Tag Archive: OIL

FX Daily, September 30: Nervous Calm

Quarter and month-end considerations could be overwhelming other factors today. Turnaround Tuesday saw early gains in US equities fade. Asia Pacific shares were mixed, with the Nikkei (-1.5%) and Australia (-2.3%) bear the brunt of the selling, while China, Hong Kong, Taiwan, and India rose.

Read More »

Read More »

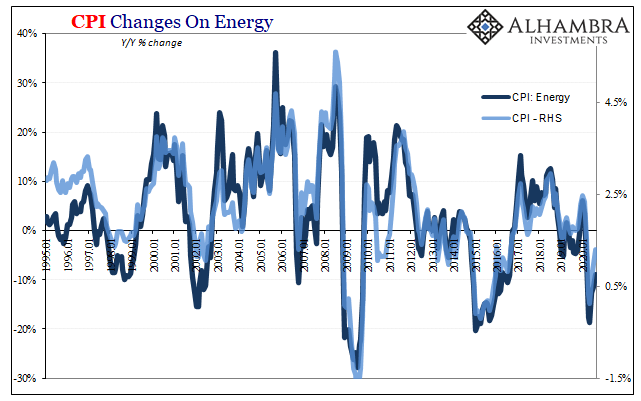

Inflation Karma

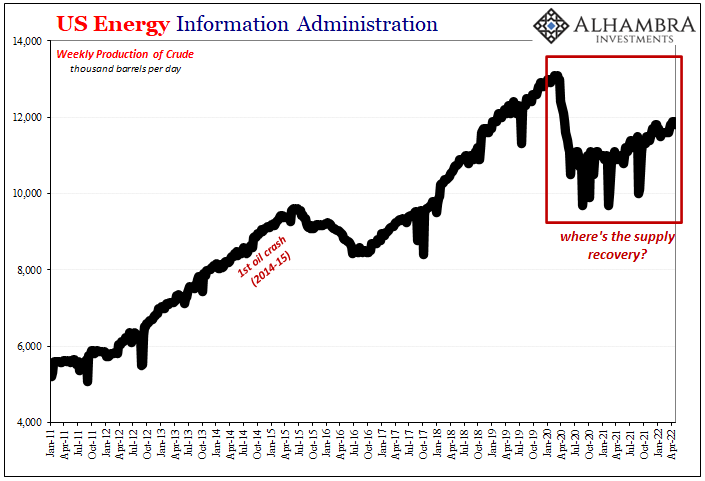

There is no oil in the CPI’s consumer basket, yet oil prices largely determine the rate by which overall consumer prices are increasing (or not). WTI sets the baseline which then becomes the price of motor fuel (gasoline) becoming the energy segment. As energy goes, so do headline CPI measurements.

Read More »

Read More »

Bottleneck In Japanese

Japan’s yen is backward, at least so far as its trading direction may be concerned. This is all the more confusing especially over the past few months when this rising yen has actually been aiding the dollar crash narrative while in reality moving the opposite way from how the dollar system would be behaving if it was really happening.

Read More »

Read More »

FX Daily, August 26: Hurricane Laura Lifts Oil Prices

A consolidative tone has emerged after US equity benchmarks reached new highs yesterday. The MSCI Asia Pacific Index had reached seven-month highs on Tuesday, but Japan, China, and Australian stocks saw modest profit-taking today. European shares are recouping yesterday's minor loss, and US shares are flat.

Read More »

Read More »

FX Daily, July 13: Risk Appetites Firm, but the Greenback is Mixed

Equities began the week on a firm note in the Asia Pacific region. The Nikkei gained more than 2%, and the profit-taking seen in China ahead of the weekend was a one-day phenomenon. The Shanghai Composite rose 1.8%, and the Shenzhen Composite surged 3.5%. Taiwan and South Korea markets also rallied more than 1%.

Read More »

Read More »

FX Daily, June 8: Monday Blues: Consolidation Threatened

Overview: The MSCI Asia Pacific Index rose for a sixth consecutive session. Japan, Taiwan, Singapore, and Indonesian markets advanced more than 1%. European bourses are mixed, with the peripheral shares doing better than the core, leaving the Dow Jones Stoxx 600 about 0.5% lower near midday after surging 2.5% ahead the weekend. US shares are firm, as is the 10-year yields, hovering near 92 bp.

Read More »

Read More »

FX Daily, June 2: Greenback’s Slide Continues

Overview: Liquidity trumps everything else. US equities shrugged off the national guard being called into action in nearly a third of US states, and the S&P 500 closed yesterday at nearly three-month highs. Asia Pacific markets followed suit. Most markets in the region rose by more than 1%. The notable exceptions were Australia and China, where benchmarks rose by 0.2%-0.3%. The Dow Jones Stoxx 600 is up more than 1% in the European morning.

Read More »

Read More »

FX Daily, May 28: Escalating Tensions, Calm Markets

Overview: The US Secretary of State's announcement that the autonomy of Hong Kong could no longer be affirmed did not derail the rally in US equities. However, the threat of an executive order against social media companies may be discouraging follow-through buying, leaving US equities little changed ahead of the open. In contrast, Asia Pacific and European equities are mostly higher.

Read More »

Read More »

FX Daily, May 14: Risk Appetites Wane

Overview: Risk appetites have been gradually waning this week. US equity losses mounted yesterday after Tuesday's late sell-off. Asia Pacific equities were off, with many seeing at least 1.5% drops. Europe's Dow Jones Stoxx 600 is off a little more to double this week's decline and leaves it in a position to be the biggest drop since panicked days in mid-March.

Read More »

Read More »

FX Daily, May 12: Markets Tread Water, Looking for New Focus

Overview: Investors seem to be in want of new drivers, leaving the capital markets with little fresh direction. While Japanese and China equities were little changed, several markets in the region, including Australia, Hong Kong, Taiwan, and India, were off more than 1%. European bourses are mostly higher after the Dow Jones Stoxx 600 slipped 0.4% yesterday.

Read More »

Read More »

New Month, New Trends?

The dollar fell against all the major currencies and most of the emerging market currencies last week. The Dollar Index fell by 1.3%, the biggest loss since the last week of March, and posted its lowest close in nearly three weeks ahead of the weekend. There seemed to be a change in the market after key equity benchmarks, like the MSCI ACWI Index of both emerging and developed markets put in a recovery high in the middle of last week.

Read More »

Read More »

FX Daily, April 28: Oil’s Slides before Steadying, while Easing of Lockdowns Support Risk-Taking

Overview: Equities are building on yesterday's gains. The MSCI Asia Pacific Index rose 2% yesterday and edged higher today. Shanghai and Austalia stand out as exceptions. In Europe, the Dow Jones Stoxx 600 is extending yesterday's 1.8% gain to reach its best level since March 11. Today would be the fourth advance in the past five sessions. US shares are firmer.

Read More »

Read More »

FX Daily, April 27: Equities Rally and the Dollar Eases to Start the Week

Overview: Global equities are beginning the new week on an upbeat note. All the markets in the Asia Pacific region rallied, led by more than 2% gains in the Nikkei and Taiwan. European bourses are higher. All the industry groups are participating and financials and consumer discretionary leading the way.

Read More »

Read More »

FX Daily, April 22: Investors Catch Collective Breath, but Sentiment remains Fragile

Overview: Risk-appetites appear to have stabilized for the moment. Most equity markets are higher. Japan and Malaysia were exceptions, but the MSCI Asia Pacific Index rose for the first time this week. In Europe, the Dow Jones Stoxx 600 is recouping about a third of yesterday's loss.

Read More »

Read More »

FX Daily, April 21: Oil Drilled Below Zero, Equity Rally Stalls, Greenback Advances

Overview: Oil's wild ride has been joined by two other developments that are keeping investors off-balance. First, reports suggest that North Korea's Kim Jong-Un maybe in critical condition after surgery. He apparently was absent from last week's events celebrating his grandfather.

Read More »

Read More »

FX Daily, April 16: Markets Brace for another Jump in US Weekly Jobless Claims

Overview: Equity losses in the US appeared to drag most Asia Pacific markets lower today, with China and India the notable exceptions. European bourses are higher, and the only energy sector is a drag on the Dow Jones Stoxx 600, which is around 1% higher in late morning turnover, while US shares are also trading firmer. Asia Pacific 10-year benchmark yields eased.

Read More »

Read More »

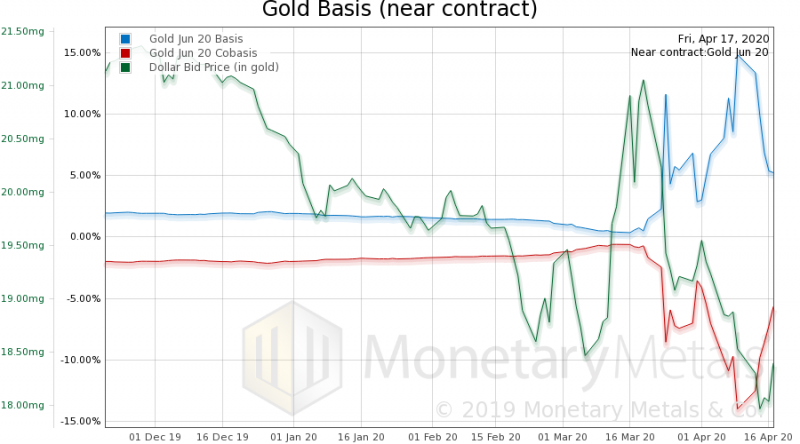

The Global Engine Is Still Leaking

An internal combustion engine that is leaking oil presents a difficult dilemma. In most cases, the leak itself is obscured if not completely hidden. You can only tell that there’s a problem because of secondary signs and observations.If you find dark stains underneath your car, for example, or if your engine smells of thick, bitter unpleasantness, you’d be wise to consider the possibility.

Read More »

Read More »

Cool Video: CNBC Asia

As the markets were re-opening in Asia earlier today, I joined Martin Soong and Sir Jegarajah on CNBC Asia. I had returned from a business trip and visited our summer house on the Jersey shore for what I thought was going to be a weekend more than a month ago.

Read More »

Read More »

FX Daily, April 10: Eight Things to Know about Global Capital Markets on Good Friday

Most of the financial centers in Europe and North America are closed today for the Good Friday holiday. Many markets in Europe will also be closed on Monday. Here is a summary of key developments.

Read More »

Read More »