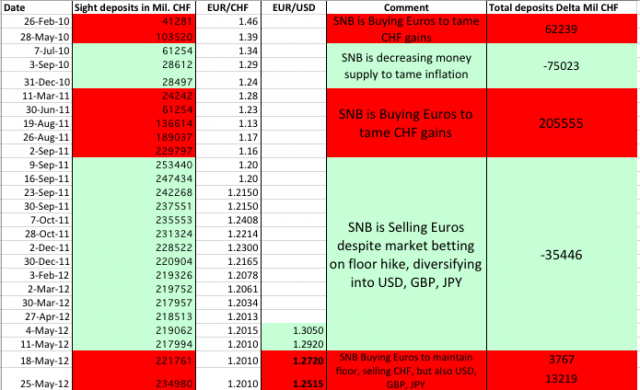

As explained in our previous post, at least till May 4th the Swiss National Bank could have been a net buyer of GBP, USD and JPY selling Euros off their balance sheet. In the week of May 11, QE3 talk came up together with a bad Phily Fed reading. From then the SNB had to acquire Euros in order to maintain the EUR/CHF floor. Partially they were probably not only printing CHF, but also realizing their gains in the SDR currency basket (USD, GBP and JPY) in which they bought before.

The currency they invested relatively to market share the most, was the British pound (it was underweighted in the SNB balance sheet, details here). Sterling, however, might be now the currency, which they are most likely to sell.

Effectively, the pound reached a top against the dollar, in the end April, beginning of May. Since the SNB has changed its strategy, sterling has plunged nearly as much as the euro.

As visible in the table above, the critical level when the SNB switched from selling Euros to buying Euros was about EUR/USD = 1.27. Adding the recent bad US data and good Swiss data, the level might have risen to EUR/USD 1.30. Over this level (and good US and global economic data) the SNB can sell Euros again, under this level the central bank continues to blow up its balance sheet.

Since for the SNB selling Euros means buying GBP (and others) and buying Euros implies selling GBP (et. al)., the exercise is simple: You could trade with the SNB traders, i.e. sell the GBP/USD and hedge this (depend on your judgement of market conditions) with a Long EUR/GBP. One could continue this strategy as long as the EUR/USD is under 1.30 and the SNB starts buying GBP again.

If the Euro rises against the dollar based on good German data, it is sure that the SNB will need to continue to buy masses of Euros and sell sterling. If, however, good US data comes in and the euro rises thanks to this data, then the SNB will buy GBP again.

Are you the author? Previous post See more for Next post

Tags: franc,QE3,Swiss National Bank