Tag Archive: newslettersent

Silver Bullion: Once and Future Money

Silver Bullion: Once and Future Money. “Silver is as much a monetary metal as gold” – Rickards. U.S. following footsteps of Roman Empire which collapsed due to currency debasement (must see table). Silver bullion is set to rally due to a combination of supply/demand fundamentals, geopolitical pressures creating safe haven demand, and increasing inflation expectations as confidence in central banking and fiat money erodes.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX closed Friday on a mixed note, but still posted solid gains for the week as a whole. Best performers last week were ZAR, PLN, and CZK while the worst were ARS, PHP, and IDR. The bearish dollar environment remains intact and so we see further gains for EM FX this week. However, we continue to warn that divergences within EM are likely to assert themselves.

Read More »

Read More »

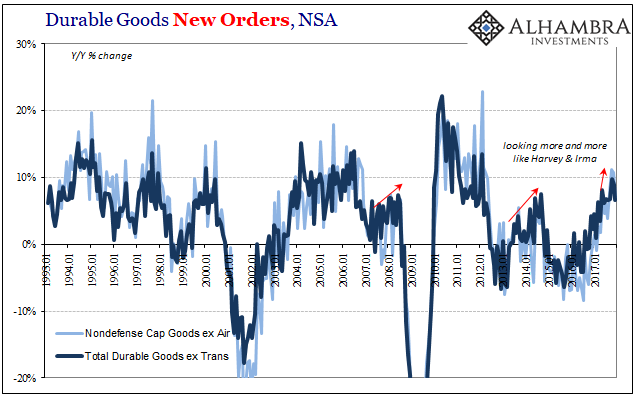

December Durable Goods

Durable and capital goods orders and shipments all increased in December by growth rates consistent with those registered in the months leading up to the big storms Harvey and Irma. We continue to find evidence that accelerated growth in October and November was nothing more than the anticipated after-effects cleaning up after those hurricanes.

Read More »

Read More »

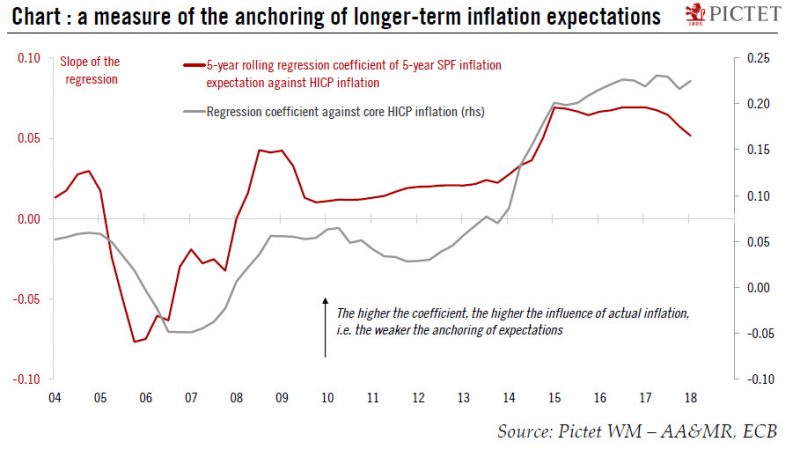

Europe chart of the week – The beginning of the ‘re-anchoring’

Professional Forecasters survey shows a substantial improvement in economic growth and employment, consistent with the ECB’s own assessment.The ECB will be pleased by its latest Survey of Professional Forecasters (SPF). The headlines are unambiguously positive, fuelled by the uninterrupted improvement in economic data, with expectations of GDP growth and HICP inflation revised higher for the next couple of years, sometimes substantially.

Read More »

Read More »

Economics minister praises Swiss tax system

Swiss Economics Minister Johann Schneider-Ammann has downplayed concerns that Swiss-based American firms might relocate to the United States in the wake of tax reform. Speaking in Davos ahead of a visit by US President Donald Trump, Schneider-Ammann said that if he were head of an American company he would think twice before such a relocation, since there is no guarantee the tax breaks will still be in place a few years from now.

Read More »

Read More »

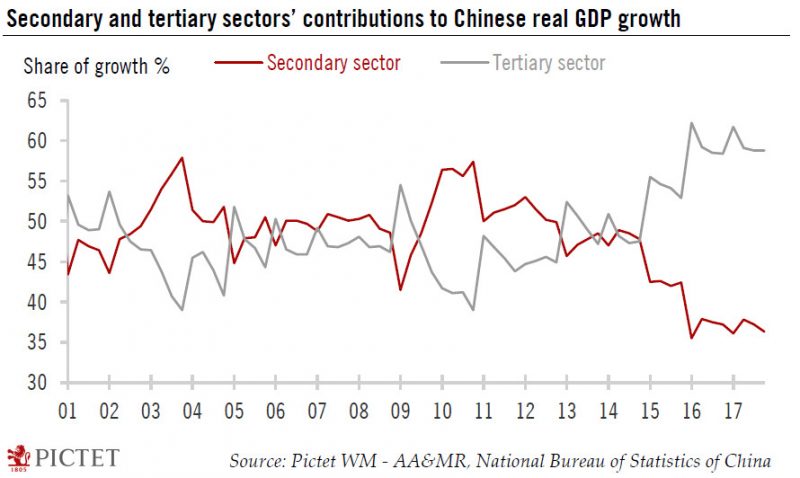

Forget It, China’s Not Booming

Jeffrey Snider, head of global investment research at Alhambra Investments, says China is in fact not growing rapidly, which sounds disheartening for commodity investors. He reckons a crucial investment metric has weakened, pointing to slower economic expansion.

Read More »

Read More »

Swiss president says Trump meeting was productive

Swiss President Alain Berset says his meeting with US President Donald Trump at the World Economic Forum in Davos was productive and frank. Trump took credit for making Switzerland “even richer”. "You have a lot of our stock in the United States so I have helped to make Switzerland even richer," Trump said shortly after the meeting. He said a booming US economy was good for Switzerland.

Read More »

Read More »

Emerging Markets: What Changed

Korea policymakers have asked state-owned banks and companies to limit the issuance of global bonds. Malaysia's central bank hiked rates for the first time in four years. Pakistan’s central bank unexpectedly hiked rates for the first time in over four years. Moody’s raised its outlook on Russia’s Ba1 rating from stable to positive. Argentina’s central bank surprised markets with its second straight 75 bp rate cut.

Read More »

Read More »

Initial Thoughts on Draghi

ECB President Draghi was unable to arrest the US dollar's slide and euro's surge. But he did not try particularly hard. While many investors are a bit stumped by the pace and magnitude of the dollar's slump, Draghi seemed to imply that it was perfectly understandable given the recovery of the eurozone economy.

Read More »

Read More »

Did Mnuchin Signal a Policy Shift Today?

Did US Treasury Secretary Mnuchin signal a change in the US dollar policy? Probably not. As Mnuchin and President Trump have done before, a distinction was drawn between short- and longer-term perspectives. In the short-term, a weaker dollar says Mnuchin, is good for US trade and "other opportunities". In the longer-term, Mnuchin explicitly acknowledged, "the strength of the dollar is a reflection of the strength of the US economy."

Read More »

Read More »

China: 2018 GDP forecast revised up

The Chinese economy ended 2017 on a strong note. In Q4 2017, China’s GDP amounted to Rmb23.4 trillion (about USD3.7 trillion), rising 1.6% over the previous quarter and 6.8% year-over-year (y-o-y) in real terms. Full-year GDP came in at Rmb82.7 trillion (about USD12.9 trillion), growing by 6.9% in real terms and beating the consensus forecast as well as our own estimate (both at 6.8%).

Read More »

Read More »

FX Daily, January 26: Trump-Inspired Dollar Short Squeeze Fades Quickly

It was dramatic. Following the BOJ and ECB's rather mild rebuke of dollar's depreciation, US President Trump cautioned that his Treasury Secretary comments were taken out of context, and in ant event, he, the President ultimately favored a strong dollar. The dollar, which had continued fall after Draghi's post-ECB meeting comments, shot higher in the US afternoon in response to Trump's comments.

Read More »

Read More »

Income inequality in Switzerland remains stable after redistribution

Income inequality in Switzerland has remained stable according to a report published by Switzerland’s Federal Statistical Office. A key measure of inequality involves dividing the income share of the top 20% by that of the bottom 20%, a measure known as S80/S20. 1 is complete equality.

Read More »

Read More »

Davos – My Personal Experience of the $100,000 Event, $60 Burgers, Massive Inequality and the Blockchain Revolution

Davos elite hear warnings of complacency akin to 2007 as economic risks grow. Toxic mix of infallible belief, arrogance, megalomania and economic ignorance. Some express concern economies are vulnerable due to imbalances, trade, geo-political tensions. Soros: Trump creating ‘mafia state’ & ‘set on a course towards nuclear war’ with N Korea. Bond bear market, rising interest rates and massive $233 trillion debt are some of the many threats to...

Read More »

Read More »

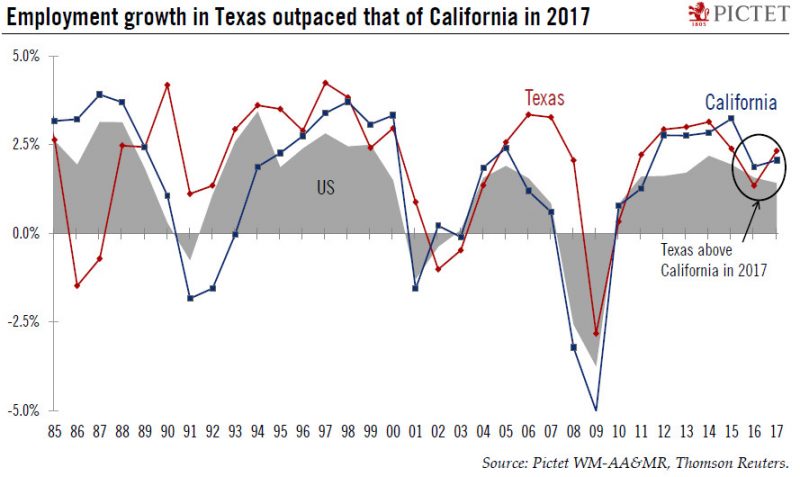

US chart of the week – Texas rebounds

One of the major rivalries in the US is that between California and Texas, the country’s biggest and second-biggest states respectively in GDP terms. They have different growth drivers (most notably Silicon Valley in California and the energy industry in Texas), and they also have different political landscapes – and local taxation regimes. But which one’s ahead when it comes to employment growth?

Read More »

Read More »

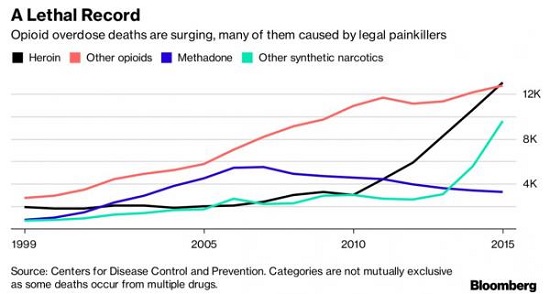

Can We Finally Have an Honest Discussion about the Opioid Crisis?

The economy no longer generates secure, purposeful jobs for the working class, and so millions of people live in a state of insecure despair. The opioid epidemic is generating a lot of media coverage and hand-wringing, but few if any solutions, and this is predictable: if you don't face up to the causes, then you can't solve the problem.

Read More »

Read More »

Tax Reform and Trump’s Chinese Trade Deficit Conundrum

Most things come easier said than done. Take President Trump’s posture on trade with China. Trump doesn’t want a bigger trade deficit with China. He wants a smaller trade deficit with China. In fact, reducing the trade deficit with China is one of Trump’s promises to Make America Great Again.

Read More »

Read More »

FX Daily, January 25: And Now, a Word from Draghi

With a backdrop of concern about US protectionism and a possible abandonment of the 23-year old strong dollar policy, and among the weakest sentiment toward the dollar in at least a decade, the ECB takes center stage. What a turn of events for Mr. Draghi, the President of the European Central Bank.

Read More »

Read More »

Switzerland still competitive despite US tax reforms, says economics minister

Swiss Economics Minister Johann Schneider-Ammann says he does not think sweeping US tax reforms will drive American firms from Switzerland. In an interview with the Schweiz am Wochenende newspaper on Saturday, he said Switzerland also has competitive advantages for companies.

Read More »

Read More »

New poll on vote to axe Swiss broadcast fee suggests rejection

A poll run by the media group Tamedia shows a clear majority in favour of rejecting the initiative, dubbed “No Billag”, which aims to end Switzerland’s broadcasting fee. This poll follows one done in December 2017, which showed a majority in favour of the initiative.

Read More »

Read More »