Tag Archive: newslettersent

Wood not labelled properly in Switzerland

Five out of six Swiss companies selling wood or wooden products fail to declare the type and origin of the wood correctly – despite a legal requirement that has been in place since 2012. As the Federal Consumer Affairs Bureauexternal link announced on Tuesday, it conducted 120 inspections last year and found that only 17% of the audited companies had declared their products correctly.

Read More »

Read More »

Greek politicians named in Novartis scandal

Greece's parliament has linked ten prominent politicians to a bribery scandal involving Swiss drug-maker Novartis. The Greek parliament announced on Tuesday the results of a judicial investigation into alleged bribes paid to public officials by Basel-based Novartisexternal link over nearly a decade to boost subscriptions of their products at public hospitals.

Read More »

Read More »

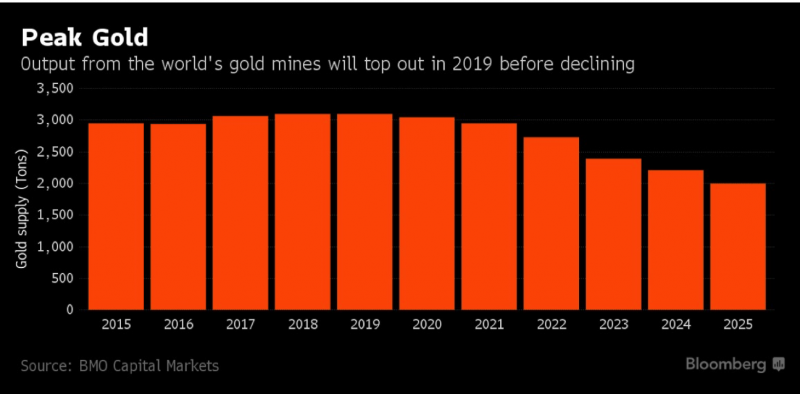

Peak Gold: Global Gold Supply Flat In 2017 As China Output Falls By 9 percent

Peak Gold: 2017 Supply Flat As China Output Falls By 9%. China gold production falls by 9% to 420.5t in 2017. Chinese gold demand rose 4% to 953.3t in same period. China is largest producer and accounts for 15% of global gold production. China does not export gold. Increasing foreign gold acquisitions to meet demand. Global gold production flat – 3,269t in ’17 from 3,263t in ’16, smallest increase since ’08. Peak Gold is here: supply set to fall...

Read More »

Read More »

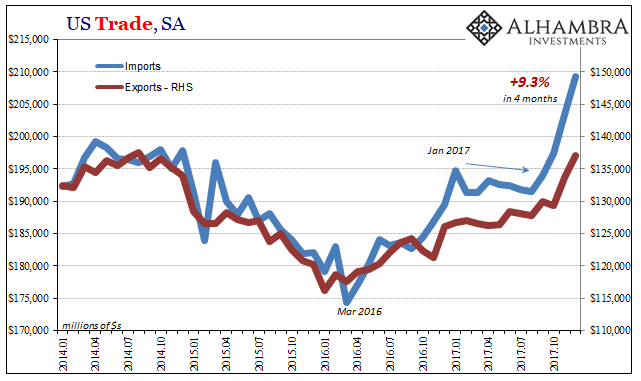

US Imports: A Little Inflation For Yellen, A Little More Bastiat

US imports rocketed higher once again in December, according to just-released estimates from the Census Bureau. Since August 2017, the US economy has been adding foreign goods at an impressive pace. Year-over-year (SA), imports are up just 10.4% (only 9% unadjusted) but 9.3% was in just those last four months. For most of 2017, imports were flat and even lower.

Read More »

Read More »

FX Daily, February 07: Guns and Butter May Resolve US Legislative Logjam

After a volatile session in North America, the major equity indices closed higher. In fact, the 1.75% rise in the S&P 500 was the best since November 2016. Asian equities stabilized, and the MSCI Asia Pacific Index was able to eke out a small gain. The European markets are moving higher is also posting early gains and the Dow Jones Stoxx 600 is about 0.45%, which threatens to snap the seven-day slide. However, the main challenge now is that the S&P...

Read More »

Read More »

Cool Video: Bloomberg Double Feature–BOE Meeting and the Yield Curve

The Bank of England meets tomorrow. Although no one expects a move, it has little to do with the recent market volatility. The FTSE 100 is poised to snap a six-day 7%+ slide. The FTSE 250 fell for seven consecutive sessions through yesterday, shedding 5.75% in the process. The UK's 2-year yield slipped about seven basis points from last week's close to58 bp before recovering to 63 bp today, around the middle of this week's range.

Read More »

Read More »

US Trade Balance is Deteriorating, Despite Record Exports

The US trade deficit swelled in December, and the $53.1 bln shortfall was a bit larger than expected. It was the largest deficit since October 2008. For the 2017, the US recorded a trade deficit of goods and services of $566 bln, the largest since 2008. The deterioration of the trade balance may be worse than it appears. There has been significant improvement in the oil trade balance. In 2017, the real petroleum balance was just shy of $96 bln, the...

Read More »

Read More »

Weekly Technical Analysis: 05/02/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/USD, USD/CHF

The USDCHF pair traded with clear negativity yesterday to approach our waited target at 0.9418, to keep the bullish trend scenario active until now, being away that it is important to monitor the price behavior when touching the mentioned level, as breaching it will push the price to extend its gains and head towards 0.9530 as a next station, while its stability will push the price to decline again.

Read More »

Read More »

Swiss tech universities boost economy by CHF13 billion, report says

Switzerland’s federal technology institutes account for 100,000 jobs and CHF13 billion in added value to the economy, a new report calculates. This represents a fivefold return on investment, it claims. The institutes – notably the universities of EPFL in Lausanne and ETH in Zurich – have long been acknowledged as vital components of the Swiss image and economy; the reportexternal link by British consulting firm BiGGAR now tries to put a value on...

Read More »

Read More »

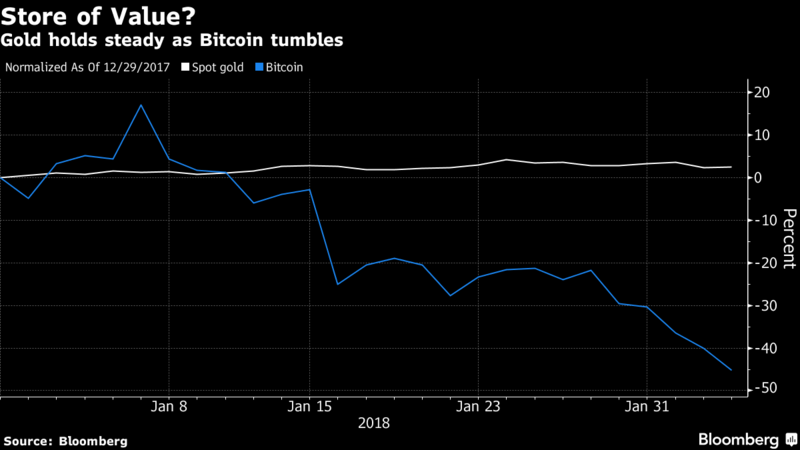

Crypto Currency Backlash Sees Flight From Cryptos and Bitcoin

Crypto Currency Backlash Sees Flight From Cryptos and Bitcoin. Bitcoin falls from $20,000 to below $6,000 and bounces back to $8000. Top 50 crypto currencies lost over 50% of value in 24 hours. Over $60 billion wiped off entire crypto currency market in 24 hours. Markets concerned about increased regulation, manipulation & country-wide bans. ‘Growing global unease about risks virtual currencies pose to investors and financial system’.

Read More »

Read More »

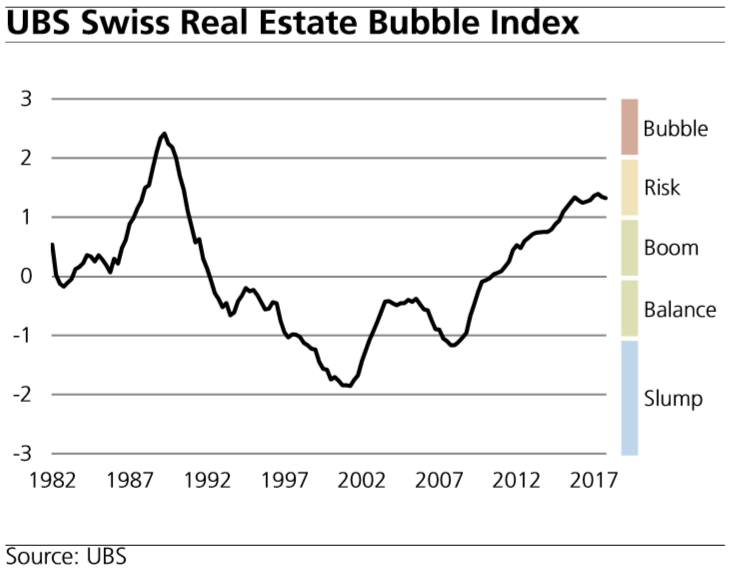

Swiss real estate market UBS Swiss Real Estate Bubble Index 4Q 2017

The UBS Swiss Real Estate Bubble Index declined in the fourth quarter of 2017, and is currently in the risk zone at 1.32 index points. This second fall in succession was driven by the persistently low increase of mortgage volumes. However, this may have been underestimated, as the records of mortgages granted by insurers and pension funds are inadequate. The majority of the sub-indicators remained unchanged in the last quarter.

Read More »

Read More »

FX Daily, February 06: Recovering US Equities Puts Floor Under Europe after Asia Tanks

After the dramatic fall in US equities, Asian equities followed suit. The MSCI Asia Pacific Index fell 3.4% following Monday's slide of 1.7%. European bourses gapped lower and spent most of the morning moving higher, though large gaps remain. At its worst, the Dow Jones Stoxx 600 was off about 3.3%, and at the time of this writing, it is half as much. US equities initially extended yesterday's losses, but the S&P 500 has turned higher in the...

Read More »

Read More »

Great Graphic: European Equities Lead Move

European equities peaked earlier and have fallen the furthest. MSCI EM equities faring the best, and as of now, they are still up on the year. MSCI Asia Pacific fell 3.4% today and is now down 0.33% for the year.

Read More »

Read More »

New Swiss tourism boss targets Alpine cyclists and non-skiers

New head of Switzerland Tourism Martin Nydegger expects hotel bookings to rise by 4% this winter season, owing to abundant snow. In an interview with Sonntagszeiting and Le Matin Dimanche newspapers, he also talks about priorities for 2018. Nydegger took over on January 1 from Jürg Schmid, who had headed the organizationexternal link for 18 years. He says he is planning some changes, but not a big shakeup.

Read More »

Read More »

Gold Rises As Global Stocks Plunge and Bitcoin Crashes 70 percent

Gold gains 0.6% in USD and surges 1.7% in euros and pounds. European stocks fall more than 3% at the open after sharp falls in Asia. DJIA falls 1,175 points, S&P 500 down 4.1% and Nikkei plummets 4.7%. Gold rises from $1,330 to $1,342, £942 to £960 and €1,067 to €1,085 /oz. Bitcoin crashes another 10% and has now plummeted by 70% to below $6,000. Increased risk aversion will drive safe haven demand for gold as its hedging properties are appreciated...

Read More »

Read More »

Is the 9-Year Long Dead Cat Bounce Finally Ending?

Ignoring or downplaying these fundamental forces has greatly increased the fragility of the status quo. The term dead cat bounce is market lingo for a "recovery" after markets decline due to fundamental reversals. Markets tend to bounce back after sharp declines as participants (human and digital) who have been trained to "buy the dips" once again buy the decline, and the financial media rushes to reassure everyone that nothing has actually...

Read More »

Read More »

How to Buy Low When Everyone Else is Buying High

The common thread running through the collective minds of present U.S. stock market investors goes something like this: A great crash is coming. But first there will be an epic run-up climaxing with a massive parabolic blow off top. Hence, to capitalize on the final blow off, investors must let their stock market holdings ride until the precise moment the market peaks – and not a moment more. That’s when investors should sell their stocks and go to...

Read More »

Read More »

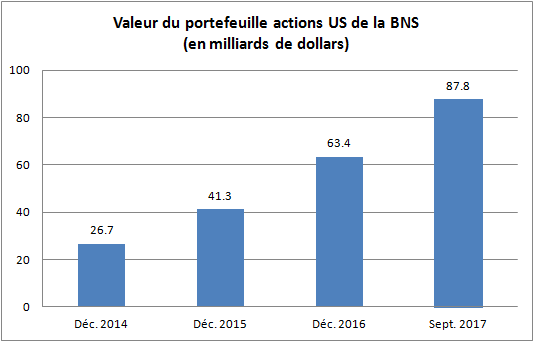

Favoritisme délibéré ou perte de contrôle? La politique d’investissement chaotique de la Banque nationale suisse

Favoritisme délibéré ou perte de contrôle ? La politique d’investissement chaotique de la Banque nationale suisse. Je peux vous assurer que nos spécialistes en investissement connaissent parfaitement leur métier (Fritz Zurbrügg). La BNS n’a aucun spécialiste qui peut dire ‘il faut prendre le titre A plutôt que le titre B’ (Jean-Pierre Danthine). Nous décidons de nos placements avec le concours d’un prestataire externe.

Read More »

Read More »

FX Daily, February 05: Dollar Consolidates while Equity Rout may be Ebbing

Asian equity markets were weighed down by losses in the US markets ahead of the weekend. The MSCI Asia Pacific Index was off 1.4% after the 1.0% pre-weekend loss. The Nikkei gapped lower and shed 2.5% and has fallen in eight of the past nine sessions. The notable exception in Asia was the Shanghai Composite. The 0.75% was led by the financial sector amid talk that a report later this week will show a strong jump in yuan lending from banks, which...

Read More »

Read More »

FX Weekly Preview: Changing Fortunes in the Capital Markets or Long Overdue Correction?

The chief development in the capital markets has been the sharp drop in equities after a significant rally since late last year and the rise in yields. The dollar had fallen alongside the exuberant appetite for risk assets. Anecdotal evidence supports the idea that the greenback was used as a funding currency to purchase those risk assets.

Read More »

Read More »