Tag Archive: newslettersent

Update on the Modified Davis Method

Frank Roellinger has updated us with respect to the signals given by his Modified Ned Davis Method (MDM) in the course of the recent market correction. The MDM is a purely technical trading system designed for position-trading the Russell 2000 index, both long and short (for details and additional color see The Modified Davis Method and Reader Question on the Modified Ned Davis Method).

Read More »

Read More »

Swiss government wants old banknotes to be valid indefinitely

The deadline of 20 years to exchange recalled banknotes should be abolished, the Federal Council suggested on Wednesday. The current system, which was introduced in 1921, operates under the assumption that discontinued notes which are not returned to the bank within the exchange deadline have either been lost or damaged.

Read More »

Read More »

Geneva to Zurich for half the price of a Swiss train

Switzerland’s transport authority (OFT) recently gave Domo Swiss Express SA, a Zurich-based bus company, a green light to run three routes across Switzerland. The first will run from Zurich to Lugano, via Basel and Luzern, the second from St. Gallen to Geneva airport, via Zurich and Bienne, and the third from Chur to Sion, via Zurich and Bern. Services are expected to run twice daily.

Read More »

Read More »

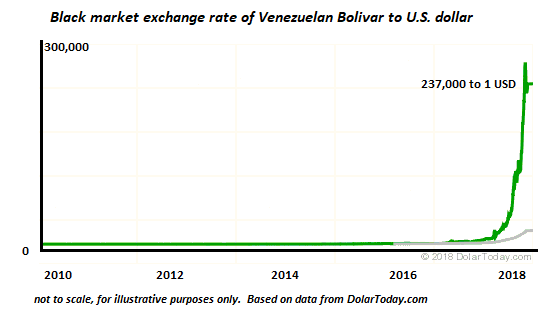

Venezuela’s New Cryptocurrency: Just Another Form of Control Fraud

The broke and broken country of Venezuela appears to be the first nation-state to issue a cryptocurrency token (the petro) as a means of escaping the financial black hole that's consuming its economy: Maduro Launches Oil-Backed Crypto "For The Welfare Of Venezuela".

Read More »

Read More »

Market Efficiency? The Euro is Looking Forward to the Weekend!

As I have shown in previous issues of Seasonal Insights, various financial instruments are demonstrating peculiar behavior in the course of the week: the S&P 500 Index is typically strong on Tuesdays, Gold on Fridays and Bitcoin on Tuesdays (similar to the S&P 500 Index). Several readers have inquired whether currencies exhibit such patterns as well. Are these extremely large markets also home to such statistical anomalies, or is market efficiency...

Read More »

Read More »

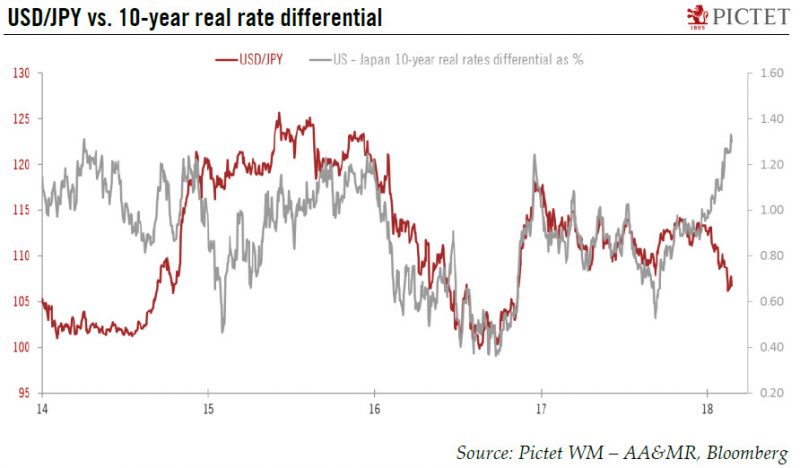

Less scope for yen and Swiss franc depreciation

The start of the year has seen the Japanese yen and Swiss franc appreciate strongly against the US dollar (they rose by 5.6% and 4.4% respectively between 1 January and 22 February) despite higher US yields. However, this rise in US yields came with heightened market volatility, favouring safe haven currencies such as the yen and franc.

Read More »

Read More »

2017 sees big boom in internet shopping

Swiss consumers are increasingly turning to the internet for shopping. Online sales were up by 10% in 2017, with a 23% increase in online purchases from abroad. The total sales generated from online shopping in 2017 was CHF8.6 billion ($9.2 billion) last year, with CHF1.6 billion going to companies abroad, The Association of Swiss Mail Order Companies (VSV)external link, the market research company GfK and Swiss Post revealed on Tuesday.

Read More »

Read More »

Switzerland’s Gotthard Base Tunnel wins European Railway Award

The 2018 European Railway Award has been awarded to two pioneers of the Gotthard Base Tunnel, the longest rail tunnel in the world that runs under the Gotthard massif in the Swiss Alps. Peter Jedelhauser of Swiss Railways and Renzo Simoni, former CEO of AlpTransit Gotthard AG, received the award on Tuesday evening in Brussels “on behalf of everyone involved in building and putting Gotthard Base Tunnel into operation”.

Read More »

Read More »

Russian Central Bank Buys Gold – 600,000 Ounces Or 18.7 Tons In January As Venezuela Launches ‘Petro Gold’

Russian central bank buys gold – large 600,000 ounces or 18.7 tons of gold in January. Russia increased its holdings to 1,857 tons, topping the People’s Bank of China’s ‘reported’ 1,843 tons. Russia surpasses China as 6th largest holder of gold reserves – after U.S., Germany, IMF, Italy and France. Turkish central bank added 205 tons “over 13 consecutive months” – Commerzbank

Read More »

Read More »

Emerging Markets: What Changed

China regulators have taken over Anbang Insurance. Group for at least one year. RBI minutes from this month’s meeting were more hawkish than expected. The RBI is reportedly reviewing its process for allowing local companies to issue debt overseas. Effective June 1, IDR-denominated debt becomes eligible for the Barclays Global Aggregate Index.Israeli Prime Minister Netanyahu is coming under increasing pressure.

Read More »

Read More »

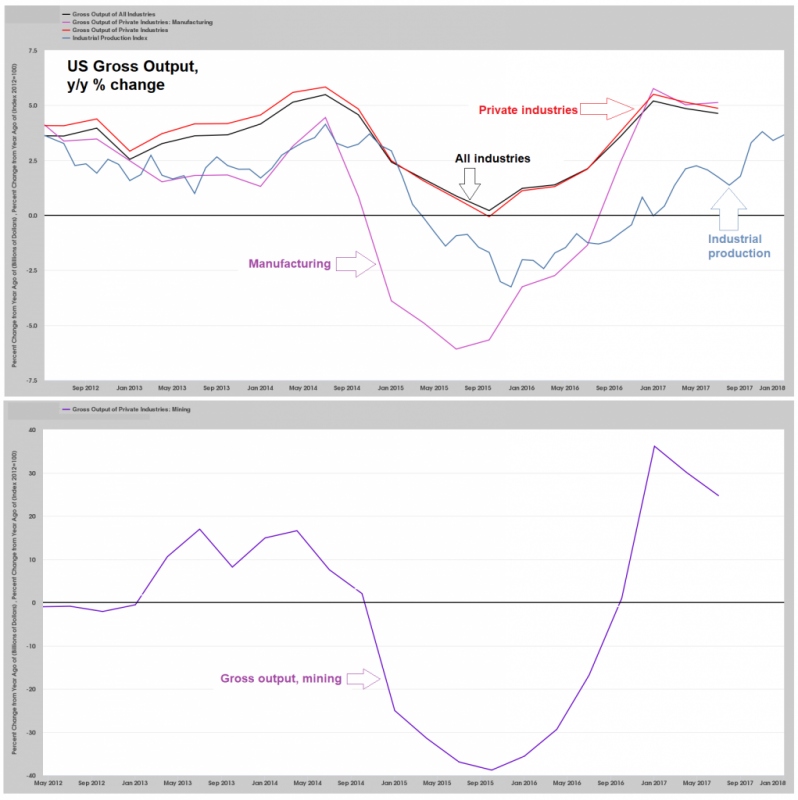

Strange Economic Data

Contrary to the situation in 2014-2015, economic indicators are currently far from signaling an imminent recession. We frequently discussed growing weakness in the manufacturing sector in 2015 (which is the largest sector of the economy in terms of gross output) – but even then, we always stressed that no clear recession signal was in sight yet. US gross output (GO) growth year-on-year, and industrial production (IP) – note that GO continues to be...

Read More »

Read More »

FX Daily, February 23: Dollar Firms; VIX Set to Close Lower for Second Week

A light economic schedule in North America may help the markets close the week on a quiet note. Perhaps if there is one number that captures this sense, it may be the VIX. It is soft and barring a new disruption today, it is poised to close lower for the second consecutive week, for the first time this year. The US dollar is steady to higher today and barring a reversal, will close stronger on the week against the major currencies.

Read More »

Read More »

US supermarket giant Walmart now selling Swiss-made chocolate

Swiss retailer Coop is producing bars for Walmart’s own-brand chocolate, the SonntagsZeitung reported on Sunday. The chocolate is produced in a newly established production centre near Basel and has been available in Walmart stores since last year, confirmed Reto Conrad, head of production at Coop, to the German-language newspaper.

Read More »

Read More »

Swiss Post Bus company invested heavily in France and lost millions

The Post has been operating its French subsidiary, CarPostal France at a huge financial loss, reported Swiss public television, SRF, on Monday. The company is also accused of having used a price dumping policy to unfairly increase its market share in France. According to an investigative report by SRF’s economics news bulletin “Eco”, CarPostal accumulated an operating loss of €1.8 million (CHF2.1 million) over the period between 2007 and 2016. The...

Read More »

Read More »

Bitcoin or British Pound ‘Pretty Much Failed’ As Currency?

Bitcoin has ‘pretty much failed’ as a currency says Bank of England Carney. Bitcoin is neither a store of value nor a useful way to buy things – BOE’s Carney. Project fear against crypto-currencies or an out of control investing bubble? Bitcoin will likely recover in value but is speculative and not for widows and orphans. British pound has been a terrible store of value – unlike gold. Pound collapsed 30% in 2016 and down 11.5% per annum versus...

Read More »

Read More »

The End of (Artificial) Stability

The central banks'/states' power to maintain a permanent bull market in stocks and bonds is eroding. There is nothing natural about the stability of the past 9 years. The bullish trends in risk assets are artificial constructs of central bank/state policies. As these policies are reduced or lose their effectiveness, the era of artificial stability is coming to a close. The 9-year run of Bull-trend stability is ending as a result of a confluence of...

Read More »

Read More »

US Equities – Retracement Levels and Market Psychology

Following the recent market swoon, we were interested to see how far the rebound would go. Fibonacci retracement levels are a tried and true technical tool for estimating likely targets – and they can actually provide information beyond that as well. Here is the S&P 500 Index with the most important Fibonacci retracement levels of the recent decline shown. So far, the SPX has made it back to the 61.8% retracement level intraday, and has weakened a...

Read More »

Read More »

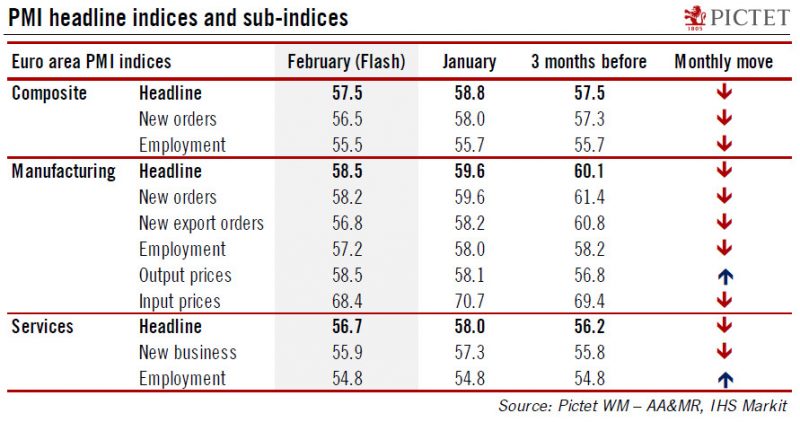

Euro area: Flash PMI surveys pass their peak

The IHS Markit flash composite purchasing managers’ index (PMI) for the euro area eased to 57.5 in February from 58.8 in January, below consensus expectations (58.4). The index marked its the largest monthly decrease since August 2014. Activity in both services PMI (-1.3 points to 56.7) and manufacturing (-1.1 points to 58.5) cooled in February. But while the breakdown by sub-indices showed that the pace of growth in new orders and output slowed...

Read More »

Read More »

FX Daily, February 22: All Eyes on Equities

The dramatic reversal of US shares yesterday in the last hour of trading has once again pulled the proverbial rug beneath the feet of investors. The turn down, moreover, occurred near important technical levels, seemingly adding to the significance. Global equities have followed suit.

Read More »

Read More »

Swiss News Agency calls for help in job cuts conflict

After three weeks of talks, management and staff at the Swiss News Agency (SDA-ATS) have not managed to reach an agreement on job cuts, and are now calling for the State Secretariat for Economic Affairs (SECO) to mediate. Both sides agreed to the call. Their negotiations followed a strike in late January-early February over a plan to cut up to 40 jobs out of a total 180.

Read More »

Read More »