Tag Archive: Precious Metals

Gold Sector – An Obscure Indicator Provides a Signal

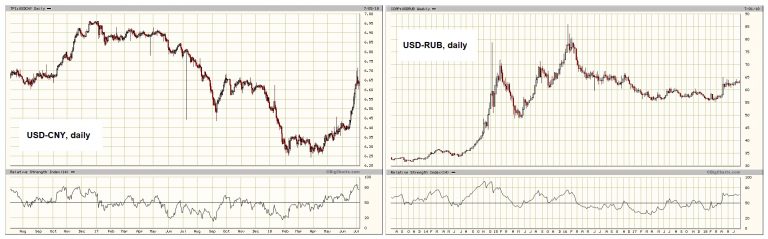

The Goldminbi. In recent weeks gold apparently decided it would be a good time to masquerade as an emerging market currency and it started mirroring the Chinese yuan of all things. Since the latter is non-convertible this almost feels like an insult of sorts. As an aside to this, bitcoin seems to be frantically searching for a new position somewhere between the South African rand the Turkish lira.

Read More »

Read More »

Separating Signal from Noise

Todd Horwitz is known as Bubba and is chief market strategist of Bubba Trading.com. He is a regular contributor on Fox, CNBC, BNN, Kitco, and Bloomberg. He also hosts a daily podcast, ‘The Bubba Show.’ He is a 36-year member of the Chicago exchanges and was one of the original market makers in the SPX.

Read More »

Read More »

Crying Wolf – Precious Metals Supply and Demand

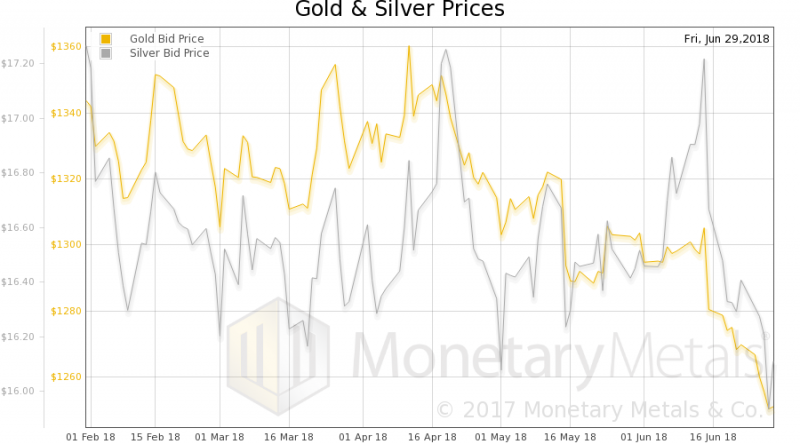

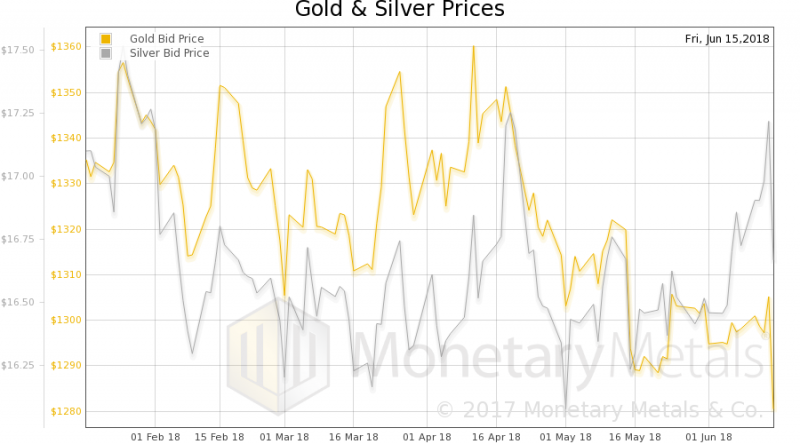

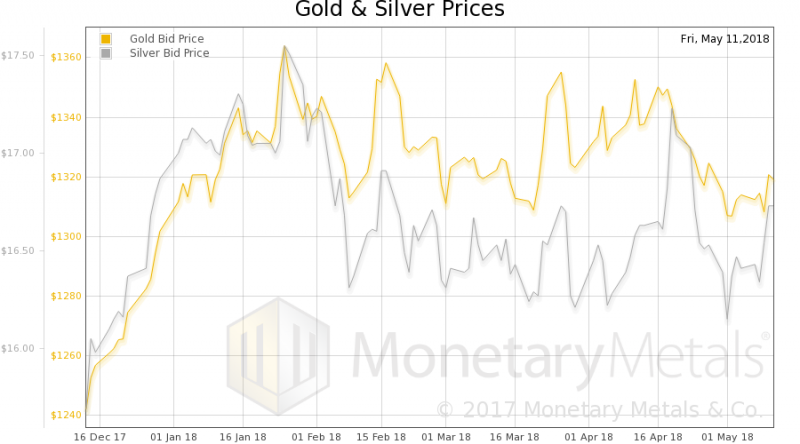

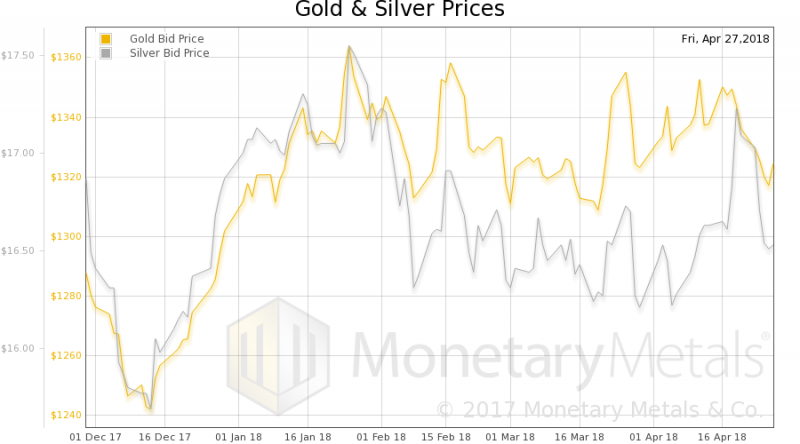

The price of gold fell another ten bucks and that of silver another 28 cents last week. Perspective: if you are waiting for the right moment to buy, the market is offering you a better deal than it did last week (literally, the market price of gold is at a 7.2% discount to the fundamental price vs. 4.6% last week). If you wanted to sell, this wasn’t a good week to wait. Which is your intention, and why?

Read More »

Read More »

Getting Their Pound of Flesh – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

The Gold Sector Remains at an Interesting Juncture

Technical Divergence Successfully Maintained. In an update on gold and gold stocks in mid June, we pointed out that a number of interesting divergences had emerged which traditionally represent a heads-up indicating a trend change is close (see: Divergences Emerge for the details). We did so after a big down day in the gold price, which actually helped set up the bullish divergence; this may have felt counter-intuitive, but these set-ups always do....

Read More »

Read More »

Gold – Macroeconomic Fundamentals Improve

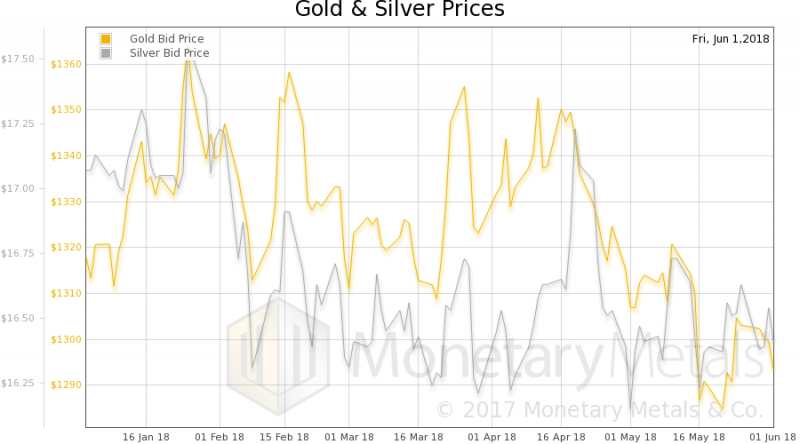

A Beginning Shift in Gold Fundamentals. A previously outright bearish fundamental backdrop for gold has recently become slightly more favorable. Ironically, the arrival of this somewhat more favorable situation was greeted by a pullback in physical demand and a decline in the gold price, after both had defied bearish fundamentals for many months by remaining stubbornly firm.

Read More »

Read More »

Black Holes for Capital – Precious Metals Supply and Demand

Race to the Bottom, Last week the price of gold fell $17, and that of silver $0.30. Why? We can tell you about the fundamentals. We can show charts of the basis. But we can’t get into the heads of the sellers. We can say that in the mainstream view, the dollar is rising. The dollar, in their view, is not measured in gold but in rupees in yuan and rubles. You know, all the superior forms of money…

Read More »

Read More »

An Idea Whose Time Has Come, Report 1 July 2018

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Lift-Off Not (Yet) – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold Divergences Emerge

Bad Hair Day Produces Positive Divergences. On Friday the ongoing trade dispute between the US and China was apparently escalated by a notch to the next level, at least verbally. The Trump administration announced a list of tariffs that are supposed to come into force in three week’s time and China clicked back by announcing retaliatory action. In effect, the US government said: take that China, we will now really hurt our own consumers! – and...

Read More »

Read More »

Retail Capitulation – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Industrial Commodities vs. Gold – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

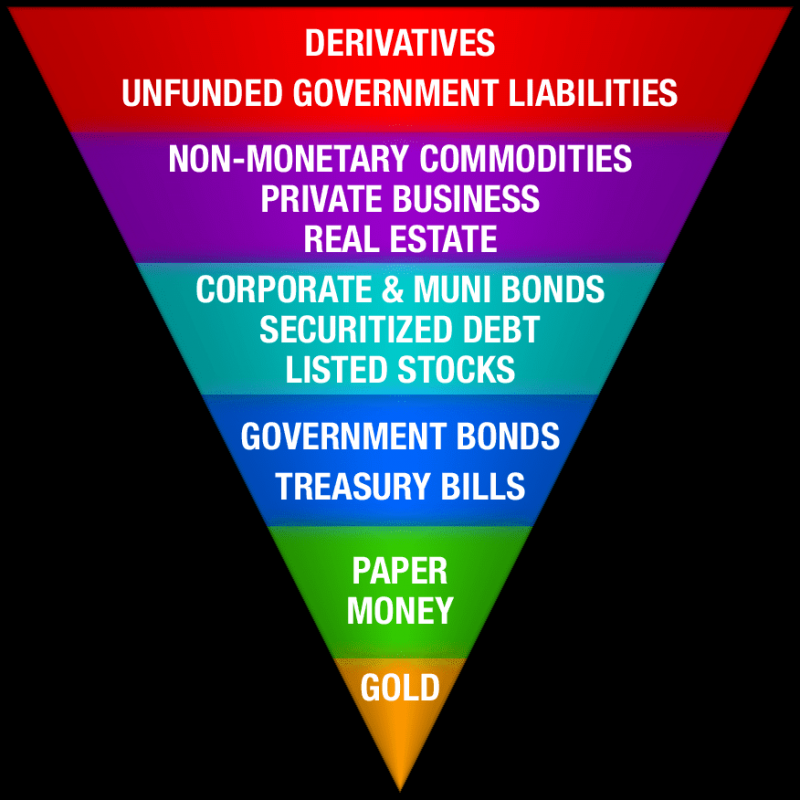

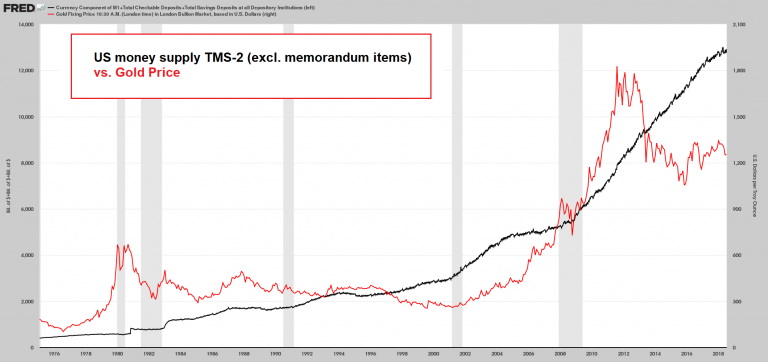

In Gold We Trust, 2018

The New In Gold We Trust Report is Here! As announced in our latest gold market update last week, this year’s In Gold We Trust report by our good friends Ronald Stoeferle and Mark Valek has just been released. This is the biggest and most comprehensive gold research report in the world, and as always contains a wealth of interesting new material, as well as the traditional large collection of charts and data that makes it such a valuable reference...

Read More »

Read More »

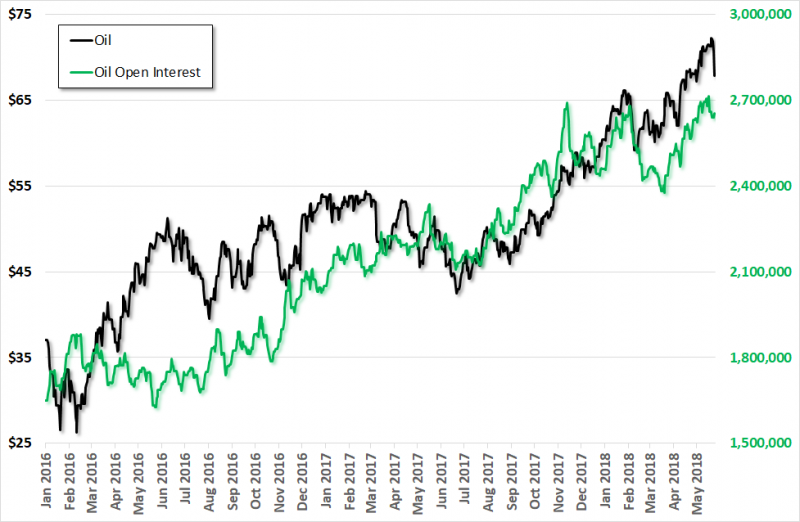

Wild Speculation in Crude Oil – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Why the Fundamental Gold Price Rose – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold and Gold Stocks – Conundrum Alert

Moribund Meandering

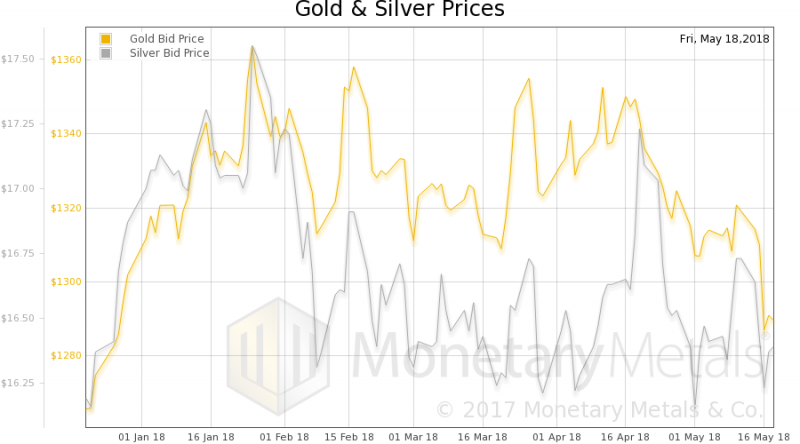

Earlier this week, the USD gold price was pushed rather unceremoniously off its perch above the $1300 level, where it had been comfortably ensconced all year after its usual seasonal rally around the turn of the year. For a while it seemed as though the $1,300 level may actually hold, but persistent US dollar strength nixed that idea. Previously many observers (too many?) expected gold to finally break out from its lengthy...

Read More »

Read More »

Scorn and Reverence – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Fear and Longing – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Wrong-Way Breakout in Silver – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Getting High on Bubbles

Back in the drug-soaked, if not halcyon, days known at the sexual and drug revolution—the 1960’s—many people were on a quest for the “perfect trip”, and the “perfect hit of acid” (the drug lysergic acid diethylamide, LSD). We will no doubt generate some hate mail for saying this, but we don’t believe that anyone ever attained that goal.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

7 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

7 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Wenig Gehalt, trotzdem glücklich?

Wenig Gehalt, trotzdem glücklich? -

unknown

unknown -

Gibt es den Cost-Average-Effect? Saidi zerlegt diesen Finanz-Mythos

Gibt es den Cost-Average-Effect? Saidi zerlegt diesen Finanz-Mythos -

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet!

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet! -

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”!

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”! -

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan -

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!”

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!” -

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

unknown

unknown

More from this category

A new era for silver?

A new era for silver?28 Aug 2024

A perfect storm in the making

A perfect storm in the making 15 Feb 2024

Gold Hits New All Time Highs

Gold Hits New All Time Highs2 Nov 2023

This Will Be The Biggest Theft of This Century

This Will Be The Biggest Theft of This Century10 Feb 2023

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton27 Oct 2022

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!16 Oct 2022

Rick Rule – Gold Helps Me Sleep at Night

Rick Rule – Gold Helps Me Sleep at Night14 Oct 2022

Were the UK pension funds just the canary in the gold mine?

Were the UK pension funds just the canary in the gold mine?9 Oct 2022

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!5 Oct 2022

Episode 5 of The M3 Report with Steve St. Angelo

Episode 5 of The M3 Report with Steve St. Angelo28 Sep 2022

US CPI Data Release Update

US CPI Data Release Update17 Sep 2022

What Problem Does Gold Solve?

What Problem Does Gold Solve?14 Sep 2022

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks10 Sep 2022

When markets forget that Central Banks cannot fix the world with interest rates

When markets forget that Central Banks cannot fix the world with interest rates4 Sep 2022

The Russian Gold Standard

The Russian Gold Standard28 Aug 2022

History Of Money and Evolution Suggests a Crash is Coming

History Of Money and Evolution Suggests a Crash is Coming27 Aug 2022

Why we couldn’t be happier that gold is boring

Why we couldn’t be happier that gold is boring23 Aug 2022

More energy blows are dealt to Europe, causing a cold chill to be even colder

More energy blows are dealt to Europe, causing a cold chill to be even colder13 Aug 2022

Will Silver Prices Go Up to $300?

Will Silver Prices Go Up to $300?11 Aug 2022

A muddled message from The Fed

A muddled message from The Fed29 Jul 2022