Tag Archive: On Economy

Trade War Game On!

“Things sure are getting exciting again, ain’t they?” The remark was made by a colleague on Tuesday morning, as we stepped off the elevator to grab a cup of coffee.

Read More »

Read More »

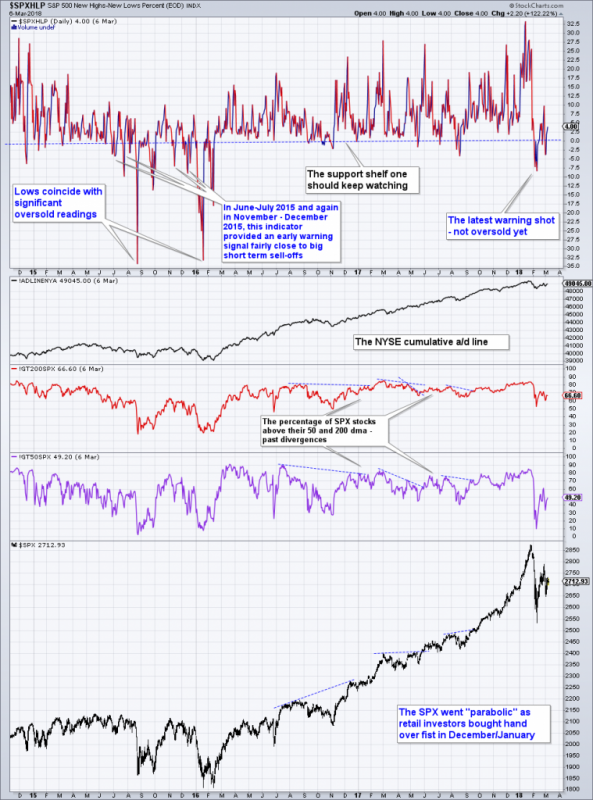

US Equities – Mixed Signals Battling it Out

Readers may recall that we looked at various market internals after the sudden sell-offs in August 2015 and January 2016 in order to find out if any of them had provided clear advance warning. One that did so was the SPX new highs/new lows percent index (HLP). Below is the latest update of this indicator.

Read More »

Read More »

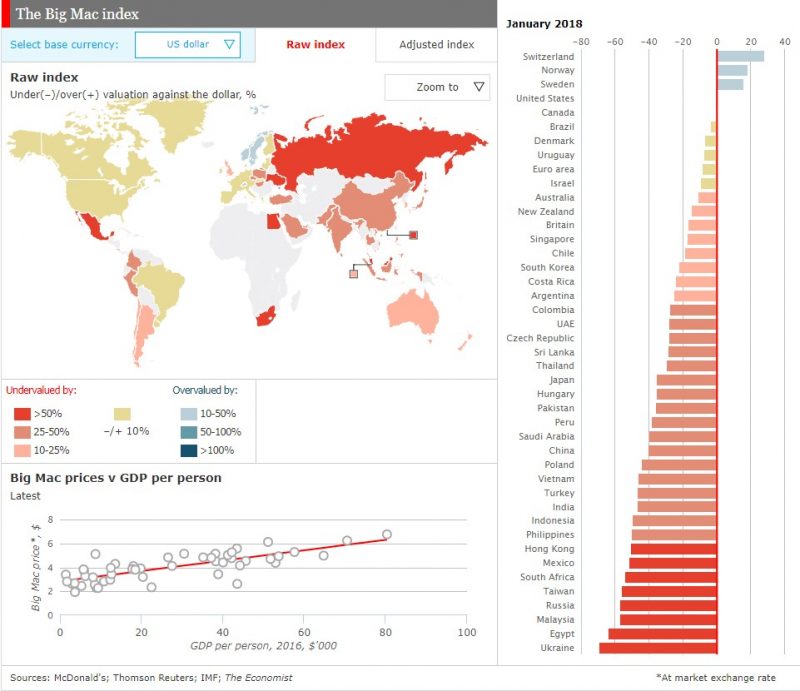

Purchasing Power Parity or Nominal Exchange Rates?

“An alternative exchange rate – the purchasing power parity (PPP) conversion factor – is preferred because it reflects differences in price levels for both tradable and non-tradable goods and services and therefore provides a more meaningful comparison of real output.” – the World Bank

Read More »

Read More »

Socialism and Capital Consumption

We have been promising to get back to the topic of capital destruction, which we put on hiatus for the last several weeks to make our case that the interest rate remains in a falling trend. Today, we have a different way of looking at capital destruction.

Read More »

Read More »

Update on the Modified Davis Method

Frank Roellinger has updated us with respect to the signals given by his Modified Ned Davis Method (MDM) in the course of the recent market correction. The MDM is a purely technical trading system designed for position-trading the Russell 2000 index, both long and short (for details and additional color see The Modified Davis Method and Reader Question on the Modified Ned Davis Method).

Read More »

Read More »

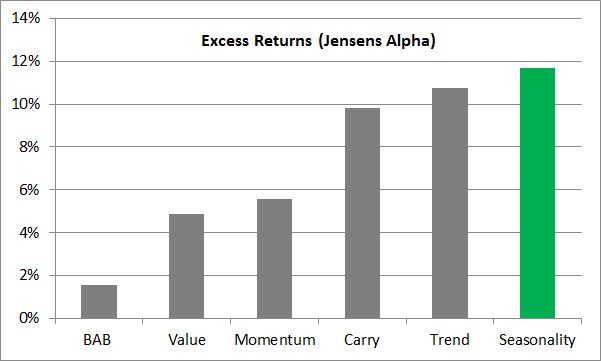

Market Efficiency? The Euro is Looking Forward to the Weekend!

As I have shown in previous issues of Seasonal Insights, various financial instruments are demonstrating peculiar behavior in the course of the week: the S&P 500 Index is typically strong on Tuesdays, Gold on Fridays and Bitcoin on Tuesdays (similar to the S&P 500 Index). Several readers have inquired whether currencies exhibit such patterns as well. Are these extremely large markets also home to such statistical anomalies, or is market efficiency...

Read More »

Read More »

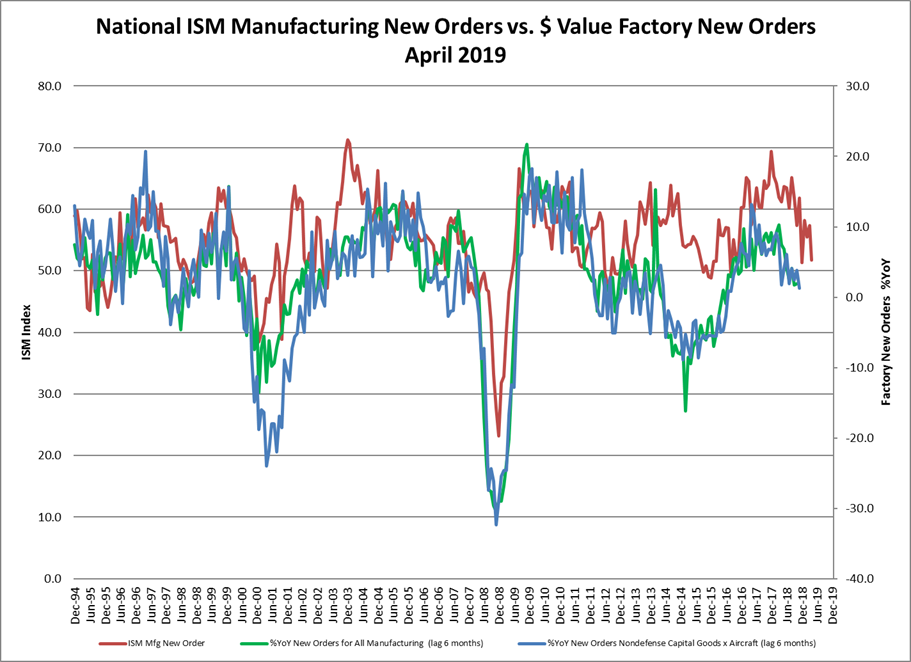

Strange Economic Data

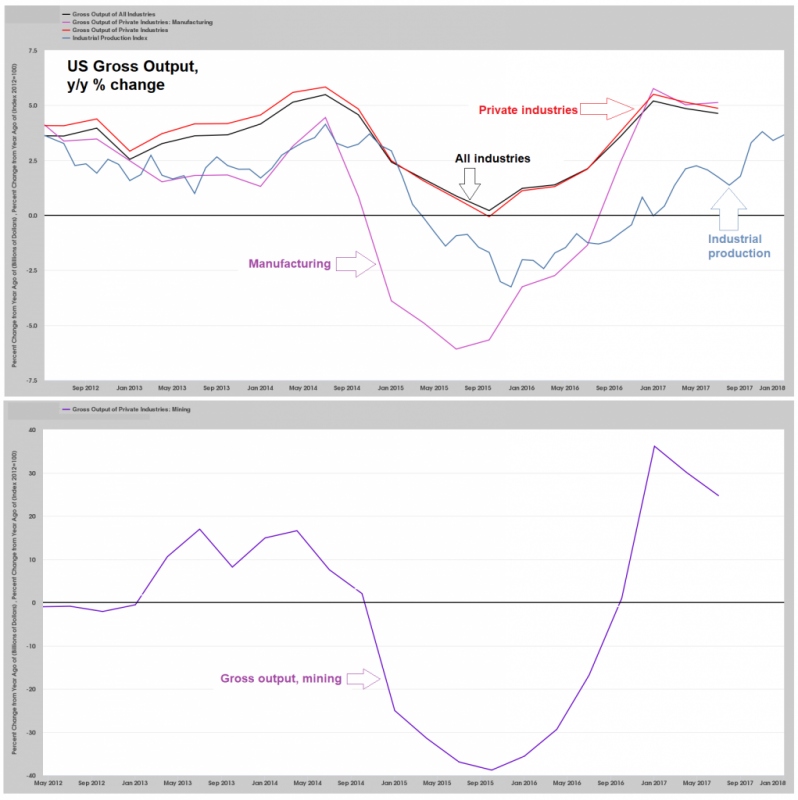

Contrary to the situation in 2014-2015, economic indicators are currently far from signaling an imminent recession. We frequently discussed growing weakness in the manufacturing sector in 2015 (which is the largest sector of the economy in terms of gross output) – but even then, we always stressed that no clear recession signal was in sight yet. US gross output (GO) growth year-on-year, and industrial production (IP) – note that GO continues to be...

Read More »

Read More »

What Kind of Stock Market Purge Is This?

Down markets, like up markets, are both dazzling and delightful. The shock and awe of near back-to-back 1,000 point Dow Jones Industrial Average (DJIA) free-falls is indeed spectacular. There are many reasons to revel in it. Today we shall share a few. To begin, losing money in a multi-day stock market dump is no fun at all. We’d rather get our teeth drilled by a dentist. Still, a rapid selloff has many positive qualities.

Read More »

Read More »

When Budget Deficits Will Really Go Vertical

United States Secretary of Treasury Steven Mnuchin has a sweet gig. He writes rubber checks to pay the nation’s bills. Yet, somehow, the rubber checks don’t bounce. Instead, like magic, they clear. How this all works, considering the nation’s technically insolvent, we don’t quite understand. But Mnuchin gets it. He knows exactly how full faith and credit works – and he knows plenty more.

Read More »

Read More »

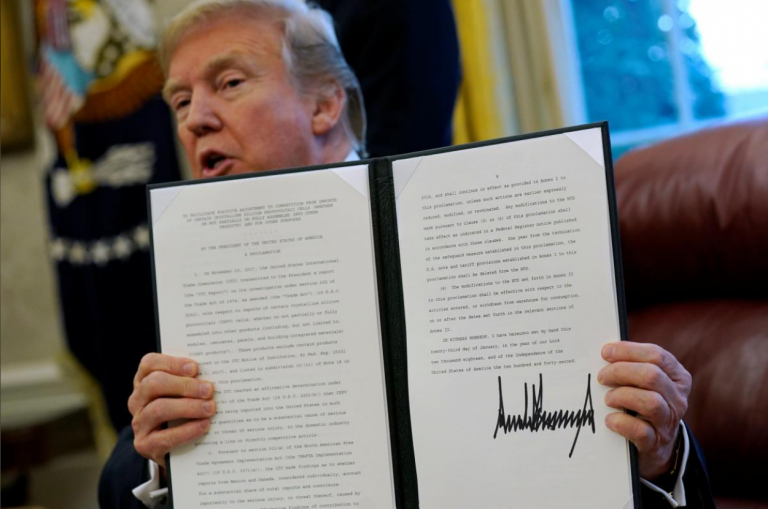

The Donald Saves the Dollar

The world is full of bad ideas. Just look around. One can hardly blink without a multitude of bad ideas coming into view. What’s more, the worse an idea is, the more popular it becomes. Take Mickey’s Fine Malt Liquor. It’s nearly as destructive as prescription pain killers. Yet people chug it down with reckless abandon.

Read More »

Read More »

The FOMC Meeting Strategy: Why It May Be Particularly Promising Right Now

As readers know, investment and trading decisions can be optimized with the help of statistics. One way of doing so is offered by the FOMC meeting strategy. A study published by the Federal Reserve Bank of New York in 2011 examined the effect of FOMC meetings on stock prices. The study concluded that these meetings have a substantial impact on stock prices – and contrary to what most investors would probably tend to expect, before rather than after...

Read More »

Read More »

Tax Reform and Trump’s Chinese Trade Deficit Conundrum

Most things come easier said than done. Take President Trump’s posture on trade with China. Trump doesn’t want a bigger trade deficit with China. He wants a smaller trade deficit with China. In fact, reducing the trade deficit with China is one of Trump’s promises to Make America Great Again.

Read More »

Read More »

As the Controlled Inflation Scheme Rolls On

American consumers are not only feeling good. They are feeling great. They are borrowing money – and spending it – like tomorrow will never come. On Monday the Federal Reserve released its latest report of consumer credit outstanding. According to the Fed’s bean counters, U.S. consumers racked up $28 billion in new credit card debt and in new student, auto, and other non-mortgage loans in November.

Read More »

Read More »

2018: The Weakest Year in the Presidential Election Cycle Has Begun

Our readers are probably aware of the influence the US election cycle has on the stock market. After Donald Trump was elected president, a particularly strong rally in stock prices ensued. Contrary to what many market participants seem to believe, trends in the stock market depend only to a negligible extent on whether a Republican or a Democrat wins the presidency.

Read More »

Read More »

Several Simple Suppositions and Suspicions for 2018

The New Year is nearly here. The slate’s been wiped clean. New hopes, new dreams, and new fantasies, are all within reach. Today is the day to make a double-fisted grab for them. Without question, 2018 will be the year in which everything happens exactly as it should. Some things you will be able to control, others will be well beyond your control.

Read More »

Read More »

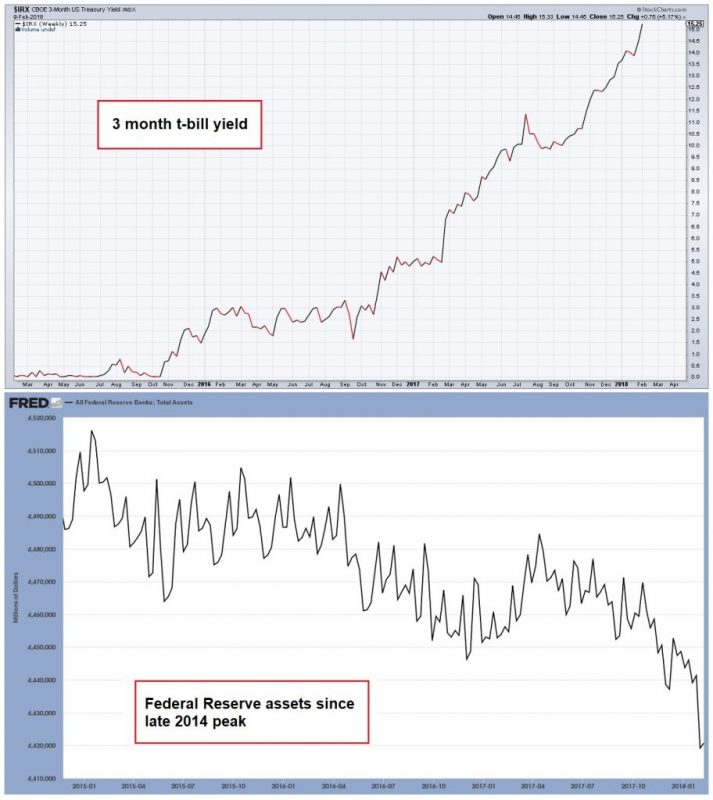

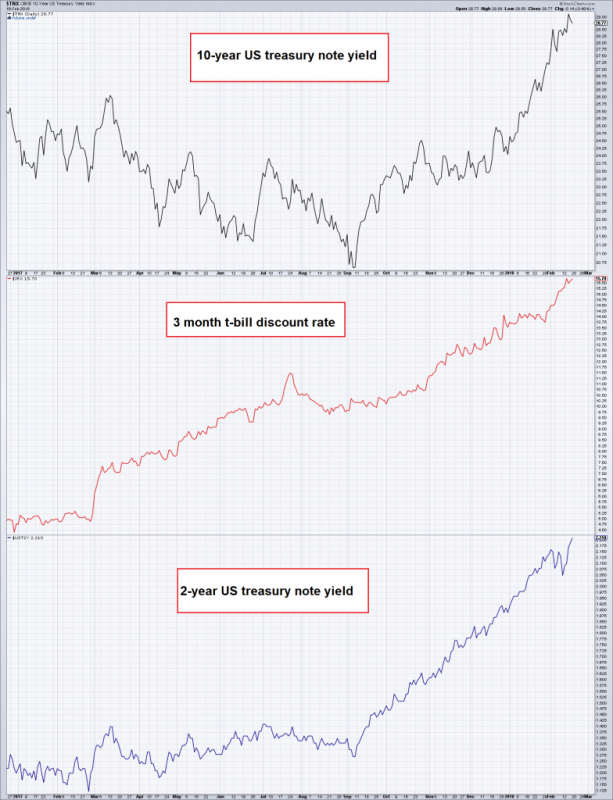

Why Monetary Policy Will Cancel Out Fiscal Policy

Good cheer has arrived at precisely the perfect moment. You can really see it. Record stock prices, stout economic growth, and a GOP tax reform bill to boot. Has there ever been a more flawless week leading up to Christmas?

Read More »

Read More »

How the Asset Bubble Could End – Part 1

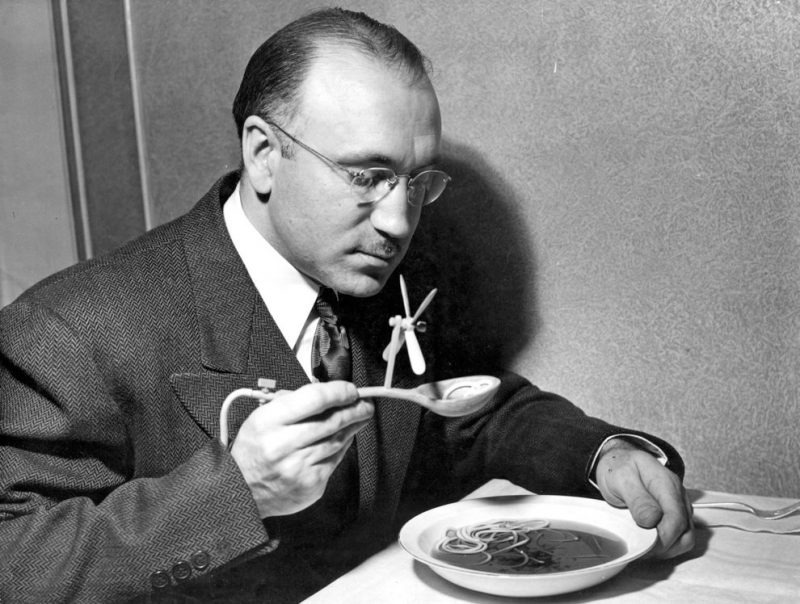

We recently pondered the markets while trying out our brand-new electric soup-cooling spoon (see below). We are pondering the markets quite often lately, because we believe tail risk has grown by leaps and bounds and we may be quite close to an important juncture, i.e., the kind of pivot that can generate both a lot of excitement and a lot of regret all around.

Read More »

Read More »

The Rug Yank Phase of Fed Policy

The political differences of today’s two leading parties are not over ultimate questions of principle. Rather, they are over opposing answers to the question of how a goal can be achieved with the least sacrifice. For lawmakers, the goal is to promise the populace something for nothing, while pretending to make good on it.

Read More »

Read More »

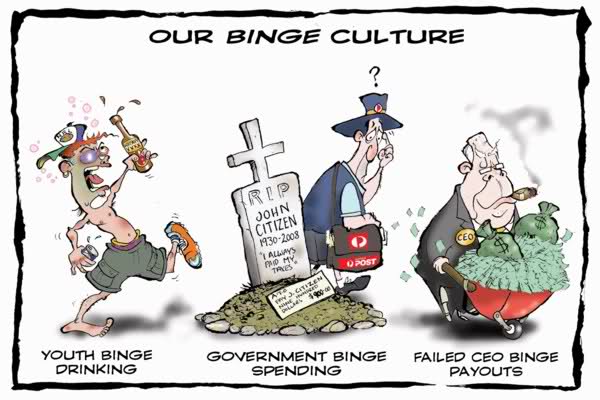

The Party of Spend More vs. the Party of Tax Less

The Senate just passed a 500-page tax reform bill. Assuming it lives up to its promise, it will cut taxes on corporations and individuals. Predictably, the Left hates it and the Right loves it. I am writing to argue why the Right should hate it (no, not for the reason the Left does, a desire to get the rich).

Read More »

Read More »

Japan: It isn’t What the Media Tell You

For the past few decades, Japan has been known for its stagnant economy, falling stock market, and most importantly its terrible demographics. For almost three decades, Japan’s GDP growth has mostly been less than 2%, has been negative for several of these years, and has often hovered close to zero. The net result is that its GDP is almost at the same level as 25 years ago.

Read More »

Read More »