Tag Archive: PMI

FX Daily, June 01: CNY Softens after PBOC’s Move; Equities Advance on Stronger World Outlook

The US dollar fell against most major currencies following the PBOC's modest move to reduce the upward pressure on the yuan. Follow-through selling was seen earlier today, and sterling reached a new three-year high. However, the dollar found a bid in the European morning, while the Scandi currencies held on to most of their earlier gains.

Read More »

Read More »

FX Daily, April 23: Greenback Slips into the Weekend

Overview: Many narratives link the prospect of higher capital gains tax on about a third of 1% of Americans as the catalyst for losses in US equities yesterday (and Bitcoin) and weakness in some global shares today. Of the large markets in the Asia Pacific region, only Japan, which is reimposing a formal emergency in Tokyo, Osaka, and two other prefectures, fell.

Read More »

Read More »

FX Daily, March 1: Animal Spirits Roar Like a Lion to Start the New Month

Overview: Equities and bonds jump back. Most Asia Pacific markets advanced 1.5-2.5% after the regional MSCI benchmark dropped 3.65% before the weekend and 5.3% last week. The recovery in European stocks was even more impressive.

Read More »

Read More »

FX Daily, February 19: Equities Stabilizing While the Greenback Remains Under Pressure

Overview: The bond and equity markets are trying to stabilize ahead of the weekend. The dollar remains under pressure. In the Asia Pacific region, Hong Kong, China, and South Korean markets advanced, but most markets could not overcome the profit-taking pressures.

Read More »

Read More »

FX Daily, February 3: The Greenback Remains Resilient as the Bulls Drive Equities Higher

Equities have charged higher, and the greenback is mostly firmer. News that Draghi may become Italy's next Prime Minister has boosted Italian bonds. The PBOC unexpectedly drained liquidity, and this may have deterred buying of Chinese stocks, a notable exception in the regional rally.

Read More »

Read More »

FX Daily, February 1: Markets Snap Back

Global equities are snapping back today, while the greenback retained the strength seen last week that was attributed to safe-haven flows. The MSCI Asia Pacific Index snapped a four-day decline led by Hong Kong, South Korea, India, and Indonesia.

Read More »

Read More »

FX Daily, January 6: High Drama Weighs on the Greenback and Lifts Yields

Overview: One of the two Georgia Senate contests remains too close to call, but the market appears to be pricing in a Democrat sweep. The 10-year yield has punched above 1% but has offered the greenback little support. Yesterday, the dollar-bloc currencies rose to highs since early Q2 2018 and are extending those gains today.

Read More »

Read More »

Seizing The Dirt Shirt Title

In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn.

Read More »

Read More »

FX Daily, January 04: Rising Equities and Slumping Dollar Greet the New Year

Overview: The first day of the New Year, but it feels a lot like last year. The dollar is under pressure, and equities are higher. Outside of Japan and Malaysia, The MSCI Asia Pacific Index extended last week's 3.6% gain. It has not rallied for seven consecutive sessions.

Read More »

Read More »

FX Daily, November 4: Indecision Keeps Investors on Edge, but the Dollar Rides High

Initially, the markets built on Tuesday's price action, but as soon as a few counties in Florida indicated that it was not going to be the "blue wave," risk came off, and it was most evident in the bond and currency markets. Equities rallied in the Asia Pacific area, and all but Hong Kong, Australia, and Indonesia advanced.

Read More »

Read More »

FX Daily, October 05: Monday’s Dollar Blues

New actions to contain the virus are being taken in the US and Europe, but investors are looking past it and taking equities and risk assets, in general, higher to start the new week. MSCI Asia Pacific recouped most of last week's 0.7% loss with gains of move than 1% in Japan, Hong Kong, South Korea, and Australia.

Read More »

Read More »

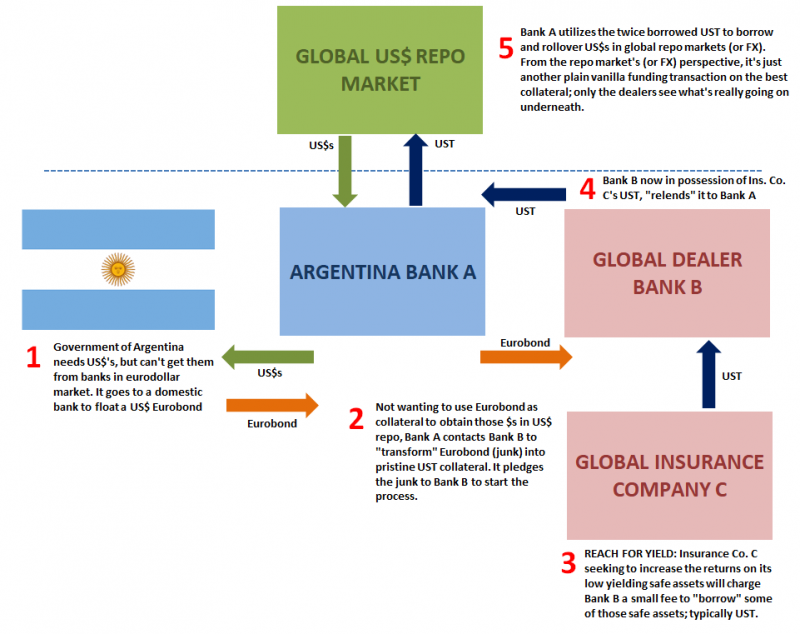

What’s Zambia Got To With It (everything)

As one of Africa’s largest copper producers, it seemed like a no-brainer. Financial firms across the Western world, pension funds from the US or banks in Europe, they lined up for a bit of additional yield. This was 2012, still global recovery on the horizon – at least that’s what “they” all kept saying.

Read More »

Read More »

FX Daily, September 23: Trying to Find Solid Ground

A more stable tone is evident in the capital markets after the S&P 500, and NASDAQ rose more than one percent yesterday. Japan returned from a two-day holiday, and local shares slipped fractionally, while China, Hong Kong, South Korea, and Australian shares rallied. India and Taiwan fell.

Read More »

Read More »

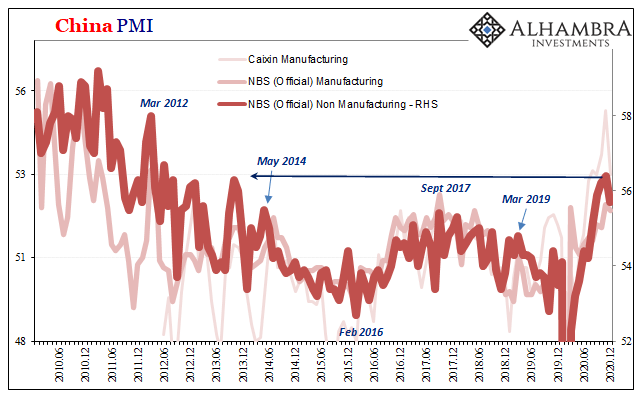

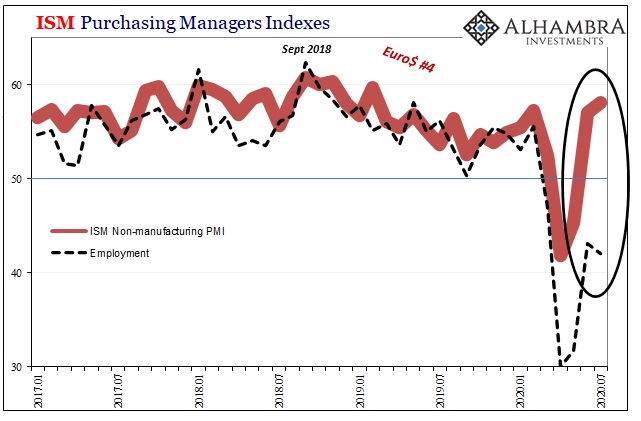

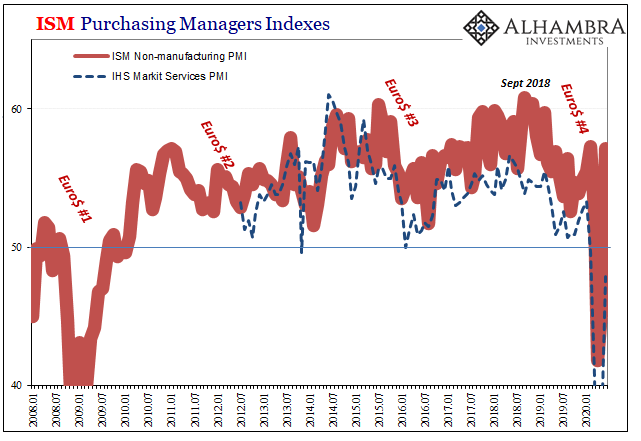

Purchasing Managers Indigestion

There’s already doubt given how the two major series supposedly measuring the same thing seemingly can’t agree. If the rebound was truly robust, it would show up unambiguously everywhere. But IHS Markit’s purchasing managers indices struggled to get back above 50 in July, barely getting there, suggesting the economy might be slowing or even stalling way too close to the bottom.

Read More »

Read More »

FX Daily, July 24: Strong PMIs Have Limited Impact as Profit-Taking Hits Equities

US stocks stumbled yesterday, and the S&P 500 nearly gave back the week's gains with its roughly 1.25% loss, the largest of the month. The NASDAQ 100 fell to two-week lows. Slower cloud growth at Microsoft and a delay in the next generation of chips at Intel were among the drags.

Read More »

Read More »

Gratuitously Impatient (For a) Rebound

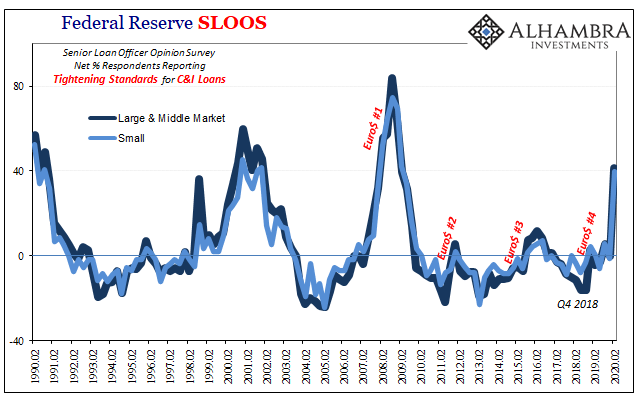

Jay Powell’s 2018 case for his economic “boom”, the one which was presumably behind his hawkish aggression, rested largely upon the unemployment rate alone. A curiously thin roster for a period of purported economic acceleration, one of the few sets joining that particular headline statistic in its optimism resides in the lower tiers of all statistics.

Read More »

Read More »

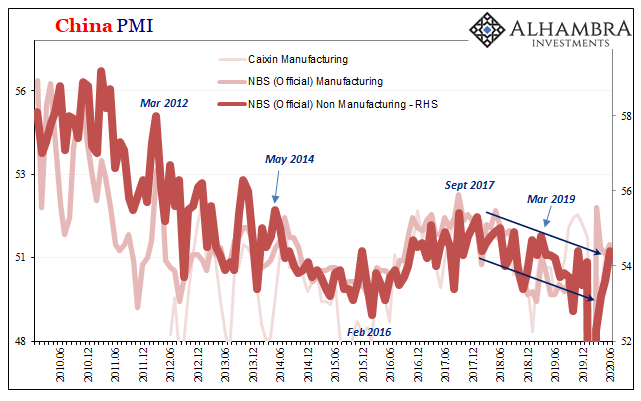

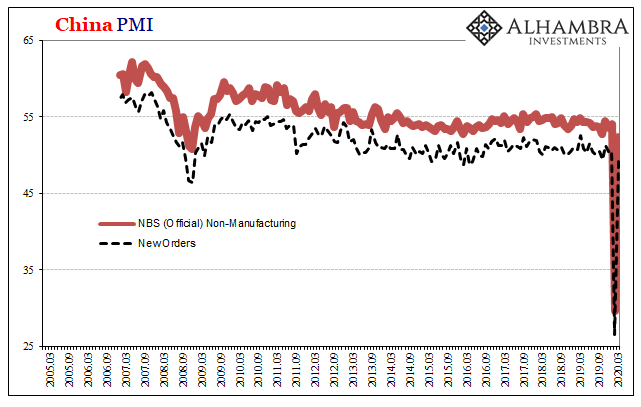

What The PMIs Aren’t Really Saying, In China As Elsewhere

China’s PMI’s continue to impress despite the fact they continue to be wholly unimpressive. As with most economic numbers in today’s stock-focused obsessiveness, everything is judged solely by how much it “surprises.” Surprises who? Doesn’t matter; some faceless group of analysts and Economists whose short-term modeling has somehow become the very standard of performance.

Read More »

Read More »

Not COVID-19, Watch For The Second Wave of GFC2

I guess in some ways it’s a race against the clock. What the optimists are really saying is the equivalent of the old eighties neo-Keynesian notion of filling in the troughs. That’s what government spending and monetary “stimulus” intend to accomplish, to limit the downside in a bid to buy time. Time for what? The economy to heal on its own.

Read More »

Read More »

China’s Back!

The Washington Post began this week by noting how the US economy seems to have lost its purported zip just when it needed that vitality the most. Never missing a chance to take a partisan swipe, of course, still there’s quite a lot of truth behind the charge. An actual economic boom produces cushion, enough of one that President Trump and his administration may have been counting on it when opting for full-blown shutdown.

Read More »

Read More »

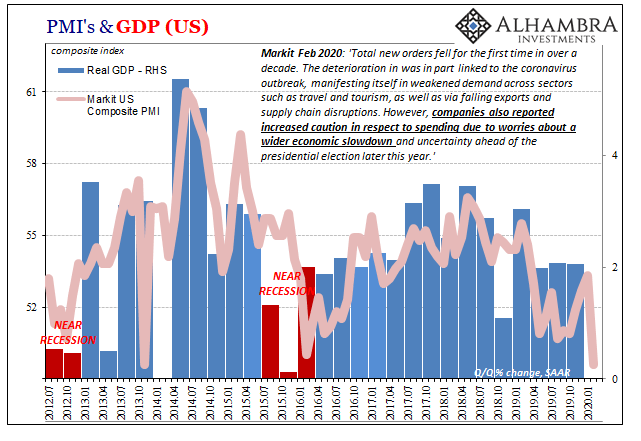

Take Your Pick of PMI’s Today, But It’s Not Really An Either/Or

Take your pick, apparently. On the one hand, IHS Markit confirmed its flash estimate for the US economy during February. Late last month the group had reported a sobering guess for current conditions. According to its surveys of both manufacturers and service sector companies, the system stumbled badly last month, the composite PMI tumbling to 49.6 from 53.3 in January.

Read More »

Read More »