Tag Archive: newslettersent

Stagnation Is Not Just the New Normal–It’s Official Policy

Japan is a global leader is how to gracefully manage stagnation. Although our leadership is too polite to say it out loud, they've embraced stagnation as the new quasi-official policy. The reason is tragi-comically obvious: any real reform would threaten the income streams gushing into untouchably powerful self-serving elites and fiefdoms.

Read More »

Read More »

FX Daily, October 03: Dollar Retains Firm Tone, Spanish Markets Stabilize

Firm US interest rates and a strong manufacturing ISM yesterday help support the greenback, while disappointing construction PMI in the UK weighs on sterling. The euro briefly slipped below $1.17 in Asia for the first time in six weeks. It has recovered toward the highs seen in North America yesterday (~$1.1760). There are several euro option strikes that may be in play today. In the euro, between $1.1750 and $1.1775, there are nearly 2.9 bln euros...

Read More »

Read More »

Another Look at Why the Return to Capital is Low

(summary of presentation based on my book, Political Economy of Tomorrow, delivered to Bank Credit Analyst conference yesterday)Alice laughed. There is no use trying; she said, “one can’t believe impossible things.” I dare say you haven’t had much practice, said the queen. When I was younger, I always did it for half an hour a day. Why sometimes I’ve believed as many as six impossible things before breakfast.

Read More »

Read More »

“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without dumping a huge and unwelcome...

Read More »

Read More »

Gold Matches S&P 500 Performance In First 3 Quarters; Up 12% 2017 YTD

Gold climbs over 12% in YTD, matching S&P500 performance. Palladium best performing market, surges 36% 2017 YTD. Gold outperforms Nikkei 225, Euro Stoxx 50, FTSE and ISEQ. Geo-political concerns including Trump and North Korea supporting gold. Safe haven demand should push gold higher in Q4. Owning physical gold not dependent on third party websites and technology remains essential.

Read More »

Read More »

Eurozone: Distinct Lack of Good Faith

The erosion of social order in any historical or geographic context is gradual; until it isn’t. Germany has always followed a keen sense of this process, having experienced it to every possible extreme between the World Wars. Hyperinflationary collapse doesn’t happen overnight; it took three years for the Weimar mark to disintegrate, and then Weimar Germany. Even Nazism wasn’t all it once. What was required was continued denial especially on the...

Read More »

Read More »

Fed Quack Treatments are Causing the Stagnation

Bleeding the Patient to Health. There’s something alluring about cure-alls and quick fixes. Who doesn’t want a magic panacea to make every illness or discomfort disappear? Such a yearning once compelled the best and the brightest minds to believe the impossible for over two thousand years.

Read More »

Read More »

Rappel: Que sont devenus les excédents de la balance courante de la Suisse

Le professeur Tille, membre du conseil de banque de la BNS nous présente un graphique ci-dessous avec une courbe verte qui est l’accumulation des excédents de la balance courante de la Suisse. Rappelons que les soldes de TARGET2 sont précisément les soldes -excédents/déficits- de la balance courante. Les excédents de l’Allemagne serviraient à combler les déficits des autres, en échange bien évidemment de reconnaissances de dettes...

Read More »

Read More »

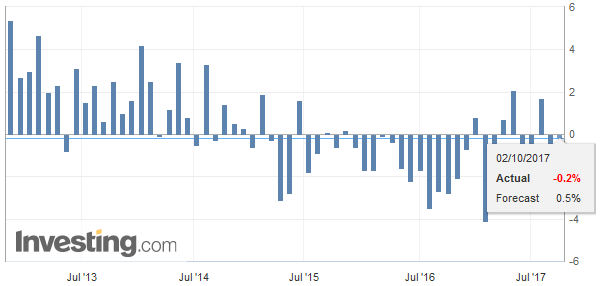

Swiss Retail Sales, August 2017: -0.6 percent Nominal and -0.3 percent Real

Turnover in the retail sector fell by 0.6% in nominal terms in August 2017 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.3% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

FX Daily, October 02: Dollar Upbeat to Start Fourth Quarter

The US dollar is broadly higher as the quarter-end positioning losses seen at the end of last week area reversed. Developments in the US are seen as dollar positive, while the Catalonia-Madrid conflict, and slightly softer EMU manufacturing PMI weighs on the euro. The UK also reported a disappointing manufacturing PMI, and more differences with the Tory government are taking a toll on sterling. Japan's Tankan Survey was stronger than expected, but...

Read More »

Read More »

FX Weekly Preview: Changing Dynamics

We agree with the consensus that the markets are in a transition phase. The consensus sees this transition phase as a new economic convergence. European and Japanese economic growth continues above trend. Large emerging markets, including BRICs, are also expanding. Central banks are gradually moving away from the extreme accommodation.

Read More »

Read More »

Switzerland Tourism Names New Director – Martin Nydegger

The top Swiss tourism body has announced that Martin Nydegger will take over from his predecessor Jürg Schmid as head of the organisation. The 46-year-old Nydegger has been a member of Switzerland Tourism’s executive board since 2008. A selection committee within Switzerland Tourism’s Board of Directors selected Nydegger for the post earlier this week, and announced the decision on Friday after the Swiss cabinet approved the move. He will formally...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX firmed Friday, but capped off a bad week overall. US jobs data this Friday is unlikely to provide much clarity on Fed policy, though we think it remains on track to hike again in December. The Fed’s balance sheet reduction will start this month. We remain negative on EM, and believe selling pressures are likely to persist in Q4.

Read More »

Read More »

Great Graphic: Potential Head and Shoulders Bottom in the Dollar Index

This Great Graphic was composed on Bloomberg. t shows the recent price action of the Dollar Index. There seems to be a head and shoulders bottoming pattern that has been traced out over the last few weeks. The right shoulder was carved last week, and today, the Dollar Index is pushing through the neckline, which is found by connecting the bounces after the shoulders were formed.

Read More »

Read More »

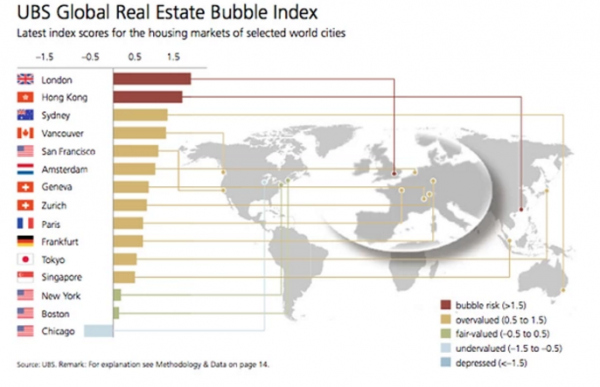

Here Are The Cities Of The World Where “The Rent Is Too Damn High”

In ancient times, like as far back as the 1990s, housing prices grew roughly inline with inflation rates because they were generally set by supply and demand forces determined by a market where buyers mostly just bought houses so they could live in them. Back in those ancient days, a more practical group of world citizens saw their homes as a place to raise a family rather that just another asset class that should be day traded to satisfy their...

Read More »

Read More »

Swiss 2018 health premiums unveiled. Brace yourself.

Yesterday, the Swiss government released health insurance premiums for 2018. There are price hikes across the board, particularly in French-speaking Switzerland. Next year, the price of standard compulsory insurance for an adult with a CHF 300 deductible will rise 4% on average. The cost varies by canton. Prices rises range from 1.6% to 6.4%. Health premiums for children will rise by an average of 5%, more than those for adults.

Read More »

Read More »

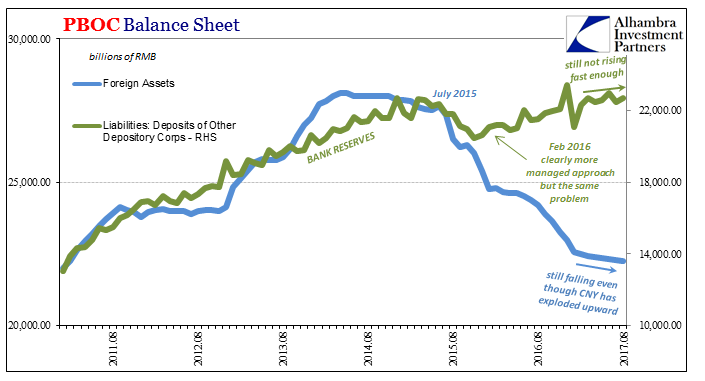

Not Political Risk For China, But Unwelcome Reality

China’s Communist Party concluded the Third Plenum of its 18th Congress in November 2013. It was the much-discussed reform mandate that many in the West took to mean another positive step toward neo-liberal reform. At its center was supposed to be a greater role for markets particularly in the central task of resource allocation. In some places, the Party’s General Secretary Xi Jinping was hailed as the great Chinese reformer.

Read More »

Read More »

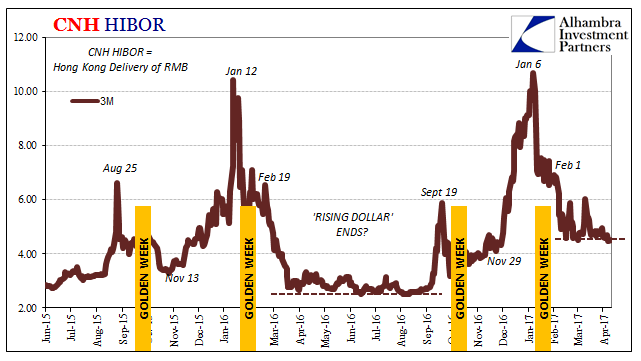

Location Transformation or HIBORMania

The Communist Chinese established their independence on September 21, 1949. The grand ceremony commemorating the political change was held in Tiananmen Square on October 1 that year. The following day, October 2, the Resolution on the National Day of the People’s Republic of China was passed making October 1to be China’s National holiday. It typically kicks off the second of China’s Golden Week holidays. The first relates to the Chinese New Year...

Read More »

Read More »

Evolving Thoughts on Inflation

In early 2005, Greenspan said that the fact that long-term rates were lower despite the Fed's campaign to raise short-term rates was a "conundrum." Many rushed to offer the Fed Chair an explanation of the conundrum, which given past cycles may not have been such an enigma in the first place.

Read More »

Read More »

The Global Housing Bubble Is Biggest In These Cities

Two years ago, when UBS looked at the world's most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk.What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank's Global Real Estate Bubble Index, it found that eight of the world's largest cities are now subject to a massive speculative housing bubble.

Read More »

Read More »