Tag Archive: newslettersent

Helvetia chairman resigns amid ongoing FINMA probe

The chairman of the Swiss insurance company Helvetia, Pierin Vincenz, has resigned. The Swiss financial regulator, FINMA, is currently investigating his activities during his time in charge of the Raiffeisen bank. In a statementexternal link released on Monday, Helvetia said Vincenz had stepped down with immediate effect.

Read More »

Read More »

How the Asset Bubble Could End – Part 2

There is just one more positioning indicator we want to mention: after surging by around $126 billion since March of 2016, NYSE margin debt has reached a new all time high of more than $561 billion. The important point about this is that margin debt normally peaks well before the market does. Based on this indicator, one should not expect major upheaval anytime soon. There are exceptions to the rule though – see the caption below the chart.

Read More »

Read More »

The Economy Likes Its IP Less Lumpy

Industrial Production rose 3.4% year-over-year in November 2017, the highest growth rate in exactly three years. The increase was boosted by the aftermath of Harvey and Irma, leaving more doubt than optimism for where US industry is in 2017. For one thing, of that 3.4% growth rate, more than two-thirds was attributable to just two months.

Read More »

Read More »

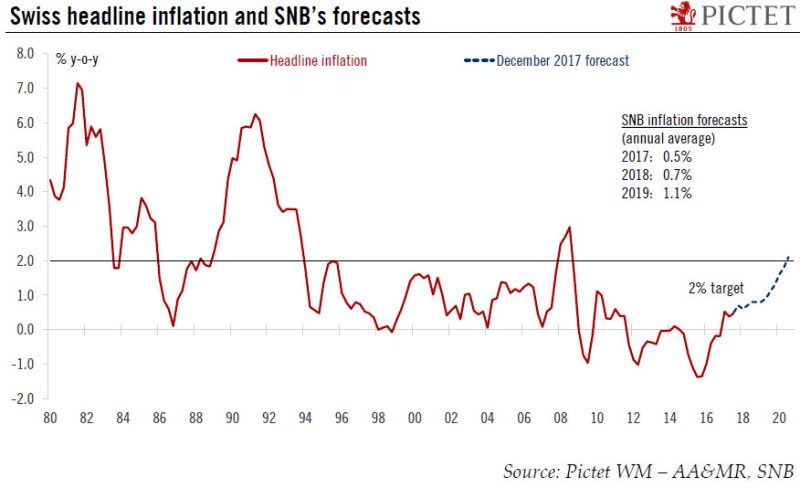

Increasingly optimistic on Swiss outlook

At its December meeting, the Swiss National Bank (SNB) left its accommodative monetary policy unchanged. More specifically, the SNB maintained the target range for the three-month Libor at between - 1.25% and-0.25% and the interest rate on sight deposits at a record low of - 0.75%. The SNB also reiterated its commitment to intervene in the foreign exchange market if needed, taking into account the “overall currency situation”.

Read More »

Read More »

Lawsuit seeks freezing of Tezos Foundation assets

A fourth Tezos lawsuit filed in the United States has called on Californian courts to freeze an estimated $1 billion (CHF990 million) of investor assets sitting in a Swiss-based foundation. Law firm Block & Leviton argues that the recent departure of a Tezos Foundation director and the apparent replacement of the entity’s auditor gives weight to its demand for funds, derived from an initial public offering (ICO) in July, to be frozen.

Read More »

Read More »

Swiss tourism – sharp rises and falls from some countries over the summer

The number of visitors to Switzerland rose 6% this summer, but this headline figure hides some steep rises and falls. From May to October 2017, 11 million people holidayed in Switzerland, 644,000 more than the over same period in 2016.

Read More »

Read More »

Regulating Cryptocurrencies–and Why It Matters

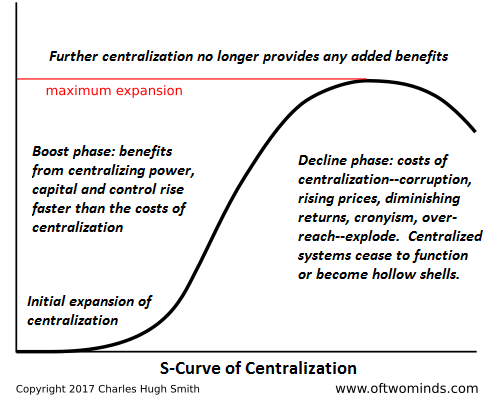

Nations that attempt to limit cryptocurrencies' ability to solve these problems will find that protecting high costs and systemic friction will grind their economies into dust. There's a great deal of confusion right now about the regulation of cryptocurrencies such as bitcoin. Many observers seem to confuse "regulation" and "banning bitcoin," as if regulation amounts to outlawing bitcoin.

Read More »

Read More »

Chinese Are Not Tightening, Though They Would Be Thrilled If You Thought That

The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the 28-day).

Read More »

Read More »

How the Asset Bubble Could End – Part 1

We recently pondered the markets while trying out our brand-new electric soup-cooling spoon (see below). We are pondering the markets quite often lately, because we believe tail risk has grown by leaps and bounds and we may be quite close to an important juncture, i.e., the kind of pivot that can generate both a lot of excitement and a lot of regret all around.

Read More »

Read More »

In Unprecedented Intervention, Swiss Central Bank Bails Out Firm That Prints Swiss Banknotes

In the most ironic story of the day, the company that makes the paper that Swiss banknotes are printed on was just bailed out by the money-printing, stock-purchasing, plunge-protecting, savior-of-global equities…Swiss National Bank. While The SNB has a long and checkered history of buying shares in companies… as we have detailed numerous times.

Read More »

Read More »

Swiss National Bank acquires majority stake in Landqart AG

Yesterday, the Swiss National Bank (SNB) acquired 90% of the shares in Landqart AG. The remaining 10% of the share capital will be purchased by Orell Füssli Holding Ltd. The vendor is a subsidiary of Fortress Paper Ltd, which is listed on the Toronto stock exchange.

Read More »

Read More »

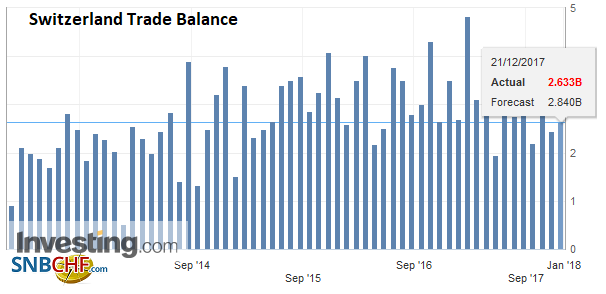

Swiss Trade Balance November 2017: Foreign Trade in Verve

Swiss foreign trade proved dynamic in November 2017. After correction of working days, exports grew by 9.5% and imports even 16.4% year on year, both boosted by rising prices. In real terms, they increased by 4.4 and 6.8%, respectively. The balance commercial loop with a surplus of 2.7 billion francs.

Read More »

Read More »

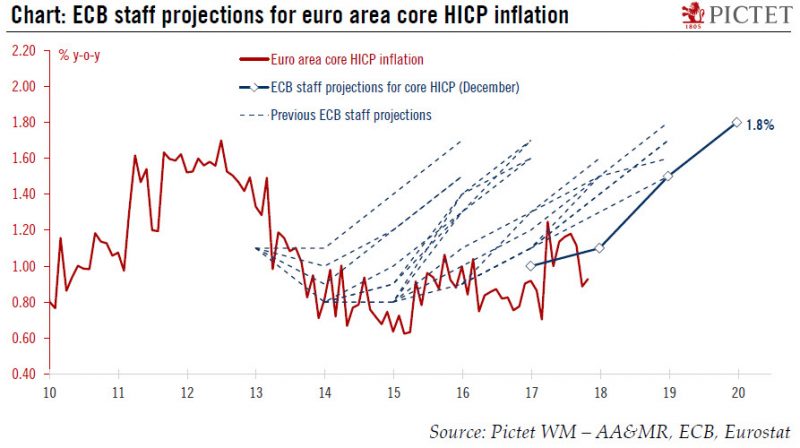

ECB closer to the 2% inflation target than meets the eye

During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation. The key word was “confidence” - in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its mandate.

Read More »

Read More »

Switzerland should not act alone against tax havens

Switzerland must not go to war on its own against offshore tax havens in the wake of the Panama Papers scandal, the lower chamber of parliament has agreed. It prefers concerted action with other countries and wants to see the results of existing measures. The House of Representatives on Thursday rejected two motions and two parliamentary questions, supported by the leftwing Social Democrats and Greens, which had called for financial transactions...

Read More »

Read More »

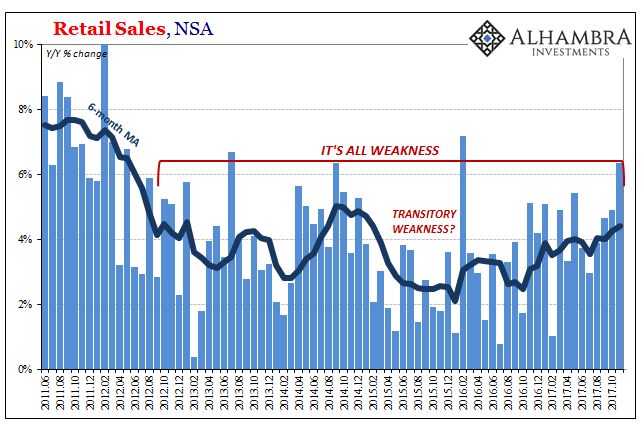

Retail Sales Bounce (Way) Too Much

Retail sales had a good month of November, or at least what counts as decent over the last five and a half years. Total retail sales (unadjusted) rose 6.35% last month, up from 4.9% (revised higher) in October. It was the highest rate of growth since the 29-day month of February 2016. For retailers, what matters is that it comes at the start of the Christmas shopping season.

Read More »

Read More »

Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well.

Read More »

Read More »

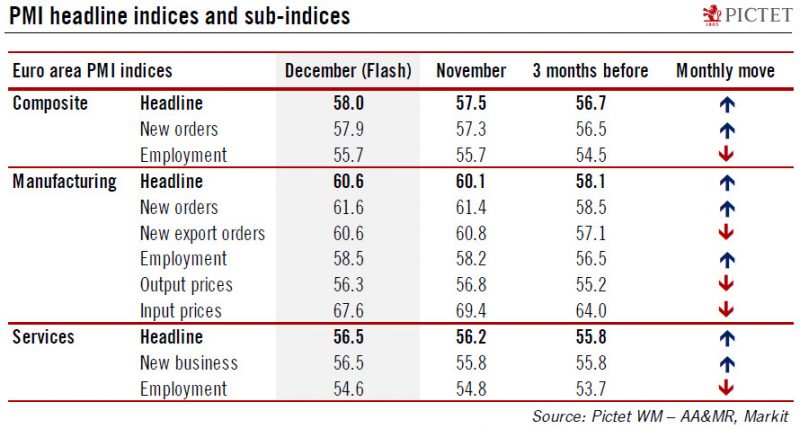

Euro area: The sky is the limit

Momentum in the euro area picked up further at the end of the year. The flash composite purchasing managers’ index (PMI) increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2). The improvement was once again broad-based across sectors.

Read More »

Read More »

China tops export destination ranking for Swiss SMEs

A study commissioned by Switzerland Global Enterprise (SGE) indicates that China is the most attractive export destination for Swiss small and medium enterprises (SMEs). A total of 107 countries were evaluated using a set of 15 criteria that included market size, market potential, export volume and average market growth in recent years.

Read More »

Read More »

A Gold Guy’s View Of Crypto, Bitcoin, And Blockchain

Bitcoin was on my radar far back as 2011, but for years, I didn’t think much of it. It was a curiosity. Nothing more. Sort of like the virtual money you use in World of Warcraft or something. In 2015, looking deeper, I slowly (not the sharpest tool in the shed) arrived at that “aha” inflection point that most advocates of honest money arrive at. I realized that a distributed public ledger has the power to change, well, everything.

Read More »

Read More »

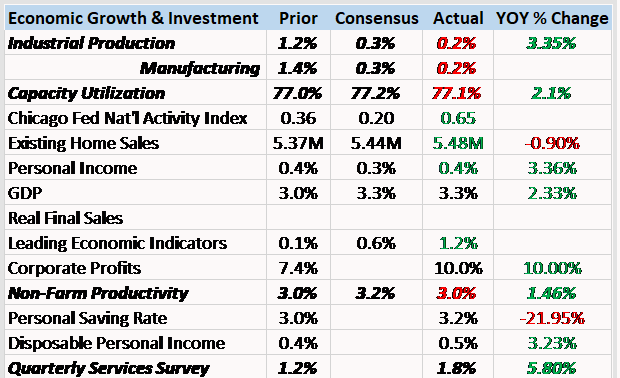

Bi-Weekly Economic Review: Animal Spirits Haunt The Market

The economic data over the last two weeks continued the better than expected trend. Some of the data was quite good and makes one wonder if maybe, just maybe, we are finally ready to break out of the economic doldrums. Is it possible that all that new normal, secular stagnation stuff was just a lack of animal spirits?

Read More »

Read More »