of the Never Mind the Markets blog. The fear of the economic effects Brake by an overvalued franc increases. Massive interventions by the Swiss National Bank (SNB) with € purchases are now ineffective fizzles. Does it …

Read More »

Read More »

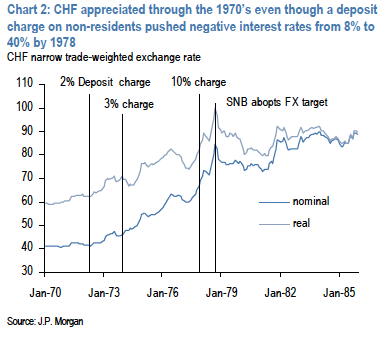

JP Morgan: Reflections on negative interest rates in Switzerland

Negative interest rates naturally attract attention given Switzerland’s use of these between 1972-1978.

Read More »

Read More »