Tag Archive: newslettersent

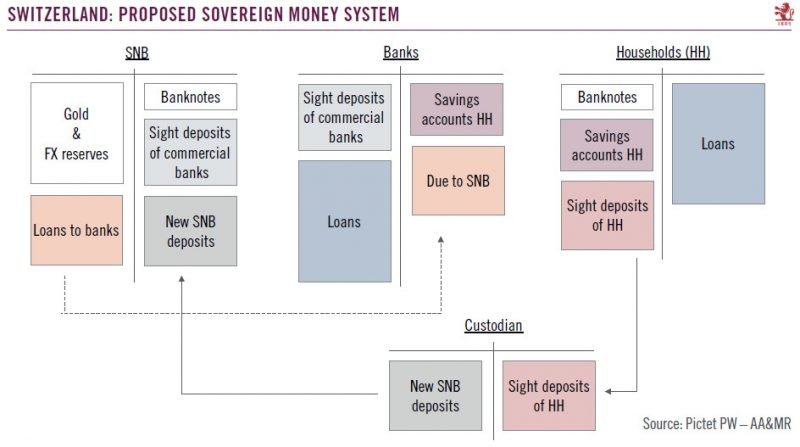

Switzerland: ‘Sovereign money’ initiative

The ‘Sovereign money’ initiative, to be voted on in June, aims at a fundamental reform of the Swiss monetary system. In a nutshell, the initiative asks that the creation of money and the granting of loans be separated by barring commercial banks from creating deposits through lending. According to the initiative’s promoters the “Swiss National Bank (SNB) should be the sole organisation authorised to create money – not only cash and coins, but also...

Read More »

Read More »

International trade unionists stage Glencore demo

On Wednesday, some 40 trade union members from as far as Australia and Africa protested the Swiss-based commodities giant’s treatment of workers. The demonstration took place on the occasion of Glencore’s annual general assembly in Zug, and included protestors from Colombia, the Democratic Republic of Congo (DRC), Canada, Australia, as well as other countries, according to a statementexternal link (in French) by Swiss trade union Unia.

Read More »

Read More »

FX Daily, May 10: Kiwi Tumbles on Dovish RBNZ, While Sterling Goes Nowhere Ahead of BOE

The US dollar is consolidating in narrow trading against most of the major currencies as participants digest several developments ahead of what was expected to be the highlight today, the BOE meeting and US April CPI. The greenback's consolidation is giving it a heavier bias against most of the major currencies. The recently strong upside momentum has stalled, but the losses are modest and the euro and sterling are inside yesterday's ranges.

Read More »

Read More »

What Really Happened In Europe

The primary example of globally synchronized growth has been Europe. Nowhere has more hope been attached to shifting fortunes. The Continent, buoyed by the persistence of central bankers like Mario Draghi, has not just accelerated it is actually booming. Or so they say.

Read More »

Read More »

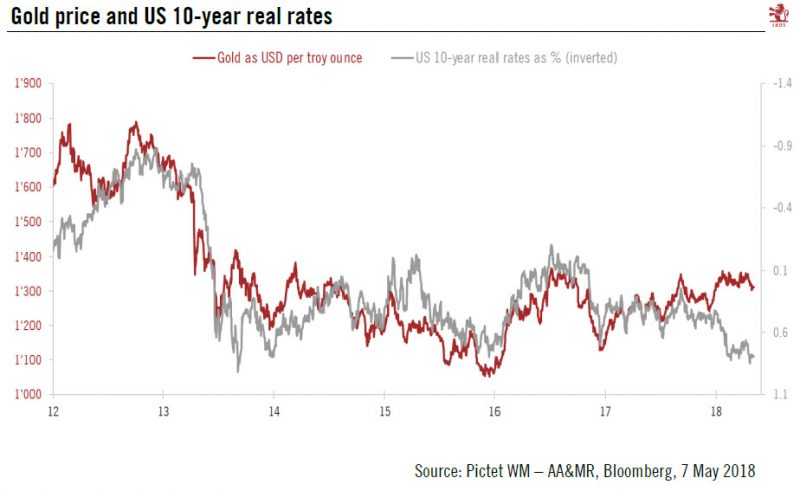

Gold price to remain trendless

The recent strength of the US dollar coupled with the rise of the US 10-year Treasury yield has weighed on the price of gold and silver. Since 19 April, gold has lost roughly 2.3%, while silver lost almost 4.5% in USD terms.

Read More »

Read More »

BNS, Initiative Monnaie Pleine veut lui donner les pleins pouvoirs

L’initiative «Monnaie pleine», qui sera soumise au peuple le 10 juin prochain, entend radicalement transformer le système bancaire suisse. Si elle est acceptée, la BNS obtiendrait les pleins pouvoirs. Décryptage des risques et des enjeux. L’initiative «Monnaie pleine», sur laquelle le peuple sera appelé à se prononcer le 10 juin prochain, demande que seule la Banque nationale suisse (BNS) puisse émettre de la monnaie.

Read More »

Read More »

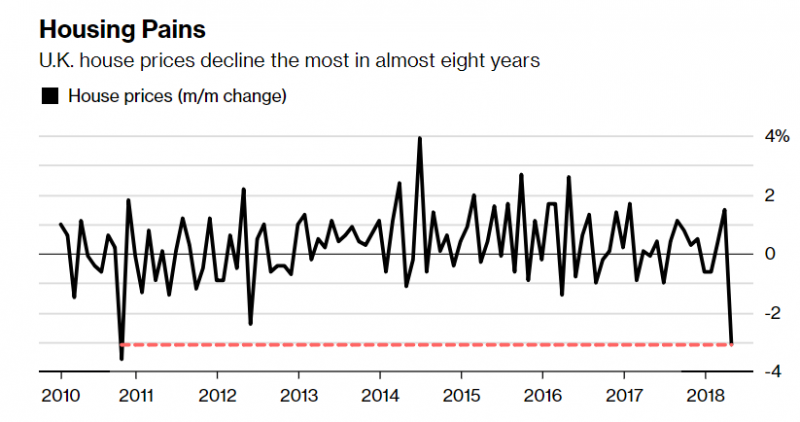

U.K. Home Prices Plunge 3.1percent In April – Largest Monthly Drop Since Financial Crisis In 2011

U.K. home prices plunged the most in almost eight years in April, adding to signs of weakness in Britain’s property market. Values dropped 3.1 percent from March to an average 220,962 pounds ($299,140), mortgage lender Halifax said in a report Tuesday. That’s the biggest drop since September 2010. While that figure can be volatile, the quarterly measure also showed a decline. It fell 0.1 percent, a third straight drop.

Read More »

Read More »

Switzerland most expensive for meat

Switzerland has the world’s most expensive meat according to a survey compiled by Caterwings in Germany. The survey, which looks at meat prices in 52 countries, ranks Swiss prices at the top across all meat categories. On average, Swiss shoppers pay 142% more than the average across all meat categories.

Read More »

Read More »

FX Daily, May 09: Oil Prices Surge and Dollar Gains Extended Post Withdrawal Announcement

The US dollar is broadly higher as the 10-year yield probes above 3.0%. Disappointing French industrial production and manufacturing data for March provided additional incentive, as if it were needed, to extend the euro's losses. The euro dipped below $1.1825. The single currency is off a cent this week after falling nearly two last week. A 38.2% retracement of the euro's gains since the beginning of last year is found a little above $1.1700 and...

Read More »

Read More »

Weekly Technical Analysis: 07/05/2018 – USD/JPY, EUR/USD, GBP/USD, Gold

The USDCHF pair’s recent trades are confined within mew minor bearish channel that we believe it forms bullish flag pattern, thus, the price needs to breach 1.0035 to activate the positive effect of this pattern followed by rallying towards our waited target at 1.0100. Therefore, we will continue to suggest the bullish trend supported by the EMA50, unless we witnessed clear break and hold below 1.0000. Expected trading range for today is between...

Read More »

Read More »

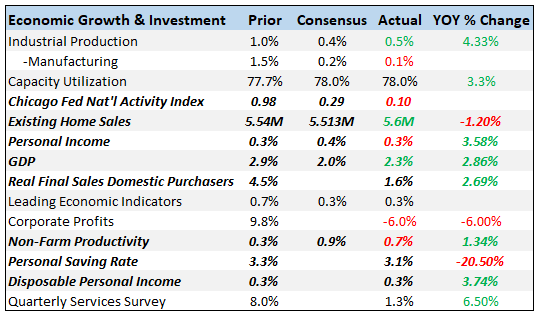

Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth

The yield on the 10 year Treasury note briefly surpassed the supposedly important 3% barrier and then….nothing. So, maybe, contrary to all the commentary that placed such importance on that level, it was just another line on a chart and the bond bear market fear mongering told us a lot about the commentators and not a lot about the market or the economy.

Read More »

Read More »

The Capital Structure as a Mirror of the Bubble Era

As long time readers know, we are looking at the economy through the lens of Austrian capital and monetary theory (see here for a backgrounder on capital theory and the production structure). In a nutshell: Monetary pumping falsifies interest rate signals by pushing gross market rates below the rate that reflects society-wide time preferences.

Read More »

Read More »

La question de Monnaie pleine induit-elle le votant en erreur?

Le peuple suisse doit, le 10 juin 2018, répondre à cette question: Acceptez-vous l’initiative populaire « Pour une monnaie à l’abri des crises : émission monétaire uniquement par la Banque nationale ! (Initiative Monnaie pleine). Le oui à la question sous-entend que ce concept monétaire garantit la monnaie suisse et les avoirs bancaires d’une part, et d’autre part que l’ensemble des avoirs bancaires relèvent de la banque centrale.

Read More »

Read More »

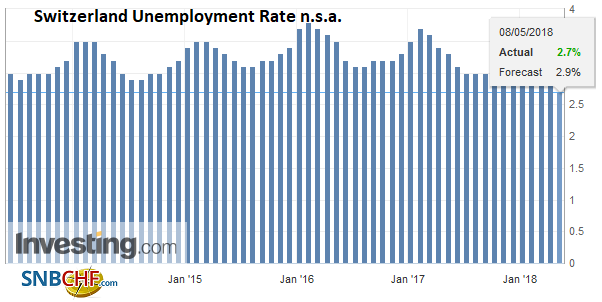

Switzerland Unemployment in April 2018: Down to 2.7 percent from 2.9 percent, seasonally adjusted decreased from 2.9 percent to 2.7 percent

Registered unemployment in April 2018 - According to the State Secretariat for Economic Affairs (SECO), at the end of April 2018, 119,781 unemployed were registered at the Regional Employment Centers (RAV), 10,632 less than in the previous month. The unemployment rate fell from 2.9% in March 2018 to 2.7% in the month under review. Compared with the same month of the previous year, unemployment fell by 26'546 persons (-18.1%).

Read More »

Read More »

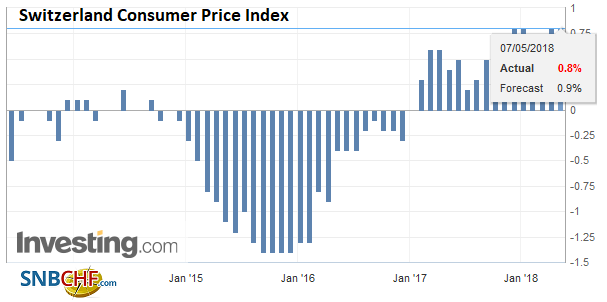

Is Swiss inflation back to stay?

Swiss inflation reappeared in February 2018 and has continued. According to the Federal Statistical Office, inflation was 0.2% in April. Since the beginning of 2018, prices have risen 0.9%. Jan-Egbert Sturm of the KOF Swiss Economic Institute says it shows the Swiss economy is doing well, and that inflation is close to what is “normal” in Switzerland.

Read More »

Read More »

FX Daily, May 08: Dollar Races Ahead

The US dollar's surge continues. The Dollar Index is testing the space above 93.00. A month ago it was below 90. It does not appear to require fresh developments. The market continues to trade as if there are short dollar positions that are trapped at higher levels and the briefest and shallow pullbacks are new opportunities to adjust positions.

Read More »

Read More »

Emerging Markets Preview: The Week Ahead

EM FX came under intense selling pressures last week. The worst performers were ARS, TRY, and MXN while the best were PHP, KRW, and TWD. US rates are likely to remain the key driver for EM FX, and so PPI and CPI data will be closely watched this week. We believe EM FX will remain under pressure.

Read More »

Read More »

Swiss Consumer Price Index in April 2018: +0.8 percent YoY, +0.2 percent MoM

The consumer price index (CPI) rose by 0.2% in April 2018 compared with the previous month, reaching 101.7 points (December 2015=100). In comparison with the same month of the previous year, inflation stood at 0.8%. These figures were compiled by the Federal Statistical Office (FSO).

Read More »

Read More »

Nestlé and Starbucks agree million-dollar tie-up

The Swiss food giant Nestlé is set to pay Starbucks $7.1 billion (CHF7.1 billion) to market the American firm’s products outside Starbucks’ coffee shops. Under the alliance deal, announced on Monday, Starbucks and Nestlé have agreed to work together on marketing strategies and innovation.

Read More »

Read More »