Tag Archive: newslettersent

FX Daily, May 23: Dollar and Yen Surge, European Data Disappoints

The US dollar has extended its gains against most of the major currencies. Momentum, positioning, and divergence continue to drive it. The euro briefly traded a little below $1.17, an important technical area and has enjoyed a bounce in late morning turnover in Europe.

Read More »

Read More »

Alpine tunnel closure causes major holiday traffic disruption

Traffic queues of up to 28 kilometres were reported at the northern entrance to the Gotthard tunnel on Saturday, owing to a long weekend and the closure of another major Alpine road tunnel because of a fire. The San Bernadino tunnel in southeast Switzerland was closed on Friday afternoon after a German tourist bus caught fire in the tunnel, leaving two people with minor injuries. It is expected to remain closed over the Pentecost weekend, since the...

Read More »

Read More »

Great Graphic: Euro-Swiss Shows Elevated Systemic Risk

The Swiss National Bank's decision in January 2015 to remove the cap on the Swiss franc (floor on the euro) that it has set at CHF1.20 is seared into the memory of a generation of foreign exchange participants. It is not exactly clear where the euro bottomed in the frenzied activity that followed the SNB's surprise move. Bloomberg records the euro's low near CHF0.8520.

Read More »

Read More »

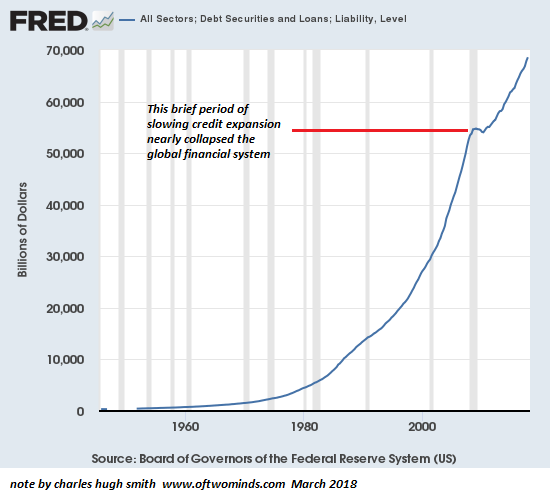

The Next Recession Will Be Devastatingly Non-Linear

The acceleration of non-linear consequences will surprise the brainwashed, loving-their-servitude mainstream media. Linear correlations are intuitive: if GDP declines 2% in the next recession, and employment declines 2%, we get it: the scale and size of the decline aligns. In a linear correlation, we'd expect sales to drop by about 2%, businesses closing their doors to increase by about 2%, profits to notch down by about 2%, lending contracts by...

Read More »

Read More »

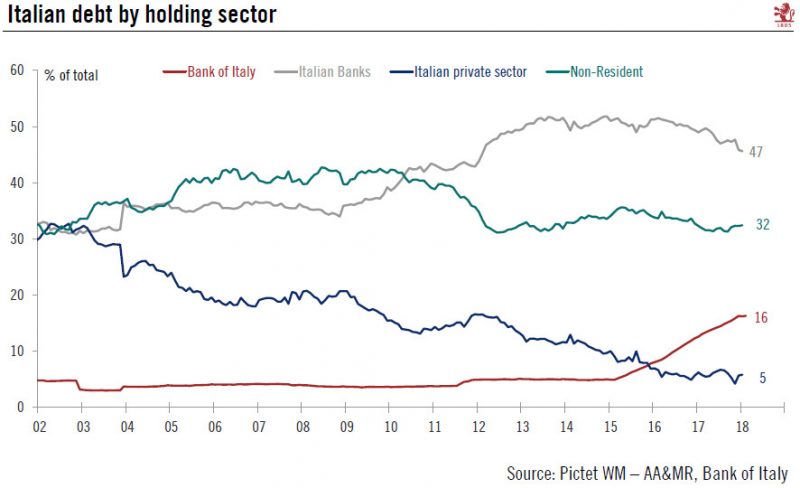

Eurosceptic Italian government faces a reality check

With the putative M5S-League government publishing its final common programme, we take a look at the road ahead for the Italian economy and for Italian government debt.We expect negative noise surrounding the Italian budget to intensify initially, but believe that negotiations with Brussels will result in compromises eventually, including dilution of the incoming Italian government’s fiscal easing measures. The biggest risks lie with the proposed...

Read More »

Read More »

Fribourg – moves to axe government pensions for life

Switzerland’s government is working hard to find ways to fix a looming state pension shortfall. Two politicians in the canton of Fribourg have decided to seek savings by attempting to cut lifetime government pensions granted after short stints in the job, according to the newspaper 20 Minutes.

Read More »

Read More »

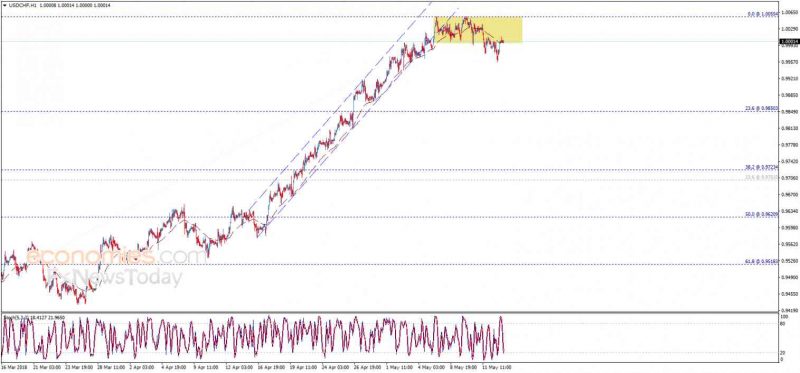

Weekly Technical Analysis: 21/05/2018 – USD/JPY, EUR/USD, GBP/JPY, USD/CAD, USD/CHF

The USDCHF pair reaches the key support 0.9955 now, and as we mentioned in our last report, breaking this level will confirm completing the double top pattern that appears on the chart, to rally towards our negative targets that begin at 0.9900 and extend to 0.9850. Therefore, we will continue to suggest the bearish trend supported by the negative pressure formed by the EMA50, unless the price managed to rally upwards to breach 1.0055 level and...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a weak note and extended the slide. For the week as a whole, the best EM performers were PHP, TWD, and SGD while the worst were ARS, ZAR, and TRY. With US rates continuing to move higher, we believe selling pressures on EM FX will remain in play this week. Our recently updated EM Vulnerability Table supports our view that divergences within EM will remain.

Read More »

Read More »

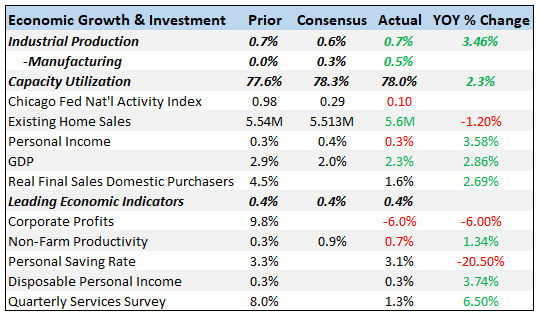

Bi-Weekly Economic Review: Growth Expectations Break Out?

There are a lot of reasons why interest rates may have risen recently. The federal government is expected to post a larger deficit this year – and in future years – due to the tax cuts. Further exacerbating those concerns is the ongoing shrinkage of the Fed’s balance sheet. Increased supply and potentially decreased demand is not a recipe for higher prices. In addition, there is some fear that the ongoing trade disputes may impact foreign demand...

Read More »

Read More »

Italy Defies Gravity and Risk to Fiscal Rectitude

Italian asset markets continue to fare better than many expected. The political uncertainty following the March election has been followed by confidence that the Five Star Movement and the (Northern) League will be able to put together a government in the coming days. If so, Italy would have taken half the time Germany did to cobble a government together after inconclusive elections.

Read More »

Read More »

Switzerland’s vote to change its monetary system – sensible or silly?

Sometimes Swiss voters are presented with questions that only specialists are equipped to answer. The vote on 10 June 2018 to change their monetary system appears to be one of these. On the surface it appears simple. Upon closer inspection it contains much complexity and uncertainty, compounded by a widespread misunderstanding of how the financial system works – banks do not act simply as intermediaries, lending out the deposits that savers place...

Read More »

Read More »

Rapid escalation in Swiss fines for freight trucks

An increasing number of heavy goods vehicles (HGVs) are being pulled over for motoring offences at border crossings. Customs officials have reported 83% more violations in the last eight years, rising from 17,997 on 2010 to 32,967 last year. A further 24,464 fines and cautions were issued against HGVs according to the SonntagsZeitung newspaper.

Read More »

Read More »

FX Weekly Preview: Dollar Power

There are several trends in the capital markets at a high-level. The euro and yen's decline has coincided with sustained rallies in European and Japanese equity benchmarks. Emerging market equities and currencies have been trending lower.

Read More »

Read More »

Emerging Markets: What Changed

Bank Indonesia started a tightening cycle with a 25 bp hike to 4.5%. Jailed Malaysia opposition leader Anwar Ibrahim was released by new Prime Minister Mahathir. Malaysia scrapped the controversial 6% goods and services tax (GST). Violent protests shook Israel as the relocated US embassy opened in Jerusalem.

Read More »

Read More »

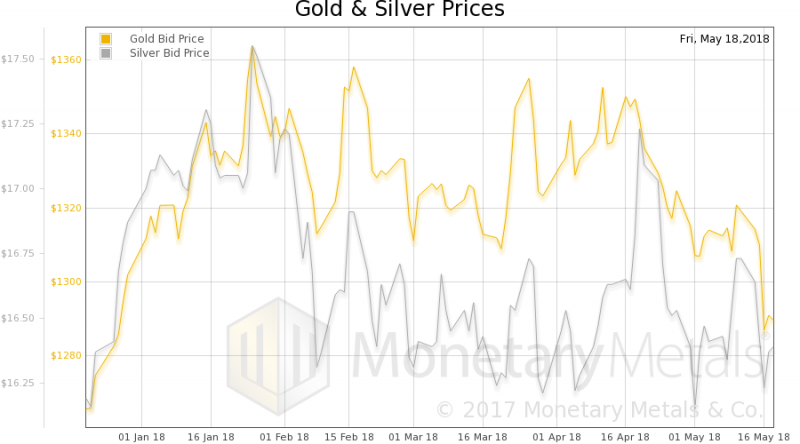

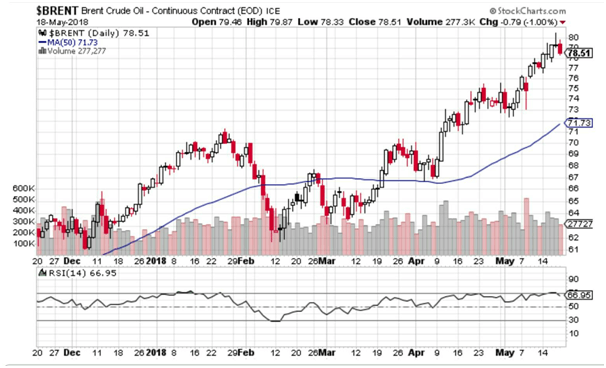

US 10-Year Surges, Emerging Markets Implode…Where Next for Gold?

US 10-Year Yields Top 3%, US Dollar Pushes Higher. Brent Hits $80, Highest in 4 years. Emerging Market Chaos, the Lira and Peso in Freefall. Italy’s New Coalition Signal Their Plans, Yields Jump. Japanese Economy Contracts, GDP Worst Since 2015. And Where Next for Gold?

Read More »

Read More »

Swiss Rail drops plan to put Wi-Fi in trains

Swiss Rail has dropped plans to install Wi-Fi in its trains, according to the newspaper Le Matin. After a survey revealed that customers would only use on-board Wi-Fi it was free, the company decided there was no justifiable way to cover the cost, according the the newspaper. Swiss Rail is not prepared to bear the costs the mobile operators would charge them for the service and cannot not justify adding the cost to ticket prices.

Read More »

Read More »

And Now For Something Completely Different

Back in February, Japan’s Cabinet Office reported that Real GDP in Japan had grown in Q4 2017 for the eighth consecutive quarter. It was the longest streak of non-negative GDP since the 1980’s. Predictably, this was hailed as some significant achievement, a true masterstroke of courage and perseverance. It was taken as a sign that Abenomics and QQE was finally working (never mind the four years).

Read More »

Read More »

“Vollgeld – Was spricht dagegen? (Sovereign Money—What are the Problems?),” RABE, 2018

Die Vollgeld-Initiative will die Schweizer Geldpolitik komplett umkrempeln. Künftig soll nur noch die Nationalbank Geld herstellen dürfen, sowohl Banknoten und Münzen als auch das elektronische Geld. Die Schweizer Geschäftsbanken wie die UBS oder die CS, die heute 90% des elektronischen Geldes herstellen, soll das künftig verboten sein.

Read More »

Read More »